Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

The health insurance industry and interested stakeholders waited anxiously last week for a decision from the Trump administration that many believe could have significant negative implications on the individual health insurance market.i Senior White House adviser Kelly Anne Conway had indicated that the president would make a decision on the funding of Cost-Sharing Reduction (CSR) payments before the end of the week. A Thursday morning warning of a ‘very big announcement’ prompted interest in the health policy world, attentiveness that was surely deflated when it was reported that the governor of West Virginia was changing political parties. The week ended without a public CSR decision, and extensive concern and speculation continues as insurers are under tight deadlines to finalize their 2018 rates.

The subject of CSR payments has received frequent attention this year as the president has often referenced the possibility of not funding CSRs, which some have characterized as threatening market viability. He has sometimes peppered his language with discussions of “death spirals” and criticism of CSR payments as “bailouts for insurers”. Critics have been quick to charge the president with “sabotage” and attempting to undermine current law. The rhetoric has heated up after the failed vote on the so-called “skinny bill” on July 28th. The nature of this discussion has likely built alignment along political and ideological lines, while diminishing interest in a genuine, unbiased understanding of the impact of such a decision.

This article is written for a general audience. Conclusions are developed from a technical understanding of the Affordable Care Act (ACA) enhanced by eight years of extensive research of individual health markets and the nuanced mechanics of the law. Illustrative computations are provided to simplify calculations into easy-to-understand examples. While reasonable numbers are used, these examples are not intended to reflect experience in a particular geographic area or to draw attention to health care costs or premium levels; the intent of the illustrations is to demonstrate directional impacts (using round numbers) of CSR defunding which will be true in all marketplaces. It is the author’s gentle request that readers momentarily dampen their policy biases and seek to understand the basic mathematical implications related to the market impact of defunding of CSR payments.

How Did We Get Here?

Due to an odd set of circumstances, the decision to fund CSRs now rests with the executive branch. In 2014, the House of Representatives sued the Obama administration on Constitutional grounds, claiming that the administration funded CSR payments which were never appropriated by Congress. In 2016, the federal district court for the District of Columbia ruled that the payments were unconstitutional. The decision was stayed, which allowed the payments to continue while the White House appealed the decision. The election of President Trump raised concerns that the defense would drop the case; this has not occurred and a recent court decision has rendered that outcome less likely.ii

Ongoing decisions to fund CSRs are being made on a monthly basis, which clearly brings uncertainty to an insurance market where premium rates are determined annually. The process is being used as political leverage to incent Congressional Democrats to negotiate on ACA replacement legislation; it arguably has had little effect in that regard.

Legal opinions are abundant on both sides of this debate which place President Trump in the untenable position of being accused of violating the Constitution with either CSR decision. However, most observers believe the president has flexibility here and that the decision lies within his office. The legal process will take its course, but the outcome in the courts will have no impact on the numerical conclusions illuminated in this article.

CSR Background

CSR payments are one of two ACA federal funding elements used to subsidize health care costs of low and moderate income individuals. CSRs reduce cost-sharing (i.e., deductibles, coinsurance, copayments, out-of-pocket limits) for individuals with incomes up to 250% of the Federal Poverty Level (FPL). The other element, advance premium tax credits (APTCs), reduces premiums for some individuals with incomes up to 400% of the FPLiii; APTCs have been appropriated by Congress and have not been legally contested.

CSR payments are viewed by many stakeholders as a critical component of the ACA. If the payments are not funded by the government, insurers are still obligated to provide additional benefits to eligible enrollees and will consequently need to raise premiums to offset the lack of funding. Concerns of insurers raising premiums or exiting markets have prompted calls across the political spectrum for both the president and Congress to permanently and decisively approve CSR funding. The National Association of Insurance Commissioners (NAIC), a group governed by state insurance officials that develops a framework of regulatory standards, wrote a letter to Congress in April indicating that fully funding CSRs was “critical to the viability and stability of the individual health insurance markets.”iv As we await a decision from President Trump, insurers and state regulators are busy preparing for either outcome.

How Have States Responded?

Insurers file plan benefits and rates each year in states which they do business. The plan benefits must be designed to fit into four value (metal level) tiers, Bronze, Silver, Gold, and Platinum, with respective benefit values (average percentage of health care costs covered) of 60%, 70%, 80% and 90%. States review the rates (and filing language) and either approve rates as proposed, reject the filing, or approve the filing at another rate level (historically usually lower, but sometimes higher recently with ACA filings).

