Introduction

On December 20, 2019, President Trump signed the Further Consolidated Appropriations Act of 2020 (i.e., HR 1865) which included a repeal of the Health Insurer Tax (i.e., HIT) as of January 1, 2021. The repeal of the HIT is good news for individuals, families, and employer groups purchasing health insurance in 2021 since it will lower health insurance premiums by 1.5% to 3.0%. However, the HIT repeal in 2021 creates a potential issue for provider organizations that are in shared savings and shared risk arrangements using loss ratio financial targets for calendar year 2020. Because loss ratios are a function of premium rates, the repeal of the HIT in 2021 could affect members and groups with 2020 plan year renewal dates on or after January 2020. The purpose of this article is to give provider organizations a basic understanding of this issue and an idea of the potential risks involved.

2020 Premiums

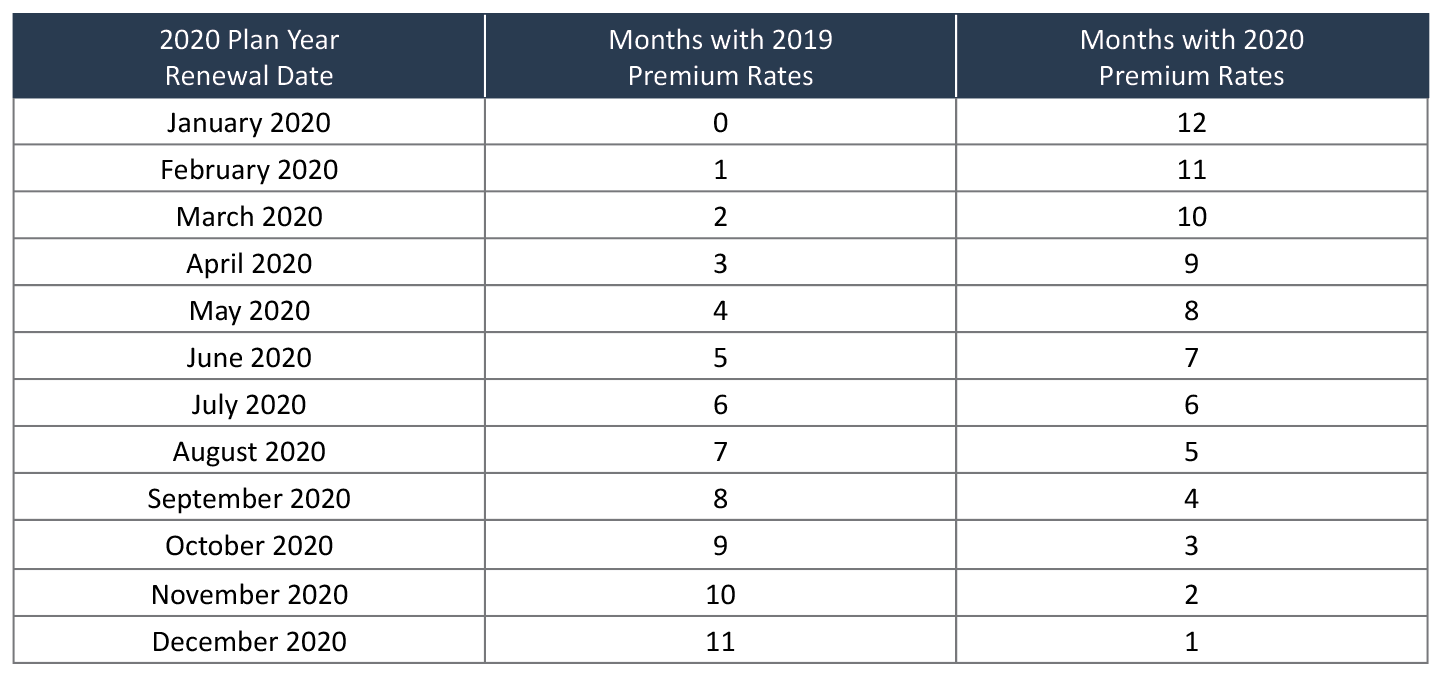

It is important to note a few things about the health insurance premiums a member will pay in 2020. First, the premiums will vary by the renewal month of the member’s plan in 2020. For members with plan years beginning January 1, 2020, the premiums they pay will all be 2020 premium rates. For the remainder of the members (i.e., those with plan years beginning in February through December 2020), they will pay premiums that are 2019 premium rates prior to their renewal date and 2020 premium rates after their renewal date. A 2019 premium rate is the premium rate charged a member on and after their 2019 plan renewal date, similarly, a 2020 premium rate is the premium rate a member pays after their 2020 plan renewal date. For example, a member that begins their 2020 plan year in March 2020 will pay their 2019 premium rates in January and February 2020 (2 months) and their 2020 premium rates in March through December 2020 (10 months). The table below shows the number of months a member will pay 2019 and 2020 premium rates in calendar year 2020 as a function of the month they begin their 2020 plan year.

