Sometimes the hardest business questions have the simplest of answers. This is also true for the many nagging questions we encounter in healthcare. Too often the decision making process ignores the obvious. No matter whether the decision is about introducing a new procedure or drug, buying or investing in a new start-up, or simply trying something that hasn’t been done before, the best and most often the most reliable answer can come from completing an Assessment of Value process.

I first became familiar with Assessment of Value in the mid-1980s. Prior to this time, this had been predominantly relegated to the economist world. The process made so much sense to me and I believed that actuarial principles could improve the process and broaden its use. I was passionate about improving the efficiency of the healthcare system and eliminating potentially avoidable care. I had focused my professional career on what at that time was called “the managed care world”. I saw opportunities to evaluate many of the generally accepted managed care practices and determine what they really were worth. I anticipated that many new medical procedures and prescription drugs could or should be studied and included in this type of study. I learned that much of pharmacoeconomics already was trying to do that, but there was much more than could be done outside of the pharmacy area. I assumed that the same concept could be used to help someone decide whether or not to acquire or invest in another organization.

I began simply by looking for opportunities where this could apply. Fortunately, there were many. Some early examples were:

- Value of specific care management tasks and functions

- Value of specific new drugs

- Value of alternatives to emergency room usage (i.e., expanded home care)

- Value of virtual medicine (i.e., remote care)

- Value of new procedures (i.e., stent vs. traditional angioplasty)

- Value of new surgical techniques or approaches

- Value of acquisition vs. building from scratch

I decided to build a generic assessment methodology and consistently apply it to the various individual situations I encountered. Yes, each would require some adaptation but the framework could be consistent. More than 30 years later, I continue to use the same approach and it has proven to be a highly valuable approach throughout all of this time.

The most significant principles for building an unbiased review process are:

- Include multiple perspectives (i.e., use a 360 degree view)

- For healthcare applications be sure to include multiple perspectives:

- Patient

- Provider

- Payer

- Society at large

- For healthcare applications be sure to include multiple perspectives:

- Concisely define value: what are we really measuring?

- Clearly define the before and after environments

- Before: the current state or current world situation.

- After: the future state or future world situation.

- Utilize detailed models to develop before and after cost information

- Identify each of the key factors that are impacted by the implementation of the proposed change

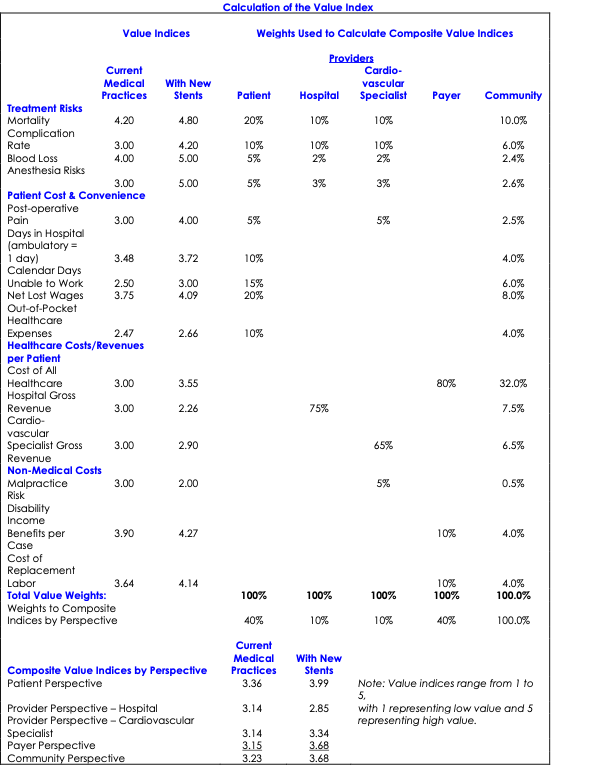

- Assign range of values (usually a scale from 1 to 5) for each of the key factors

- Develop a weighting scheme to define importance of each and to use to composite all of the results.

- Convert results to a numerical result to concretely see the differences in value or the impact of a change

- Document each of the factors so alternate perspectives can be developed.

This approach or methodology has been universally used for all of the above assessments and others not described above. This approach was published in a refereed journal and was widely distributed.

