Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

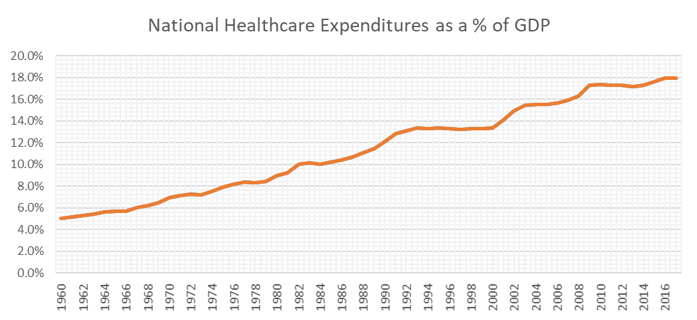

We continue to observe increasing health care costs here in the US, although since 2010, health care costs as a percentage of the GDP have flattened out as shown in the chart below.

Source: National Health Expenditures; Aggregate and Per Capita Amounts, Annual Percent Change and Percent Distribution: Calendar Years 1960-2017

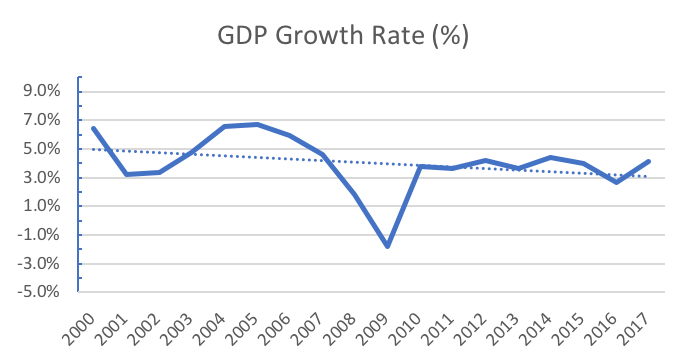

Have cost increases actually stabilized or has something else created this apparent slowing down of the historical growth in health care costs? Since 2010 the annual increase in GDP has been at or below the mid-4% level averaging 3.8% over this time period. Since 1960 the annual increase in GDP has averaged 6.5%. It is reasonable to assume that health care cost increases have stabilized in recent years.

Source: National Health Expenditures; Aggregate and Per Capita Amounts, Annual Percent Change and Percent Distribution: Calendar Years 1960-2017

Although the health care cost increases have likely stabilized in recent years, the question begging to be answered is how much more health cost increases can our economy afford? Is there a natural cap we can’t or shouldn’t exceed?

I have tried to answer this from several perspectives including:

- How much “free cash” exists in our current economy to pay for increased demands by various segments of our economy (e.g., increased health care costs or increases in some other non-healthcare sector)?

- What other segments of our economy are rapidly growing and will likely consume a higher portion of the GDP?

- Are there segments of our economy that are declining and require less of the GDP?

My simplistic analysis suggests there is limited “free cash” in our economy and demand in excess of what is available in the economy could lead to serious and undesirable economic outcomes. Over the long term I was not able to identify any segment of the economy that are growing at a consistently higher rate than the rest of the economy. There are some segments that are growing slower than average, but I am not aware of any segment that over the long term has consistently been less than the average. The only consistent segment of the economy seems to be health care and it is demanding an ever increasing portion of the GDP.

The US economy seems to have between three and four percentage points of “free cash”. In other words, if any one sector or segment of the economy demands increases of more than these three or four percentage points, the other segments of the economy will not have adequate resources to maintain their demands. Similar to family budgeting, if the cost of food increases past some point, the family has to cut spending in other areas to balance their budget. Recent US economy spending has resulted in a significant Federal deficit.

At the point the health care sector consumes more than 21% – 22% of the US economy, the entire economy will suffer.

At the point the health care sector consumes more than 21% – 22% of the US economy, the entire economy will suffer. If this continues for some time, perhaps even getting worse, this could have a severe and irreparable impact on the overall economy. This occurs when other segments of the economy no longer have the freedom to reach their goals or objectives. The most draconian view of this scenario might suggest a significant stalling of the economy or perhaps even a shutdown of the US economy. At that point, the most serious question will be how does one start up a “just-in-time” economy that has stalled?

This undesirable potential scenario has impacted both my personal and professional life for the past 35+ years. As a result, I have focused my professional life to work with other health care professionals to find ways to keep health care costs under control.

This has included:

- identifying how to maximize the effectiveness of care management practices (reducing the demand for health care)

- designing reimbursement and incentive programs to motivate healthcare providers to deliver high quality health care at a lower price (reducing utilization and the cost of healthcare)

- identifying those providers who are more efficient than others, etc. (who does the best job at this)

- Identifying other solutions to this problem (i.e., wellness)

The good news is that we have identified many potential solutions to the health cost problem, the bad news is that so little progress has been made to broadly solve the problem.

Some of the most effective solutions we collectively have developed and/or have identified to date are:

- Evidence based practice guidelines: while working at a different consulting firm, several of our consultants funded and developed what was initially known as the Healthcare Management Guidelines, later the Care Guidelines, and now a resource owned and marketed by MCG, a Hearst Health Company. This tool was designed to be integrated into the delivery of healthcare, helping providers deliver high quality, cost-effective, patient-centered health care services. The use of such guidelines have a significant impact on the consumption of healthcare.

- Effective provider reimbursement and incentive systems: Dating back to the invention and inception of primary care networks (i.e., PCN) more than one of our consultants were involved developing the PCN concept and its related reimbursement and incentive systems. This experience led to the core model that Axene Health Partners, LLC (i.e., AHP) uses today for provider reimbursement and incentive. The basic format of this was develop by AHP consultants between 1974 and 1982 and its use has continued through today validating its significant impact on provider behavior.

- Clinically-based efficiency assessments: In the mid to late 1980s, AHP actuarial consultants collaborated with physicians and nurses to develop methodologies to review detailed patient chart information to identify provider efficiency and potentially avoidable care. Through this process distinct clinical items were presented to help providers understand how to minimize potentially avoidable care and to improve the efficiency of the care they provide. This began with hospital inpatient services and transitioned to outpatient care and other health care services. This capability continues today and clients continue to find this assessment quite useful.

- Provider profiling and effectiveness measurement: The quality and efficiency of care varies from one provider to the other. Through the effective application of the above approaches, AHP consultants have developed methodologies to assess provider performance and rank providers from most efficient to least efficient. This ranking system and process enables health customers to design provider networks that utilize the most effective providers. This concept has been effectively used in designing tiered network programs and narrow network programs. The methodology is based upon a combination of the above described methodologies and is currently used to design a variety of high performance networks.

- Other Effective Solutions: Multiple solutions have been developed, reviewed and/or analyzed by AHP consultants. One of these include assessing the impact of wellness programs on the cost of healthcare which shows significant promise of healthcare cost reductions as individuals improve their health status. Another includes virtual medicine and emergency room avoidance programs.

The common factor in all of the above programs is the introduction of accountability into the delivery of health care. Some have referred to this as the introduction of common-sense business practices into the health care system. Without accountability, health care utilization and costs rise without constraint. With accountability we will have some hope of constraining the rise of health care costs and avoiding the serious economic issues discussed above.

About the Author

David Axene, FSA, FCA, CERA, MAAA, is the President and Founding Partner of Axene Health Partners, LLC and is based in AHP’s Temecula, CA office.