Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

Introduction

There is a big wave of changes coming to the pharmacy market. The extent of the impact this wave will bring is not yet fully known, but there are trends we can follow that help predict what this change will look like. We know biosimilar uptake is key to driving savings, but it can take a while to ramp up and become material. Biosimilars bring competition and there’s going be a lot of opportunity to drive competition to an extent that we really haven’t seen with previous biosimilars.

Patent Estates

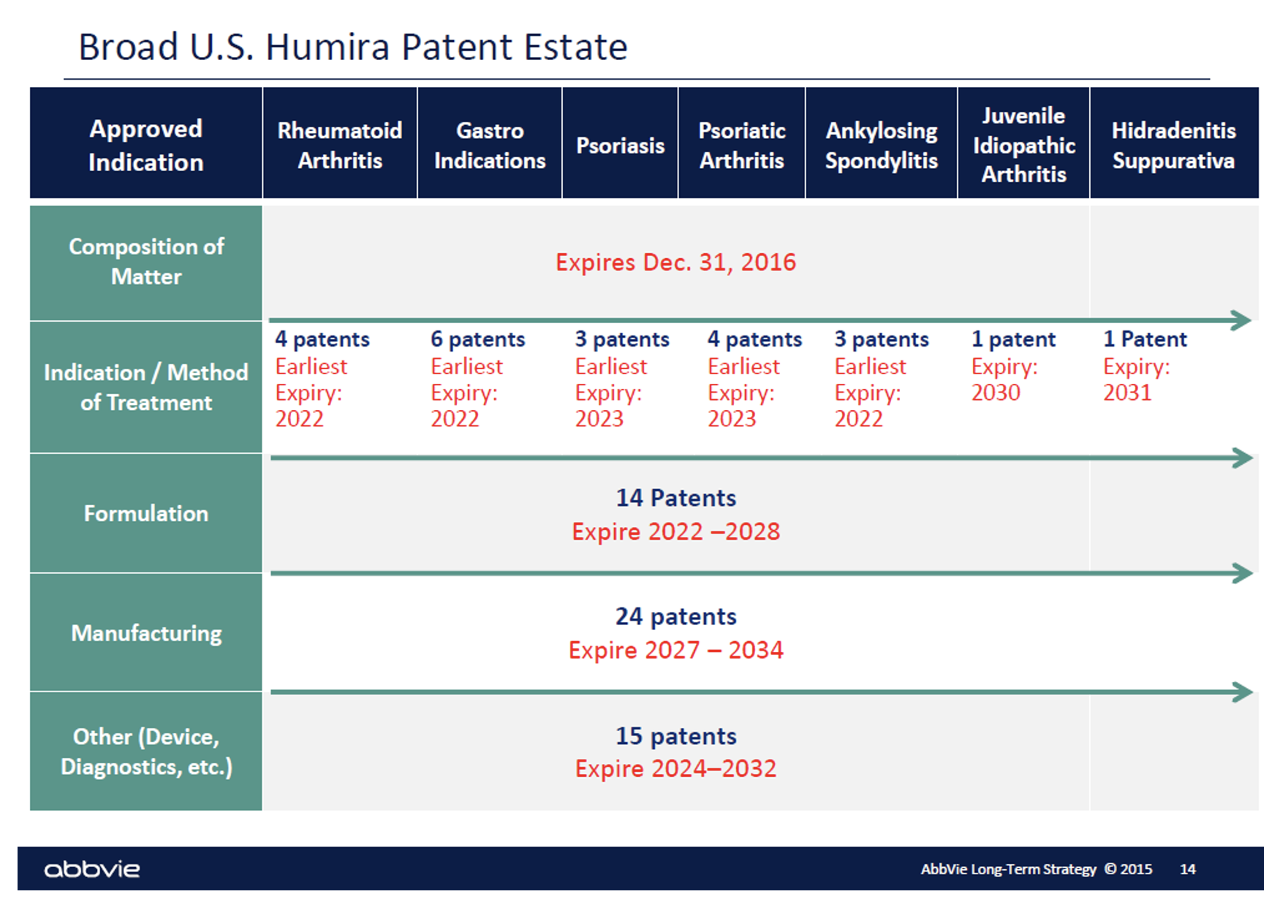

Biosimilars cannot launch until patent claims from the reference product expire or settlement is reached. Patents can extend the reference product’s exclusivity period and complicate litigation challenging patents. Humira may have the most extensive patent estate of any product.

