Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

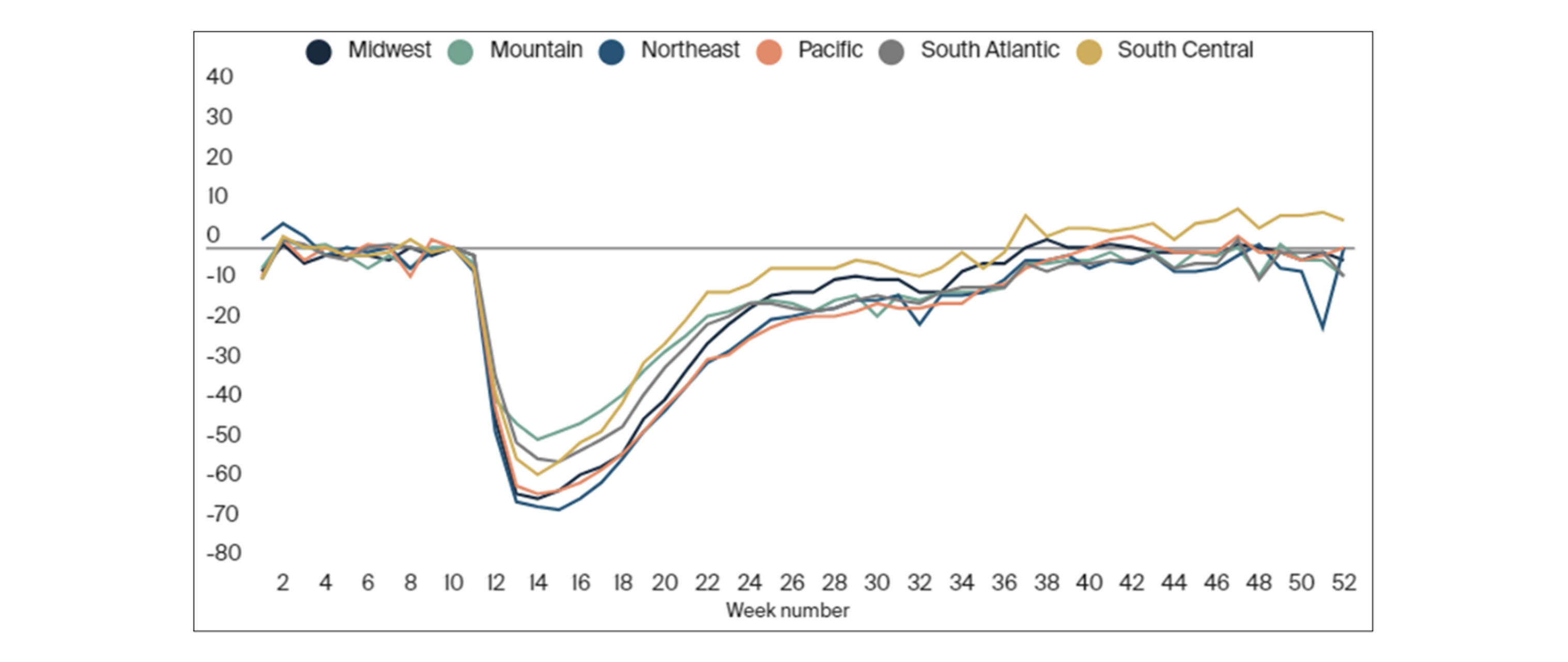

There have been a number of market-changing dynamics over the last few years affecting healthcare with COVID unsurprisingly being the most notable. There was a steep decline in healthcare utilization in April of 2020, which rebounded at a varying pace depending on geographic region, service category, and provider specialty, among others[1] as illustrated in Chart-1 below.

Chart-1: Percent change in visits from baseline by region

Looking past the obvious of COVID altering utilization and creating higher costs due to a higher resource demand, there have been other downstream effects as a result of everything that followed. Research suggests that although it was observed that the suppressed utilization has largely rebounded from the pandemic since April 2020[2], inflationary pressures that will raise unit costs will be the main driver that will cause healthcare costs to rise and push trends higher in the coming years.

As market dynamics develop and mature in the general economy we are getting early warning signs of things to come. In the general economy, supply chain problems made it difficult to get everyday items in stores. Historically and unprecedented high inflation, particularly in gas prices and housing, put upward pressure on costs for just about everything. Given the rising increases in general inflation in the economy and the relationship that medical inflation has historically been higher, it appears there will be rising trends in the next couple of years that could slow down by 2025. “Applying the historical 12–18 month lag from the general economy, higher health care inflation could emerge in 2023 and beyond. In addition, a quick review of historical patterns shows that the natural inflection point for trend increases is due later in 2022[3]”.

