Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

Introduction

Today is the day! The Big Event of 2023 is the launch of multiple Humira biosimilars which begins today with the arrival of Amgen’s Amjevita on the market. The launch of Amjevita is the first step in the Big Event of 2023 and it begins the process of changing the specialty drug marketplace in the United States. The expectation of the full impact of this big event is very hopeful, but uncertainty abounds as we approach this first step today.

The Big Event: Humira

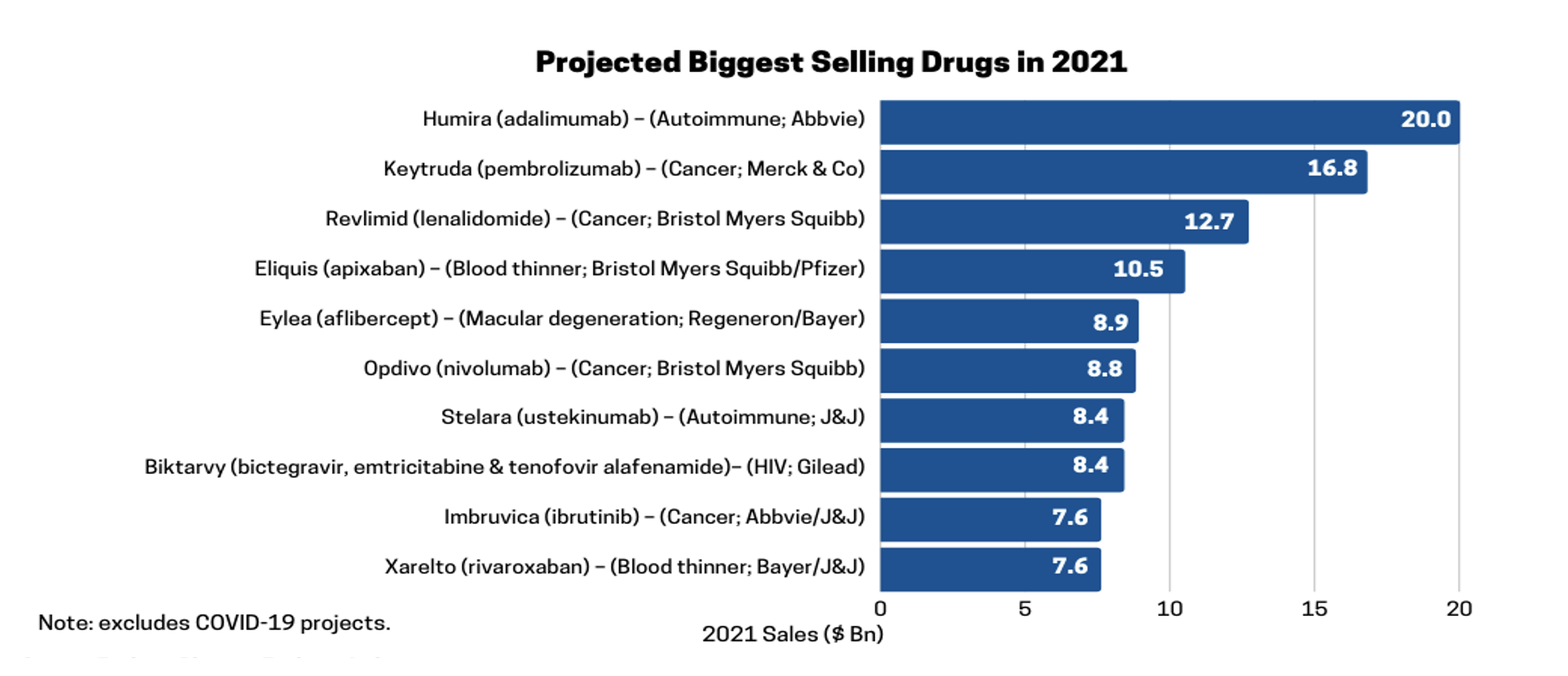

Humira is the highest-selling drug in the world and has been since 2013 except for when the COVID-19 projects temporarily surpassed it. The world is eagerly awaiting the Big Event of 2023 … the launching of multiple biosimilar drugs to compete with Humira and hopefully bring more competitive pricing to the benefit of payers and patients everywhere.

