Introduction

This is a follow-up to a prior Inspire Blog article[1] we posted and the first of three we’ll be posting now that more information, detail, and realities have come to pass; this post delves deeper into the Drug Price Negotiations, and the next two will explore the implications of the Part D Benefit Design changes and Maximum Out-of-Pocket Cap changes in greater detail.

Negotiated Drugs

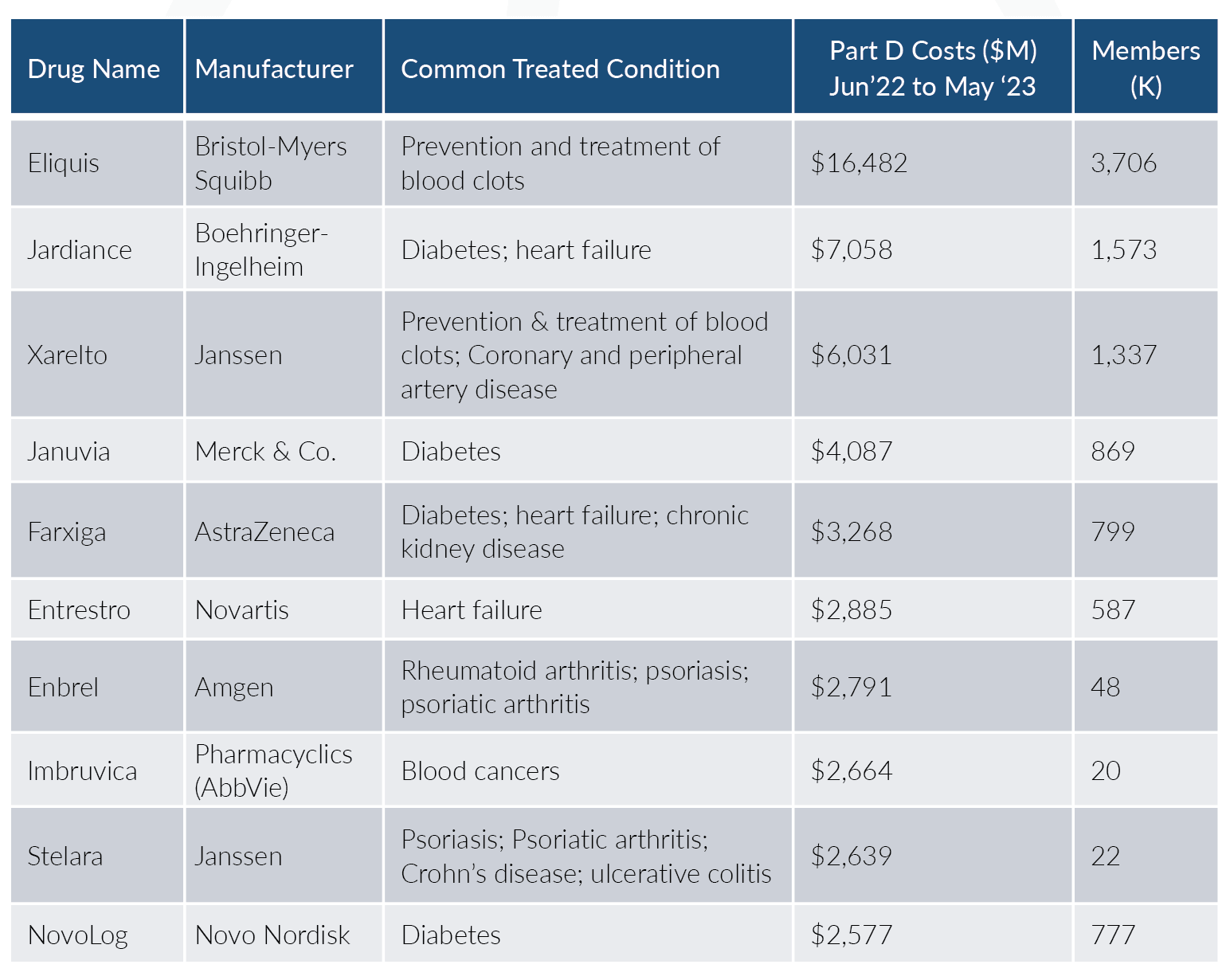

The Inflation Reduction Act (IRA; H.R. 5376)[2] established a ‘Drug Price Negotiation Program’ in which the Secretary will negotiate a Maximum Fair Price (MFP) for a growing list of select single source drugs and biologics that will be applicable for Medicare Part B and Part D plans. This growing list begins with 10 drugs effective for 2026, an additional 15 drugs for both 2027 and 2028, and then 20 more drugs each year from 2029 and beyond; Part B drugs are included beginning with the 2028 selection. Here are the first 10 drugs[3] that CMS (the Centers for Medicare and Medicaid Services) has selected:

Together this initial list of ten drugs comprises approximately $50.5B, or about 20%, in Medicare Part D gross drug spend. As you can see, these drugs cover key conditions related to cardiovascular, diabetes, rheumatoid arthritis (RA), and some autoimmune diseases.

