Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

Introduction

I read the 725-page draft of the Deficit Reduction Act[1] so you don’t have to. Well, I skimmed 427 pages of it while focusing on the 164 pages which make significant changes to prescription drugs. This article outlines the main provisions of the law and discusses the potential impacts each provision may have.

Drug Price Negotiation Program

The bill sets up a “Drug Price Negotiation Program” under the Secretary of HHS. The program would identify a list of single source drugs which HHS would negotiate favorable pricing terms for with these drug manufacturers. Beginning in 2026, the list would contain 10 drugs per year, then increase to 15 drugs in 2027, and then to 20 drugs in 2029. A drug would be considered “negotiation-eligible” if it is among the 50 single-source drugs with the highest total expenditures under either Medicare Part D or Medicare Part B (considered separately). HHS would select the list of drugs to negotiate from among the list of negotiation-eligible drugs. The bill targets “single source” drugs and specifies that this may apply to both brand and generic/biosimilar products.

Several provisions exclude drugs from the negotiation-eligible list. A “small biotech” provision excludes drugs whose expenditures are less than 1% of total expenditures and which make up >80% of a manufacturer’s total revenue. Similarly, drug products would be excluded from negotiation for the first 7 years following initial FDA approval, and biologics would be excluded for 11 years following initial licensure. The negotiated pricing agreements would not take effect until 2 years following each of those dates. The bill also excludes orphan drugs and products derived from human whole blood or plasma. Finally, biologic products for which a biosimilar is expected to enter the market within 2 years or has already entered the market would be excluded from negotiation, provided the biosimilar manufacturer is not the manufacturer of the reference product.

The bill states that HHS’ goal during negotiations with manufacturers is “to achieve the lowest price possible”, though it does not specify particular discounts that must be achieved. HHS is not allowed to agree to a negotiated rate that is higher than the lowest of the following three prices: the ASP-based reimbursement in place for Part B drugs for the previous year, the enrollment-weighted average price paid by MA-PDP plans net of all price concessions received by the plan or pharmacy benefit managers on behalf of the plan for the previous year for drugs not paid for through Part B, or the average manufacturer price for the drug indexed from 2021 by the consumer price index (for urban consumers, for all items).

HHS is directed to consider the following information when negotiating with manufacturers, and manufacturers are also required to confidentially disclose the information to HHS: research and development costs for the drug and the extent to which the manufacturer has recouped these costs, the unit cost of production and distribution, existing patents and exclusivity arrangements, national sales, information on clinical trials, and the extent to which the drug represents a therapeutic advance over existing alternatives. The bill also directs HHS that in considering the prolongation of life it should not consider extending the life of an elderly, disabled, or terminally ill individual to be of lower value than extending the life of an individual who is younger, nondisabled, or not terminally ill. CMS is directed to publish its negotiated prices and an explanation of how they arrived at that price concerning these factors.

Manufacturers of drugs selected by HHS for negotiation who do not enter into a pricing agreement will be subject to significant excise taxes which the bill singles out as being ineligible for deduction from the company’s income taxes. The bill outlines an “applicable percentage” which is equal to the share of the post-tax sale price attributable to the excise tax. The applicable percentage is initially 65% and increases by 10% for every 90 days of non-compliance up to 95%. This corresponds to tax rates of 185.71%, 300%, 566.67%, and 1,900%. For example, if a drug costs $10 pre-tax, in the first 90 days of non-compliance it would be subject to a 65% applicable percentage, or 185.71% tax rate. The drug would cost $28.57, of which $18.57 is attributable to the excise tax.

Inflation Rebate

The bill requires manufacturers of Part B and D single-source drugs to provide a rebate to HHS in the amount of the difference between the price charged for a drug (ASP for Part B, AMP for Part D) and the price of the drug in the previous year indexed by the consumer price index (for urban consumers, for all items). This would limit the price increases manufacturers could enact to the broader rate of consumer inflation. Inflation rebates paid under the bill would not be considered in the calculation of the ASP or AMP, so the rebates paid by manufacturers will index to the initial launch price of the drug.

