Introduction

There is a coming wave of changes arriving soon to the pharmacy market in the form of biosimilars. And that coming wave has a big event in 2023: the launch of Humira biosimilars, which began last week with the arrival of Amjevita on the market. The extent of the financial impact of this coming wave and its big event are not yet fully known, but there are trends we can follow that help predict what this change will look like. We know biosimilar uptake is key to driving savings, but it can take a while to ramp up and become material. Biosimilars increase competition and there’s going be a lot of opportunity through the big event to begin to drive competition to an extent that we really haven’t seen with previous biosimilars. So let’s dive into what drives the financial impact of biosimilars.

Accelerating Savings from Biosimilars

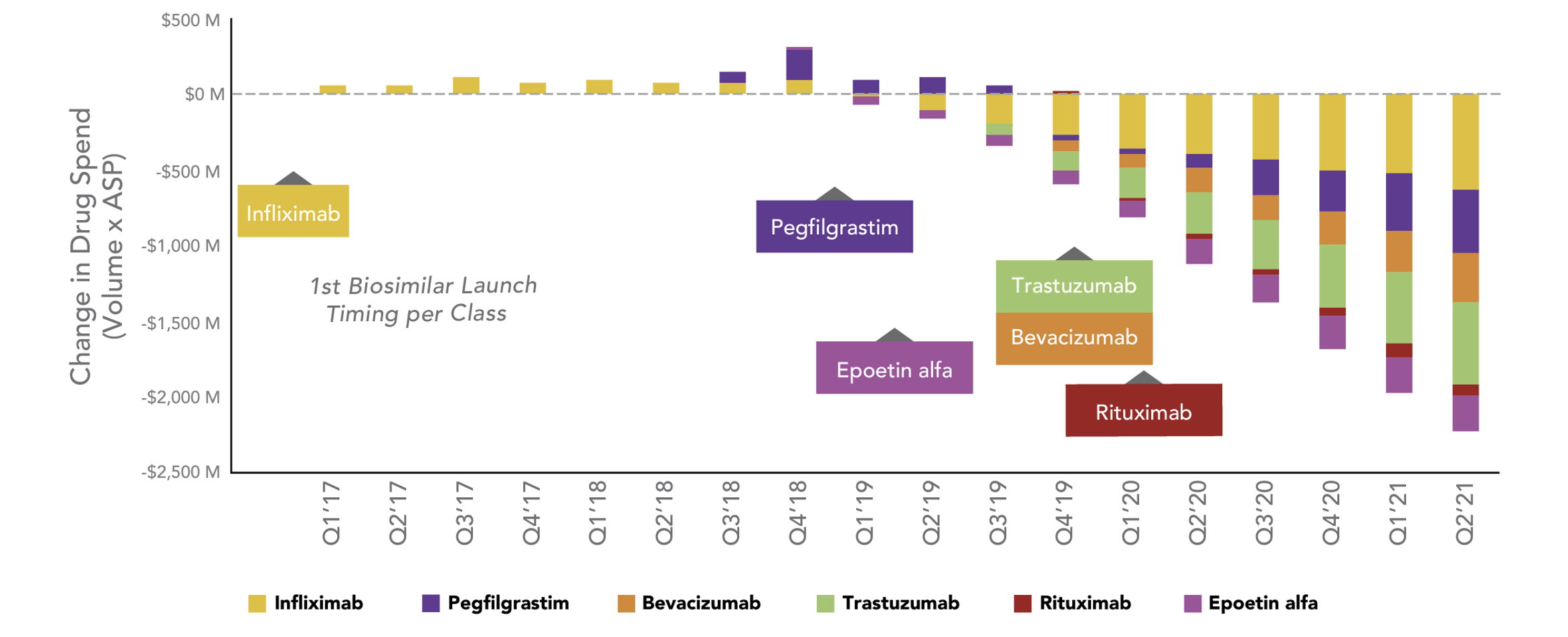

Savings from biosimilars have accelerated significantly in the last two years. There have been a number of relatively recent biosimilar launches that we can look at to help shape our expectations of the financial impact that could result from this year’s big event.

Estimated Change in Total Drug Spend After Biosimilar Competition

Source: https://www.amgenbiosimilars.com/commitment/trends-report

It can take a while for savings to ramp up in markets with biosimilars, but these last two years the quarterly savings due to biosimilars have grown to where they now exceed $2 billion in quarterly savings.

