Once the first Humira biosimilar, Amjevita, launched in the United States in January, payers needed to begin making decisions about coverage not only for Amjevita but for all the other Humira biosimilars launching in 2023: on or off formulary, coverage tier, prior authorizations, etc. A continuum of payer responses could include anything from doing nothing (stay with just Humira) to adding selected biosimilars to the formulary as they launch throughout 2023 (how many? A few? Many? All?) to the most aggressive approach of removing Humira from formulary entirely.

Payer Priorities

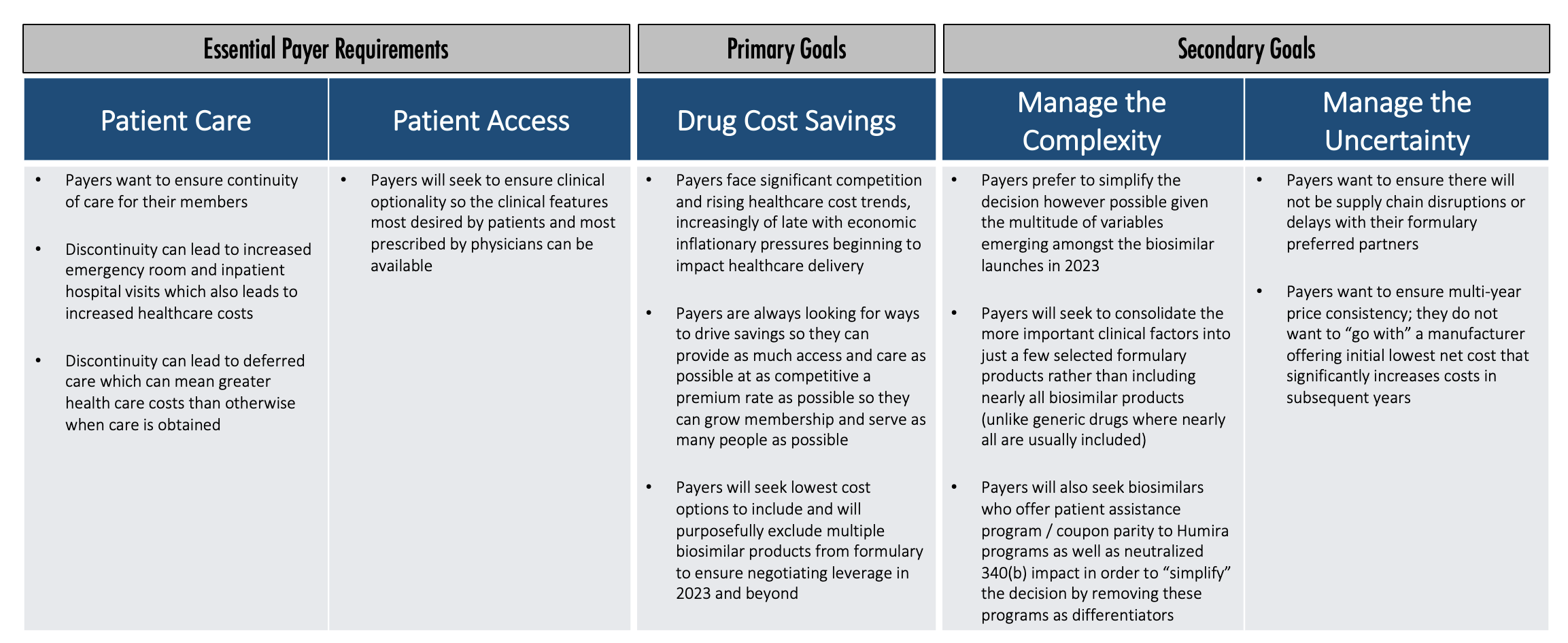

So how do payers think about this? What are their priorities? What is their decision-making process? We believe payers generally have some essential requirements, one primary goal, and a couple of secondary goals.

Essential payer requirements include making sure patients get access to the care they truly need. Discontinuity of care can lead to increased healthcare costs in the short term and over time. Payers want patients to have access that provides clinical optionality so the right clinical features can be available for patients.