Member coinsurance would be limited to 20% of the inflation-adjusted payment, so while the rebates would be paid to CMS retrospectively, members would receive cost savings at the time of purchase in an arrangement like historical point-of-sale rebate proposals.

Part D Benefit Changes

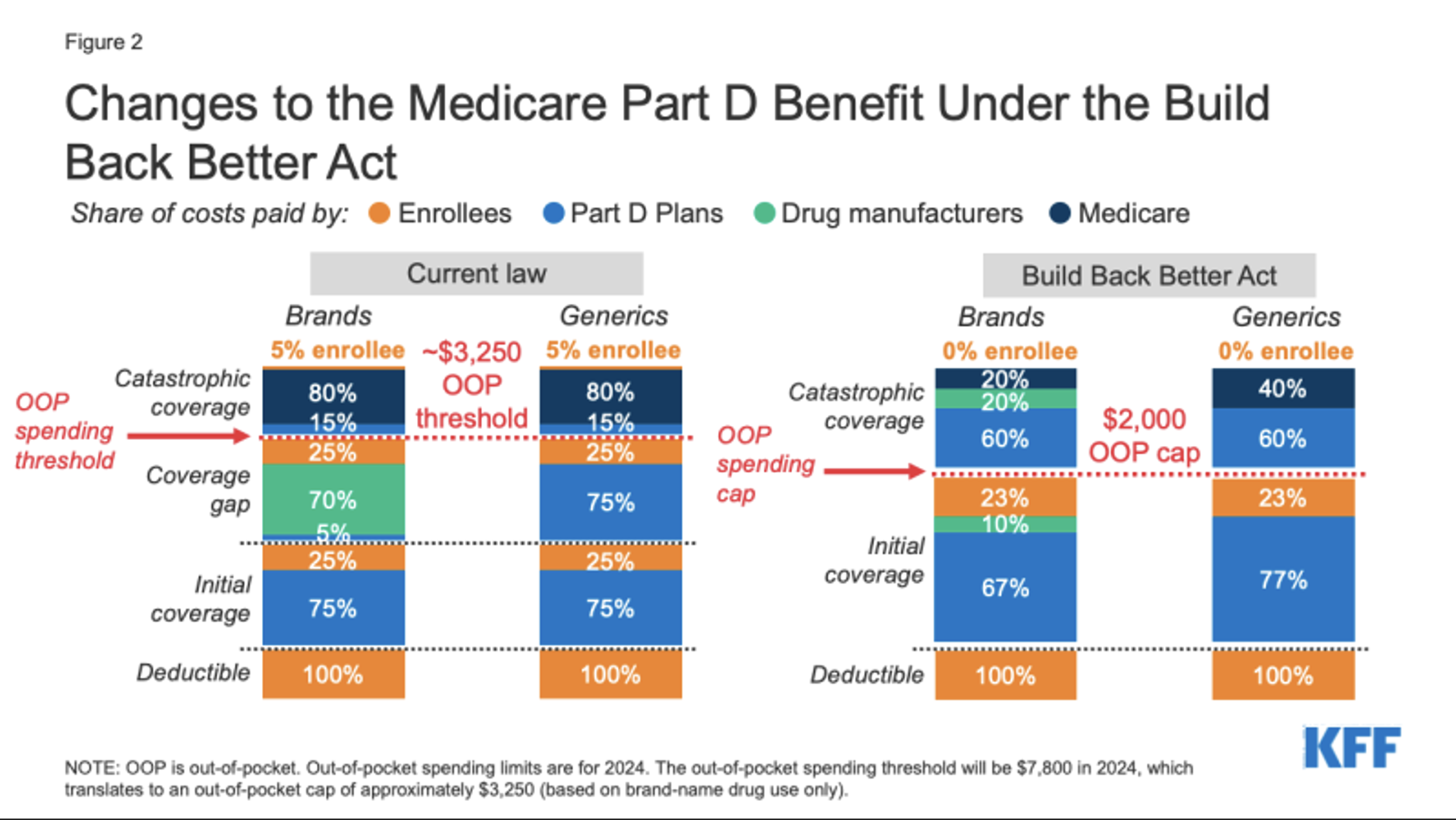

The third and final major section of the Prescription Drug Pricing Reform portion of the bill makes several changes to the Part D benefit. These changes were also contained in the proposed Build Back Better Act, which is illustrated below. The most significant change is a restructuring of the complex cost-sharing arrangement which apportions the cost of drugs provided under Part D among member cost sharing, plan responsibility, Federal government reinsurance, and manufacturer reinsurance.

Under the current plan design, Part D plans pay a minority of total costs for members in the coverage gap and catastrophic coverage phases. The cost-sharing is based on total drug costs before rebates. This can contribute to a unique incentive for Part D plans to prefer higher-cost drugs which offer large rebates because the current benefit design may sometimes even create a net financial gain for the plan on a per prescription basis. This can distort both manufacturer pricing and formulary plan design decisions. The proposed benefit design would reduce this incentive though it will not be eliminated.

Another major change to the proposed benefit design is to place a $2,000 annual out-of-pocket cap on member expenditures. Under the current benefit design, Medicare beneficiaries are responsible for 5% of costs even after hitting a $3,250 out-of-pocket threshold. Manufacturers would be responsible for 20% of costs after a member has met their out-of-pocket cap, whereas today a manufacturer’s reinsurance responsibility only applies before the out-of-pocket threshold is met.

Finally, beneficiaries will have the option to satisfy the out-of-pocket cap through level monthly payments spread throughout the year, as opposed to paying much higher cost-sharing while in the deductible and initial coverage phases at the beginning of a plan year, and then relatively less cost-sharing later in the year while in the coverage gap and catastrophic coverage phases.

Other Miscellaneous Changes