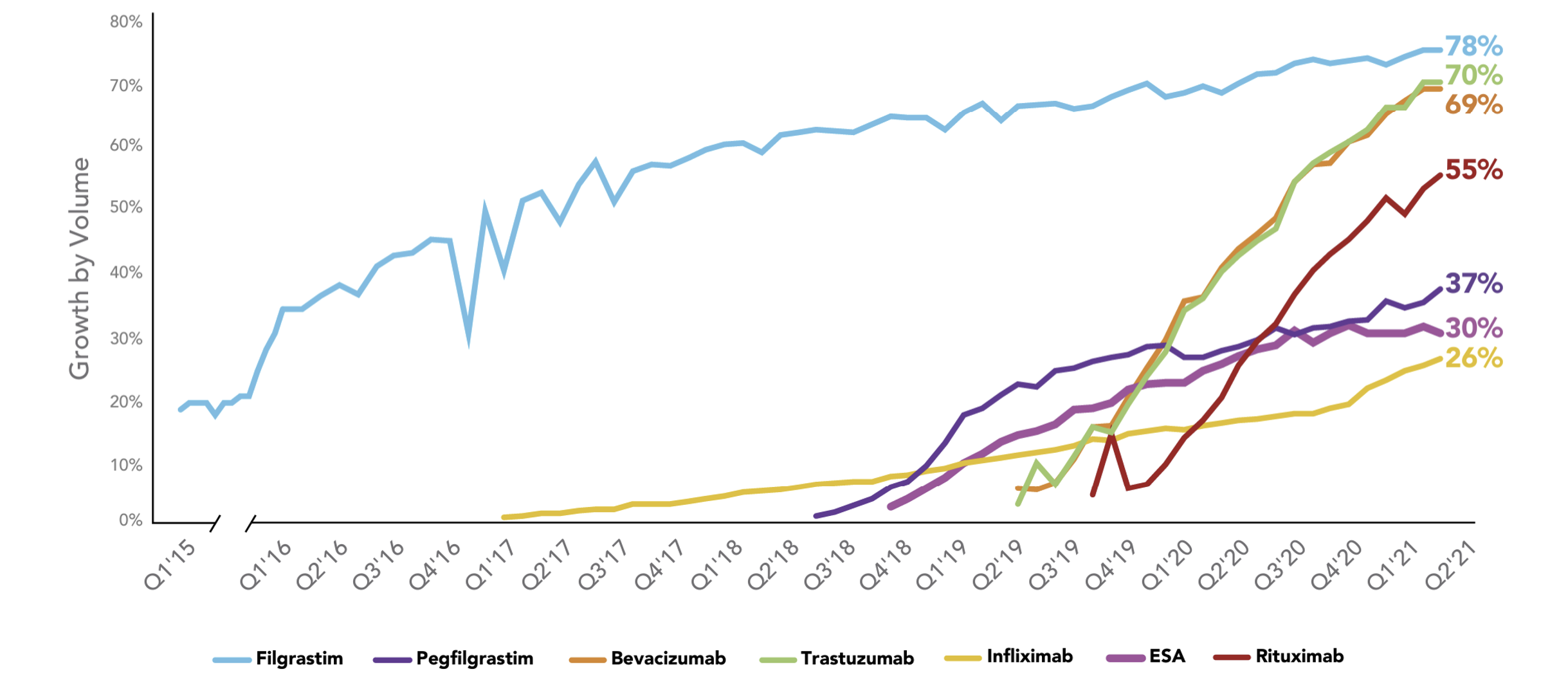

Biosimilar Uptake Pace is Critical

Biosimilars Uptake Curve

Source: https://www.amgenbiosimilars.com/commitment/trends-report

The pace of the biosimilar uptake curve is a critical driver of savings resulting from biosimilars. The older biosimilar (filgrastim) had a longer and more gradual pace (a flatter shape) to its uptake curve. It has ultimately achieved 78% uptake which is very substantial, but it took many years to get there.

The next biosimilar on the market (Infliximab) also has had a flatter uptake curve and still has only reached 26% uptake even four years after launch. The next two biosimilars after Infliximab (ESA and Pegfilgrastim) have had modestly steeper uptake curves than Infliximab but still have only reached 30% and 37% uptake rates.

The more recent biosimilar launches (Bevacizumab, Rituximab and Trastuzumab) have shown steeper, more promising uptake curves that give strengthening hope to the financial impact we might expect from the coming wave of biosimilars. We can also observe that sometimes oncology products have quicker uptake than non-oncology products.