Technically, the patent for Humira itself expired six years ago. However, there are over thirty patents still in place on the different indications and methods of treatment that were later developed for Humira. And dozens more patents around the formulation of the product, its manufacturing and other patents related to the administration device, diagnostics, etc. Humira rolled out citrate free versions, different dosage forms and different needle sizes each tied to new patents.

The Coming Wave

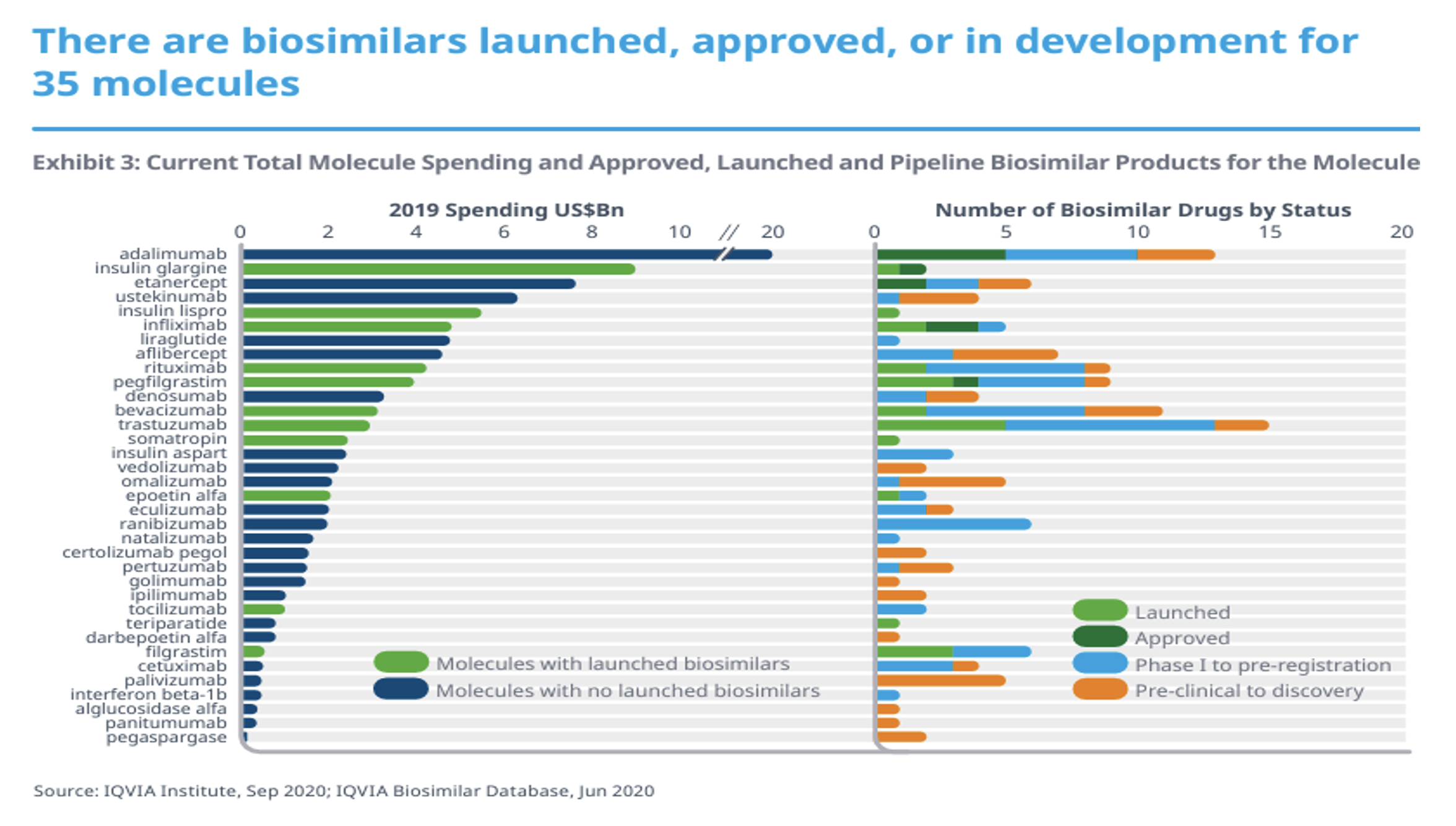

There are a lot of reference products with biosimilars in development. Those reference products can range from about $20 billion in annual spend in 2019 for Humira (adalimumab) to ‘just’ one or two billion dollars of annual spend in 2019. It is interesting to observe how many biosimilar drugs are in development for each reference product and their relative development status. There is clearly a big wave coming!