Source: EvaluatePharma, Evaluate Ltd.

Many Humira Indications

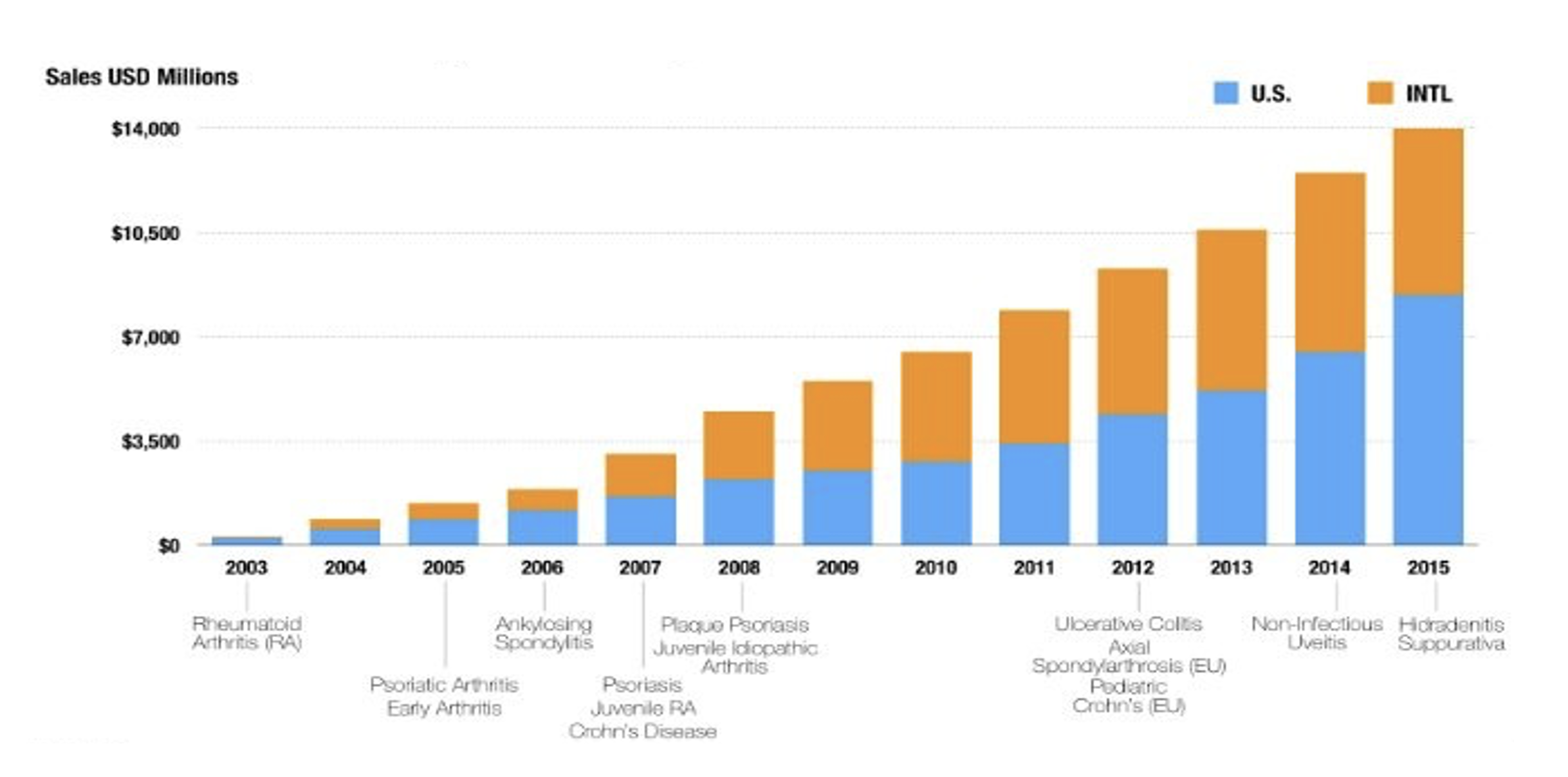

Humira’s exponential sales growth has been driven in part by its approval for multiple indications over the years. Some have called Humira the “wonder drug” because of all the diseases it has been approved to treat.

