Introduction

It is a hot afternoon in late summer. Representatives from the managed care team at GreatCare Health Systems and the provider contracting department at Acme Health Insurance are meeting to discuss the financial results of their shared savings arrangement from the previous calendar year. The GreatCare team is happy since the cost of care financial target for the previous calendar year was set at $500.00 per member per month (PMPM) and GreatCare’s actual financial results came in at $495.50 PMPM. GreatCare had generated a gross savings of $4.50 PMPM. Since the arrangement covered 125,000 member months in the previous calendar year and the contractual savings rate is 50%, the GreatCare team is looking forward to getting a shared savings payment from Acme Health of over $280,000.

“As you can see, actual results under the contract came in at 0.9% below the target”, reports the lead representative from Acme.

“Right, so we will be getting a check for $281,250 from Acme. When can we expect that?” replies her opposite from GreatCare.

“Not so fast”, says the representative from Acme. “Yes, you beat the financial target, but you didn’t beat the Minimum Savings Rate. The minimum savings rate is set at 1%, so to earn a share of any savings, GreatCare needed to have actual financial results of $495.00 PMPM or lower. Since GreatCare did not produce financial results at or below $495.00 PMPM last year, you aren’t entitled to any share of the resulting savings.”

“What is this Minimum Savings Rate? I thought we just had to beat the financial target. This doesn’t sound fair.”

“Yes, you do have to beat the financial target. But we aren’t sure if you really beat the financial target, or if you just got lucky. The whole point of our shared savings arrangement is to incentivize GreatCare to lower the cost of care. You do that by becoming more efficient while maintaining or increasing quality. The savings you generated last year are not big enough for us to be sure that you are really becoming more efficient at providing care to our members, or if you just got lucky. And you don’t get rewarded for being lucky.”

“So, we need to beat the financial target and the Minimum Savings Rate?”

“Right.”

“And then the savings are calculated based on a comparison of actual financial results to the financial target and the minimum savings rate, correct?”

“No that is incorrect. If GreatCare beats the financial target and the minimum savings rate, the savings are calculated by comparing actual financial results to the financial target only. We think this is pretty straight-forward and clear.

“Yeah, clear as mud.”

You may have been involved in a similar conversation or wondered about what minimum savings rates are and why they are included in your organization’s shared savings agreement. In this article, I will explain minimum savings rates, how they should be set, and why provider organizations should push to include them, and a related contract feature called a minimum loss rate, in their shared savings and shared risk arrangements.

What is a Minimum Savings Rate?

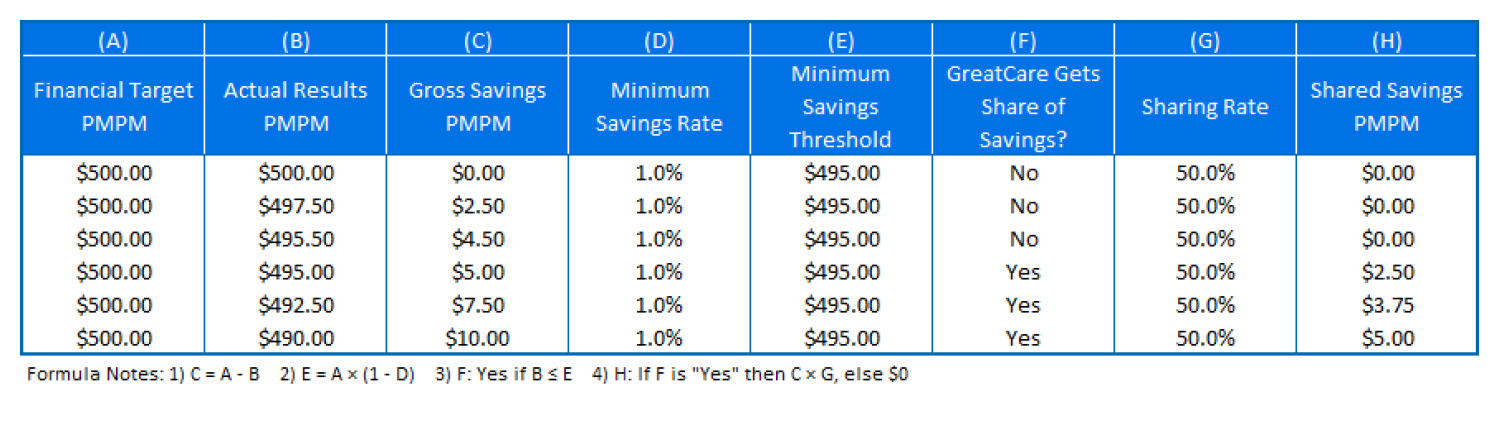

A minimum savings rate is the percentage rate below the financial target that a provider organization must meet or exceed to earn a share of any gross savings realized. In the case of GreatCare and Acme Health’s shared savings arrangement, the financial target for the previous calendar year is $500.00 PMPM and the minimum savings rate is 1.0%. Table 1 shows GreatCare’s shared savings as a function of its actual results taking into account the minimum savings rate.

