The general election is less than a month away as of this writing. Health care is at the top of mind for many as an issue this election—as it was in the last election and the one before that. Access to health care has gained even more prominence as an issue this year given the COVID-19 pandemic, millions of people losing their employer-sponsored health insurance coverage over just a few months, and a looming Supreme Court decision on the fate of the Affordable Care Act.

But there is another, extraordinarily important health care issue that has lost prominence in recent discussions: affordability. Particularly—for those lucky enough to still have health care coverage through work—the affordability of employer-sponsored health insurance.

Workers with lower wages tend to pay both a higher dollar amount and a higher share of their salary on health insurance premiums, whether they’re paying for single coverage or family coverage.

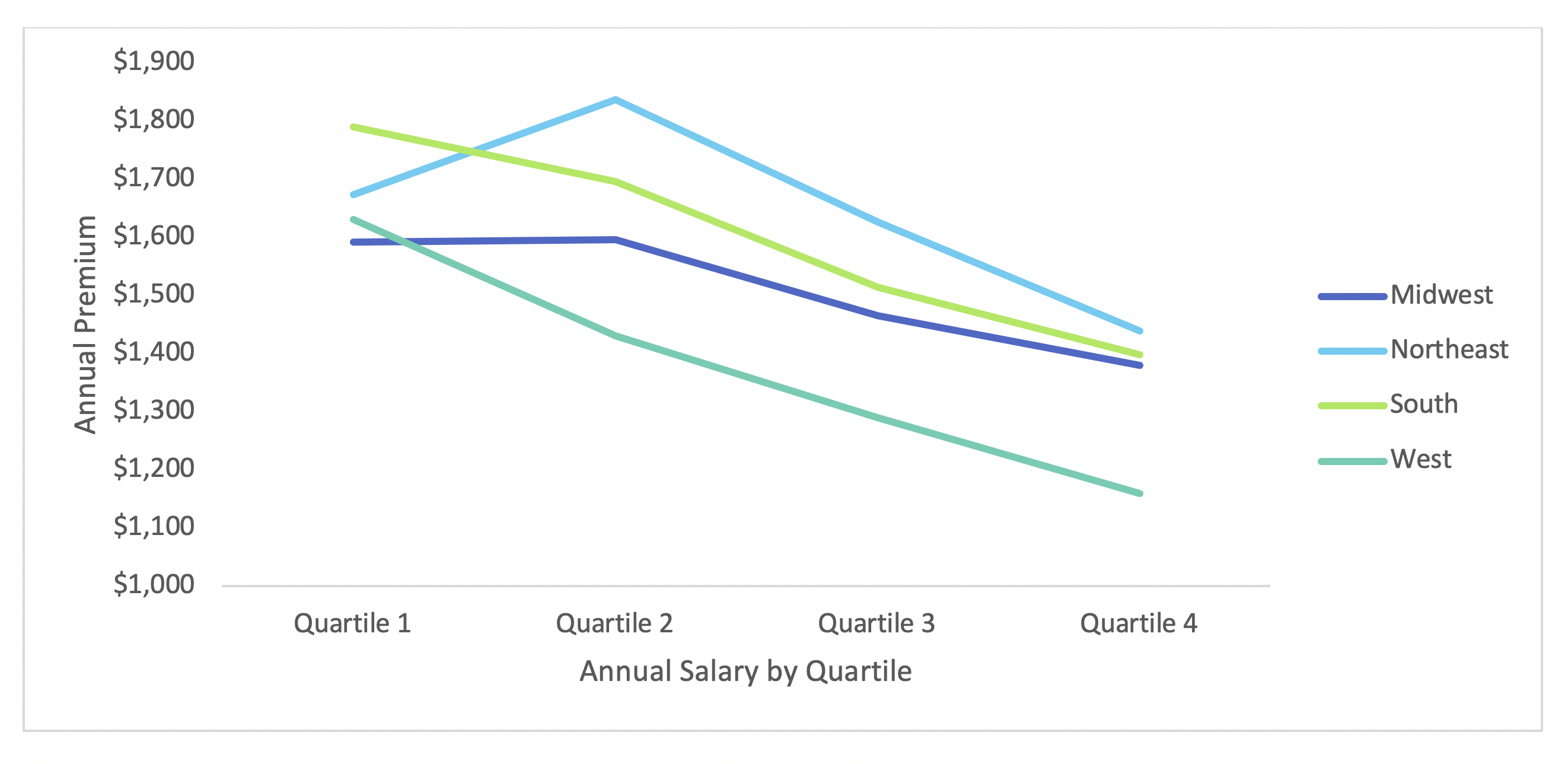

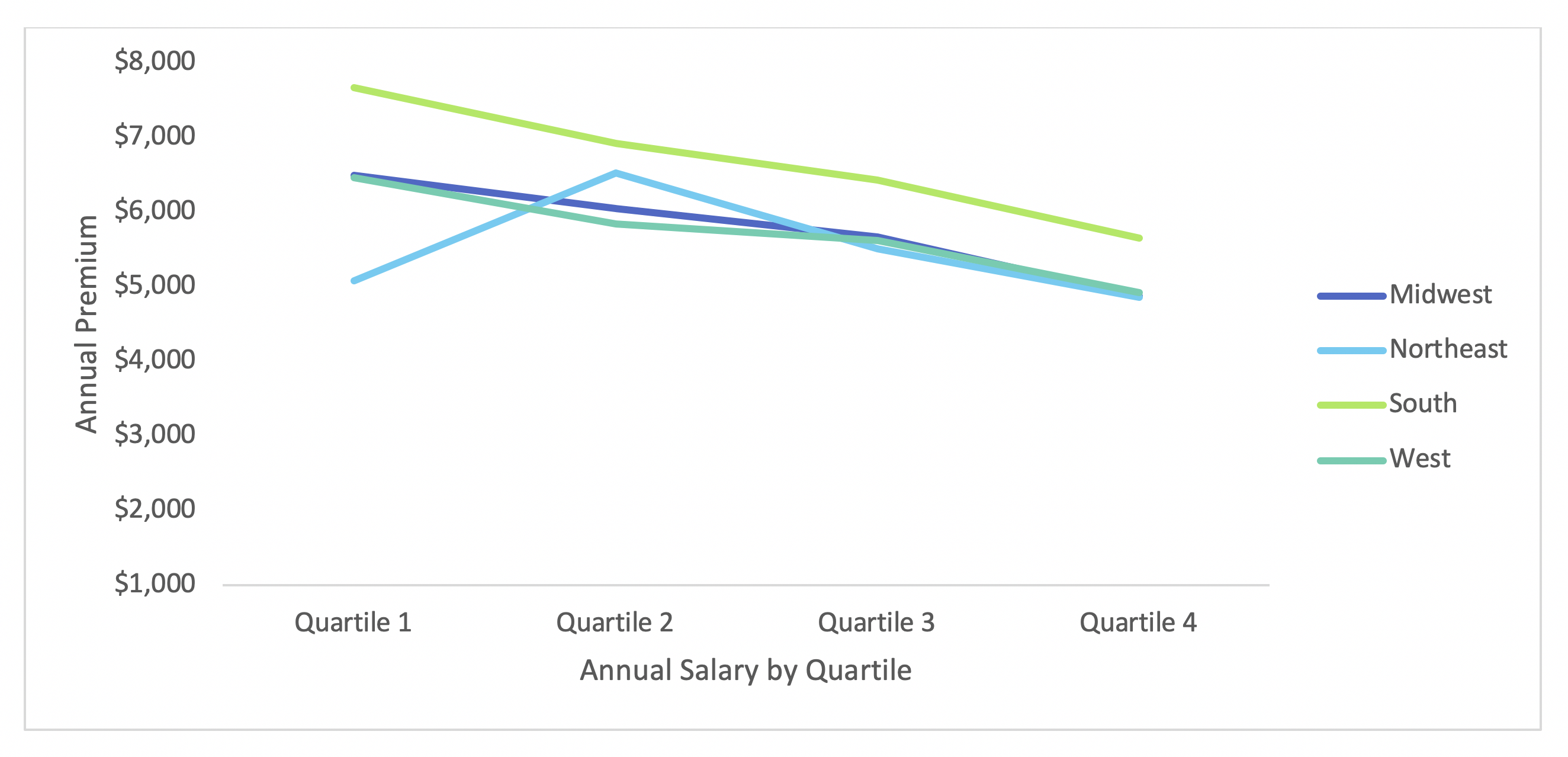

Affordability of employer-sponsored insurance coverage is an issue for employees and employers alike—typically, both the employee and employer pay some portion of the employee’s insurance premium, with the lion’s share funded by the employer. However, high costs of coverage tend to have a disproportionately negative impact on low-income workers. Workers with lower wages tend to pay both a higher dollar amount and a higher share of their salary on health insurance premiums, whether they’re paying for single coverage or family coverage. This is shown in Figure 1 for employees with employee-only coverage and Figure 2 for employees who purchase coverage for their spouse and dependents as well[1]. Figure 1 and Figure 2 show the average premium in four regions of the US for the bottom 25% earners, the top 25% earners, and those in the middle.

