Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

A health plan’s transition from fee-for-service to value-based reimbursement (i.e., VBR) can be very challenging. This article provides a pathway to successful implementation of these programs and summarizes how the implementation might be accomplished, the key requirements for the health plan success, and some of the major pitfalls to be avoided. This is not intended to be an exhaustive document, but rather a high level overview.

Illustrative Implementation Plan

An effective implementation plan should include the following items:

- Confirm executive leadership commitment: Top-down leadership acceptance as a key strategic initiative is required for long term success. This transition presents significant challenges and leadership must be willing to stick with it until implemented. Linking incentives/bonuses to its overall success is recommended. Leadership should be committed to helping providers do well under this program and doing all they can to maximize provider performance. This is a different way of doing business. It might be the most successful way to constrain the growth of health care costs as a percentage of GDP. This is a high priority initiative and must be taken seriously.

- Evaluate the cost for this initiative: The cost to effectively implement is not insignificant. It will require:

- Dedicated staff – Contract executive, actuarial/analytics staff, and medical director focused specifically on this initiative to conduct periodic meetings with providers (at least quarterly, monthly as needed) to hold providers accountable and share “secrets” of best performing providers.

- Focus group of providers – Quarterly meeting of dedicated staff with focus group of physicians to share learnings and challenges, build relationships with providers and move to a less confrontational contracting process.

- Provider newsletter – Development of a quarterly newsletter to providers sharing insights learned within the health plan and some external information from other organizations experimenting with these types of reimbursement programs.

- New tools and methods – Design and implementation of measurement and reporting tools and methods to help communicate the results of these programs.

- Additional software requirements – Provider-facing software to allow for reporting measurement results and performance.

- Recognition of diluted earnings – Estimate of the potential financial impact for shared savings/gain-share contracts and other incentive programs on health plan earnings. Without other adjustments, health plan earnings will decline. Careful financial planning and review of rate setting assumptions is required to assure profitable and viable ongoing operations.

- Itemization of potential investments – Evaluation of current care management effectiveness (CME), including capabilities and gaps. There might be a need for some sort of investment in Care Management related areas for key hospitals and health systems to get these programs implemented.

- Provider training resources – Focused education program for participating providers. The health plan may need to build out specialized tools for providers and support with dedicated staff to help providers learn how to manage their operations in new ways (i.e., providing “training wheels” for providers).

- Develop reimbursement models and test them: The health plan will need to develop and finalize their reimbursement and incentive models, including validation of these models with focus groups of key providers.

- Complete market assessment:

- Understand provider community as far as risk readiness and risk willingness

- Complete market surveillance of competitor plan programs

- Survey providers to gain information regarding health plan’s positioning vs. competitors

- Develop prioritized list of providers: Stratify providers and markets to determine prioritized list of providers for contact and negotiation.

- Identify historical risk adjusted performance in terms of an actuarial cost model with comparison to norm or best practice norm

- Assess care management readiness of providers

- Identify who are high performers today

- Focus on material middle performance providers who can immediately improve profitability

- Create matched provider list: Match stratified list of target providers with list of providers with greatest health plan influence to expedite enrollment into program.

- Assess health plan readiness:

- Product readiness: Review the health plan products to determine how consistent they are with value based provider reimbursement. Complete analysis by region and line of business. Identify differentiators for the health plan (i.e., why would customers come?)

- Operational readiness: Establish a communication strategy to address individual providers, training for teams, etc.

- Financial department readiness: Refine procedures potentially affected by value based reimbursement approaches (e.g., off-system claim and premium adjustments, rebates, Part D subsidies)

- Data readiness: Implement reporting system, including training for health plan users and providers to interpret reported results.

- Publicize the program: Publicize the success of an initial pilot program to catch the interest of other providers (i.e., be willing to fund support activity of this provider to help broadcast the value to others)

- Develop monitoring infrastructure: Develop infrastructure for monitoring and performance measurement:

- Complete financial and risk review – assurance that provider payments under value based programs are reasonable in light of other programs (i.e., the “contracting paradigm”)

- Demonstrate commitment to monthly performance reporting and multiple delivery methods (i.e., electronic, web portal, etc.)

- Integrate with CME Index performance measurement to clearly demonstrate current gaps and expected impact of improved CME Index

- Employ and deploy adequate clinical staff to communicate results to key provider groups in person on a monthly basis. An analytically minded physician can do this or could be in tandem with an actuary. Clinical perspective will be key to the effectiveness of the discussion.

- Develop provider-facing reporting package

- Develop internal reporting requirements – high level financial reporting and target development by line of business, product, region, etc.

- Complete risk analysis: Develop risk model financial analysis, risk analysis, acceptable variations, etc.

- Develop transitional plan: Develop transitional approach to move from fee-for-service to Population Based Reimbursement

- Straight to it!

- Parallel model where both are run with opportunity to share some gains with providers as incentives

- Define ASO methodologies: Develop methodologies to handle self-funded/ASO cases and effectively incorporate provider incentives into cost reporting

- Affirm role of PCPs: Affirm commitment to key role of primary care providers even with health systems who often minimize the importance of them.

- Integrate with other health plan strategies: Integrate strategy with narrow network strategy, potentially with tiered network strategy.

Key Requirements For Success

In my experience, successfully implemented initiatives reflect the following characteristics:

- Ability to improve CME Index for operations: incentive programs alone will not achieve adequate improvement; success will require material CME Index improvement internally within the health plan.