The possibility of defunded CSRs has led states to consider how they might review insurers’ rate proposals, both in terms of projecting whether CSRs will be funded and how the impact of defunding should be reflected in premium rates. Many states have been proactive and strategic in counteracting the potential negative implications of CSRs being defunded. As CSRs are only available on Silver plans, encouraging insurers to only increase rates on Silver plans best minimizes risks and aligns plan rates with insurer liability. Many states have recommended this approach. Some states have requested that insurers file two separate sets of premium rates, reflecting scenarios with and without CSR funding included. For our purposes, we will study a likely impact of defunded CSRs, a state that limits the additional rate adjustment to Silver plans.

Demonstration of CSR Defunding Impact

The table below represents premium levels for two similar individuals with different income levels. The first individual has a higher income and pays the full “Unsubsidized Premium”. The second individual has a lower income and is eligible for APTCs but not CSR payments, and the “Subsidized (or net) Premium” is shown. The impact on both individuals is analyzed separately as the CSR impact will vary. In this scenario, the ACA limits the premium of the lower income individual to $200.v This allows the second individual to purchase the Silver plan for $200. As the gross premium amount is $700, a $500 APTC is granted that can be used to purchase coverage at other metal levels.

| Premium Levels with CSR Funding | ||||

| Bronze | Silver | Gold | Platinum | |

| Individual 1 (Unsubsidized Premium) | 600 | 700 | 800 | 900 |

| Subsidy (APTC) | 500 | 500 | 500 | 500 |

| Individual 2 (Subsidized Premium) | 100 | 200 | 300 | 400 |

If CSRs are not funded (see table below), eligible individuals will still receive the CSR benefits and insurers will still need to pay the additional costs associated with CSRs. As the benefit is only eligible on Silver plans, insurers would only need to raise to the Silver plan premiums. This results in an increased APTC of $650 (up from $500) to fund the difference between the loaded premium ($850) and the limited net premium ($200). The increased APTC of $650 can then be used to purchase other metal level coverage where premiums have not increased. This results in $150 premium savings for Gold and Platinum plans. It also results in a $0 net premium for a Bronze plan as the calculated APTC is larger than the unsubsidized premium. Overall, these dynamics result should lower the uninsured rate as APTC eligible individuals have a larger price incentive to seek coverage and more individuals have free coverage options.

| Premium Levels without CSR Funding | ||||

| Bronze | Silver | Gold | Platinum | |

| Individual 1 (Unsubsidized Premium) | 600 | 850 | 800 | 900 |

| Subsidy (APTC) | 600 | 650 | 650 | 650 |

| Individual 2 (Subsidized Premium) | 0 | 200 | 150 | 250 |

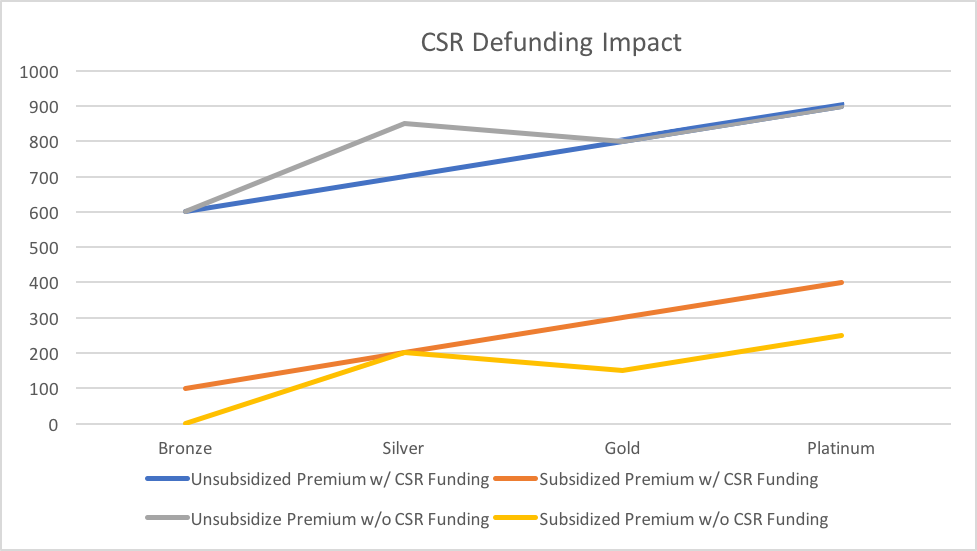

The chart below illustrates the impact of defunding CSRs for each metal level.