Timeline

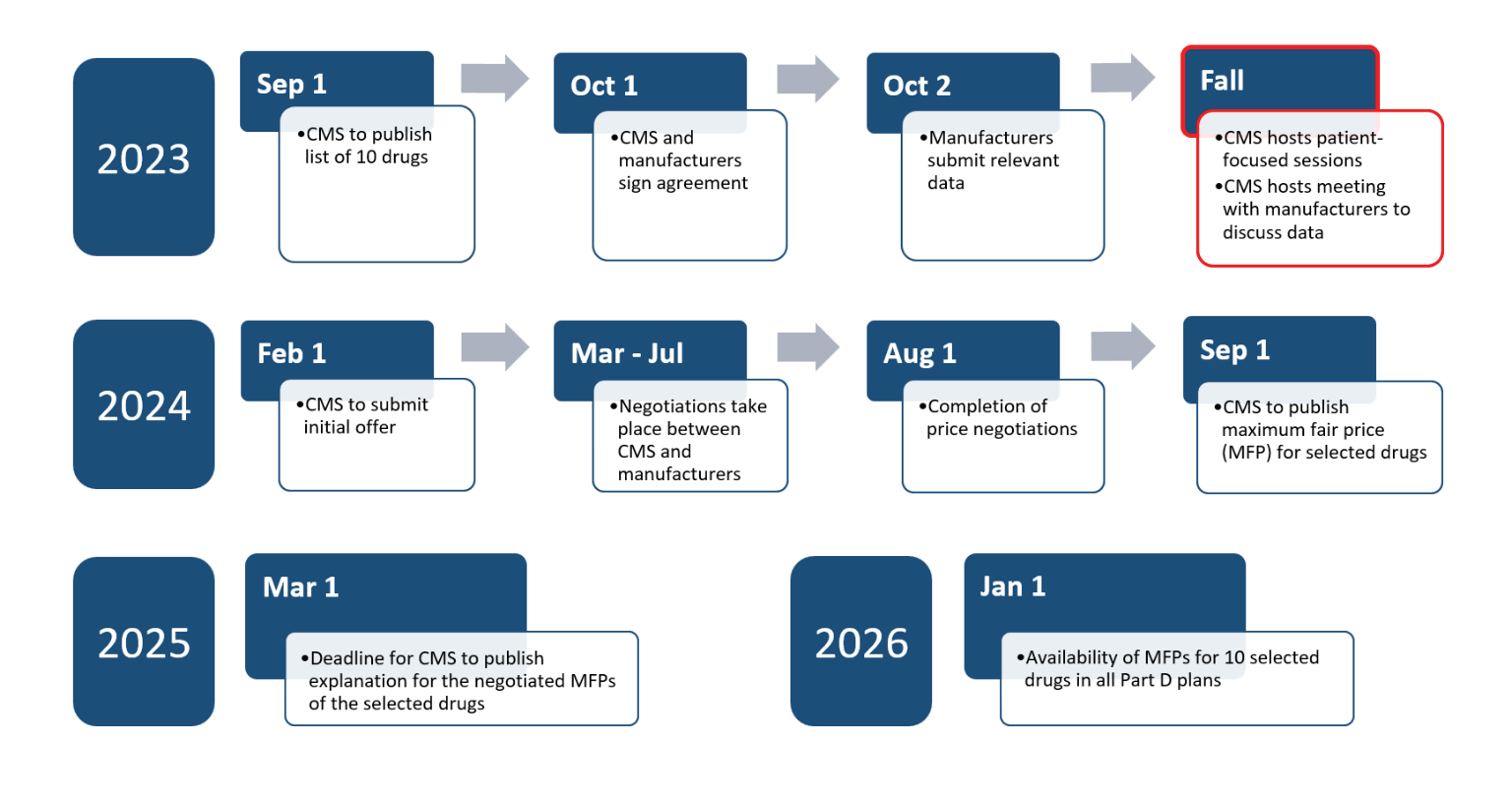

Efforts of the Drug Price Negotiation Program are on schedule thus far. CMS is hosting a meeting with manufacturers to discuss the submitted data. CMS is also hosting listening sessions with consumer and patient organizations to gather information to consider in the initial offer to be submitted by February 1, 2024. Here is an outline of the schedule[4], [5]:

Most of 2024 will be devoted to the actual negotiation efforts between CMS and the respective manufacturers to come to an agreement on price with the first offer being submitted by 2/1/2024. If manufacturers wish to provide a counteroffer, they must do so by 3/2/2024. All negotiations must be completed by 8/1/2024 and CMS will publish the MFPs by 9/1/2024. A detailed explanation of the negotiated rates will be published in early 2025.

Renegotiations will begin in 2028 on the initial 10 drugs and will continue from there annually. Updated prices will be published by 11/30 applying to the following year. Therefore, in 2029 there should be 60 drugs with negotiated prices with up to 10 of them having been recently refreshed.