Table 1: GreatCare’s Shared Savings

Under its shared savings arrangement with Acme Health, GreatCare is only entitled to shared savings when its actual financial results are less than or equal to the minimum savings threshold of $495.00 PMPM or 99% of the financial target. The minimum savings threshold is the product of the financial target and 100% minus the minimum savings rate. Please note that the shared savings are $0 PMPM if the actual financial results are greater than the minimum savings threshold, and the product of the gross savings and the sharing rate otherwise.

The purpose of the minimum savings rate is to separate the signal from the noise concerning a provider organization’s performance under a shared savings arrangement. As pointed out by Acme Health’s provider contracting representative, the purpose of shared savings, and other types of risk contracting or value-based reimbursement arrangements is to incentivize providers to lower or restrain the growth of the cost of care while maintaining or increasing the quality of care. Provider organizations can lower the cost of care by being more efficient in several ways, including not ordering unnecessary tests, discharging patients from hospitals when they are ready to go home, substituting brand drugs for just as effective, but cheaper, generic drugs, encouraging patients to use the Urgent Care center instead of the Emergency Room when appropriate, referring patients to more efficient specialists, etc.

Success under shared savings arrangements is measured by comparing the provider’s actual results to a financial target. Obviously, if the provider organization’s actual results are 20% less than the financial target, the provider organization has been successful in lowering the cost of care. As long as that lowered cost of care is not achieved at the expense of quality, the provider organization is judged to be a success under the arrangement. However, fluctuations in the cost of care occur as a result of statistical noise, in addition to a provider organization’s efforts to lower the cost of care. Statistical noise is a phenomenon that effect the cost of care, and is beyond the provider organization’s control, cannot be anticipated, is not easy to measure, and cannot easily be accounted for in the financial results. Statistical noise in financial results could be caused by many things including the weather, traffic jams, a very mild or very severe flu season, etc. A minimum savings rate is a metric used to give a level of assurance that a provider organization’s financial results are in fact representative of its efforts to become a more efficient and cost-effective provider of care.

How is a Minimum Savings Rate Determined?

A minimum savings rate can be determined using a statistical method called hypothesis testing. Hypothesis testing states a “null hypothesis” and then determines a threshold at which the null hypothesis is false, given a statistical “level of confidence” chosen by the tester. In the case of a provider organization’s performance under a shared savings arrangement, the null hypothesis would be that the provider organization did not achieve any shared savings. This null hypothesis can be tested using a simulation model which includes a cost of care claims probability distribution (CPD) that is representative of the population covered under the shared savings arrangement with an expected cost of care calibrated to the arrangement’s financial target. The simulation model is then run thousands of times to generate a statistical distribution of the provider organization’s financial results under the shared savings arrangement. Using the statistical distribution’s mean (which should be equal to, or very close to, the financial target), standard deviation, and a level of confidence expressed as a percentage, we can determine the value at which the null hypothesis is false. This level will be equal to the minimum savings rate. The minimum savings rate (MSR) can be calculated using the following formula derived from the hypothesis testing statistics:

MSR = z × CV × (1/nmpp + 1/ncpd)0.5, where

- z is the critical value

- CV is the coefficient of variation. This is equal to the standard deviation of the statistical distribution divided by the mean of the statistical distribution.

- nmpp is the size of the population being measured

- ncpd is the size of the population used to develop the CPD

The critical value is a statistic used in hypothesis testing to determine whether the null hypothesis is false at a specified level of confidence.

Using this formula, we can calculate the minimum savings rate for GreatCare and Acme’s shared savings arrangement as follows:

- Mean of the statistical distribution generated by the simulation = $500.00 PMPM

- Standard deviation of the statistical distribution = $296.53 PMPM

- CV = standard deviation ÷ mean = $296.53 ÷ $500.00 = 0.5931

- z = 1.6445, from the standard normal distribution

- represents a level of confidence that 95% of the time the resulting MSR truly signifies that GreatCare achieved a savings

- nmpp = 10,417 members

- ncpd = 110,000 members

MSR = 1.6445 x 0.5931 x (1/10,417 + 1/110,000)0.5 = 1.0%

Because the MSR determined using this formula is a function of the size of the population being measured, very small populations may result in an MSR that is larger than the savings that the provider organization can reasonably expect to achieve. For this reason, most shared savings arrangements also include a minimum number of members as a way of ensuring that the arrangement measures actual savings, rather than statistical noise.