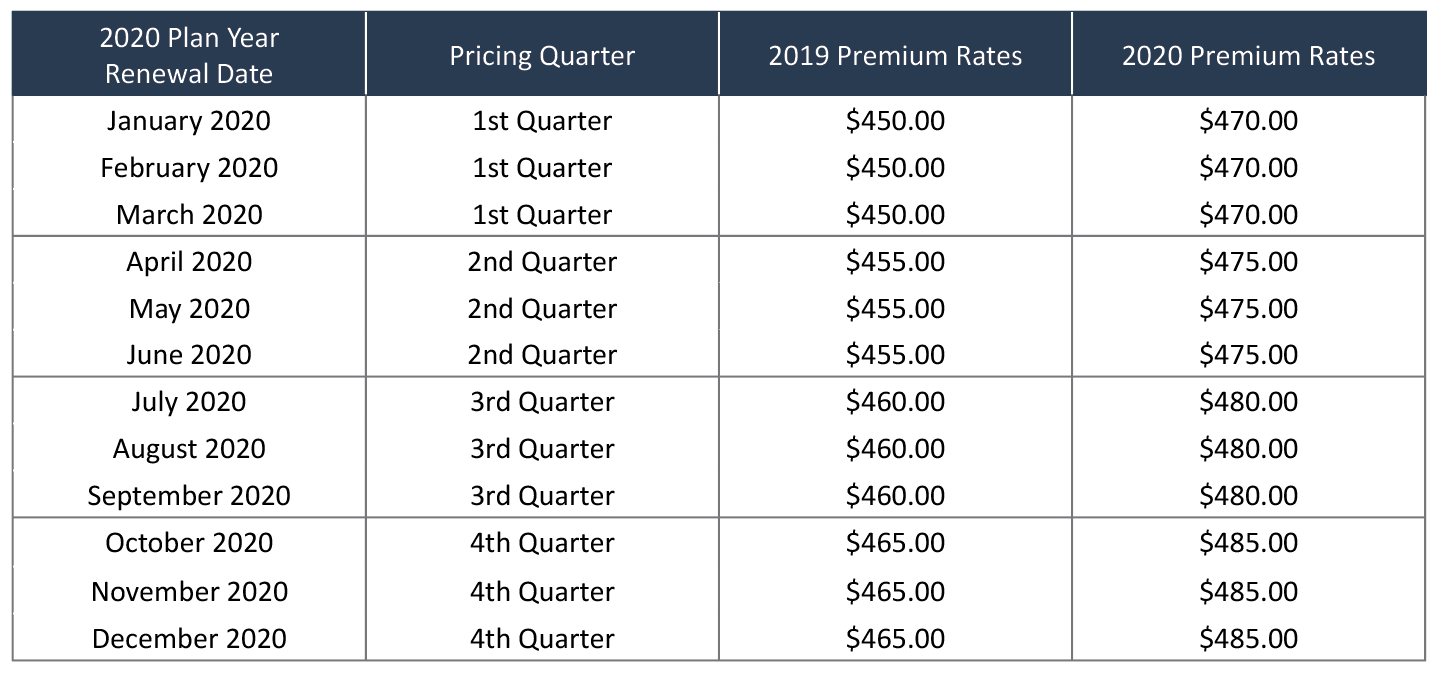

The second thing to keep in mind is that 2019 and 2020 premium rates offered to members by health insurers will vary by each specific member’s plan year renewal date. Regulators typically allow health insurers to change their premium rates on a quarterly basis. This is because premium rates are commonly locked in for a coverage period of twelve months and the cost of health care is continuously increasing. Therefore, premium rates are set to cover the expected cost of health care over the coverage period. The table below shows an illustration of how the 2019 and 2020 premium rates for a specific health product and plan would vary by a member’s 2020 plan year renewal date.

In this illustrative example, a hypothetical insurer will charge a member that begins their 2020 plan year in March 2020 premium rates of $450 PMPM in January and February 2020, and $470 PMPM in March through December 2020. However, if the member’s 2020 plan year begins in July 2020, the insurer will charge them premium rates of $460 PMPM in January through June 2020, and premium rates of $480 PMPM in July through December 2020.