Maximum Fair Price

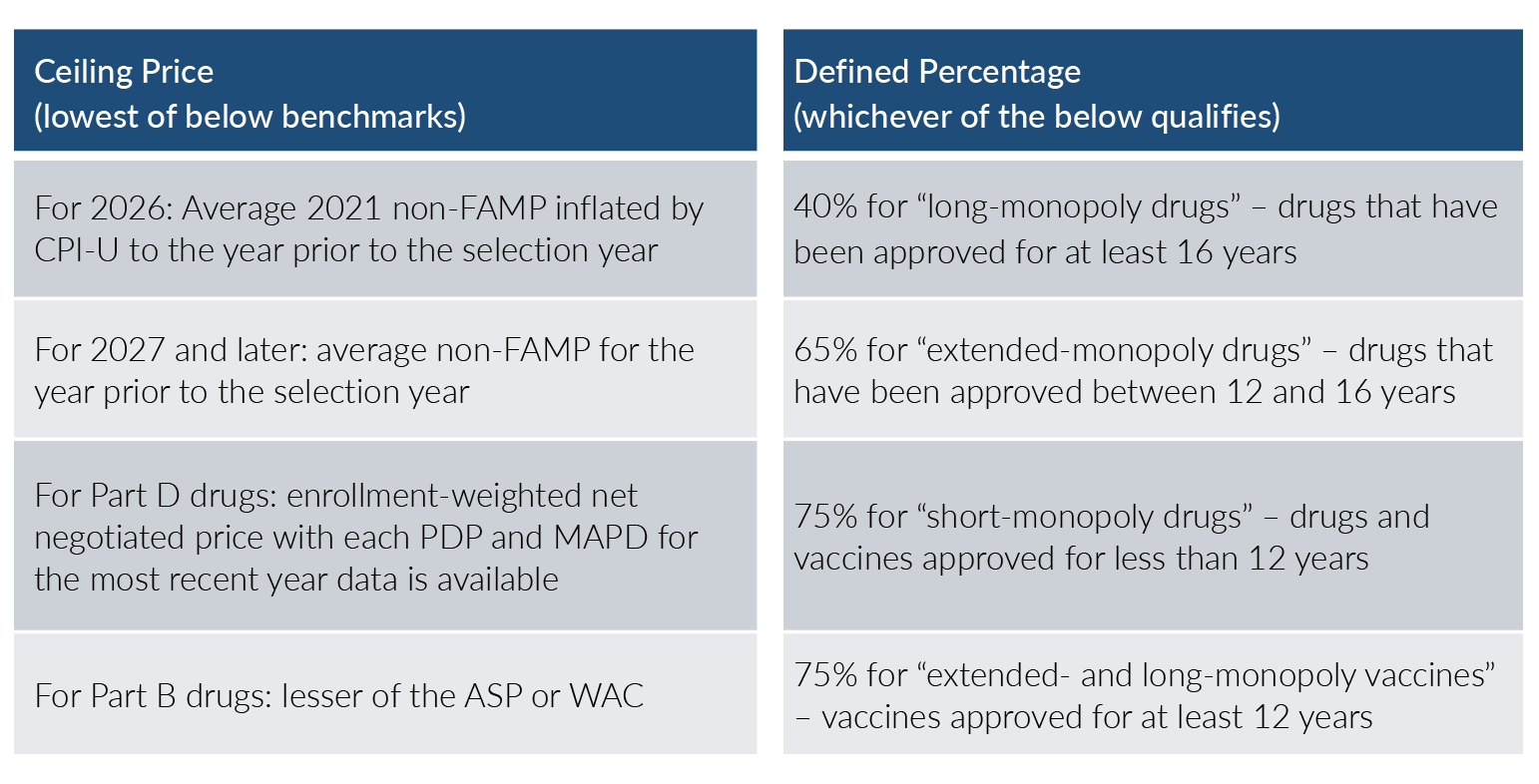

As with most things in healthcare, the Maximum Fair Price is not without a bit of complexity. The MFP will be equal to or less than a ceiling price multiplied by a defined percentage. For the 2026 Part D drugs listed above, the ceiling price is defined as the lower of the following[6], [7], [8]:

- The average 2021 non-FAMP (Non-Federal Average Manufacturer Price) rate inflated by CPI-U

- The enrollment-weighted net negotiated price with each PDP and MAPD in the most recent year

As with most things in healthcare, the Maximum Fair Price is not without a bit of complexity.

For 2027 and later, instead of the 2021 non-FAMP rate, it will pull the most recent year available. For Part B beginning in 2028, instead of enrollment-weighted net negotiated pricing, it will simply use the minimum of the Average Sales Price (ASP) and Wholesale Acquisition Cost (WAC), along with the non-FAMP rates.

The defined percentage by which this ceiling price is multiplied is dependent on the age of FDA approval and whether the drug is classified as a vaccine or not. The defined percentage is 40% for drugs with an FDA approval of at least 16 years prior and are classified as “long-monopoly drugs.” The percentage increases to 65% for “extended-monopoly drugs” where the FDA approval is between 12 and 16 years old. It is 75% for “short-monopoly drugs” and vaccines with FDA approvals less than 12 years prior.

CMS will also be considering a number of factors within the negotiating efforts spanning:

- Research and Development Costs