While defunding CSRs will offer clear benefits to enrollees, it might require enrollees to select a different level of benefits to optimize their coverage value. The market dynamics may include:

- Unsubsidized individuals will likely avoid Silver plans. To fund the CSRs, Silver plan rates will be inflated without offering additional benefits. Bronze plans have historically been the most popular choice for unsubsidized individuals, so most individuals will not need to change coverage levels. Selection of a Gold plan will likely offer greater value than a Silver plan for a lower price. With the exception of “losing” the Silver plan option, defunding CSRs is of neutral impact to unsubsidized individuals.

- Individuals eligible for APTCs but not eligible for CSRs will benefit from CSR defunding.vi They will also avoid Silver plans and take advantage of the increased APTC funding. Selecting a Gold or a Platinum plan will provide the most premium savings, but many individuals, particularly those with low expected health care costs, will opt for a free Bronze plan. Bronze enrollment would also likely increase due to enrollment from currently uninsured individuals.

- Individuals eligible for APTCs and CSRs will remain in Silver plans. The additional premium required to fund CSRs will be paid through the APTCs. The net premiums and the level of coverage available will not change; defunding CSRs has a neutral impact on these individuals.vii

- Insurers that only operate off-exchange will not be impacted by CSR defunding. In other words, they will not need to adjust their rates. This means that their Silver plan rates will be relatively more competitive than other insurers. They might attract enrollment from a small segment of the market that is more preferential to Silver level coverage than selection of an insurer.

- Silver plan enrollment will shrink and will primarily will only be a viable option for individuals with significant CSR eligibility (incomes up to 200% FPL). Bronze plan enrollment will increase due to more free coverage options. Gold, and to a lesser extent Platinum, enrollment will increase to maximize the additional APTC amount triggered by the defunding of CSRs.

In addition to being able to attract more enrollees through additional APTC funds, insurers may benefit as higher premiums add increased Minimum Loss Ratio requirement flexibility. Insurers have to pay at least 80% of their premiums in claims; the remaining 20% is available for profit and administrative costs. Using our example, the Silver plan premium of $700 includes an allowable $140 ($700 * 20%) for profit and administrative costs. Under the CSR defunded scenarios, an insurer would have an additional allocation of $30 ($850 * 20%- $140).

An understanding of these mechanics challenges the conventional wisdom on CSR Funding. The table below illustrates the Myth versus Reality in terms of the financial ‘Winners’ and ‘Losers’ of an appropriations decision to not fund CSRs.

| CSR Defunding: ‘Winners’ and ‘Losers’ | |||

| Consumers | Insurers | Taxpayers | |

| Myth | Losers | Losers | Winners |

| Reality | Winners | Winners | Losers |

Risk Adjustment Impactviii

While the impact of not funding CSRs has an overall market benefit, it may have different impacts on various insurers. The ACA risk adjustment model is calibrated with an assumption that CSRs will be fully funded; a change in CSR funding is likely to add new disruption to the risk adjustment methodology. As the risk adjustment methodology is based on average premiums and the “formula transfers significant sums of money based on items that are not predictable and not based on actuarial risk”ix, a change in premium levels will have a significant risk adjustment impact on small insurers with lower than average market premiums. This would amplify an existing problem with the current model. Insurers wanting to understand their specific impact should seek the counsel of a qualified actuary. In states with only one insurer, risk adjustment is not a current concern as the model results are inconsequential.

Will Defunding CSRs Cause Insurers to Exit Markets?

Adequate participation in the individual health market has always been a concern.x As the market functions as the last resort for individuals who do not have coverage through their employer and are not eligible for any government programs, it is imperative that a viable market exists with fair and reasonable premium rates. The individual market was most impacted by the ACA and has certainly received the most attention since the law’s inception. There are external pressures for insurers to support the ACA and “participation in this high-profile market is more involved than an isolated business decision based on a financial forecast.”xi

Insurers have experienced significant losses, and market exits and the potential of “bare counties” have permeated the news since 2016xii, although many insurers have remained in the market despite a poor financial outlook. Recently, the CSR uncertainty has been used as an external rationale to exit markets as it is easily explained and understood, while the pattern of market exits (which existed before the CSR discussion) are likely the result of other challenging dynamics. Insurers have until September 27th to finalize 2018 decisions regarding ACA market participation; it would be foolish to believe that an insurer with strong performance has decided to exit the market prior to this date solely due to CSR uncertainty. Likewise, the same insurer would likely benefit from CSR defunding assuming its rates properly reflected reflect the new dynamics.

