Introduction

This is the second[1] in a three-part series discussing the impact of the Inflation Reduction Act (IRA; H.R. 5376)[2]provisions. Here we’ll look deeper into the changes coming to Medicare Part D, specifically the benefit design changes and how they affect liability sharing amongst the four stakeholders – Patient, Plan, Manufacturer, and Centers for Medicare and Medicaid (CMS). The next post will explore more of the implications along with the Medicare Prescription Payment Plan (aka ‘out-of-pocket smoothing’).

Medicare Part D Benefit Design – An Overview

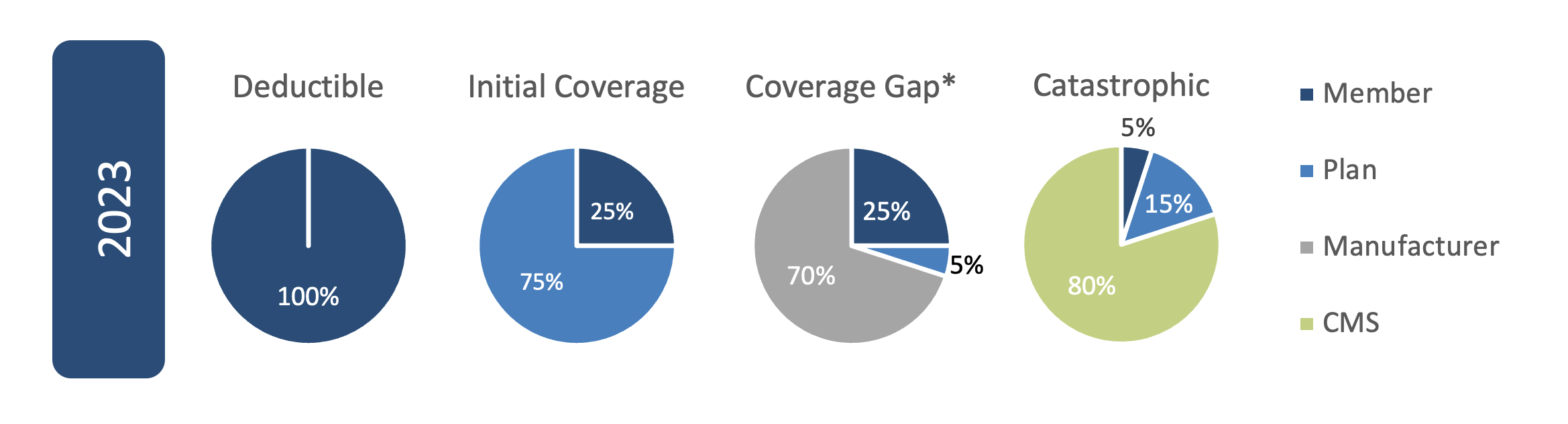

Part D went into effect on January 1, 2006, and the benefit design provisions have continued to evolve since then. For 2024 and recent years, there are four benefit phases based on total claim cost and the amount each stakeholder is liable for changes within each phase. Here is what the percentage share breakdown looked like for 2023, the most recent full calendar year of experience:

Deductible amounts have also continued to grow over time. In 2006 the deductible was $250, by 2010 it crested three hundred landing at $310[3] and for 2023 it broke five hundred at $505.[4]

