In a time when fear and anxiety seem to grip an entire world, the small population of risk managers experiences a rare moment of mixed emotions. Not happiness or joy – that would be inappropriate. Instead, our shared anxiety is joined by a profound vindication stemming from months or years of advocating preparedness for an imminent crisis. Risk managers are often castigated as “doomsday preppers” or, in generous cases, simply ignored because their recommendations require an investment which detracts from other fruitful business development initiatives.

Like the doctors we trust to diagnose & manage our health, risk managers can be identified by reassuring acronyms after our surname (most commonly CERA or FRM) in order to advertise an ability to manage enterprise risk. However, unlike medical doctors, a risk manager’s duty can be predominantly hypothetical until that fateful day of risk-turned-reality comes. There inevitably comes a time when enterprise risk management (ERM) pivots from theory to practice.

It goes without saying – the COVID-19 pandemic has catapulted ERM to the highest of priorities as our modern economy faces an unprecedented crisis in addition to a widespread health risk. Risk managers have a platform and an attentive audience.

The Greatest Misconception

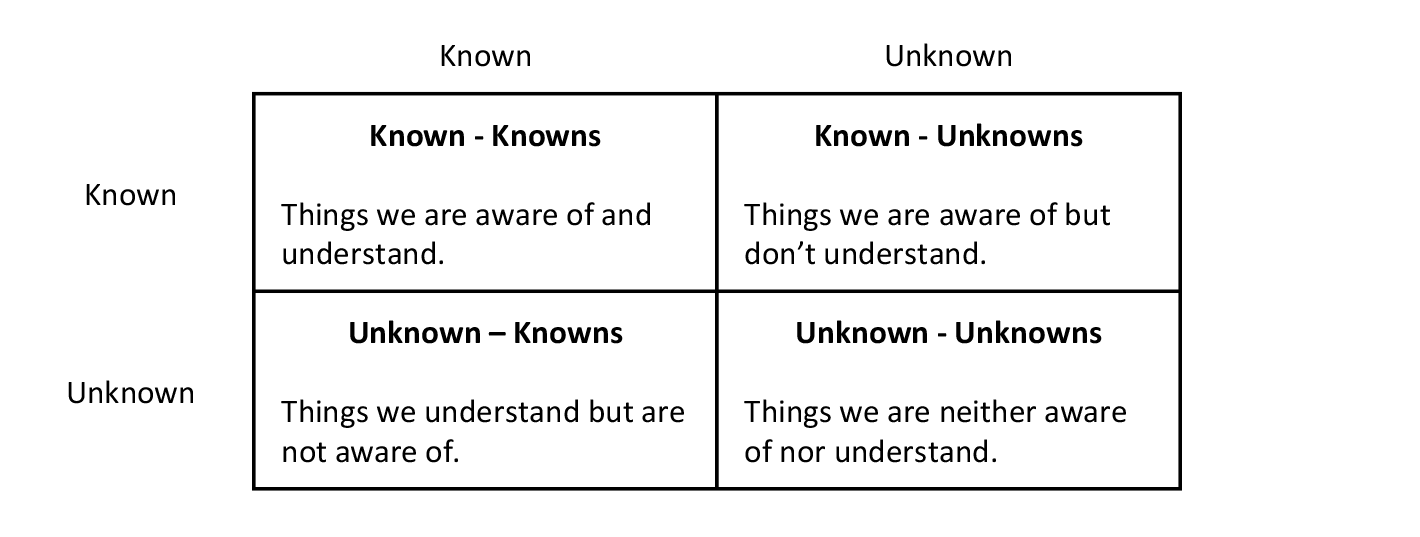

Most of us are facing difficult questions while lacking clear answers. We wonder how long the outbreak and social distancing will persist, how severely it will impact the economy, and fear our loved ones will be among the victims. The commonly held belief is that the outbreak of COVID-19 thrust the world into a time of extreme uncertainty. However, this blame-casting is the type of thinking that led to the unpreparedness we feel amidst this pandemic. A more proper framework for evaluating the risks/uncertainty is demonstrated below:

