Unlike insurers whose plans must comply with strict metal tier and essential health benefit requirements, self-funded groups benefit from flexibility of plan design and offerings. However, most of the time this freedom is not strategically exploited and a haphazard approach takes place. With each annual renewal, it is tempting to make small modifications to existing plans and follow “the way things have always been done”. Instead, this should be a time to reflect on broader organizational priorities while offering compelling benefits to employees. This article discusses several major topics any self-insurer should consider annually.

Employee Feedback

The first step to designing any benefit offering is to understand your employee population. What are the age and gender demographics? Have you conducted any surveys or received consistent feedback? What industry are you in and are certain benefits more relevant than others? These are all necessary considerations. A tech company with younger employees will have different priorities than a manufacturing company with an older population. In the absence of employee feedback, analyzing the claims history can provide insights into which services are more highly utilized than others. Although this should be compared with cost-sharing to ascertain whether services are under or over-utilized due to out-of-pocket costs.

The first step to designing any benefit offering is to understand your employee population.

Competition

In addition to employee feedback, you should have a general understanding of health plans competing for your employee’s business. Benefits are an important aspect of employee attraction and retention. What type(s) of health plans are your industry and geographic peers offering? What are the employee premiums and plan actuarial values? Federal/state exchange plans are another source of comparison. Attracting top talent likely requires offering benefits that are more lucrative than available options.

Number of plans

Before considering the specifics of plan design, first, you should decide how many plans would be ideal to offer employees. There are advantages and disadvantages to offering multiple plans or a single plan. Multiple plans allow for variety and offer employees the choice of plan that best suits their needs. Depending on the situation, it can also allow for incentivizing and steering employees toward certain cost-effective options. However, multiple plans come with a significant risk of adverse selection. Employees will choose the plan that works best for themselves, not the employer. Successful implementation requires robust monitoring and analytics, more so than a single plan offering. While offering only one plan is simple, employees might be dissatisfied.

When offering multiple plans, it is crucial to incorporate variety among the plan designs. It makes little sense to offer three plans with very similar features and cost-sharing (this is surprisingly common!). Make an effort to ensure that there are different actuarial values, networks, and premiums among the options presented to employees. Not only does this give employees options, but it also provides an opportunity to be strategic with the offering to either maximize employee satisfaction or reduce company costs.

Cost Sharing

Designing plan features before the aforementioned considerations is premature and can lead to unwanted administrative burdens and costs. Now that a well-thought strategic vision is cast for the self-funded benefits, appropriate plan design and cost-sharing should become clearer. Prior employee feedback and competition analysis should also provide insights into plan design as well.

