Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

In a recent Inspire article, Are We In For Significant Healthcare Cost Increases?, David Axene explained why healthcare cost trends may soon accelerate. This article explores one of the drivers for that acceleration – rapidly rising provider input costs.

The Changing Provider Financial Environment

Health care providers and private health plan sponsors have enjoyed low medical unit cost trends for the past decade. In the wake of Obamacare, uncompensated care declined, reducing the need for providers to cost shift to private payers. In addition, health care providers faced low input cost inflation and a strong economy produced a high share of commercial patients. As a result of these factors, unit cost trends moderated.

The period of moderation in unit cost increases is ending. Hospitals and medical groups experienced significant financial stress during the pandemic, with increased staffing challenges and costs, and with COVID cases displacing profitable surgical cases, only partially offset by CARES funding. They are now experiencing the beginning of what they expect will be extended, significant input cost inflation. In April, the American Hospital Association reported that hospital input costs increased by 20% between 2019 and 2021: (Source: Costs of Caring | AHA)

In addition, an increasingly likely recession-producing unemployment would weaken their payer mix.

Large hospital systems, individual hospitals and medical groups typically have multi-year contracts with health plans. Those with a year or more left on those contracts are signaling that they are financially stressed and, as reported in May by the Wall Street Journal, those beginning renewals are making the largest unit cost increase requests in a decade…up into the double digits.

The Role of Cost Shifting and Production Efficiency

Public to private payer cost shifting could play a large role in multiplying the increases providers need from private payers in response to input cost increases. However, there are also wide variations in provider production efficiency and input cost pressures can also be offset with production efficiency improvements:

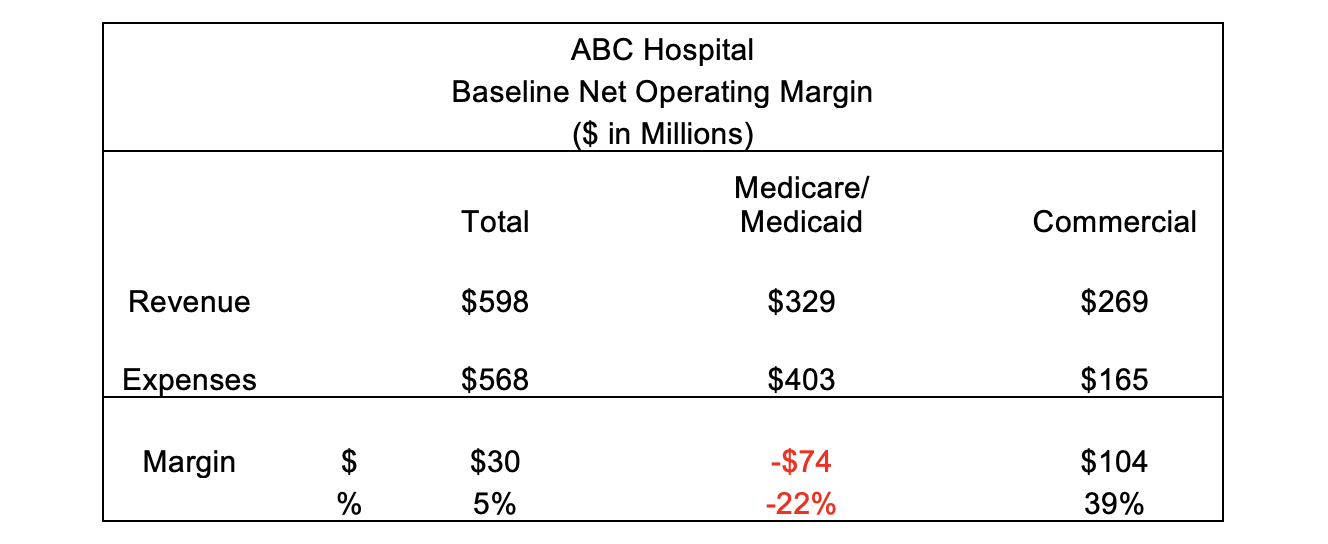

Consider the illustrative “ABC Hospital” that has annual net patient revenue of $598M, operating expense of $568M and a resulting net operating margin of 5%. Additionally, 55% of its net patient revenue is from Medicare or Medicaid with the remaining from commercial payers.

The following table provides a high-level view of the hospital’s operating financial statement. Although ABC has an overall 5% profit margin, positive margins (+39%) from commercial business are offsetting a negative margin (-22%) on Medicare/Medicaid business.