Your Contract Should Also Include a Minimum Loss Rate

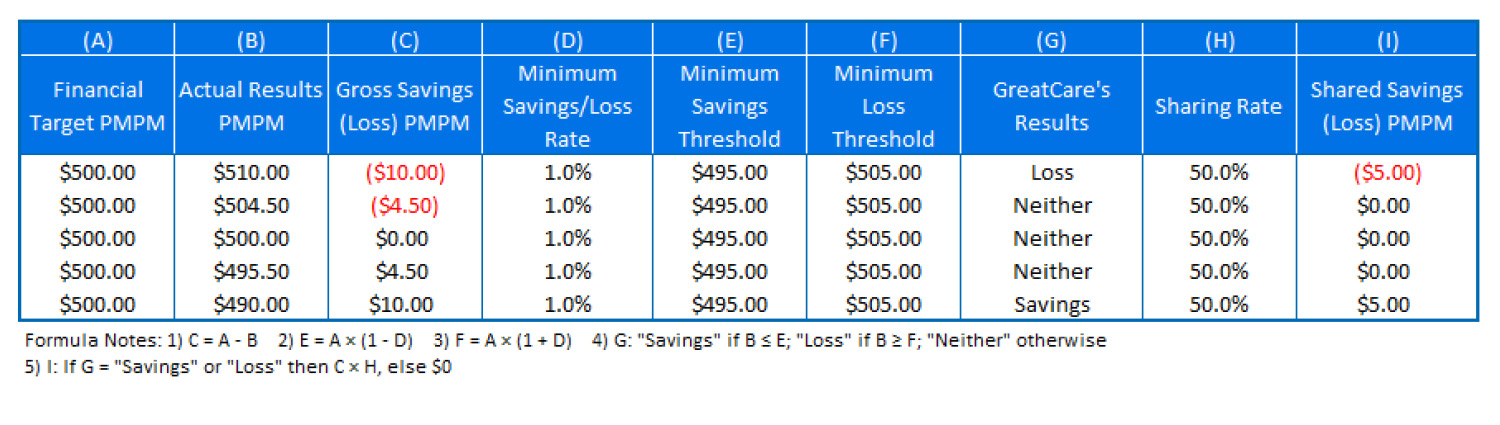

Shared savings arrangements between provider organizations and payers often lead to shared risk arrangements. In a shared risk arrangement, the provider organization not only shares in any savings realized under the arrangement, but also pays a share of the loss to the payer if the financial target is not met. A minimum loss rate, like a minimum savings rate, makes intuitive sense in a shared risk arrangement. If a savings less than a statistically determined threshold cannot be confidently attributed to the provider organization’s efforts to manage care rather than statistical fluctuations, then a loss less than that threshold likewise should not be considered proof that the provider organization failed to become a more efficient provider of care. In the example of GreatCare and Acme Health, a minimum savings and loss collar of 1.0% around the financial target would provide both parties protection from either marginal savings or loss. Table 2 shows GreatCare’s shared savings and shared losses under a shared risk arrangement as a function of its actual results taking into account both the minimum savings rate and the minimum loss rate.

Table 2: GreatCare’s Shared Savings/Shared Losses

Epilogue

Approximately one year later, GreatCare and Acme Health’s two teams are meeting once again to discuss the financial results of their risk contracting arrangement from the previous calendar year. For the previous calendar year, the arrangement has transitioned to a shared risk arrangement. The financial target for the previous year was $530.00 PMPM with a +/- 1% minimum savings/loss collar.

“As you can see, actual results under the contract show a loss of exactly $5.00 PMPM”, reports the lead representative from Acme.

“Well, I don’t think we can be sure that the actual results truly reflect a loss”, responds her opposite from GreatCare.

“Now that we have transitioned into a shared risk arrangement, the contract specifies a minimum savings/loss rate of +/- 1%” she continues. “The financial target was $530.00 PMPM, which means neither party will make a payment to the other if actual results are between $524.70 PMPM and $535.30 PMPM. Since actual results landed inside that range at $535.00 PMPM, GreatCare does not owe Acme Health a shared loss payment. In other words, the reported loss is small enough that we can’t be sure that GreatCare didn’t become a more efficient and cost-effective provider of care, and that the result is due to bad luck. And we don’t get punished for bad luck. We think this is pretty straight-forward and clear.”

“We agree,” says Acme Health’s lead negotiator. “Now, if you turn to the next slide, you can see that the financial target for the current calendar year is…”.

About the Author

Guest Author – Joe Slater, FSA, MAAA

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.