Pandemics can manifest in a wide array of manners and are inherently less specified than many risks normally tackled within ERM. For years people have been aware of the risk of a pandemic, yet our modern global economy has not experienced anything on the scale or severity as COVID-19. This lends pandemics to classify primarily as a “Known – Unknown” risk but with some qualities that are “Unknown – Unknowns”. Many will echo the famous trader-turned-flaneur Nassim Taleb by calling this a “black swan” event, but that isn’t entirely true by Taleb’s own admission[1]. The “Unknown – Unknown” qualities of pandemics simply give the risk distribution a very fat tail and potential for extreme consequences. Now that the risk is realized we are in the process of shifting quadrants into the “Known – Known”, all the while realizing the susceptibilities of globalization to a pandemic’s destructive force. The uncertainty didn’t increase due to the outbreak; in fact, uncertainty has decreased because we are now aware of a severe risk and the gaping holes in our pandemic response measures.

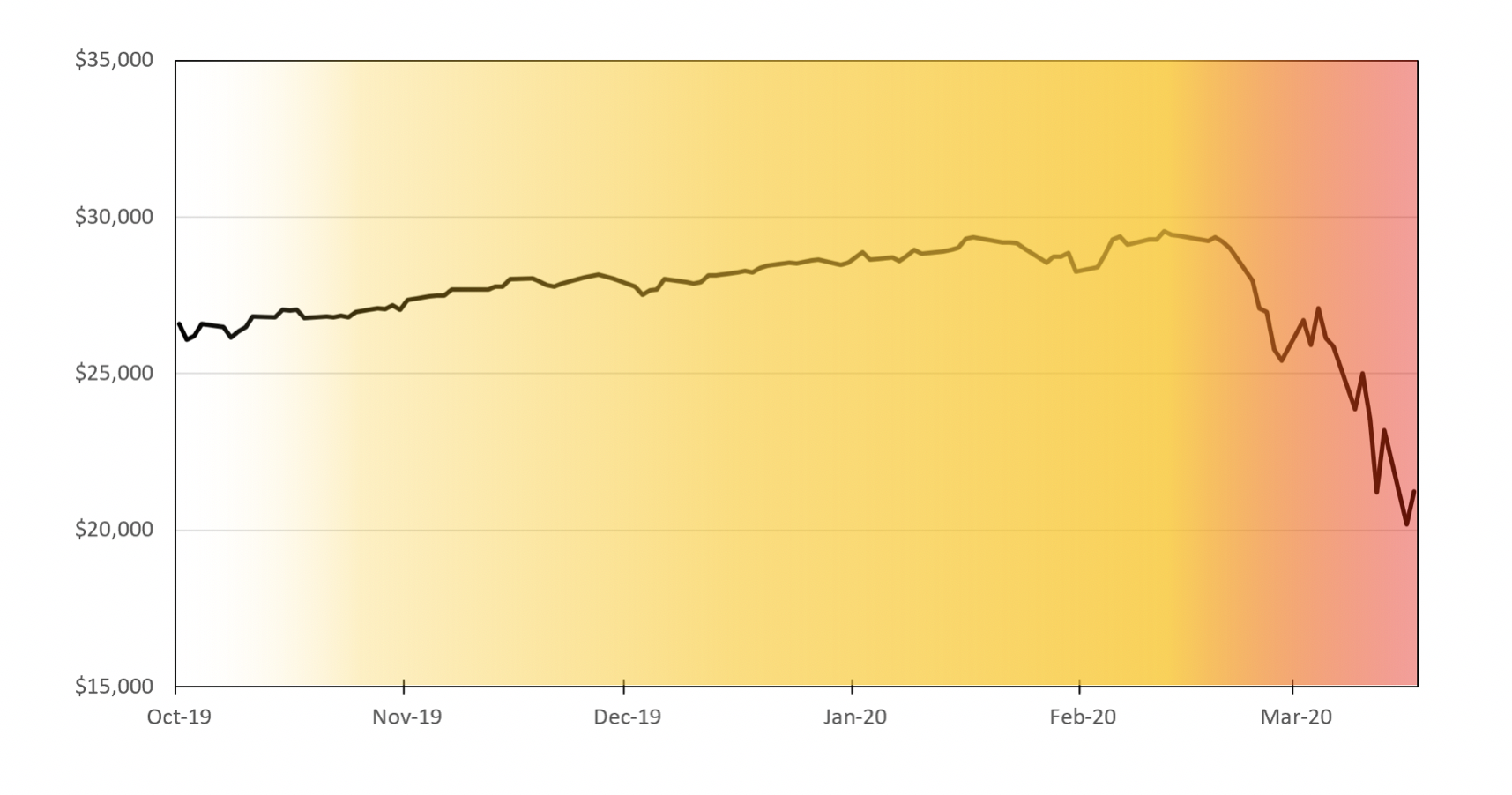

Chart 1: Dow Jones Industrial Average

Chart 1 shows the Dow Jones Industrial Average from October 2019 through March 17, 2020. For illustrative purposes, the yellow shading represents the onset of “Known – Unknown” pandemic risk, with uncertainties that give it a fat tail. Without prophetic foresight in early February, one would have assumed that the economy is as healthy and robust as ever. Who could blame them? The market and everyone’s 401k were reaching record highs. No market indicators foreshadowed the extreme impact that COVID-19 had in store even as we knew an outbreak was occurring in various parts of the world. We just “didn’t have enough evidence” that it was actually a monstrously imminent threat and respond in kind. Unfortunately, when the “Known – Unknown” threat became a “Known – Known” it invariably coincided with extreme volatility due to insufficient preparedness (*cough* *cough*… ERM). This is indicated by the yellow shading shifting to red. Like Socrates describes in the allegory of the cave, a sudden and forceful acquisition of knowledge is often painful. Risk management’s purpose is to mitigate volatility and the accompanying catastrophic consequences; hopefully, it also curbs the surprise when a catastrophe actually occurs. Most people become troubled by the volatility being added to a respectable amount of uncertainty, which is perfectly reasonable considering the current circumstances. However, we should be most troubled by the extent of uncertainty we naively accepted without preparation prior to the outbreak.

