On April 1, 2021, the Global and Professional Direct Contracting (GPDC) Model began its first performance year. Effective through 2026, the CMS GPDC Model introduces risk sharing arrangements with the goal of reducing overall healthcare costs while maintaining or improving efficiency. As many providers wade into risk-sharing arrangements, and some for the first time, it is vital to incorporate an actuarial perspective to improve the likelihood of profitability over multiple years. The GPDC Model continues the trend towards increasing providers’ “skin in the game,” akin to an insurer. Since the latter has relied on actuaries for decades to manage healthcare risk, providers engaged in direct contracting would also benefit from actuarial input.

Program Overview

There are numerous existing resources that explain the goals and mechanics of the program in great detail. Nevertheless, a brief overview will be provided for readers less familiar with the GPDC Model and more information can be found on the CMS website[1] or by contacting Axene Health Partners.

Direct Contracting Entities (DCEs) are legal entities engaged in Direct Contracting with CMS and may be comprised of multiple participating providers. A myriad of organizations can form a DCE, including ACOs, IPAs, hospital systems, health plans, MCOs, and more. According to CMS, there are 53 entities participating in direct contracting during the 4/2021-12/2021 performance year. Organizations are no longer allowed to apply for the 2022 performance period; only those that previously applied for 2021 and chose to defer will commence in 2022. There are three primary types of direct contracting entities based on prior experience and operational parameters:

- Standard – Organizations with prior experience serving Medicare FFS and dual-eligible beneficiaries.

- New Entrant – Organizations with limited or no experience serving the Medicare FFS population.

- High Needs Population – Organizations that provide services for Medicare FFS beneficiaries with complex needs.