Medicare Part D Benefit Design – IRA Changes

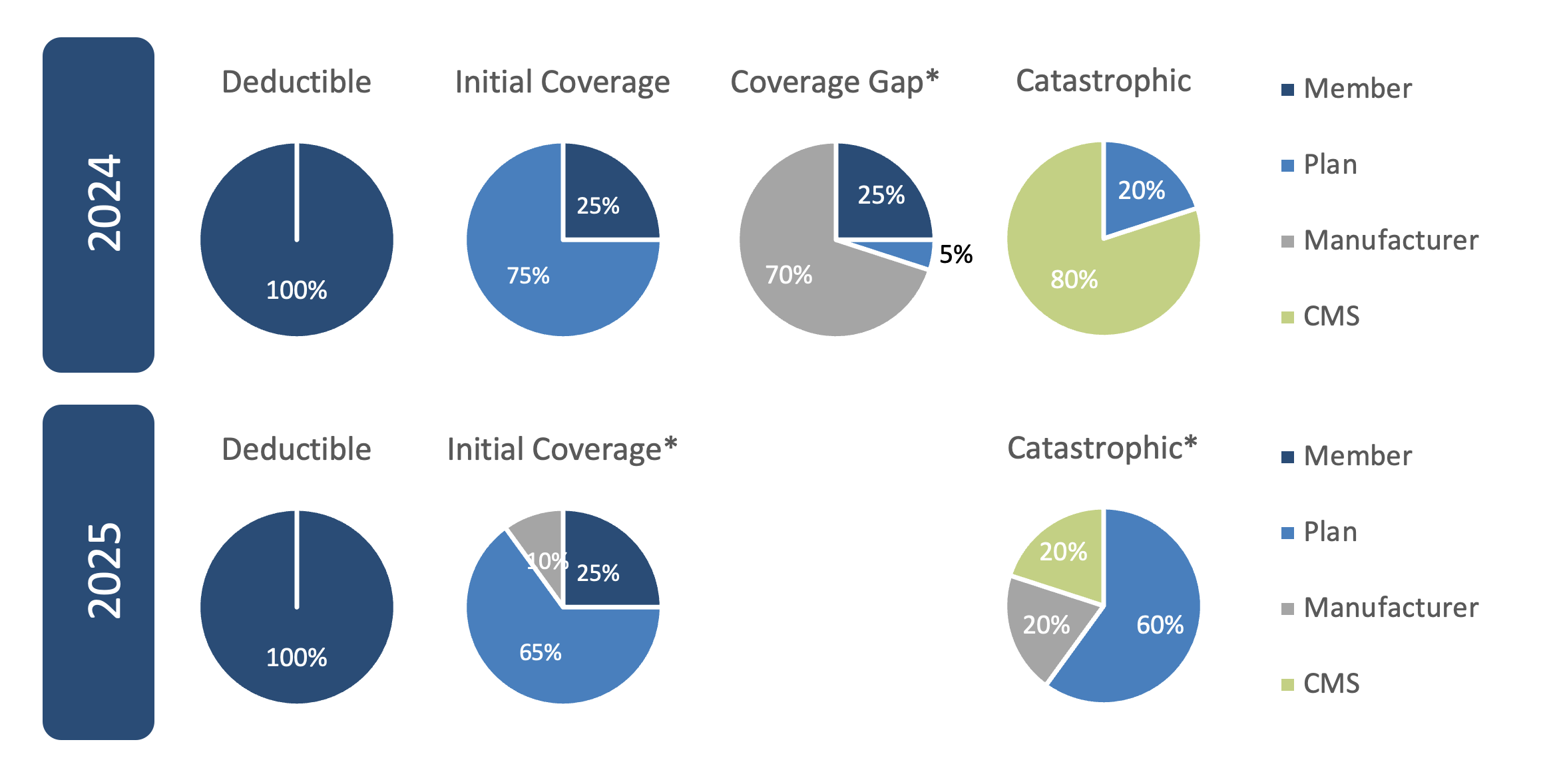

There are significant changes to the Part D benefit design provisions per the IRA beginning in 2024, but mostly coming in 2025:

- Member catastrophic share of 5% is being eliminated in 2024 (total member spend is dependent on brand/generic mix but expected to be in the $3,500 to $4,500 range); that 5% liability is picked up by the Plan increasing its liability to 20%

- Creation of a $2,000 annual out-of-pocket (OOP) maximum for patients effective in 2025

- Removal of the Coverage Gap Phase in 2025

- Changes to the share percentages for the Plan, Manufacturer, and CMS effective in 2025

- Initial Phase

- Plan’s liability decreases from 75% to 65% (75% still on generics)

- Manufacturer picks up 10% of liability for brand drugs (0% for generics)

- Catastrophic Phase

- The plan’s liability increases considerably from 20% to 60%

- Manufacturers pick up 20% of liability for brand drugs (0% for generics)

- CMS picks up the remaining 20% of liability (or 40% of liability for generics)

- Initial Phase

*These charts show brand drug breakdown; for generics, manufacturers have 0% liability & the plan picks up the remainder

As stated, the two differences between 2023 and 2024 are 1) the removal of the patient’s 5% share in the catastrophic phase and 2) the deductible increases from $505 to $545. The catastrophic phase is defined as any claims where the patient and manufacturer spend more than $7,700 in 2023 and $8,000 in 2024 (note that total claim cost will depend on the brand and generic utilization mix).

For 2025, the deductible decreases slightly to $540, the Coverage Gap is eliminated, and the Catastrophic Phase begins much sooner. Once the member hits their $2,000 annual OOP maximum, the Catastrophic Phase begins. The Initial Coverage Limit (ICL) is implied to be $6,380 given the $540 deductible and the 25% member share in the Initial Phase. While the ICL is higher than prior years, it is more appropriately compared to the total spend through the Coverage Gap phase which is ~$11,700 in 2024 just for brand drugs, but when including generic utilization as well it would increase to over $20,000.