- Appropriate budget expectations for providers: Budgets will have to be reasonable, believable, and validated by providers so they will perform

- Responsiveness to provider Input: Most provider arguments against the initiative will have to be opposed with valid answers

- Support for different sources of margin for the health plan: The health plan’s margins will need to be obtained from multiple sources, and no longer just profit, since traditional profit will be diluted with provider incentives (e.g., perhaps add explicit loads to expense load margins). As the health plan assumes less risk, it is not entitled to as much risk return. As providers assume more risk they are entitled to more. The end customer needs to see value from the composite of all of this. Need to anticipate customer complaints if value is not demonstrated.

- Provider accessibility: Must apply across the board to providers across all lines of business the health plan offers; has to be understandable by providers.

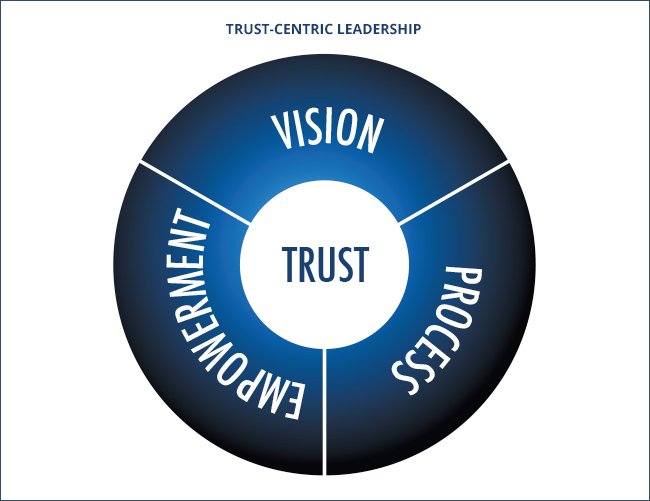

- Mutual trust: The health plan should pursue a “Trust Centric” model with your providers and customers regarding this. The diagram below describes a model we have developed and found effective in multiple types of situations ranging from staff leadership to customer relations. It seems to directly apply to this situation. As your providers trust you and you them, the relationship will improve to the point that you can collaborate effectively. The trust issue emerges in their eyes when they look at the budgets (i.e., Is the health plan giving us a good budget?). The trust issue emerges for health plan when you are looking at the results (i.e., Is this provider group trying to game the system?).

It is critical that both sides develop a trust-centric relationship so the provider will be willing to rely on help from the health plan to develop the process they need to build to be a success. As they develop and learn what it takes, they will be empowered to be successful and expand their efforts. If they fail to trust the health plan in this venture, they will give up and the health plan will not gain any value from the exercise.

On the other hand, the health plan has to develop its process to win to the point that the provider has reason to trust the health plan. It needs to provide a roadmap for the providers so the provider can be empowered to win. As the provider wins, the health plan wins and together they become an unstoppable combination in the market.

Major Pitfalls To Avoid

There are several unfortunate pitfalls waiting for the health plan, and if not dealt with appropriately, they can derail a health plan’s important efforts in this space. We have identified some of these below:

- Laissez faire attitude about care management: Far too many organizations fail to recognize the true value of care management and the ability to impact provider behavior. Studies show that the primary difference in health care utilization (after adjusting for risk and demographics) is provider practice style, not other meaningful risk variations. We have found few compelling explanations for the difference and as a result believe that such observed variations for the most part could be unnecessary and in almost all cases result in “wasted” health care expenditures. The potential savings are real and all effort should be expended to help providers understand the potential for them and for improved performance.

- “Not Invented Here” attitude: Many times providers will say “my patients are sicker than average”, “that’s okay for California”, “it’s different here”, etc. The concept that “here” is different and that it trumps other insights impedes success. We have many stories of providers finally getting this and the changed performance patterns are dramatic. Very similar to the “frog in the kettle” story, we sometimes don’t notice things and get immune to them.

- Recognition that financial self-interest can hurt you: Some providers will over-react to the incentives and perhaps underserve the population. It is mandatory for the health plan to build in protections or monitoring or surveillance tools to identify this when it emerges. It is natural for someone to react in an unintentional way to maximize financial self-interest. However, gone unrestrained this can cause serious issues for the health plan.

- Major market shifts: Occasionally there are major market shifts that impact health care costs. A recent example is the emergence of very high-cost drugs to treat hepatitis-C. This has dramatically impacted budgets without significant warning. The health plan needs to make administrative adjustments to protect the providers. Back to the trust-centric model, one oversight like this could ruin any trust built up over years.

- Paying attention to quality and efficiency: Although studies show that quality is highly convergent with efficiency, there are some examples where they are not convergent. Most of these are extremes and are obviously improper. Without caution it is possible to slip into a problem and not be aware of it. We need to implement double-checks to be sure we don’t miss key issues. For example, efficient care has very high quality. Inadequate care can appear to be efficient but it is poor quality care. We need to be sure we are measuring what we claim to be measuring.

Summary

Value based reimbursement is becoming increasingly important. It is critical that health plans roll this out carefully and with much thought to the variety of requirements and challenges that implementing value based reimbursement brings. This document will help health plans accomplish this.

About the Author

David Axene, FSA, FCA, CERA, MAAA, is the President and Founding Partner of Axene Health Partners, LLC and is based in AHP’s Murrieta, CA office.