Humira’s broad applicability has really solidified it on formularies as a brand-name drug that is necessary to include so patients can have the care access they need. In order to remove Humira from your formulary, you would need to cover all these indications with other prescription drugs. That gives Humira a lot of market leverage.

Several Humira Product Changes

In 2018, Humira launched a citrate-free version. Citrate refers to an inactive ingredient that acts as a stabilizer. Some felt the citrate might have been causing pain or a burning sensation during injection. So, removing the citrate would improve the patient experience.

Humira also made some other changes. A thinner needle was implemented thereby also potentially improving patient experience and possibly lowering discontinuation rates. The concentration was also doubled so that twice as much Humira was received per injection. The result of that was you may then only need half as many shots.

The other fascinating aspect of this is that some biosimilars launching in 2023 were already in development, perhaps even had already received FDA approval, when Humira’s citrate-free version entered the market. So they were developed to compete directly (with interchangeability once that is approved) with a version of Humira that many people are no longer taking as they’ve moved to the newer versions of Humira.

Humira Pricing

As we consider Humira’s pricing, another interesting aspect of Humira’s new versions (citrate-free, high dosage form, thinner needle sizes, etc.), is that each new version was assigned a new National Drug Code (NDC) number. The 340(b) “penny pricing” rules impose a limit on list price increase applicable to 340(b) entities at the rate of general inflation, but because the new NDC has a new initial price, the 340(b) pricing rules effectively reset to that new initial price. The previous versions of Humira saw significant historical list price increases, so this had a significant effect on Humira’s revenue generation.