The Larger Story

As a health insurance professional, I am often asked if the public characterizations of policy considerations are accurate. I began writing from a volunteer capacity about the ACA in 2014xiii as I was concerned that most of the technical conclusions reaching general audiences lacked objectivity and included frequent misrepresentations, often intended to support a policy viewpoint. Similar advice has led to unguided policy solutions and volatile markets.

The CSR discussion is an example of a debate being waged publicly with conjectured opinions formed without a concrete understanding of a rational market reaction. Some of the “loaded words” mentioned earlier detract from a sober evaluation of policy effectiveness.

Is funding the CSRs a “bailout of insurers”? No.xiv Insurers will actually receive more federal money if the CSRs are not funded.

Is it market “sabotage” to not fund the CSRs? No. Defunding CSRs improves markets and boosts federal funding in other areas, which would result in lower net premiums for subsidized consumers and likely lower the uninsured rate.

Are the markets in a death spiral? No. As previously discussedxv and demonstrated in our example, a paradoxical impact of the ACA is that subsidized premiums decrease as unsubsidized premiums increase. A death spiral requires escalating premiums across the entire market; it is valid to suggest that a portion of the market is in a death spiral and believe that the long-term consequences are an ACA market that is only attractive to subsidized enrollees. The implication of the regulatory rules and subsidy allocation limits the market attractiveness to certain demographics.xvi

Is President Trump actively trying to undermine the ACA? This question requires more clarification. One might also fairly ask, “Did President Obama undermine the pre-ACA health insurance environment when he talked about insurer abuses, ‘junk insurance’, and ‘insurers canceling your policy when you get sick’?” It is common to criticize the impact of current law when highlighting problems to promote new legislation. The criticism of the ACA has received more attention than the prior criticism for several reasons: the fragility of the individual market which didn’t exist prior to the ACA, the current view that ACA markets need active government promotion to thrive, and the identification of the ACA as a major legislative achievement of a recent president.

As we move forward, it would be wise to focus on the underlying challenges and seek to better understand market dynamics. As we have hopefully learned with the ACA, public support, excitement and promotion can only carry a new government program so far. Ultimately, markets are based on mathematics and economics, not politics or public appeal. Policymakers designing legislative and regulatory solutions should consult with real experts on these matters; they should also recognize that the individual insurance market has some unique complex challenges, and regulatory solutions often elicit unexpected and unintended market responses.xvii Actuaries are well known for their insurance expertise, technical rigor, fair-minded approach and objective reasoning. Greater dialogue between policymakers and actuaries will enhance the effectiveness of health policy.

My effort in this article is to explain the mathematical implications of defunding CSRs, not to advocate a particular policy. As a taxpayer, I am concerned that an increase in federal subsidies through an unintended legislative abnormality is not the wisest approach of utilizing government resources. At the same time, I am passionate about building a properly functioning individual market that allows people without government or employer-sponsored to obtain their own insurance. The use of tax policy to incent desired consumer behavior is well established in home ownership and employer-sponsored health insurance. Extending that idea to the individual health insurance market should be well thought out and strategic, with appropriate recognition of expected market behavior. The ACA market rules and federal fund allocation naturally led to a skewed demographic market that some experts had predicted.

States now have the authority to more appropriately take advantage of the federal resources committed to the individual market and attract a broader cross-section of enrollees,xviii but ultimately the problematic elements need to be addressed at the federal level. A long-term sustainability viewpoint will properly recognize inherent incentives and financial implications, and acknowledge the need of positive outcomes for both insurers and consumers for the market to thrive. A fair-minded understanding of the current challenges and new challenges prompted by policy changes is critical before actively moving forward in a new direction.

Conclusion

It is imperative that insurance premiums accurately reflect the coverage that they insure, especially in the low margin business of health insurance. A challenging aspect for ACA insurers has been the non-enforcement of existing rules.xix The market requires that rules that impact insurer finances can only be changed in concert with established premiums. It is crucial that insurers understand the rules before premium rates are developed and that the rules are properly enforced.