Once that foundation is established, then the primary goal is really cost savings. Payers face significant competition and rising healthcare cost trends. Also, economic inflationary pressures are beginning to impact healthcare delivery.

Payers are constantly looking for ways to drive savings so they can provide as much access and care as possible at as competitive a premium rate as possible. Then they can grow membership and serve as many people as possible. Payers will seek to include the lowest cost options and will purposefully exclude multiple products from the formulary to create the negotiating leverage to accomplish that.

Once they identify how to accomplish that primary goal, payers will then pursue secondary goals. Payers want to manage the complexity and uncertainty in this market, so they want to simplify the decision, which is difficult to accomplish with all the Humira biosimilars that will potentially be launching in 2023.

Managing Complexity and Uncertainty

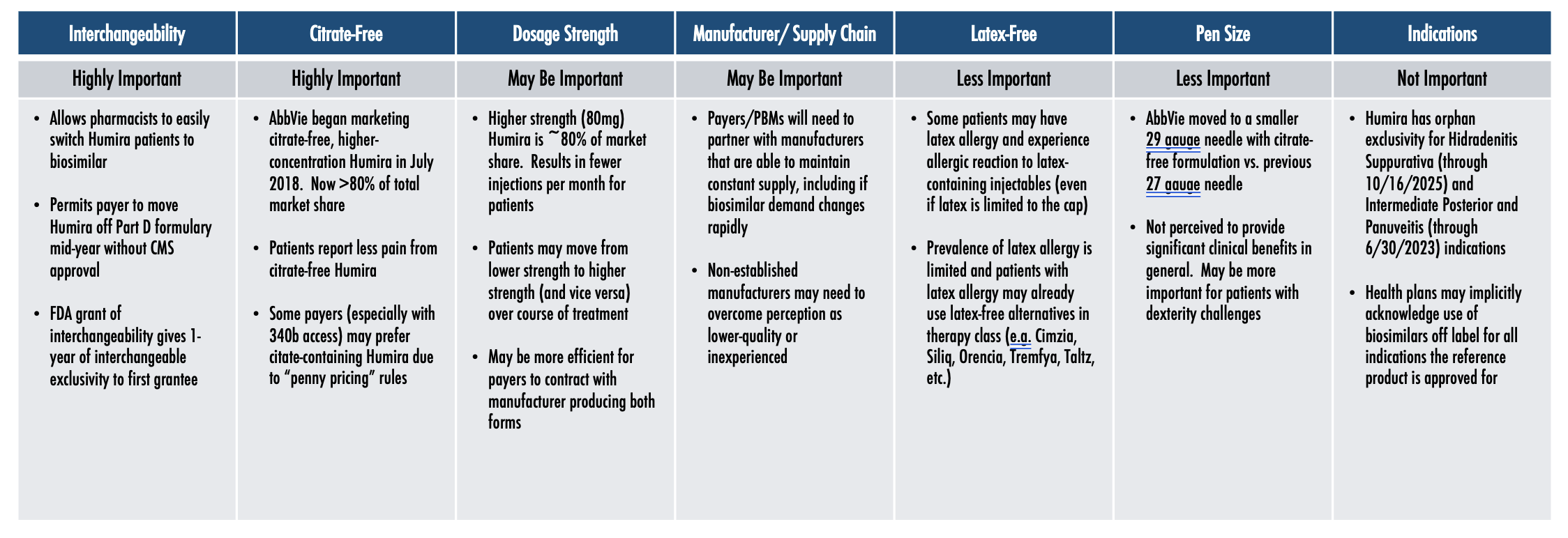

A lot of differences exist among the Humira biosimilars that are expected to launch in 2023, which is unusual in a generics market, once again demonstrating that biosimilars are not generics. The many differences increase payers’ interest in simplifying the complexity.

Payers want to be confident that whichever manufacturers they make preferred on their formulary have the infrastructure and supply chain to ensure there are no disruptions or delays. They also want to make sure there’s going to be multi-year price consistency. And they want to simplify the complexity in the variety of clinical factors differentiating the various Humira biosimilars.