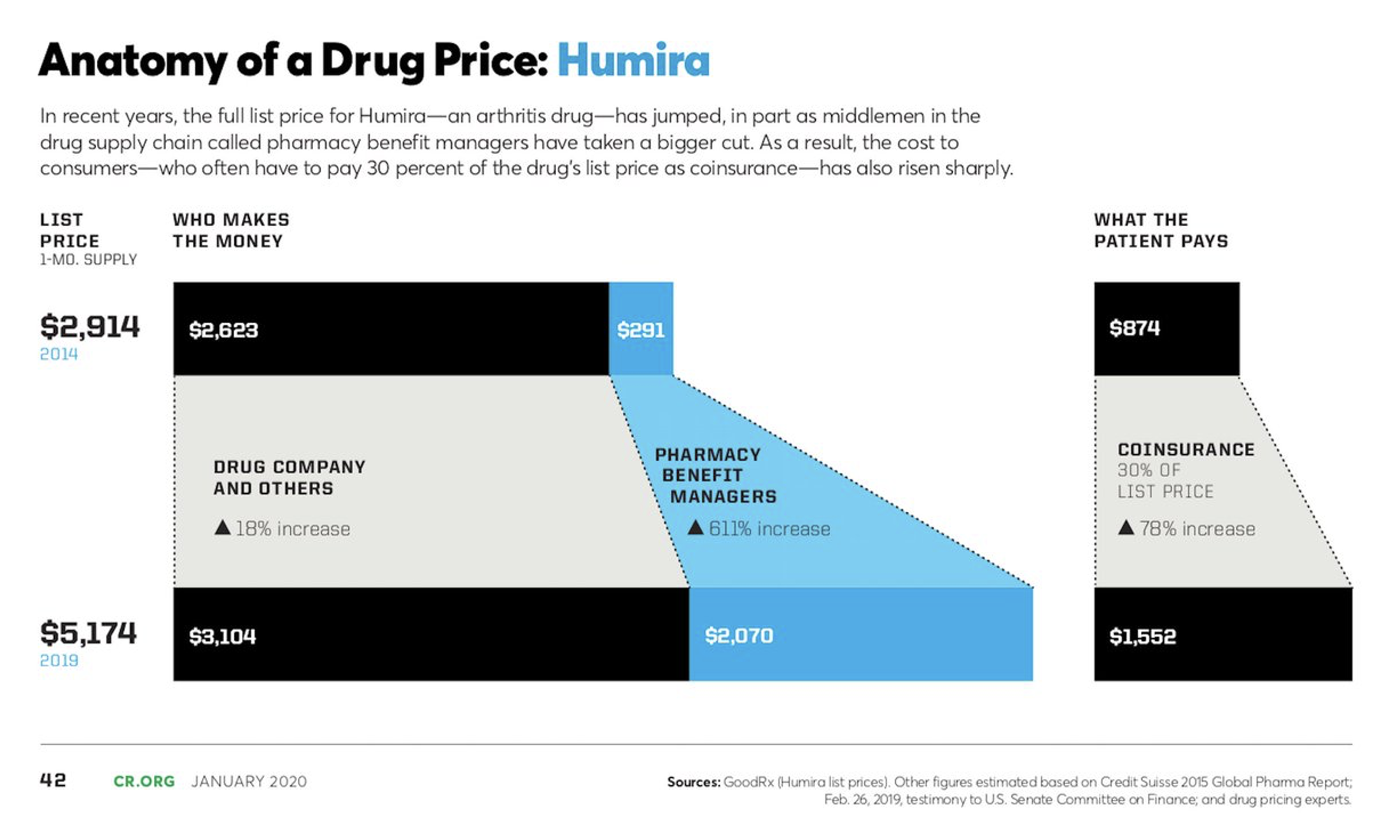

Without the 340(b) “penny price” applied, traditional commercial coverage for Humira has seen its list price inflate significantly in recent years, though the net price of the drug has remained relatively level because of equally significant increases in the rebates paid. Humira alone can represent upwards of 1/3 of all rebate dollars received for a pharmacy benefit manager or health plan. This increased the “spreads” that pharmacy benefit managers and health plans can sometimes keep on rebates paid by Humira for formulary access while the list price inflation also increased the coinsurance and other cost-sharing amounts patients need to pay for their Humira prescriptions.

The magnitude of these pricing increases and their impact on plan sponsors and patients highlights again the great anticipation of the Big Event beginning today.

The Extent of the Big Event

So what all is included in this big event, how many biosimilar launches are coming and with which of the various versions of Humira will they be “similar”?