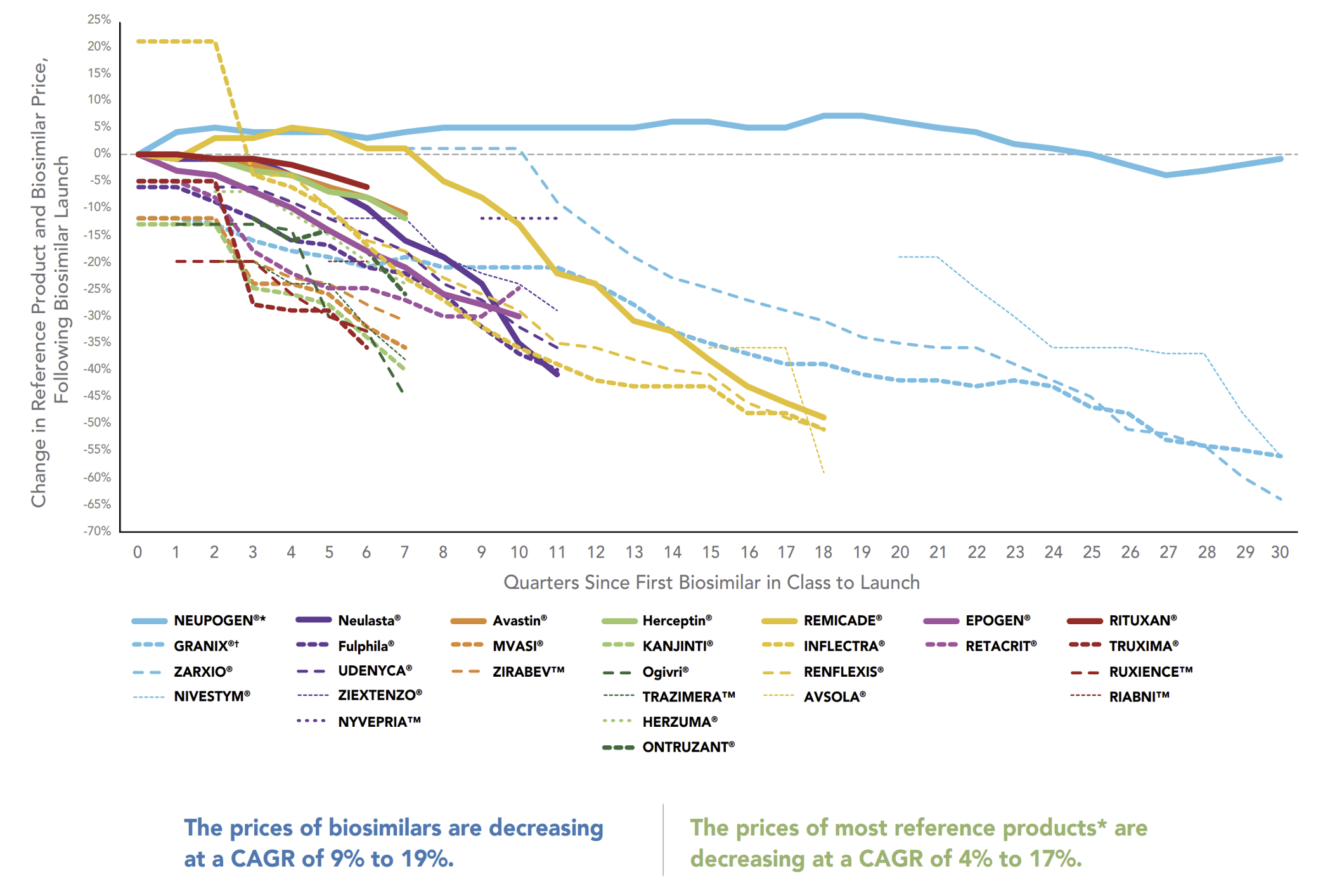

Biosimilar Competition Drives Price Declines

As biosimilar uptake accelerates, prices for both the reference product and its biosimilars drop sharply due to the intensifying competition. Prices here are defined as the “Average Sales Prices” (ASPs) which are net of rebates for those products that are paying rebates. The bold lines in this graph represent the declining reference product prices while the dashed lines of the same color represent the prices of that reference product’s biosimilars.

Downward Trend in ASP for Biosimilars and Reference Products Over Time

When there are more biosimilars, there is more opportunity for competition to accelerate the drop in average sales price. Where there are fewer biosimilars for a reference product, it can be more difficult for the biosimilars to gain uptake traction. With this year’s big event of the Humira biosimilar launch, there will be a ton of opportunity for biosimilar uptake with potentially as many as ten biosimilars entering the market. Thus, the opportunity for even faster, steeper price declines is greater than what we’ve seen from biosimilars in the past.