- Current unit costs of production and distribution

- Any prior federal financial support

- Data on pending and approved patent applications

- Market data (utilization, revenue, etc.)

- Availability and costs of alternative options considering clinical effectiveness and any related side effects

Open Questions

As should be expected with legislation of this magnitude, there are many open questions such as:

- How will CMS address push-back from industry stakeholders?

- How will this impact future drugs and their launch prices?

- How will future innovation and pharma research and development be impacted?

- Will there be more and/or accelerated market consolidation within healthcare as manufacturers, physicians, hospital systems, and other stakeholders seek cost containment?

- How will this new MFP pricing index impact the other segments such as Commercial and IFP?

Conclusion

Axene Health Partners is ready to assist payers, pharmaceutical manufacturers, PBMs, and other health system stakeholders in their analysis as they navigate the implications of the many provisions within the Inflation Reduction Act.

Endnotes

[1] https://www.cms.gov/files/document/drug-price-negotiation-timeline-2026.pdf

[3] https://axenehp.com/pharmacy-provisions-inflation-reduction-act/

[4] https://www.congress.gov/117/plaws/publ169/PLAW-117publ169.pdf

[5] https://www.cms.gov/files/document/fact-sheet-medicare-selected-drug-negotiation-list-ipay-2026.pdf

[7] https://www.lw.com/admin/upload/SiteAttachments/Alert%202997.pdf

About the Author

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.