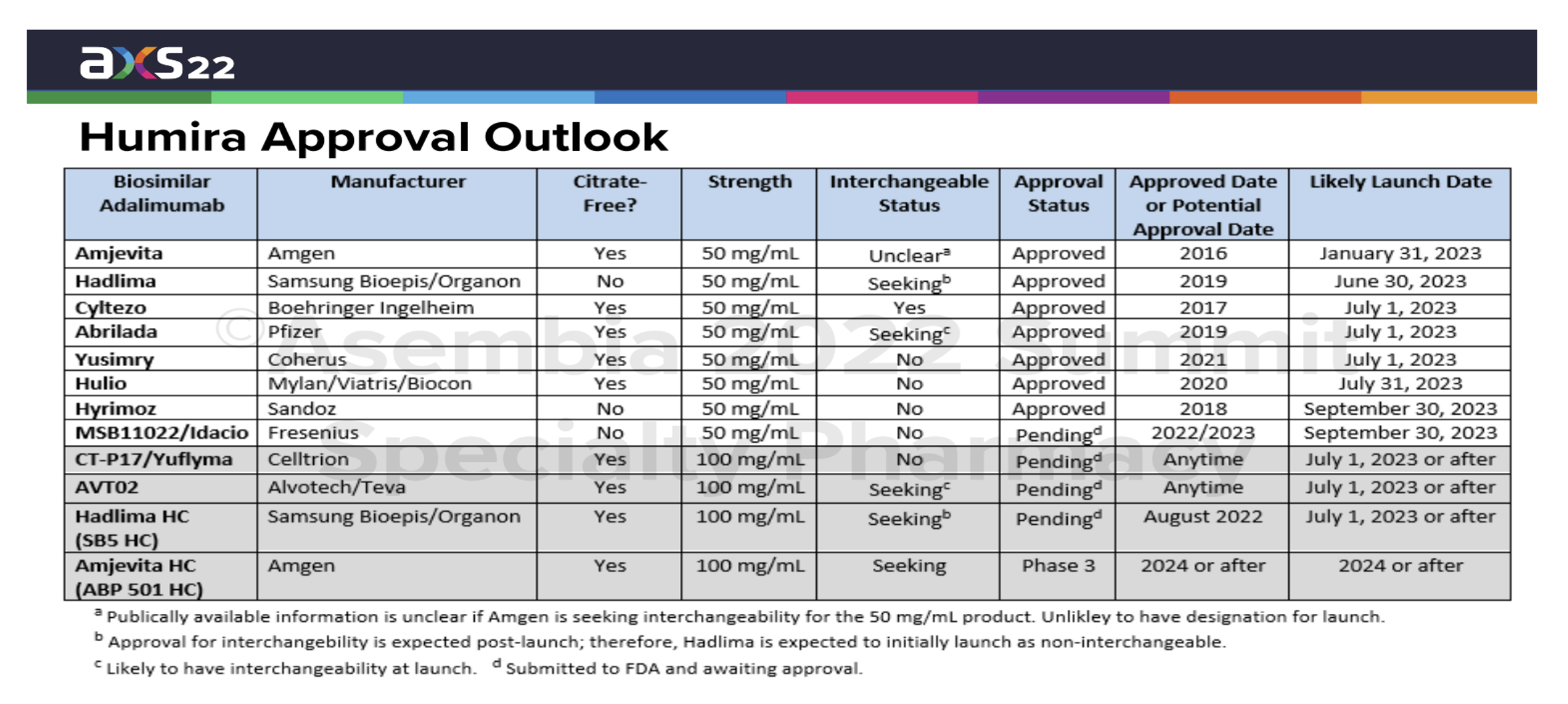

This exhibit below was presented back in May 2022. So, the “approval status” and “interchangeable status” are not entirely current, but it does a nice job of summarizing the various biosimilar drugs, their manufacturer, citrate-free status and strength (high-dose or low-dose) which helps us identify the various forms of Humira with which they will compete.

The various launch dates have been determined through negotiations with Humira’s manufacturer AbbVie. AbbVie’s many patents have not all expired, but these biosimilars have obtained the right to launch through settlement negotiations with AbbVie.

Some of the manufacturers are familiar names and others are less familiar in the United States market. This raises one question some payers and pharmacy benefit managers might ask: reliability of the supply chain and certainty of the manufacturer’s ability to deliver whatever quantities might be demanded in a timely manner.

Amjevita from Amgen is the first Humira biosimilar to launch with several more to follow around July 2023. Cyltezo from Boehringer Ingelheim will be launching with interchangeability with Humira’s low-dosage form. Others are still seeking approval to be interchangeable with Humira’s high-dosage form.

Summary/Conclusion

This is the Big Event of 2023. Beginning today. It is going to be a fascinating and exciting journey throughout the year. Numerous on-formulary, off-formulary and preferred or non-preferred tiering options exist for payers and PBMs to employ to try to achieve the greatest savings benefits for themselves and the patients they cover. Only time will tell how the manufacturers’ various pricing strategies and the payers’ and PBMs’ various clinical and savings strategies will play out. Will competition really drive the financial impact so many are hoping for? We will keep you posted!

About the Author