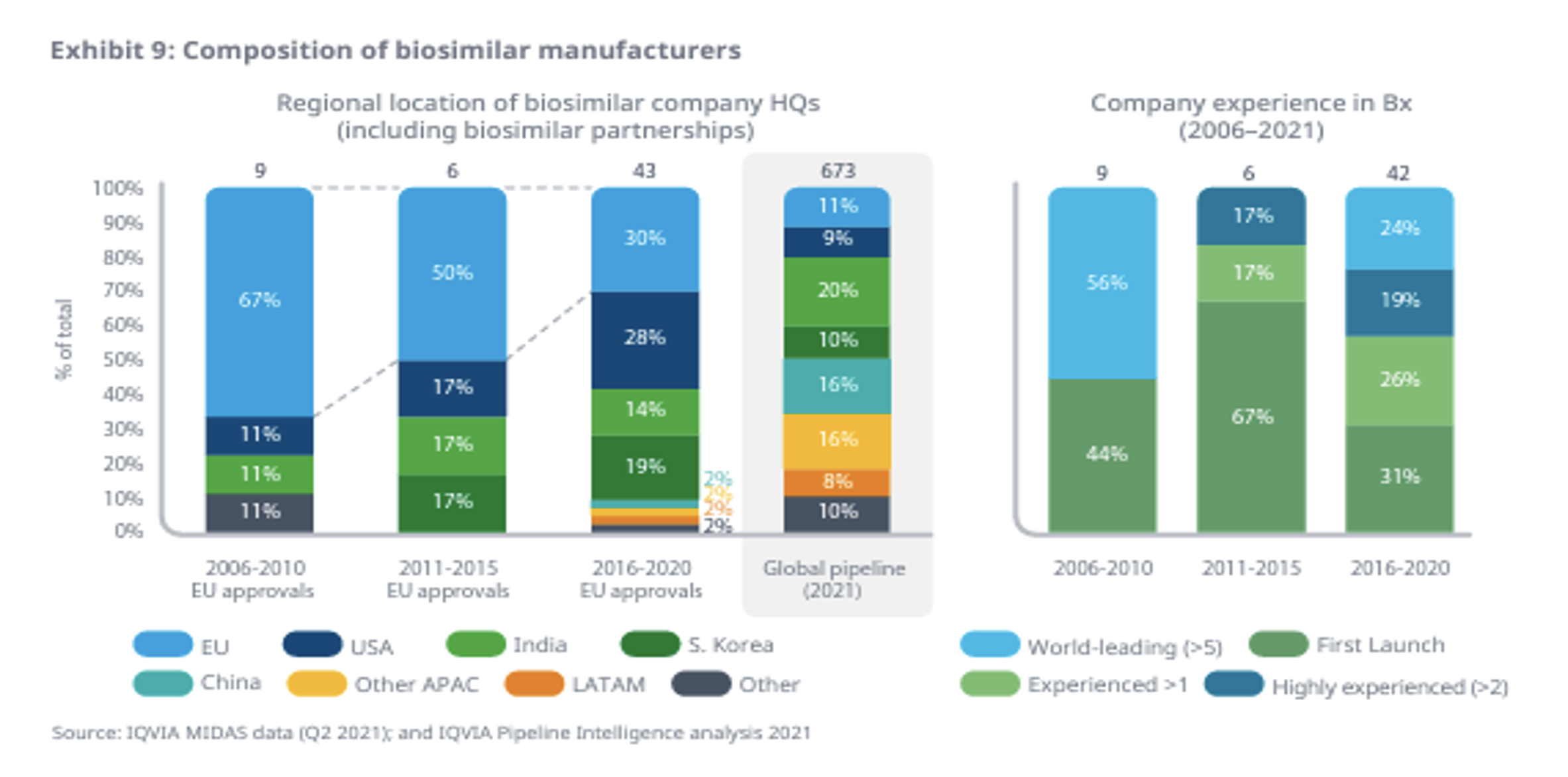

It is also interesting to see how the composition of biosimilar developers and manufacturers is changing over time. There have been many more manufacturers launching biosimilars in the last five years than in prior years and those manufacturers are much more regionally diverse than they used to be.

Conclusion

There is a big wave of biosimilars coming. They are expected to bring a significant increase in competition to the markets for biologics and potentially help drive better affordability as a result. But it is not clear yet what their full effect will be. There is a ‘big event’ occurring in 2023 with the launch of Humira (adalimumab) biosimilars that will begin to accelerate that effect and our understanding of it. In the next article in this series we’ll take a closer look at this ‘big event’.

About the Author