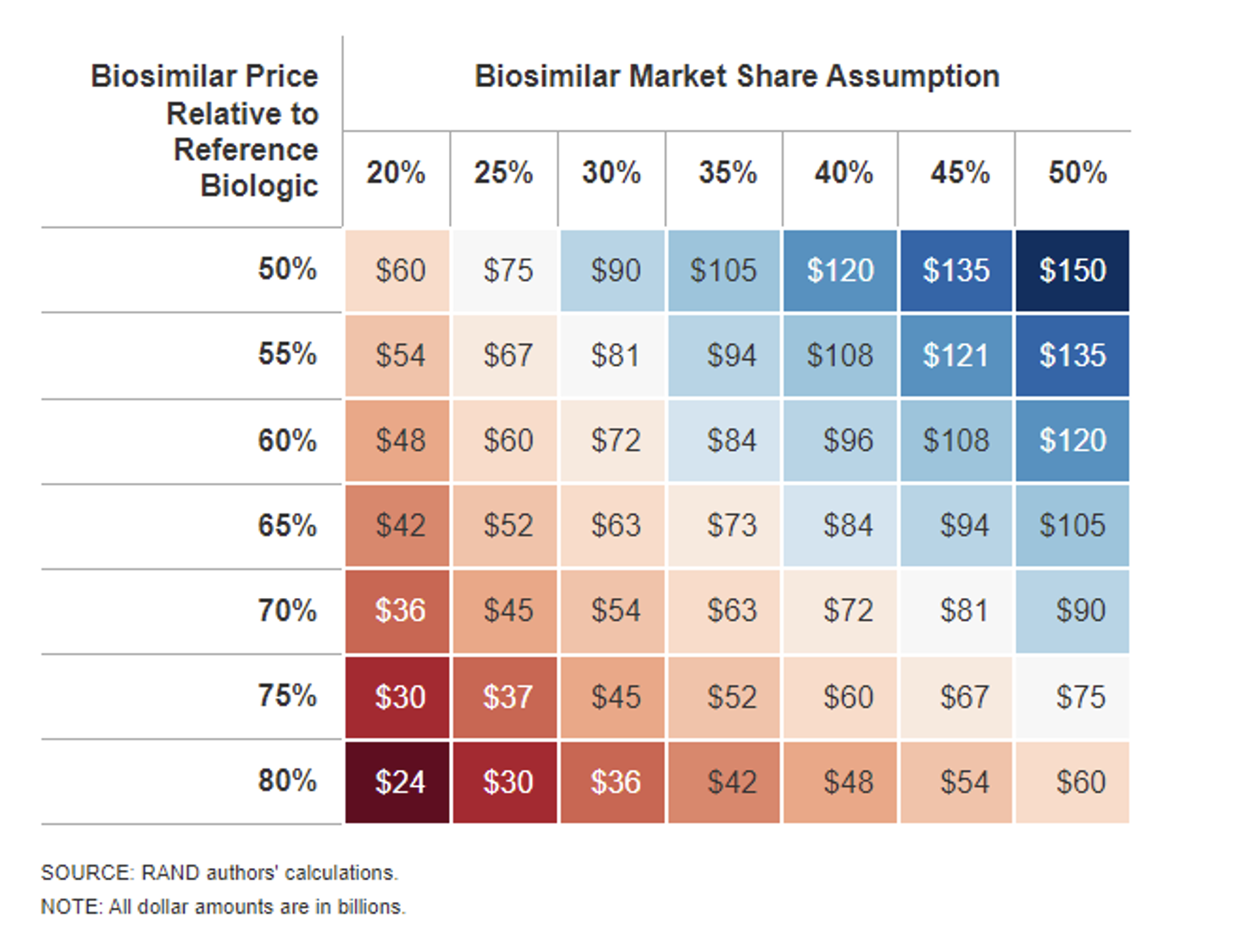

Biosimilar Cost Savings Sensitivities

Biosimilar uptake (or market share assumption) and biosimilar (and therefore reference product) price declines as a result of that competition are the two factors most driving biosimilar cost savings.

Sensitivity Analysis Results: Ten-Year Biosimilar Cost Savings

Total ten-year biosimilar cost savings estimates range from as low as $24 billion up to $150 billion in this RAND study.