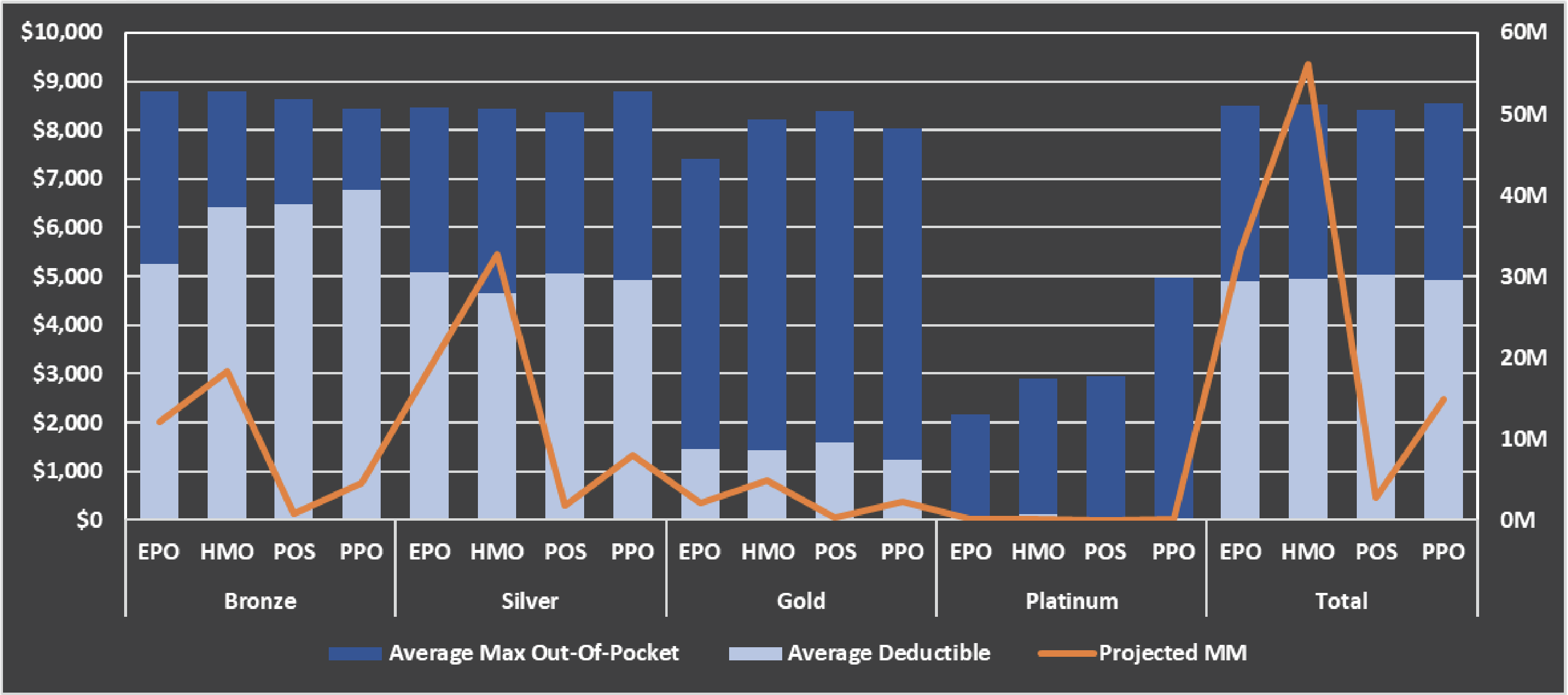

There are three primary drivers of plan design: deductible, max out-of-pocket, and the intermediate cost sharing between the two. Deductibles will have the largest impact on actuarial value and employee selection. Some plans will include separate deductibles for various services (e.g., medical versus pharmacy). A survey of plans offered on healthcare.gov for the 2023 plan year shows that the primary difference between metal tiers is the deductible. It isn’t until the platinum tier (AV of approximately 90%) does max out-of-pocket become a factor. This does not have to be the case. Self-funded groups may offer plans with similar deductibles and max out-of-pockets but vastly different cost sharing.

Intermediate cost sharing typically takes the form of copays and coinsurance. Copays benefit members with fixed costs for services while coinsurance helps align incentives with proportionate cost sharing. Much can be said about how to design these elements for each category of service. In practice, this should be done in conjunction with an actuarial value calculator and a cost model. The AV calculator will model what percentage of claims will be covered by the employer versus the employee. A cost model uses historical claims experience to break out utilization and unit cost by any type of service.

What benefits are most pertinent to your organization? If many of your employees are having children, employees will value lower out-of-pocket maternity costs. Older employees might value more generous surgical and imaging benefits. Cost sharing can also be used to steer services toward lower-cost settings (outpatient versus inpatient surgery, urgent care versus emergency room).

Plan Types

Employers may offer plans with identical cost-sharing but different networks or plan types. An HMO plan will come with a more tightly managed network but generally lower costs relative to a PPO. Employee opinions can vary wildly about plan types, especially because it has a large impact on premiums. Lastly, make sure that any network changes do not disrupt the continuity of care or cause members to lose their preferred providers.

Rating

Premium structure can be another strategic element for self-funded groups. The most important item is to maintain adequate funding for benefits. Once that’s accomplished, additional guidance can be put into how plans are rated. How many tiers will be offered? Will members be rated based on region? Will rates be lowered or raised for one plan to steer membership? A large amount of historical data can be very helpful for guiding these decisions. Because premiums represent nearly all cash inflows, it is important to accurately model the effects before implementation.

Final Considerations

It’s impossible for one article to summarize every consideration for benefit design. Some issues not mentioned include stop loss, administration, care management initiatives, provider contracting, and vendors. Axene Health Partners can assist with a more thorough and relevant assessment.

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.