Figure 1: Employee Share of Health Insurance Premium by Salary Level in 2019, Single Coverage

Figure 2: Employee Share of Health Insurance Premium by Salary Level in 2019, Family Coverage

Figures 1 and 2 demonstrate that in every region of the US, on average, the highest earners pay less than the lowest earners do for their health insurance. For family coverage, the top 25% pay an average of $1,479 less than their low-wage counterparts. In other words, a high earner could buy a year of family coverage plus a year of single coverage for the same price that a low-wage worker would pay for a year of family coverage alone.

It’s important to note that these premiums are averages across states. Figures 1 and 2 don’t necessarily imply that low-wage workers are paying more for insurance than high-wage workers who are employed at the same company[2]. These figures simply imply that, on average, low-wage workers in most states are paying more for insurance than high-wage workers.

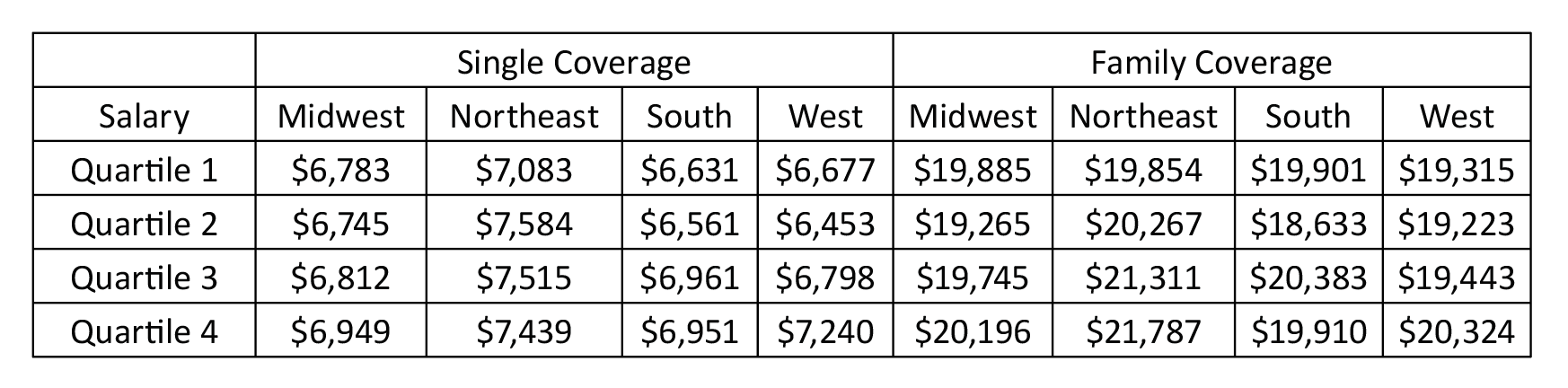

We see that higher-wage workers generally pay less for their coverage. However, they still get better coverage than low-wage workers, if we use cost as a proxy measure for value. In Table 1 below, we see that for single and family coverage tiers, the top 25% earners have more expensive coverage than the bottom 25%.

Table 1: Total Health Insurance Premium by Salary Level in 2019

Table 1 demonstrates that total health insurance premiums (the sum of the employer and the employee share of the premiums) are relatively flat across salary levels but still higher for high-earners than low-earners. The premium itself is not an ideal measure of value—in health care, rarely is cost a good measure of value. But—speaking very generally—higher premiums are associated with more comprehensive benefits, lower cost-sharing, wider provider networks, and other features that employees might valuable.

Taken together, these data imply that lower-wage workers are paying more for health insurance but receiving less. There are a few potential explanations for this phenomenon. Benefits, including health insurance, are used by employers as a tool for recruitment and retention. Companies may assign higher importance (and thus be willing to spend more) on recruiting and retaining top talent. And companies that employ high-earning professionals may enjoy higher profits than companies that primarily employ low-wage workers, such that they can pass some of the profits through to the employees via their benefits package.

Even though the reasons for the discrepancy are clear, though, the problem remains. And it’s been getting worse over time. For example, consider the average salary increase over the last 10 years compared to the average premium increase for family coverage. Across all earnings groups, after adjusting for inflation, salaries have increased by about 4% in the past 10 years while family-tier premiums have increased by about 44%. In other words, premiums are rising at a faster clip than salaries for both high earners and low-wage workers.