Costs are expected to rise as things such as multi-year labor contracts for reimbursement rates, case rates, and division of financial responsibility (DOFR) agreements expire and/or renegotiated with the corresponding increases passed along to employers and consumers[4]. Since a large number of reimbursement contracts are multi-year agreements, reimbursement rates and trends that were agreed upon within the last couple of years have been locked in leaving providers unable to recoup any losses from low rates and assumed trends. With the 12-18 month underwriting cycle, more experts are of the opinion that “it is only a matter of time before prices for healthcare catch up to this increase. Much higher prices are only being delayed by the unique features of the healthcare industry. In healthcare services, prices, reimbursement rates, labor contracts (which are typically indexed to consumer price inflation), and several other input factors are set two to three years in advance.[5]”

As we see more things in the general economy drastically change and the costs increase, we see more reports that the medical cost inputs such as labor, energy, and purchased services are expected to be large drivers in cost increases. Many providers are reporting that as general costs in the economy increase such as gas prices, groceries, and housing, workers are pushing for higher wage increases in an attempt to keep up. More directly, providers that have transportation costs, especially those who specialize in non-emergency medical transportation as well as nonmedical transportation have had a large increase in fuel costs they’ll need to pass on.

Adding fuel to the fire of rising costs of basic inputs, another main market dynamic that has come to light that is anticipated to increase costs and raise trends is labor costs. Reported nursing shortages have been a big component of increasing labor costs. Reports note that “although the nursing shortage is on the rise, it is intensified by the COVID-19 pandemic that overwhelmed hospital staff starting in early 2020. Hospitals are facing critical staffing shortages due to:

- Excessive turnover rates

- Overwhelming burnout

- Frequent patient influx

- The growing population of older adults

- Early retirement

- Lack of nurse educators

Hospital employment has continued to decline due to COVID-19, which is also a cause of the nursing shortage. According to the Bureau of Labor Statistics data, hospital employment is down 95,600 employees from February 2020.[6]” A shortage of nurses pushes the number of hours existing staff would have to work to provide care, leading to more overtime hours where nursing pay increases to multiples of their regular hourly wage. Also, if stretching staff isn’t enough healthcare systems would have to grapple with the costs of replacing staff which is an expensive endeavor that introduces another dynamic in that “rising costs to replace the workforce are also a factor. For example, most health systems have become more reliant on temporary and travel nurses, who receive premium pay[7]”.

A tightening labor market is also contributing to higher costs. Those working in the medical field are leveraging the scarcity of workers to get higher wages for retention purposes. They are aware healthcare systems need staff and it is becoming increasingly more difficult to bring in more nurses. In fact, it is getting even harder to train new nurses, “Nursing programs across the country are also suffering as they have limited the number of applications, they accept due to their lack of staff. Without enough faculty, nurses won’t be able to train and assist healthcare systems with their excessive number of patients.[8]”

We are beginning to see these impacts affect claims costs even at the federal level. Federal projections also show increases in national health care spending in the short term in 2022. “Underlying the expected acceleration in health care prices is the lagged effect of faster growth in projected input costs (such as for labor and supplies) that are affected by economy-wide price growth…those increases are expected to be ultimately passed on from providers as higher service prices in 2022. Also, the rate of growth in utilization is expected to remain elevated as the demand for patient care is projected to stay high[9]”.

Some of this impact can be seen in the CMS advance notice from early 2022. Included in the advance notice is a projection or the consumer price index (CPI) “to ensure that plan sponsors and CMS have sufficient time to incorporate cost-sharing requirements into the development of the benefit, any marketing materials, and necessary systems, CMS includes in its methodology to calculate the annual percentage increase in the CPI for the 12-month period ending in September 2022, an estimate of the September 2022 CPI[10]”. In this notice when CMS projected an annual percentage increase to the CPI for 2023, they made a correction to prior year estimates and revised the trends up once actual claims were known. This revision up raised the cumulative annual percent increase in September 2022 CPI from 4.17% to 7.44% for 2023.

In a typical healthcare claims environment, trends are usually a hot topic. They flow into pricing healthcare products, reimbursement rates, and many other aspects. Most of the talk surrounding trends usually is centered around “bending the curve” and slowing them down to some extent. However, COVID threw a monkey wrench into the system and its ripple effects on trends are just beginning to be felt. Shortages from supply chain issues, labor shortages due to stressed out and overworked healthcare providers, and historically high inflation in the general economy are beginning to make their way into the trend conversation scene. As these market dynamics mature and play out, trends in healthcare will continue to rise and put pressure on everyone.

Endnotes

[3] https://axenehp.com/are-we-in-for-some-significant-health-cost-increases/

[9] https://www.cms.gov/files/document/nhe-projections-forecast-summary.pdf

[10] https://www.cms.gov/files/document/2023-advance-notice.pdf