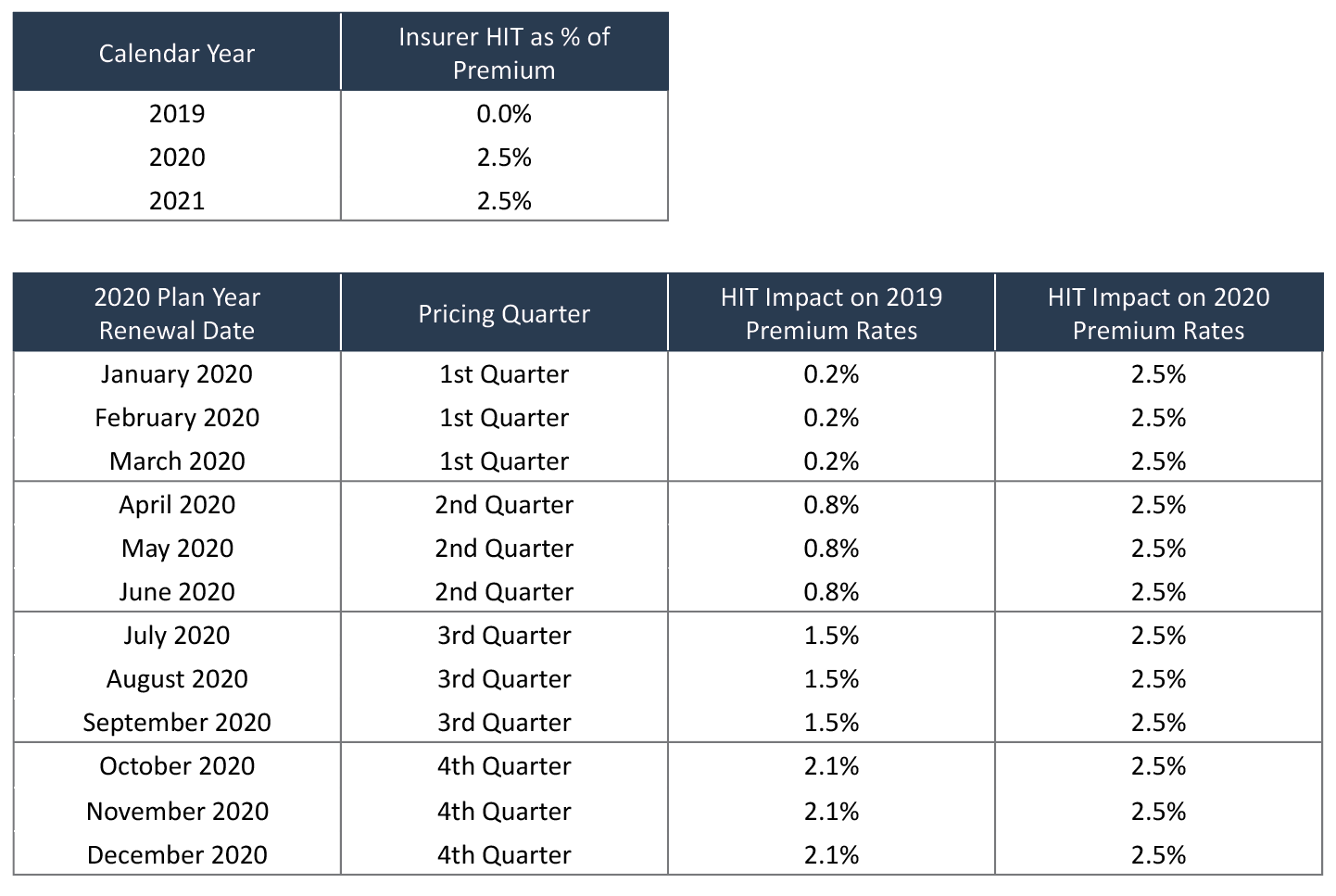

The third thing to keep in mind about the premiums a member will pay in 2020 is that the 2019 and 2020 premium rates include a charge for the HIT that varies by year and pricing quarter. The federal government varies the HIT by calendar year and, as shown above, health insurers typically vary premium rates by plan year and pricing quarter. In calendar year 2019, there was a HIT moratorium. Because the HIT moratorium ended in 2020, the originally filed 2020 premium rates assumed that the HIT would exist in both 2020 and 2021. The tables below illustrate the impact of the HIT on the 2019 and 2020 premium rates.