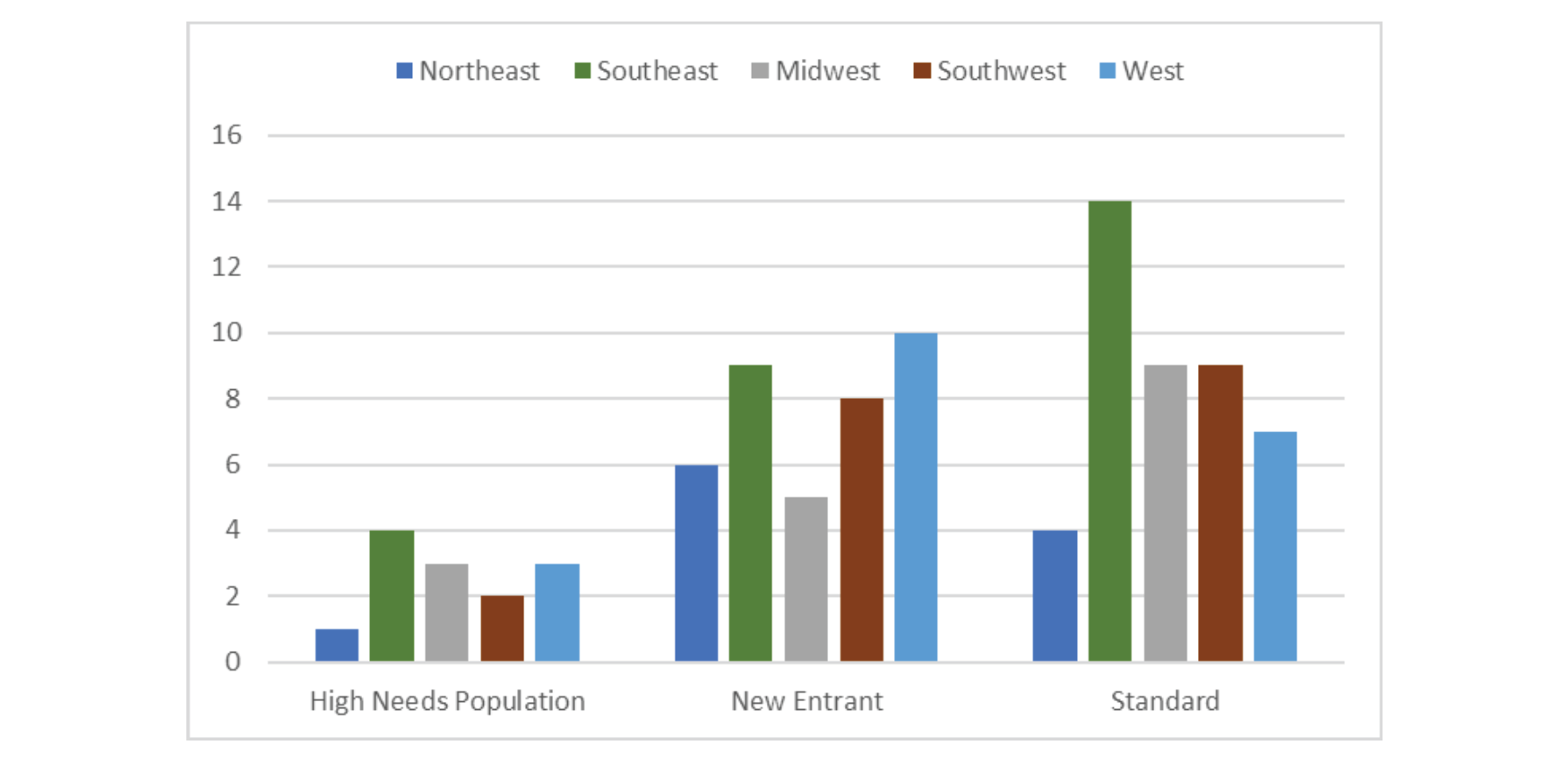

DCEs can operate in multiple states through their participating providers. The geographic distribution of organizations participating in performance year 2021 is reflected in Exhibit-1.

Exhibit-1: Geographic Distribution of PY2021 DCEs

Generally, there are fewer DCEs operating in the Northeast region than in all the other regions. Although High Needs Population has the fewest DCEs, the number of New Entrant and Standard DCEs are comparable. Overall, the Southeast region has the most DCEs with 27, followed by the West and Southwest with 20 and 19, respectively.

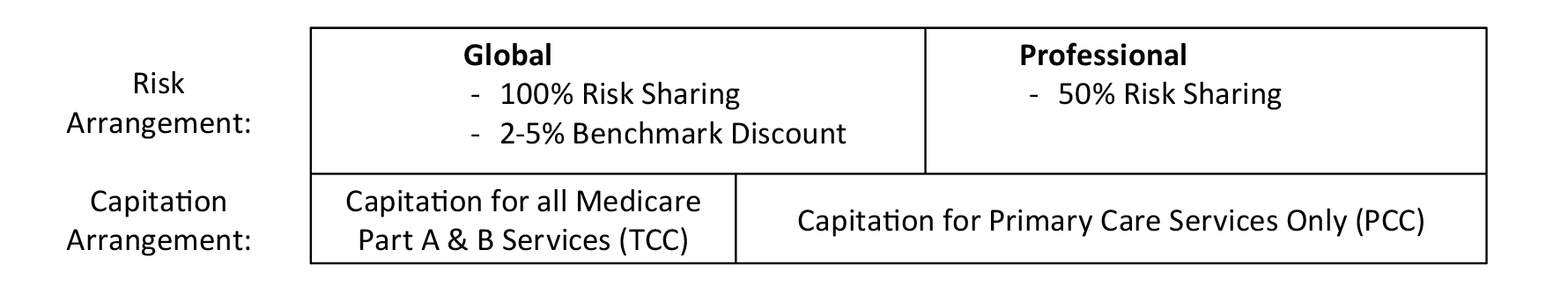

DCEs can participate in gain/loss sharing under two different arrangements, primarily characterized by the degree of risk sharing. The first is Global, which shares 100% of gains or losses and discounts benchmark expenditures by a predetermined percentage to derive a risk-sharing target (allowing CMS to obtain savings). The second option is Professional, which is limited to 50% of the gains or losses but does not include a discount. Furthermore, there are two forms of capitation: Total Care Capitation (TCC) and Primary Care Capitation (PCC). Under TCC, the DCE receives a capitated amount for all services covered under Medicare Parts A & B. On the other hand, PCC offers capitation for primary care services only. These arrangements contain many details and nuances not mentioned in this article but can be found on the CMS website. One important distinction is Professional risk sharing is only permitted under PCC, whereas Global risk sharing can be elected under any capitation arrangement. This is exemplified in Exhibit-2.