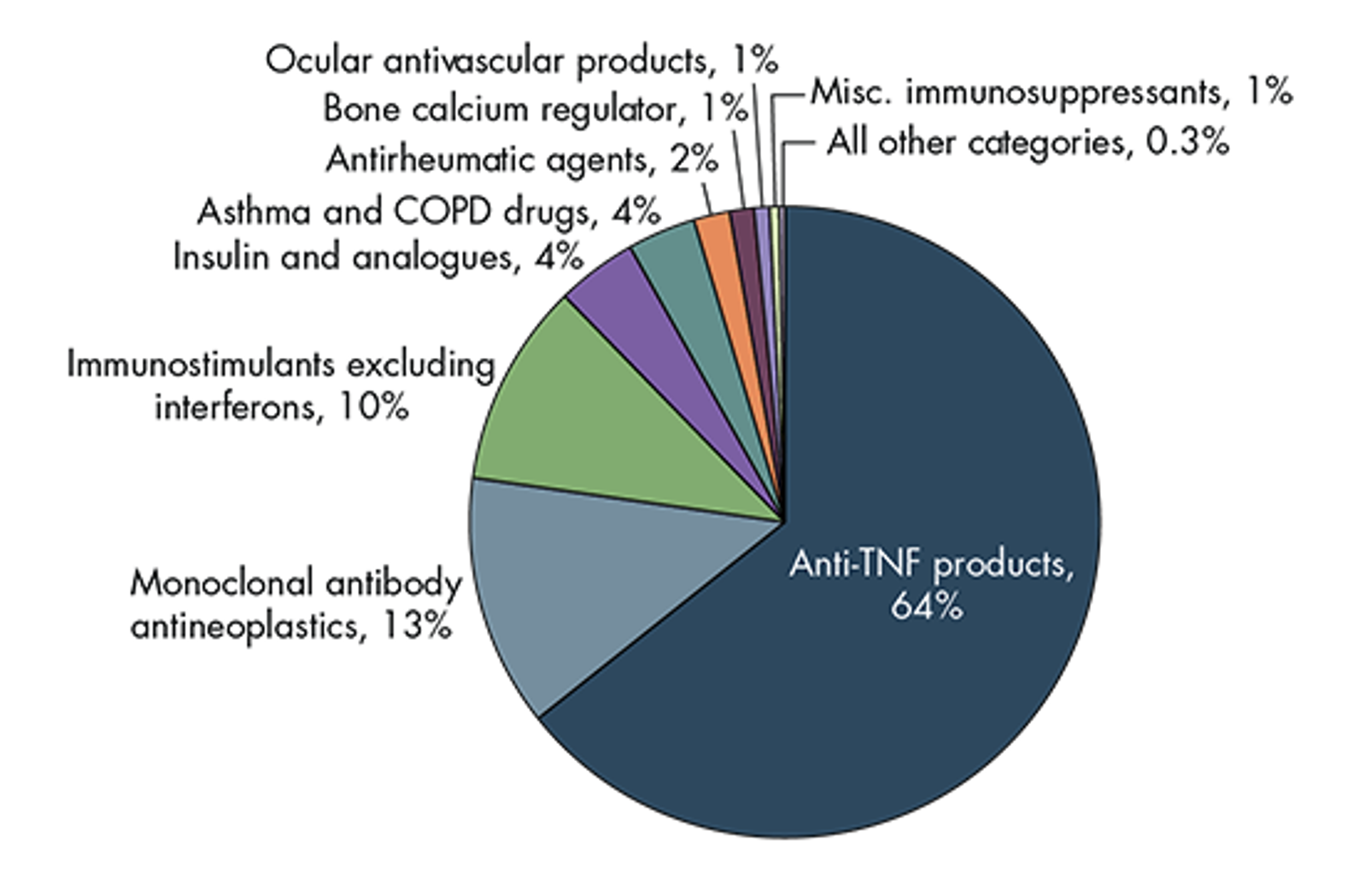

And another study from RAND estimates the portion of savings coming from each of several different biologic classes.

Estimated Cost Savings, by Biologic Class

Source: https://www.rand.org/pubs/periodicals/health-quarterly/issues/v7/n4/03.html

The Anti-TNF products are the various reference products and biosimilars competing with Humira. So the Big Event of 2023, the launch of Humira biosimilars, and the related biosimilar uptake and price competition that result over the next few years, are expected to comprise about 64% of the total biosimilar savings.

Ultimately the financial impact of this Big Event of 2023 could comprise half or more of the total financial impact of the Coming Wave of Biosimilars over the next ten years.

Summary/Conclusion

It will take a couple of years for us to see what the full financial impact of the Big Event of 2023 (the Humira biosimilar launch) will be. But we will get leading indicators as we track the biosimilar uptake curve and related average sales price declines of Humira and each of its biosimilars and compare them to the same curves for other biosimilar launches in the recent past. Ultimately the financial impact of this Big Event of 2023 could comprise half or more of the total financial impact of the Coming Wave of Biosimilars over the next ten years. It won’t be long until we have a good idea of what the total financial impact could be. These are truly exciting times!

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.