ERM Guidance from the Divine

The first book of the Bible is replete with timeless lessons for humanity, offering a divine peak under the universe’s metaphorical hood. Genesis concludes with the life of Joseph in Egypt, where he was sold into slavery by his jealous brothers. Yet against all odds (by God’s divine providence) he gained notoriety in the jails as a dream interpreter and eventually his services were enlisted by Pharaoh himself. He had the pleasure of informing Pharaoh that Egypt was due for seven years of record-smashing GDP growth and the lowest unemployment in decades. However, Joseph also had the unfortunate responsibility of warning Pharaoh that following a seven-year rally would be a seven-year recession. The redeeming part is that Egypt had seven years to prepare, save an emergency fund, and temper its indulgence during the good times so that the recession wouldn’t be so devastating. The “Known – Unknown” famine risk became a “Known – Known” ahead of schedule thanks to a divinely provided ERM guidance.

Some might say Joseph was the first and greatest risk manager of all time. Never has a single person changed the course of a nation and lifted the economic fortunes of so many people. Give Pharaoh credit for declaring Joseph second-in-command to prepare for the inevitable famine and not prioritizing it below other pressing business development initiatives. Had Pharaoh taken some extra time to calculate an NPV based on worst-case cash flow projections he might have simply placed Joseph in charge of a risk committee under his VP of Finance. The main lesson we learn from Joseph is that the only time to effectively treat catastrophic risks is when we perceive their threat the least. It may require more responsible gratification in the bounty yielded during a roaring economy and some may even mock the risk management measures, but perhaps the fact that this type of ERM goes so strongly against our human nature is exactly why similar stories are repeated all over religious texts.

How Then Shall We Live?

