“Medicare for All” is a term that can assume many different meanings and its lenient usage tends to generate confusion or misinformation. To provide some clarification, AHP has provided an actuarial perspective of various health care public policy proposals, summarizing the options and considerations for each[1]. Although some policy proposals such as public options and buy-ins retain private insurance, the most revolutionary proposals intend to abolish private health insurance altogether and would place all Americans on a universal health plan administered by the federal government. This is commonly referred to as “single-payer,” although there are certain hybrid versions that allow a reduced role for private insurance.

Proponents of abolishing private health insurance, one of the largest employing industries, have acknowledged the fact that this will leave many people without jobs. The cost of implementing such a system is beyond the scope of this article and estimates have ranged widely. However, there is one crucial question that has not been publicly discussed or addressed: what happens to the equity?

Quantifying the Equity Value

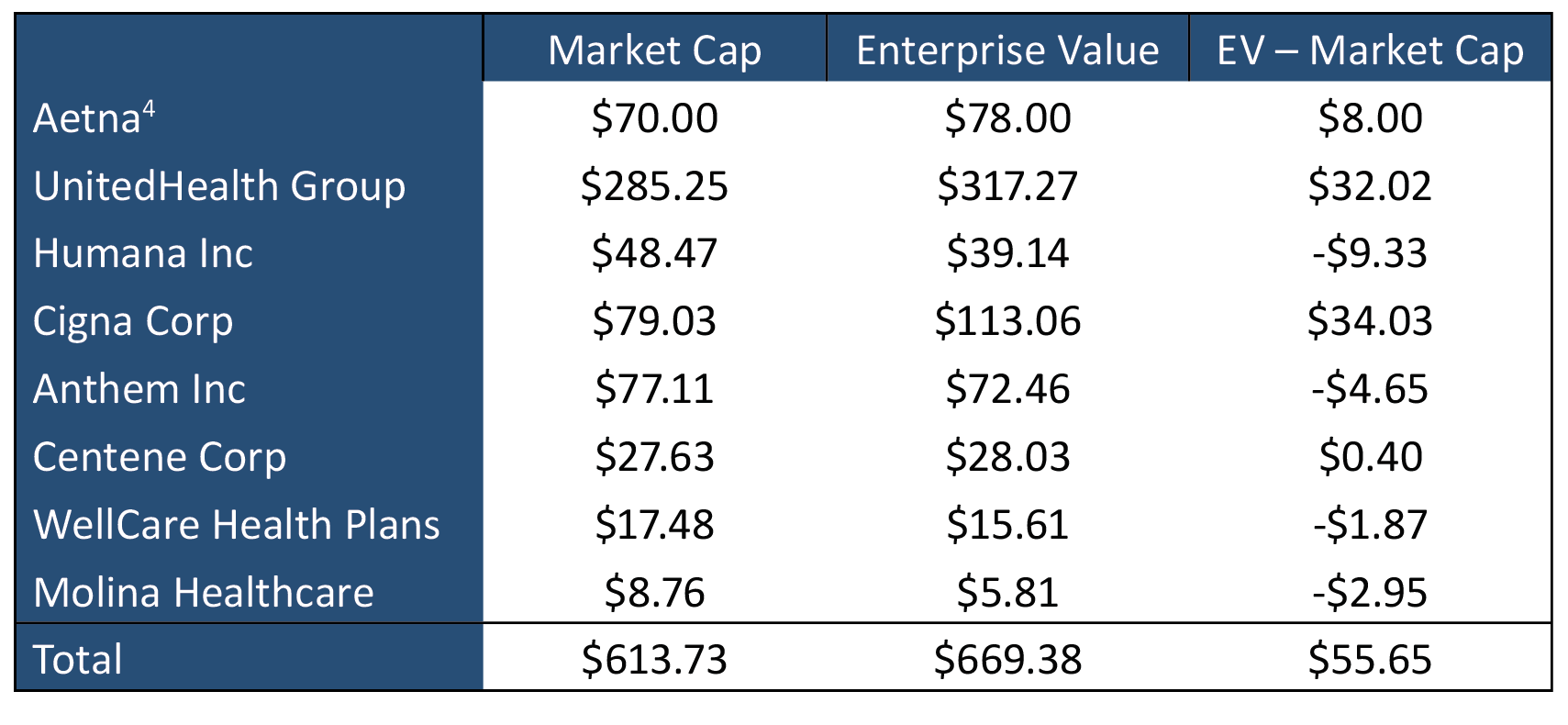

Healthcare is an enormous industry, representing about 18% of GDP[2]. If the U.S. transitions to an economy where private health insurance no longer exists, a major casualty is the shareholders of both large and small health insurance corporations. An analysis of publicly-traded health insurance companies demonstrates their aggregate market capitalization to be approximately $600 billion:

Table 1 – Publicly traded health insurance companies ($ Billions – as of 1/22/2020)[3]

The approximately $600 billion in equity is a very conservative figure because it does not include private companies. Some of the largest insurers (most notably the Blue Cross/Blue Shield brand) are not publicly traded nor are their financials readily available. Furthermore, there is an additional $56 billion in debt owed by these companies that is unsupported by cash and likely suffer default.