If the rules and policies are known ahead of time, the lack of reimbursement for CSR payments itself does not harm the market. It actually improves it by increasing premium subsidies to APTC eligible enrollees. It is convenient to suggest (and intuitively easy to understand) that removal of a government funding element harms the market, but in this case the opposite is true.

My only profressional advocacy is that policy decisions related to health insurance are based on a sound understanding of market dynamics rather than political hyperbole. As health care is a concern to all Americans, we should aim to seek solutions to restore stability, vibrancy and confidence to health care financing on behalf of consumers and suppliers of medical services. The complexity of health care financing requires a rigorous technical understanding and objective rationale to formulate workable policy objectives. Unfortunately, much of the public discourse has exploited the emotional and personal nature of the delivery of health services and diminished public understanding. Opinions on health care are easy to come by, but it is critical to have unbiased, reliable experts with dispassionate, technical insights that can be trusted.

It is now critical that insurers and regulators receive finality on whether CSRs will be funded in 2018. The need to make that decision now is urgent; the decision itself is not. CSR clarity will return attention to the necessity of addressing current market problems; it will not provide market stabilization. The NAIC letter to Congress plainly warns that “additional legislative actions will be necessary to fully stabilize this very volatile market”xx and that CSR funding resolution does not solve existing problems. Neither a decision to fund or defund CSRs will stabilize the exchanges, but either determination will allow us to return our focus to addressing the structural issues that plaque the individual market.

ihttp://www.politico.com/story/2017/07/30/obamacare-health-care-stabilization-241151 iihttp://thehill.com/policy/healthcare/344886-court-rules-allowing-dem-states-to-defend-obamacare-payments

iiiIndividuals can purchase the “benchmark” plan for a fixed percentage of their income. The difference between this amount and the actual premium is the APTC, which can be used to purchase other plans in the marketplace.

ivhttp://www.naic.org/documents/government_relations_170419_testimony_csr_house.pdf

vIn the marketplace, the subsidy is calculated using the individual’s income level and the 2nd lowest cost Silver plan in the marketplace.

viThis group also practically include individuals between 200% and 250% of FPL who receive a minor CSR benefit. The premium reductions due to CSR defunding in non-Silver plans will outweigh the CSR benefit in Silver plans.

viiThe impact will be entirely neutral for individuals with the 2nd lowest cost silver plan. There will be small premium adjustments for individuals in other Silver plans.

viiiThis article is written to inform the general public of the impact of not funding CSRs. The section on risk adjustment is necessarily technical and of consequence for insurers, but may of less interest to the general reader.

ixhttps://axenehp.com/annual-aca-check-stabilizing-new-marketplaces/

xhttps://www.soa.org/Library/Newsletters/Health-Watch-Newsletter/2017/march/hsn-2017-iss82.pdf

xihttps://www.soa.org/Library/Newsletters/In-Public-Interest/2016/september/ipi-2016-iss13-fann.aspx xiihttp://www.kff.org/health-reform/issue-brief/2017-premium-changes-and-insurer-participation-in-the-affordable-care-acts-health-insurance-marketplaces/

xiiihttps://www.soa.org/library/newsletters/health-watch-newsletter/2014/may/hsn-2014-iss-75-fann.pdf

xivThe partial funding of losses under the 2014-2016 risk corridor program was also derided as an “insurer bailout”. While not fully reflecting the nature of the risk corridor program, the bailout reference was a more appropriate characterization of the risk-corridor program that the funding of CSR payments.

xvhttp://www.theactuarymagazine.org/the-true-cost-of-coverage/ xvihttps://www.soa.org/Library/Newsletters/Health-Watch-Newsletter/2016/november/hsn-2016-iss-81-fann.aspx

xviihttp://bit.ly/ahp-healthcare xviiihttps://www.soa.org/Library/Newsletters/Health-Watch-Newsletter/2016/may/hsn-2016-iss-80-fann.aspx xixhttp://healthaffairs.org/blog/2017/08/07/supporting-the-individual-health-insurance-market/

xxhttp://www.naic.org/documents/government_relations_170419_testimony_csr_house.pdf

About the Author

Greg Fann, FSA, FCA, MAAA, is a Senior Consulting Actuary with Axene Health Partners, LLC and is based in AHP’s Murrieta, CA office.