Perhaps ancient Egypt was better served by an ERM framework that adhered to timeless fables & traditions rather than an over-reliance on quantifying expected outcomes and measuring value-at-risk based on the normal distribution. In our modern economy, where numbers reign supreme, we need a more effective way to quantify the need and effectiveness of risk mitigation strategies. One thought-leader on this matter is Mark Spitznagel, President and Chief Investment Officer of Universa Investments. He has demonstrated that proper risk mitigation for catastrophic scenarios is not always effectively achieved by merely adding an extra degree of conservatism, diversification, or trying to avoid risk altogether (although that could be appropriate depending on the specific risk). Rather, long-term growth is optimized when responses to catastrophic risks are equally, ideally more, asymmetric and exponential[2]. When the COVID-19 pandemic subsides and panic has settled, we will have an opportunity to develop the asymmetric type of risk mitigation strategies to combat the next pandemic (there will be one… eventually) with sufficient force all the while preserving our economy.

If we learn any lessons from the pandemic, the world after coronavirus should not simply go “back to normal” and operate in the same manner it did before.

As frightening and serious as the COVID-19 pandemic is, it also provides a stress test on our local and global health systems, economies, supply chains, education systems, and more. If we learn any lessons from the pandemic, the world after coronavirus should not simply go “back to normal” and operate in the same manner it did before. Just like air travel changed dramatically after 9/11 to prevent future hijackings, there should be sweeping changes so that our society is better prepared to handle the next (and likely more severe) pandemic. Motivation to find and implement effective strategies will be at an all-time high immediately after it subsides and diminishes the more it fades into the past.

It is tempting to prognosticate on which risk management measures should be enforced in a post-coronavirus world. At the moment we reside in a state of emergency response and damage control; a more thorough study of the underlying issues which permitted the initial COVID-19 outbreak, subsequent spread, and inability to respond quickly enough or with enough scale to manage the pandemic will be completed by many for years to come. At this point, several overarching ERM principles have been revealed which can be applied in a variety of contexts.

- Scale & Speed – Medical supply, staffing, and bed shortages are crucial problems currently inhibiting the pandemic response. Most medical providers maintain adequate staffing and beds to be profitable under normal circumstances, it would be financially irresponsible and a disservice to equity partners otherwise. However, pandemics quickly maturate and consume exorbitant resources in a short period of time. How does the private sector swiftly respond in such a situation? What sort of coordination will be required with the government? How can this be achieved while maintaining fiduciary duties during normal times? These questions likely have unique answers depending on the institution and will relieve the pressure to “flatten the curve” with extreme social distancing.

- Redundancy – A shortage of medical supplies and drugs has demonstrated that supply chains lack adequate alternatives. Axios reported that approximately 150 drugs are at risk of shortage due to the COVID-19 pandemic[3]. Insufficient redundancy not only impedes the pandemic response but also exacerbates other health risks.

- Business Continuity & Decentralization – The broader economy has come to a grinding halt as social distancing measures become more extreme. Some companies already had business continuity measures in place which allow their employees to work from home. Other businesses, including healthcare professionals on the frontline treating COVID-19 patients, necessitate in-person interaction. Businesses non-essential to a minimally functioning society were required to shut down. Limiting the pandemic’s impact on health factors and reducing its economic devastation will require enhanced remote work arrangements across many industrial sectors. Telemedicine will also play an increasingly important role to promote the safety and efficiency of health care professionals as they care for pandemic victims. Until recently, remote work arrangements have been considered an optional perk for many employers. COVID-19 has demonstrated that society is required to test and be capable of implementing a remote economy in its most extreme forms.

As we continue to face uncertainty and volatility over the coming months our attention and energy will primarily be consumed with defeating our common invisible enemy. But may we also be cognizant of how drastically more devastating a pandemic could be with a higher mortality rate, more debilitating symptoms, or major adverse impact on youth. Like Joseph, we ought to confront the plausible scenarios only conceived in our nightmares. When handling risk, we don’t put our seat belt on after the accident. Making provision and preparing during the times of plenty is the only effective way to ensure that nightmares, akin to the one we are experiencing now, do not become our reality.

Endnotes

[1] https://twitter.com/nntaleb/status/1240272428246368256

[2] https://www.universa.net/riskmitigation.html

[3] https://www.axios.com/newsletters/axios-vitals-0b7b9698-9677-4966-b060-a084f99356e4.html?chunk=0%26

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.