Exhibit-2: Risk Sharing and Capitation Arrangements Under GPDC

Beneficiaries are aligned to DCEs in two different ways: voluntary alignment or claims alignment. Voluntary alignment occurs when the beneficiary specifically elects the DCE as their primary source of care. Beneficiaries who do not make a voluntary election are aligned to a DCE based on where the plurality of their primary care services are performed (i.e., claims alignment).

Although DCEs do not have to be licensed insurers, emulating certain aspects of insurer operations would increase the likelihood of success in the GPDC Model.

Actuarial Considerations

The GPDC Model has garnered appeal because efficient providers can assume risk and benefit from potential upside without being totally subject to insurer regulation, processing claims internally, or developing pricing models. Although DCEs do not have to be licensed insurers, emulating certain aspects of insurer operations would increase the likelihood of success in the GPDC Model.

- Reserving – One of the most important components of assuming and managing risk is reserving, a practice uniquely suited to actuaries. Whatever the risk arrangement or degree of capitation, provider groups run the risk of taking a loss. The amount of an adequate reserve is dependent on a variety of factors. It requires a detailed analysis of historical claims from both voluntarily- and claims-aligned members. DCEs will need to determine an appropriate risk threshold (e.g., enough to withstand an 80th percentile downside scenario) that ensures continued operations and reassures regulators yet is not overly burdensome on the organization. This can be accomplished using stochastic or deterministic techniques by adjusting utilization and unit costs for an array of services.

- Care Management – Under the global risk arrangement, CMS applies a discount to the claims benchmark to arrive at the risk-sharing target. The discount starts at 2% in PY2021 and increases to 5% by PY2025. DCEs risk becoming overconfident that they can achieve shared savings by simply comparing to historical performance. However, this is a fragile assessment that should be supplemented by proactive care management. Health plans traditionally have a designated position of Medical Director or Chief Medical Officer who is responsible for the clinical oversight and holding the doctors accountable for the care they deliver. DCEs would benefit from mirroring health plan care management and significantly reduce their downside risk in doing so. Furthermore, CMS applies a quality withhold that returned to DCEs contingent on meeting certain quality and reporting measures. Providers must continuously monitor their progress and dialogue with participating providers to ensure the withhold does not become a financial loss.

- Administration – Although CMS is still responsible for processing claims, DCEs will need to develop many administrative functions related to capitation and risk-sharing they are only accustomed to fee-for-service (FFS) payment. Claims experience should be continuously monitored throughout the year, tracking progress towards the benchmark to update reserving estimates and identify any anticipated high-cost claimants. These claims files are provided by CMS in a format that is disjointed and probably unfamiliar to many practices. Unless DCEs have the internal expertise to manage this data, they will need to rely on consultants such as Axene Health Partners to synthesize these files into aggregated and analyzable datasets. Competent administrative functions are a prerequisite to implementing successful care management and reserving.

Competent administrative functions are a prerequisite to implementing successful care management and reserving.

- Negotiations – DCEs may be comprised of many participating providers which have independently negotiated payment arrangements. Meanwhile, the DCE operates under the GPDC risk and capitation arrangement with CMS. If these independent arrangements deviate from Medicare FFS, negotiations will necessitate an actuarial analysis to preserve the profitability of the DCE.

- State licensing – Operating as a DCE can attract the attention of state regulators. Compliance measures will vary, but it is important to accurately communicate the degree of risk assumed in the direct contracting arrangement. Global DCEs under total care capitation will likely face more scrutiny from regulators than Professional DCEs under PCC. Regulators will be more concerned with DCE financials on a statutory basis with an emphasis on solvency rather than profitability.

Conclusion

The Global and Professional Direct Contracting Model aims to transform risk-sharing arrangements in Medicare FFS and encourage providers to participate in CMS Innovation Center models. The incentive structure accommodates providers with varying risk appetites and reduces the administrative burden that might impede smaller groups from participating in similar arrangements. Over the course of the program, the benchmark expenditures used to calculate risk sharing targets are weighted more towards regional expenditures and less on DCE historical expenditures. For DCEs in Global risk sharing, the discount applied to the benchmark also increases which increases the aggressiveness of risk sharing targets. Recognizing the allure of easier profitability in early years, DCEs should ensure they can maintain profitability against progressively aggressive targets in later years. It is imperative that rigorous actuarial and care management practices are implemented in order to ensure success not just in Performance Year 1, but through the entire program.

Endnotes

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.