As I sit at my desk looking out the window at the rain covered streets, barely a person in sight and cars randomly scattered on the curb, it is hard not to think, “should we have seen this coming?” The reality is that we could not have seen it coming, but we should have been preparing for it to come. Companies regularly hold reserves for many different situations and events, but it may be surprising how few hold explicit reserves for extraordinary events like pandemics. Traditional IBNR claim liabilities attempt to account for unexpected claim activity, but even with an appropriate provision for adverse deviation those liabilities would not be able to cover the costs associated with a pandemic.

In 2009 far before the current COVID-19 pandemic, setting up pandemic reserves was a conversation we were having with many of our clients. Some looked at us like we were crazy, while others acted on the idea and started to set aside additional reserves for pandemics, natural disasters and similar events.

Some looked at us like we were crazy, while others acted on the idea and started to set aside additional reserves for pandemics, natural disasters and similar events.

When setting up a pandemic reserve several risks should be considered:

- Unexpected or unusual healthcare utilization and related costs

- Unexpected Costs (example: new tests, telemedicine, staffing)

- Supply / Equipment Shortages

- Higher than expected mental health costs during and post pandemic

- Operational risks associated with maintaining adequate staffing

- Economic challenges on the local, national and international economies (i.e., potential for recession, stock market performance, interest rates, etc.)

The actual impact of a pandemic is hard to totally understand, but for this article, we will do some simplified scenario testing to show some projected impacts. For our testing let’s assume a commercial population of about 50,000 members with average medical costs around $412 PMPM. That would equate to a total annual claim expense of about $250 million. If we were to assume an 85% loss ratio (claims/premium) this would equate to about $294 million in premium. Assuming 12% of admin costs, that would leave 3% of potential profit/risk margin for the health plan or about $8.8 million.

It is too complex to model out the complete financial impact for this article, so I have concentrated on the impact on the claim payments. There will surely be increased costs associated with delivering the care and operational complexities, but those are not included in the cost analysis below.

Pandemic Scenarios

- Minor impact– 2% overall unexpected increase in health costs with no more than a 12-month duration

- $5 million in extra Claims expense (2% * $250M)

- Moderate impact– 5% overall unexpected increase in health costs with no more than 12-month duration

- $12.5 million in extra Claims expense (5% * $250M)

- Significant impact– 10% overall unexpected increase in health costs with no more than 12-month duration

- $25 million in extra Claims expense (10% * $250M)

When comparing the profit/risk margin for the impact of the pandemic scenarios above it quickly becomes apparent that in most cases the margin is not enough to account for the pandemic costs. In the minor impact scenario, the profit margin is enough to cover the additional claim costs, but in the other two scenarios, it is inadequate to cover the increased claims cost.