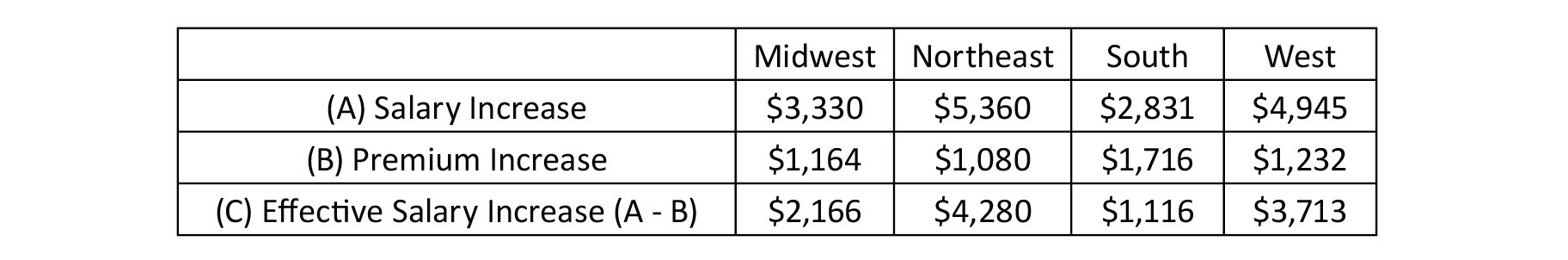

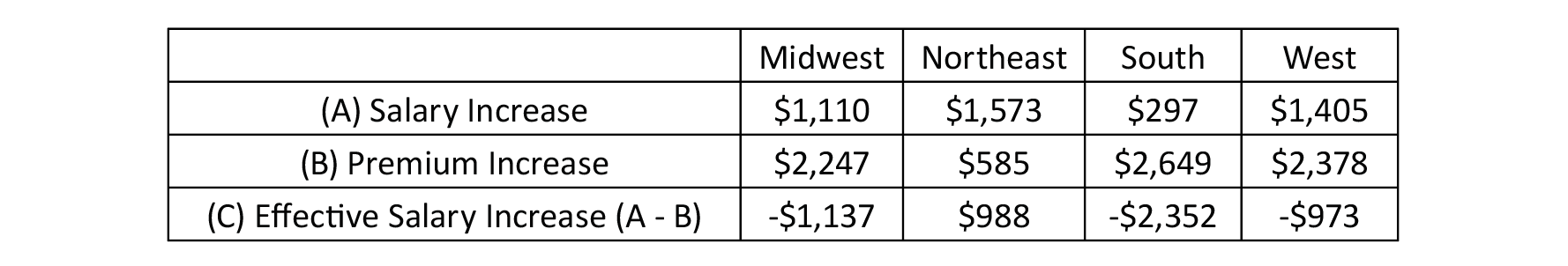

For example, for top quartile earners, premium increases offset a sizeable portion of salary increases gained over the last decade, as shown in Table 2[3]. The values shown in Table 2 have been adjusted for inflation, which was about 19% over the period 2009-2019[4].

Table 2: Adjusted Annual Salary Increases from 2009 to 2019, for Top Quartile Earners

As shown in Table 2, premium increases offset between 20% and 60% of salary increases, depending on the region. For low-wage workers, however, the impact of premium increases is even more damaging. This effect is shown in Table 3 below, using inflation-adjusted results.

Table 3: Adjusted Salary Increases from 2009 to 2019, for Bottom Quartile Earners

For low-wage workers, premium increases for family coverage were larger than salary increases in every region but the Northeast. These workers are effectively getting paid less now than they were 10 years ago. In fact, in 15 states (mostly in the South) the average salary for low-wage workers decreased between 2009 and 2019, after adjusting for inflation but before taking premiums into account. The number of states with a negative salary change for low-wage workers increases from 15 to 34 if we adjust for premiums[5].

Rising health care costs hurt employers and employees. Rising premiums hinder employers’ ability to pay higher salaries and reduce employees’ take-home pay. And premium increases are disproportionately burdensome on low-wage workers. Employers could attempt to fix this issue by setting up a tiered premium structure, like a progressive tax system. For each salary bracket, employees would pay an increasing percentage of their salary on health insurance premiums. The higher-earners would then subsidize the premiums of the lower-earners.

The root of the problem, however, is the high cost of health care in the US. This is a problem that needs fixing, and we at AHP have ideas for solutions.

Endnotes

[1] All premium data shown in this article was collected from the Medical Expenditure Panel Survey at https://meps.ahrq.gov/mepsweb/

[2] Companies aren’t required to provide the same health insurance benefits to all employees, but they must pass nondiscrimination testing on the benefits they offer.

[3] All salary data shown was collected from the U.S. Bureau of Labor Statistics at bls.gov.

[4] https://www.usinflationcalculator.com/

[5] Assuming family coverage

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.