Key Clinical Factors Differentiating Humira Biosimilars

Among the different clinical factors, having interchangeability and being citrate-free both seem to be highly important, while dosage strength may be important, and being latex free and the pen size are less important. Obviously, the less important factors are very important for the patients they impact, but they’re less important when you’re looking at a population strategy as a whole.

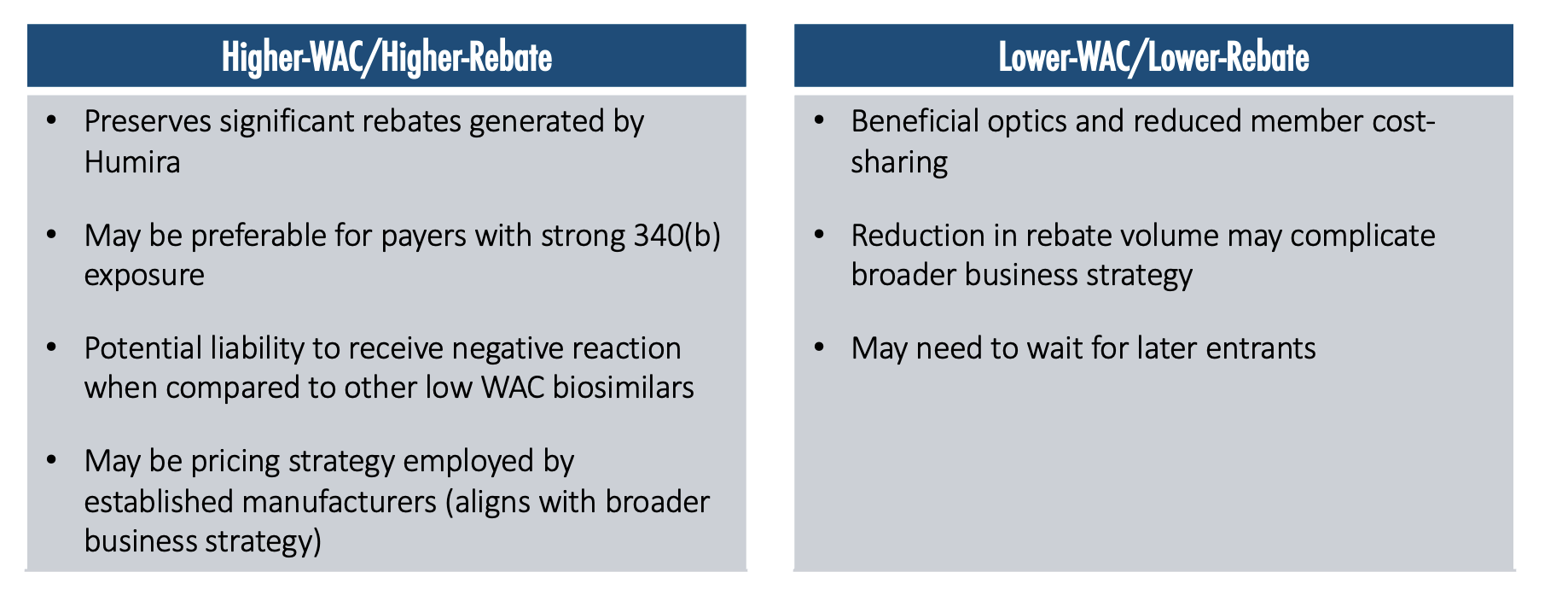

Manufacturer Pricing will Likely Bifurcate into Two Main Strategies

The higher-WAC/higher-rebate strategy preserves significant rebates that are being generated by Humira and may be preferable for payers with strong 340(b) exposure. It may be a potential liability to receive a negative reaction when compared with other lower-WAC biosimilars. There may be pressure in the media and widespread public opinion to push toward a lower-WAC price, because then there is a lower ingredient cost, a lower allowed cost amount, and therefore a lower cost-sharing for members.

