Since the first hint of a pandemic Axene Health Partners has been monitoring COVID-19 and its impact on the nation, especially on the healthcare system. COVID-19 data and its trends are rapidly evolving and the likely impacts on healthcare costs change every day. We are deeply involved both regionally and nationally helping our publics understand COVID-19 including infection rates, death and recovery rates and the required healthcare resources caused by the virus. Starting with this significant understanding of COVID-19 we are translating our knowledge into how COVID-19 will affect healthcare costs in 2020 and beyond.

We believe COVID-19 has already started to impact health care costs in 2020. The pandemic will similarly impact both insurers and self-insured groups. No projection model will perfectly predict the impact, but we are confident the AHP COVID-19 Cost Projection Model (CCPM) provides a valuable resource for predicting the cost impact.

As with any model, especially those with limited data, the assumptions used will drive the output. For this reason, we have built a projection model that lets the user set the assumptions and adjust these as more data becomes available. The core of our model is an actuarial cost model for a typical commercial under age 65 population. We have used benefit plan paid data to project costs[1]. The projection model requires assumptions related to the following:

- Paid Claims Data– CCPM uses paid claims data to measure the benefit cost to the insurer/plan sponsor and is net of the out of pocket costs of the members.

- Allocation of Elective vs. Required Services– CCPM allocates the utilization by type of service between elective (or delayable) and required (not delayable).

- Acuity Adjusted Provider Costs- CCPM adjusts individual provider cost/unit for both elective and required services to properly project costs. In most cases, elective services have a lower acuity than required services (i.e., lower unit costs).

- COVID-19 Cost Model- CCPM projects COVID-19 related costs. Most of the COVID-19 costs are related to inpatient hospital care and ER costs. We have attempted to incorporate the cost of testing into the model but it could be a higher variable as the cost and availability of the tests are highly variable.

- Utilization adjustment by month– CCPM adjusts the monthly utilization for the elective, required and COVID-19 costs.

- COVID-19 Peak- CCPM assumes that the peak impact of the COVID-19 will likely occur in June 2020. Many experts believe a second wave may occur in the fourth quarter as a result of relaxing social distancing limitations and enforcement. CCPM information in this document does not include any adjustment for this second wave.

- COVID-19 Copays- We are assuming that COVID-19 Copays are waived for all members with COVID-19 claims.

Summary of Results

Exhibit 1: Projected Results for 2020 Costs

Applying reasonable assumptions, CCPM projects that the impact of COVID-19 on 2020 health care costs will range from -2.4% to 7.9%. This wide range of results shows the unknown nature of the virus and how long it will materially affect the economy and the health care system. We developed three separate scenarios: Favorable, Expected and Moderately Adverse. Favorable is not the best-case scenario, but rather a more favorable than expected scenario. In the same manner, the moderately adverse scenario is not the worst-case scenario, but rather a reasonably adverse outlook. If an insurer/plan sponsor was fortunate enough to not have any costs related to COVID-19, our projections would show that as a potential 8.6% reduction in claims cost.

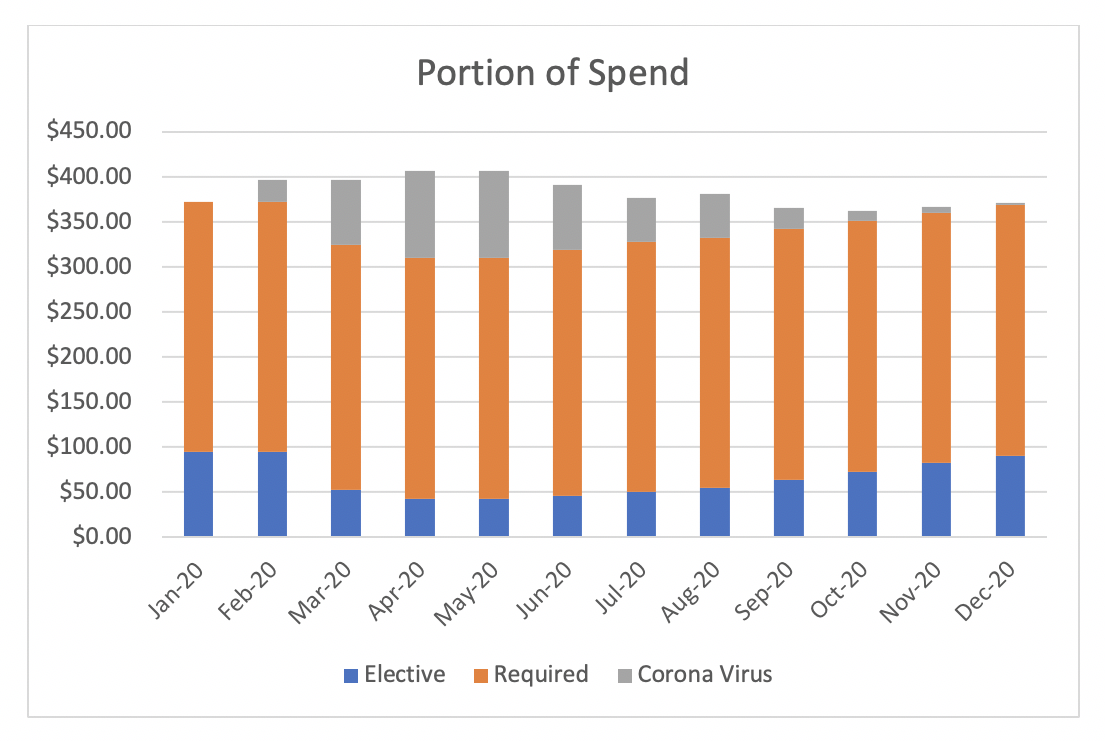

Exhibit 2: Spend by Category

Exhibit-2 allocates claim dollars by Elective, Required and COVID-19. These estimates are based on the expected scenario above that represented a 2.72% increase in total costs. The Elective (Blue) spend starts at about 25% of the overall cost and dips to lower levels in March through July and then begins to increase. The Required (Orange) spend stays fairly constant throughout the time period. The COVID-19 (Grey) spend increases dramatically and then tapers off over time. As you can see the projection assumes the peak is in the May/June time period and then goes down over the next several months.

In addition to the variation in cost by month, it is also helpful to understand the allocation of costs by category of service. CCPM shows higher inpatient costs (+37%), with reductions in outpatient and professional costs (-8.2% and -11.9%, respectively). CCPM shows a slight increase in ER spend during this period. Overall usage of the ER is dramatically lower, but the costs associated with COVID-19 higher than average. All other Outpatient categories are seeing 5-15% reductions as is shown in Exhibit-3 below.

Exhibit 3: Spend by Category

CCPM incorporated an assumed delay in Elective services. Those delayed services will likely result in some pent-up demand in the future, potentially increasing future health costs and/or raising future trend rates. Some research suggests services once delayed may potentially never be provided. Any adjustment to cost forecasts needs to consider this.

Final Thoughts

These projections were done on average and reflect our best estimates of costs related to COVID-19. Nationally available data changes by the hour and therefore projections need to be updated regularly. The information presented here was published in early April. Please reach out for the most up-to-date projections. Also please visit our website at https://axenehp.com/covid-19/ for other articles related to COVID-19. Customized projections can be done by insurer/plan sponsor and incorporate the individual characteristics of the plans and its geographic region. Costs related to COVID-19 are unpredictable, but we all need to be considerate of others and do all we can to flatten the curve, save lives and in the end save costs.

Endnotes

[1] Assumed benefits approximate an 85% actuarial value.

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.