In a scenario where private insurance is supplanted by a single-payer system, over $600 billion either disappears from the economy due to the forced bankruptcy of these companies or the federal government exercises some form of a hostile takeover by buying out all outstanding shares. This would be an act of eminent domain unprecedented in American history[5]. The overreach of government power required to extinguish such a large swath of equity from the marketplace is a far greater violation of America’s free-market ideals than the mere consideration of healthcare becoming a public good.

Everyone Pays a Transition Tax

In addition to hundreds of thousands of employees either transitioning to the public sector or seeking employment elsewhere, retirement and savings accounts across the country will significantly drop if the government doesn’t buy out their publicly traded shares at fair market value. Moreover, a large percentage of outstanding shares for health insurance companies are institutionally owned, with over 90% being fairly common[6]. Over 15 institutions have greater than $1 billion in exposure to public health insurance companies. Table 2 lists the institutions with more than $10 billion of exposure.

Table 2 – Institutions with the largest dollar exposure to

private health insurance ($ Billions – as of 9/29/2019)[7]

These institutions provide some of the most widespread ETFs and mutual funds, which means that the exposure to health insurance equity is spread across nearly all retirement and investment accounts. Healthcare is full of “hidden taxes” due to cost-shifting or other market inefficiencies[8]; it’s time to acknowledge another hidden tax in single-payer policy proposals which do not include a cash acquisition of all health insurance stocks.

“It’s time to acknowledge another hidden tax in single-payer policy proposals.”

Conclusion

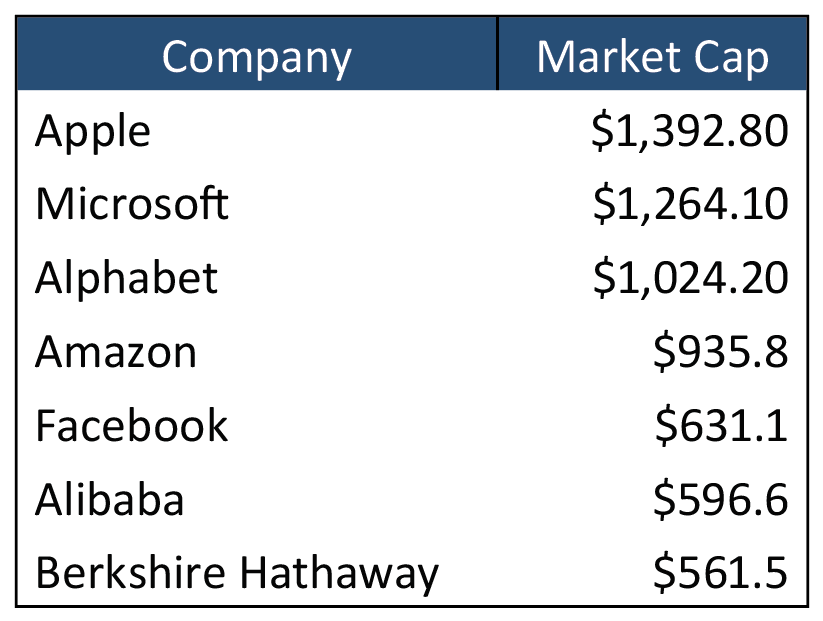

While these figures are large, it is also important to note the relative scale. Some of the largest tech companies such as Apple and Microsoft have market capitalizations greater than the aggregate market cap of health insurance companies. Table 3 demonstrates that the aggregate market cap would be roughly equivalent to Facebook, the 5th largest company on major US stock exchanges. If the entire health insurance market capitalization were to disappear, it would not drop the S&P 500 by a drastic amount; however, the secondary and tertiary effects could have a more dramatic impact on the economy.

Table 3 – Top companies by market cap ($ Billions – as of 1/22/2020)[9]

It is commonly accepted that healthcare has risen to an unacceptably high percentage of US GDP and many individuals struggle to afford healthcare. Irrespective of whether a single-payer system is the most effective solution, the fate of health insurance equity must be addressed directly by single-payer advocates. People can learn a new healthcare system and private workers can transition to government employees, but equity which supports thousands of retirement accounts should not simply disappear. This article merely presented data from public companies and discussed the issue in isolation, but the ramifications of $600 billion disappearing from the economy would be much more widespread.

Endnotes

[1] https://axenehp.com/actuarial-view-health-care-public-policy-proposals/

[3] Data taken from Yahoo Finance

[4] Aetna was purchased by CVS in 2018, metrics are reflective of that purchase price. https://cvshealth.com/newsroom/press-releases/cvs-health-completes-acquisition-of-aetna-marking-the-start-of-transforming-the-consumer-health-experience

[6] According to data from Yahoo Finance

[7] Table 2 includes exposure amounts for CVS Corp, the acquirer of Aetna

[8] https://khn.org/morning-breakout/hidden-tax/

[9] https://www.dogsofthedow.com/largest-companies-by-market-cap.htm

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.