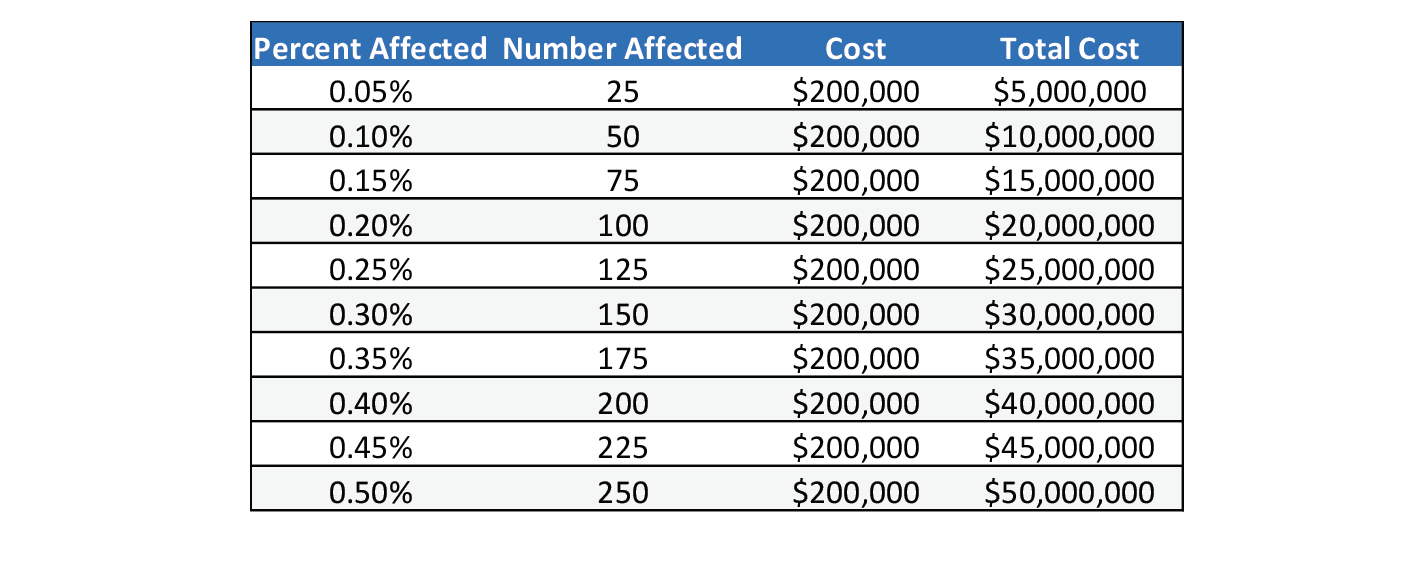

The scenarios above may show a more favorable picture than should be expected. The table below shows what the potential cost to the health plan would be by the percentage of the population that might incur an extended hospitalization and/or ICU stay. For this projection, we are assuming an extended hospitalization that may include ICU would average a cost of about $200,000. When 0.05% of the 50,000 members (25) people fall into this category, the cost on average could be $5 million. If the plan experiences 0.25% of their population (125) requiring this care that would be an expected total cost of $25 million. When comparing the cost below to the scenarios above, it is not hard to believe that the significant impact scenario could become a reality. It would only take 0.25% of the population to get hospitalized for the cost to reach the significant level.

Table-1 Inpatient Projected Cost by # Affected

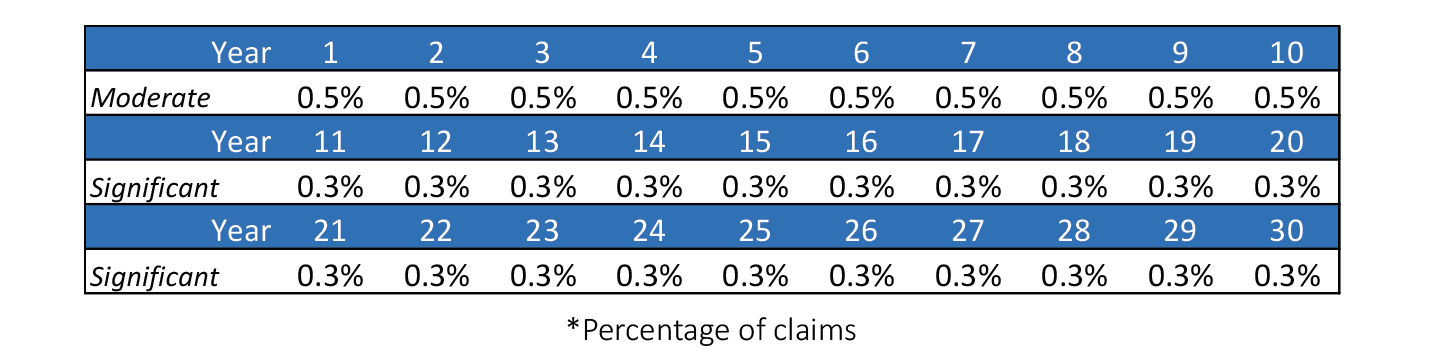

The table above shows between $5 and $50 million of additional costs that may be incurred through pandemic related hospitalizations. Reserving for pandemics would most often be something that would need to be done over time. We recommend funding a pandemic reserve over a long period of time (10 plus years) and monitor its adequacy on a regular basis. I would suggest a minimum reserve of no less than the moderate scenario (5% of claim cost) and work to raise it to the significant level over the following 20 years. (10% of claims). When following this schedule, the plan would want to set aside an additional $1.25 million a year for the first ten years, and then over the following 20 years $0.625 million a year. These estimates were assuming no inflation or growth in membership.

It may be better to look at the building of this reserve by setting aside a percentage of claims because that would help account for growth in claims and also members. If the goal was to get to the moderate level in 10 years and to the significant level over a 30-year period, a company would need to follow the table below.

Table-2 Funding by Percentage of Claims

Pandemics are rare and funding can be done over time. Due to regulatory rules not all the funding of this reserve will be available through the pricing of the products. We suggest the pandemic reserve is funded from years of better than expected experience and from other sources such as allocating overstatements in IBNR reserves, excess returns on investments, or other unexpected payments.

When considering pandemic reserves the most important thing is to start. It will take time to build up the reserve, but until you start you will not have anything set aside. There are other regulatory requirements such as RBC than can help offset some of the burden, but those should be looked at separately as they are most concerned about solvency under moderately adverse situations, not the extreme events that created by a pandemic.

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.