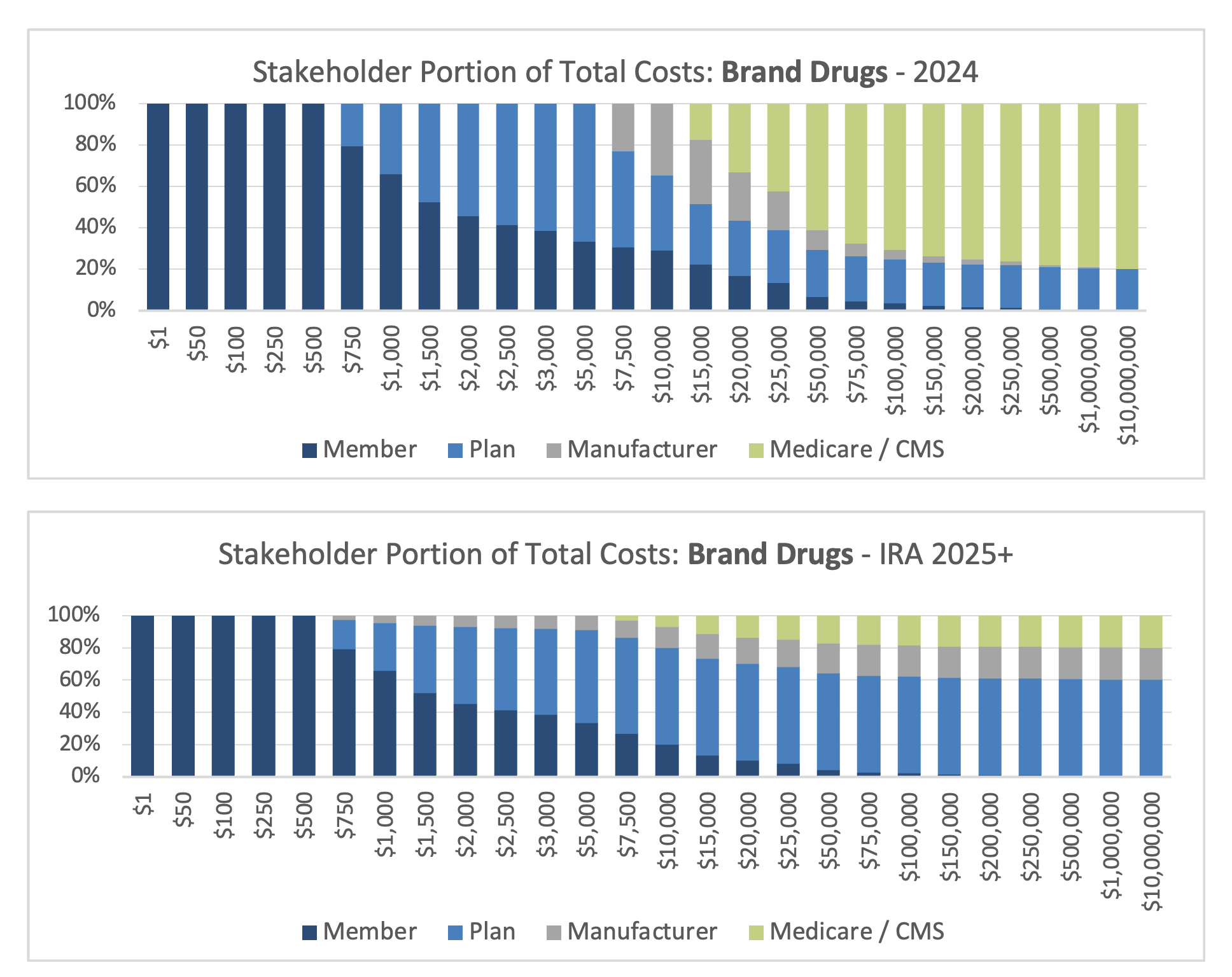

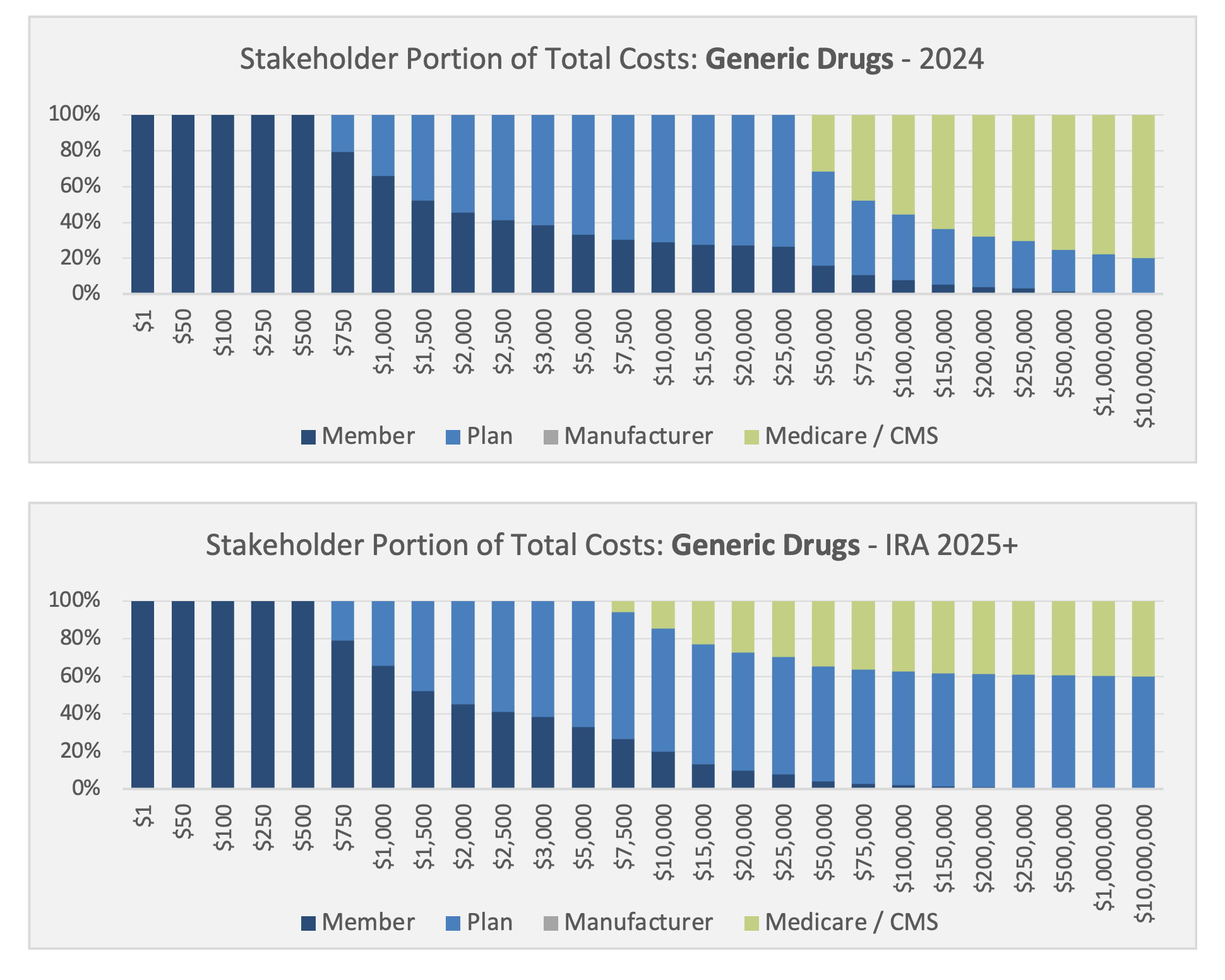

Here is a visualization of what the liability sharing looks like across the four stakeholders by total spend for both brand drugs and generic drugs shown separately:

Evaluating expected impacts is critically important for every stakeholder. Members are obviously benefiting from their reduced costs and fixed annual OOP limits. Payer liability is certainly increasing though not as sharply for generics. Manufacturers and CMS have more dynamic impacts as brand/generic drug mix and aggregate spend by member are key drivers of the ultimate impact on Manufacturers and CMS.

Questions to Consider

- What new or intensified utilization management and formulary strategies will Payers and their PBMs implement to mitigate Plan liability increases?

- How will those strategies impact drug mix and spend?

- How does this influence rebate negotiations between Payers, their PBMs, and Manufacturers as these stakeholders react?

- Will we see increased utilization from members given their OOP costs are now capped?

- How precisely can the new liability shares be quantified for each Plan and each Manufacturer as they negotiate with each other, set their budgets and business strategies, and then execute to achieve them?

Conclusion

Axene Health Partners is ready to assist plans, PBMs, pharmaceutical manufacturers, PBMs, and other health system stakeholders as they analyze the implications of the many provisions within the Inflation Reduction Act and navigate to achieve their organizational goals.

Endnotes

[1] https://axenehp.com/drug-price-negotiation-program/

[2] https://www.congress.gov/117/plaws/publ169/PLAW-117publ169.pdf

[3] https://files.kff.org/attachment/fact-sheet-the-medicare-part-d-prescription-drug-benefit

About the Author

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.