Scenario 1 – In this scenario, we illustrate the impact that a 10% increase in operating expenses has on required rate increases for health plan payors. In particular, the impact that cost shifting between Medicare/Medicaid payors, whose increases are defined by law, and commercial payors, who must negotiate reimbursement rates.

The upper half of the following table includes an additional 10% in expenses distributed between payors based on each payor’s gross revenue billed, with the resulting margin dropping from 5% to negative 4%.

In the lower half of the table for scenario 1, we show that the increase in net revenue required to maintain a 5% operating margin is 10% in total. However, due to an assumed 3% increase in Medicare/Medicaid net revenues, the balance of required increases — from commercial payers — is 19%. This result puts both ABC and its commercial payors in a challenging situation. This is likely complicated by the likelihood that ABC may have multiyear contracts with some payors limiting their options even further.

Scenario 2 – In our second scenario, we illustrate the moderating impact that hospital efficiency improvements of 5% would have and the resulting cost shifting. This 5% is a combination of productivity increases required by current short staffing conditions and underlying productivity improvements. As with the previous scenario, the expense line in the upper half of the table has a 5% reduction in the expenses shown in scenario 1.

The lower half of the above table shows a material reduction in required revenue increases from commercial payors from Scenario 1 of 19% to 6%.

In the following section, we share a number of recommendations for both private health plans and sponsors as well as providers to better manage upcoming contract negotiations

Notes: The above scenarios, although based on actual hospital financial data, have been simplified for the purpose of illustrating the concept of Cost Shifting and offsetting impact resulting from cost efficiency improvement. Dollars have been rounded to the nearest million and percentages to the nearest whole number. The rate increase of 3% for Medicare/Medicaid is illustrative only and not a projection of current or future increases to CMS’ IPPS or OPPS conversion factors.

Recommendations for Private Health Plan Sponsors and Providers

As provider unit cost trends moderated over the past decade, health plan and provider contracting leaders shifted their focus to other priorities, such as performance of the individual market, Medicare Advantage, and Medicaid networks and commercial risk arrangements. Many have never had to negotiate within the economic challenges we see today.

Unless health plans rapidly restructure their core provider contracting processes, private health plan sponsors are likely to experience several years of elevated and higher than budgeted costs.

Steps health plans should take include:

- Negotiate provider unit cost increases that reflect production efficiency opportunities, not just higher provider input costs.

- Evaluate the largest 10-20 providers annually, not just when renewals are approaching, to identify and develop pre-renewal strategies for each, based on a robust range of analytics.

- Model provider profitability based on input cost and efficiency improvement variables.

- Keep key customers and producers aware of factors that may drive higher provider unit prices, and of the health plan’s strategy to respond.

- Respond to provider pre-renewal messages regarding financial stresses with appropriate counterpoints.

- Respond to high provider unit cost proposals by requiring financial analyses and projections that support the proposals.

Similarly, unless providers can respond to health plan resistance to higher than normal unit cost increases and implement productivity improvements, they will not able to maintain necessary margins.

Steps providers should take include:

- Begin discussions of the impact of unit input cost increases and staff shortages with health plans as they are happening and not wait until renewal discussions.

- Document for health plans’ recent and projected financial performance, including the effect of input unit cost increases and staffing shortages on per patient cost, patient care revenue and margin.

- Understand and document their current production efficiency relative to peer providers.

- Develop new productivity improvement initiatives and document how these mitigate unit cost increase requests.

- Examine opportunities to decrease per patient costs and increase revenue by decreasing length of stay in DRG and case rate payment environments.

- Consider multi-year proposals that spread out payment increases or allow lower payment increases as productivity improvement efforts take effect.

Conclusion

Health care providers are experiencing staff shortages, large increases in salaries and other input costs and a potential recession. As a result of limited payment increases from government payers, some providers will want to shift the recoupment of their costs with disproportionately large rate increases from commercial payers. However, some of the unit input cost increases providers are facing can be offset through short- and long-term productivity improvements. Health plans and providers should recognize both the economic challenges providers face and provider accountability for productivity improvements. To do so, health plans and providers will need to re-tool their contracting analytics and processes.

If you found this Inspire article useful, you may also like the following articles:

About the Authors

Oscar Lucas is a Consulting Actuary with Axene Health Partners, LLC and is based in AHP’s Seattle, WA office.

Richard Maturi is a Management Consulting/Provider Contracting for Axene Health Partners, LLC. Richard can be reached at richard.maturi@axenehp.com