Please note that the first table provides illustrative HIT percent of premium loads for a hypothetical health insurer. The HIT as a percent of the premium is a function of the total amount of the HIT tax, the health insurer’s nationwide market share, and the size of the health insurer’s premium rates. The HIT percent of premium loads in the second table above reflect weights assigned to each calendar year HIT percent of premium load and the number of months of the calendar year HIT loads apply to the 2019 and 2020 premium rates. The calendar year 2021 HIT percent of the premium load in the tables above does not reflect the HIT repeal in 2021.

The HIT Repeal in 2021 and 2020 Shared Savings MLR Targets

The repeal of the HIT in 2021 will cause most health insurers to revise their 2020 premium rates for the 2nd, 3rd, and 4thquarters. Due to the timing of the passage of HR 1865, it may be too late for insurers to revise their 2020 premium rates for 1stquarter pricing since members with renewal dates in January through March 2020 have already agreed to their 2020 premium rates which assume that the HIT was not repealed in 2021. Since 2020 loss ratios are a function of the premium paid in calendar year 2020, it will be necessary for insurers to properly adjust any shared savings loss ratio financial targets to appropriately reflect the revised 2020 premium rates. The risk to provider organizations is that their health insurer partners revise their 2020 premium rates to reflect the 2021 HIT repeal, but do not appropriately revise the loss ratio financial targets that apply to the provider organizations’ shared savings arrangements in 2020. Since removing the HIT percent of premium load causes actual loss ratios to increase all other things being equal, a provider organization being measured against a loss ratio target that does not correctly account for lower premium rates due to the 2021 HIT repeal could have its financial performance measured against an inappropriately low loss ratio target. The table below shows an illustration of this issue.

Please note the following about this illustrative example:

- The table shows the calculation of a provider organization’s shared savings for calendar year 2020 under three scenarios: 1) without the HIT repeal in 2021, 2) with the HIT repeal in 2021 using a loss ratio target that is not appropriately adjusted for the HIT repeal, and 3) with the HIT repeal in 2021 using a loss ratio target that is appropriately adjusted for the HIT repeal.

- Because the calendar year 2020 premium decreases with the 2021 HIT repeal, both of the “With HIT Repeal” scenarios reflect the same actual premium, regardless of whether the Target MLR is adjusted appropriately.

- The “With HIT Repeal Incorrect Target” scenario uses the loss ratio target calculated assuming the HIT would be in effect in 2021. As a result, the Target Incurred Claims PMPM (which is the metric that the provider organization’s financial performance is truly measured against) is set artificially low.

- In all three scenarios, the provider organization’s actual performance is identical (i.e., Actual Incurred Claims PMPM of $403.00)

- The “With HIT Repeal Correct Target” scenario uses a loss ratio financial target that appropriately reflects the HIT repeal in 2021 and therefore produces the same total shared savings for the provider organization as the “Without HIT Repeal in 2021” scenario.

- The “With HIT Repeal Incorrect Target” scenario produces total shared savings for the provider organization that are slightly less than 50% of the true savings that the provider organization should earn.

How To Avoid The Risk of an Incorrect Loss Ratio Target

Provider organizations that have shared savings arrangements with health insurers that use loss ratio financial targets to measure performance in 2020, should use the following steps to eliminate the risk associated with the HIT repeal in 2021:

- Determine whether or not your health insurance partner intends to revise their 2020 premium rates to reflect the 2021 HIT repeal.

- Ask for details about the impact of the HIT on premiums charged in 2020 with and without the 2021 HIT repeal.

- Also, ask for a detailed derivation of the loss ratio financial target with and without the HIT repeal in 2021. The derivation should include the following elements:

- Percent of expected member months by renewal month

- Expected 2019 and 2020 average premium rates with and without the HIT repeal

- 2019 and 2020 HIT percent of premium loads with and without the HIT repeal

- Also, have the insurer provide a reconciliation of actual 2020 shared savings results with and without the 2021 HIT repeal. Be sure to check that the reconciliation is consistent with the loss ratio financial target derivation and that the results are identical under both scenarios.

It is important to keep in mind that the calculations involved in developing a loss ratio financial target can be convoluted and become even more so with the HIT repeal in 2021. Furthermore, depending on the size of the population covered by the shared savings arrangement, an error in determining the correct loss ratio target could cost a provider organization hundreds of thousands or millions of dollars. Therefore, it is necessary that the provider organization and its health insurer partner get the financial target right.

About the Author

Guest Post – Joe Slater, FSA, MAAA

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.