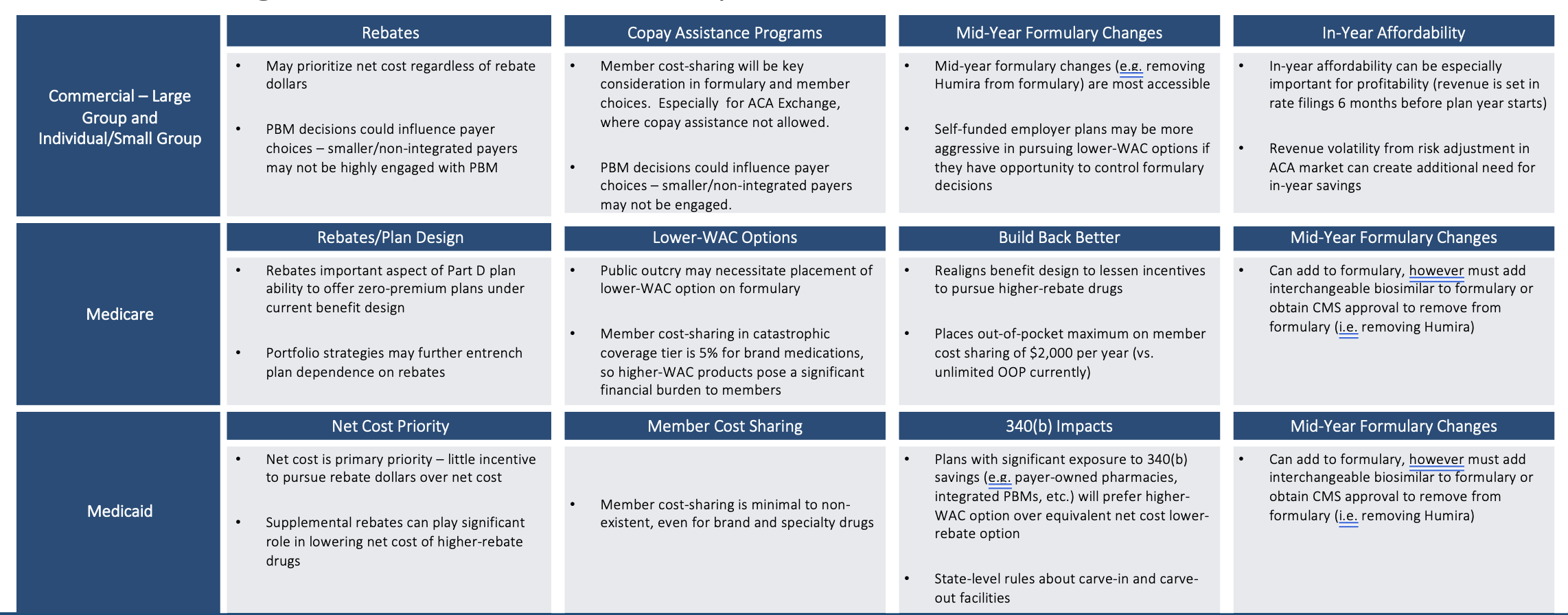

Cost Savings Considerations Vary by Book of Business

Cost savings considerations differ by book of business. If a lower-WAC product is put on formulary (even more so if it is put on a preferred tier), then a PBM with aggressive rebate guarantees with their clients that don’t have a lot of exception language in the guarantees could be at risk of missing their rebate guarantees.

Those employers and health plans that have a tightly worded rebate guarantee in their PBM contract could now see that work against them (or against their patients), in a sense, because their PBM will not be incentivized to move to include or prefer a lower-WAC option on their formulary. Humira may contribute more than 1/3rd of the total plan rebate dollars. Humira could further entrench itself by increasing rebate percentages throughout the 2023 biosimilar launches. PBMs may have an incentive to delay the adoption of biosimilars if those biosimilars do not offer similar total rebate dollars to Humira so that those PBMs can protect existing rebate guarantee contract provisions.

In Medicare, rebates have a leveraging effect that incentives higher rebates more than lower WAC prices in that the higher rebates are advantageous in driving lower premium rates that are more competitive in enrolling members. The Inflation Reduction Act reduces that reliance upon rebates some, but the reliance is still there and is still substantial. In Medicaid plans, patients typically have pretty low-cost sharing. So, the goal of trying to mitigate member cost sharing with a lower-WAC strategy is less relevant in the Medicaid book of business.