The bill would reimburse providers for Part-B dispensed biosimilars at 108% of ASP for the next 5 years, which is 2% more than the standard 106% of ASP that is applied to all other drugs. This could create an additional incentive for providers to prescribe biosimilars. 340(b)-eligible providers are already reimbursed for biosimilars at the cost of the reference product, which creates a significant financial incentive for 340(b)-eligible providers to prescribe less expensive biosimilars yet receive reimbursement for the more expensive reference product.

Cost sharing for vaccines reimbursed through Part D will be provided at $0 cost-sharing under the bill.

Potential Impacts

The Congressional Budget Office estimates[2] that the drug pricing provisions will reduce Part D expenditures by $29.5B over the next 5 years and $288B over the next decade by reducing Part D spending significantly and increasing Part D rebates. These are savings that will flow to members in the form of reduced cost-sharing and lower premiums.

However, some are concerned that the bill may cause manufacturers to increase the launch price of drugs to counteract decreases in price driven by negotiation as the maximum price HHS could agree to is indexed to the launch price of the drug. The exception of drugs for the first 9 years after commercial launch and biologics for 13 may also distort pricing dynamics as manufacturers seek to maximize revenue during that initial period.

Similarly, some have concerns that having the Federal government negotiate drug prices may replicate a dynamic in the drug market that is prominent in non-pharmacy-related medical spend, where commercial plans pay significantly higher rates than government-sponsored plans, potentially subsidizing inadequate rates paid to providers by the government-sponsored plans.

Finally, in an analysis[3] of Build Back Better, which had similar though more aggressive pricing provisions than the Inflation Reduction Act, the CBO estimated that an average of 8 to 15 fewer drugs would come to market over the next decade (a reduction of 2.5% – 5.0% from the average 30 drugs the FDA is currently approving annually). A reduction in drugs coming to market may limit therapeutic options for members and result in fewer innovations and slower enhancements to the quality of care.

Conclusion

Axene Health Partners is available to help payers, pharmacy manufacturers, PBMs, and other health system participants navigate the changes that the passage of the Inflation Reduction Act will bring.

Endnotes

[1] https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_of_2022.pdf

[2] https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_one_page_summary.pdf