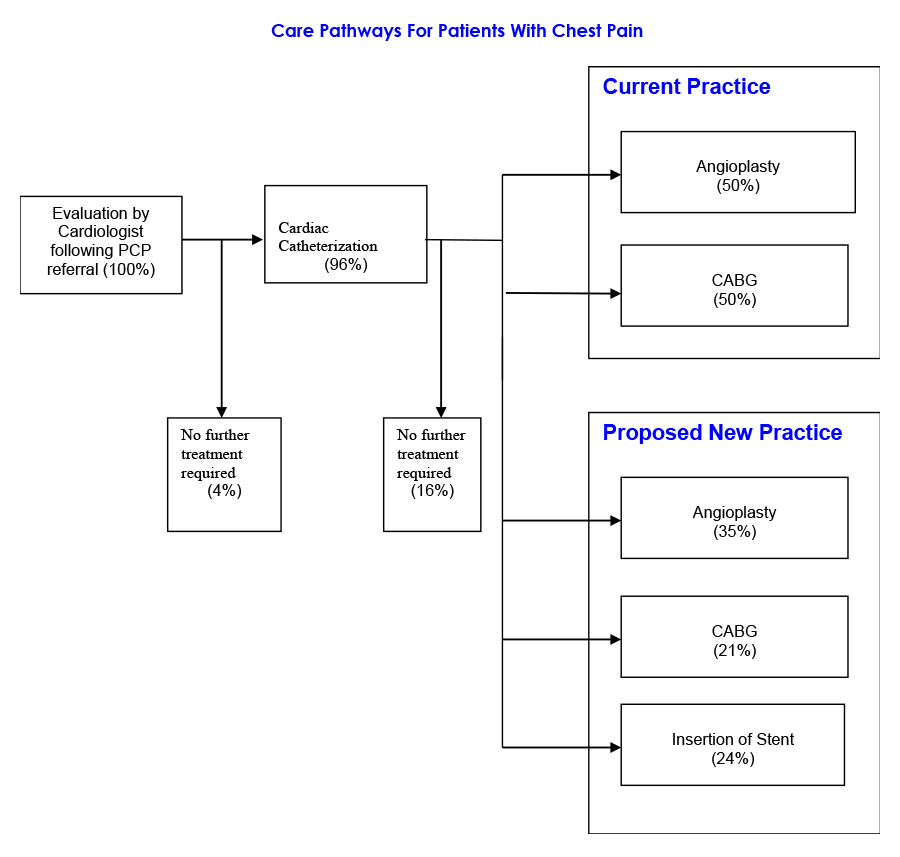

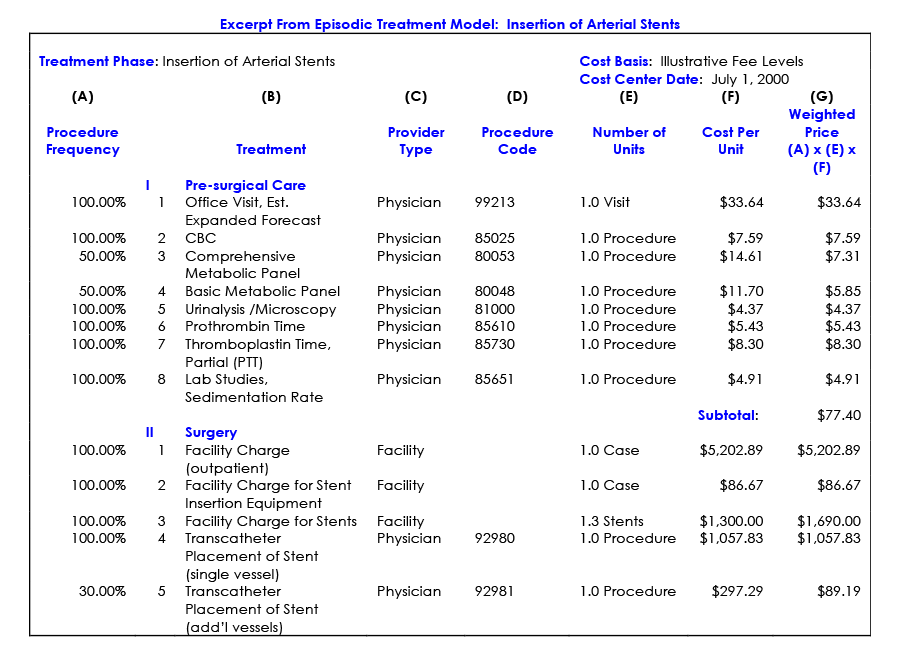

Some extracts from one of the early applications of this assessment methodology is shown below.

The bottom line of this evaluation showed that the use of stents instead of the traditional angioplasty showed a significant value to society. The only area having a net negative value was the hospital’s perspective. As history has shown, this has emerged in the market with even further advances.

Assessment of Value is a worthwhile exercise to help make wise decisions particularly in the healthcare area. This is another example of how actuaries can inform business leaders and help them make better decisions.

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.