Regulatory Impediments to Making Immediate Formulary Changes

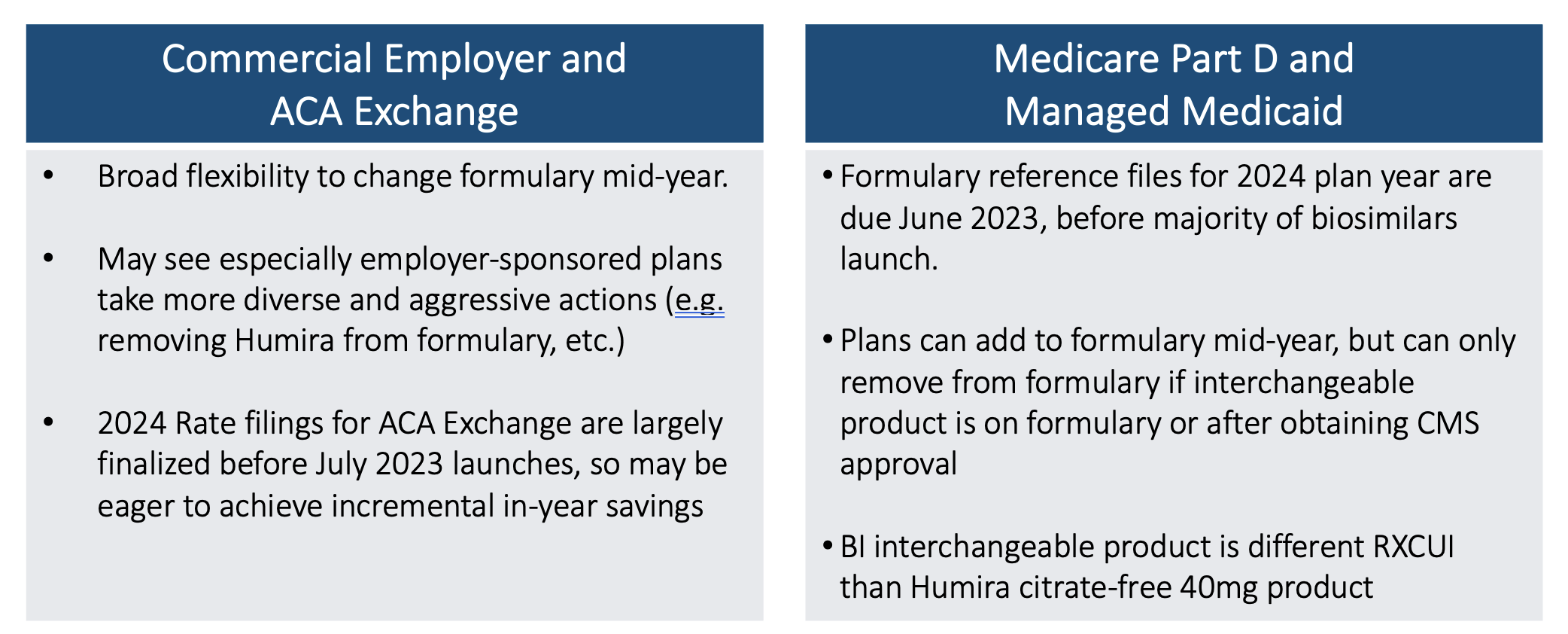

Timing matters. Medicare actuaries know that Medicare bids for 2024 coverage are due early in June 2023. At that point, there will only be Humira and Amjevita approved on the market. The others are not launching until July. Price negotiations are not supposed to occur until approval to launch. Commercial Employer and ACA Exchange markets have different timing flexibilities.

So even though 2024 Medicare formularies are not likely to do anything dramatic like kicking Humira off of formulary, they will still have the opportunity to add the other biosimilars to their formulary midyear should they choose to do so. But they won’t be able to remove Humira unless an interchangeable product is approved and then 60 days of notice is given. But that would still be a very dramatic step to take.

Summary

We will be watching what happens in July, September, and then in the years beyond when we will potentially see more active movement with Humira. It will be interesting to see which manufacturers are reaching their market share goals in the back half of 2023 and which are not. That could define which manufacturers take dramatic steps in price declines if they are not hitting their expectations. We may be close to entering the wildest period in this coming wave of biosimilars. Buckle up!

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.