Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

Shared savings arrangements have increased in popularity as healthcare shifts towards value-based care. In its most basic form, the total healthcare costs of members associated (i.e., or those attributed) with a provider group (hereafter referred to as “group”) are compared against a benchmark. If costs are lower than the benchmark, the payor reimburses a portion of the savings to the group. If the sharing arrangement is two-way, groups are liable for a percentage of the loss when they are unable to keep costs below the target. Contracts can be extremely detailed and individualized to the group and payor. However, gaining familiarity with the dynamics and considerations for common features will be worthwhile for groups considering assuming more risk from payors.

Sharing Percentage

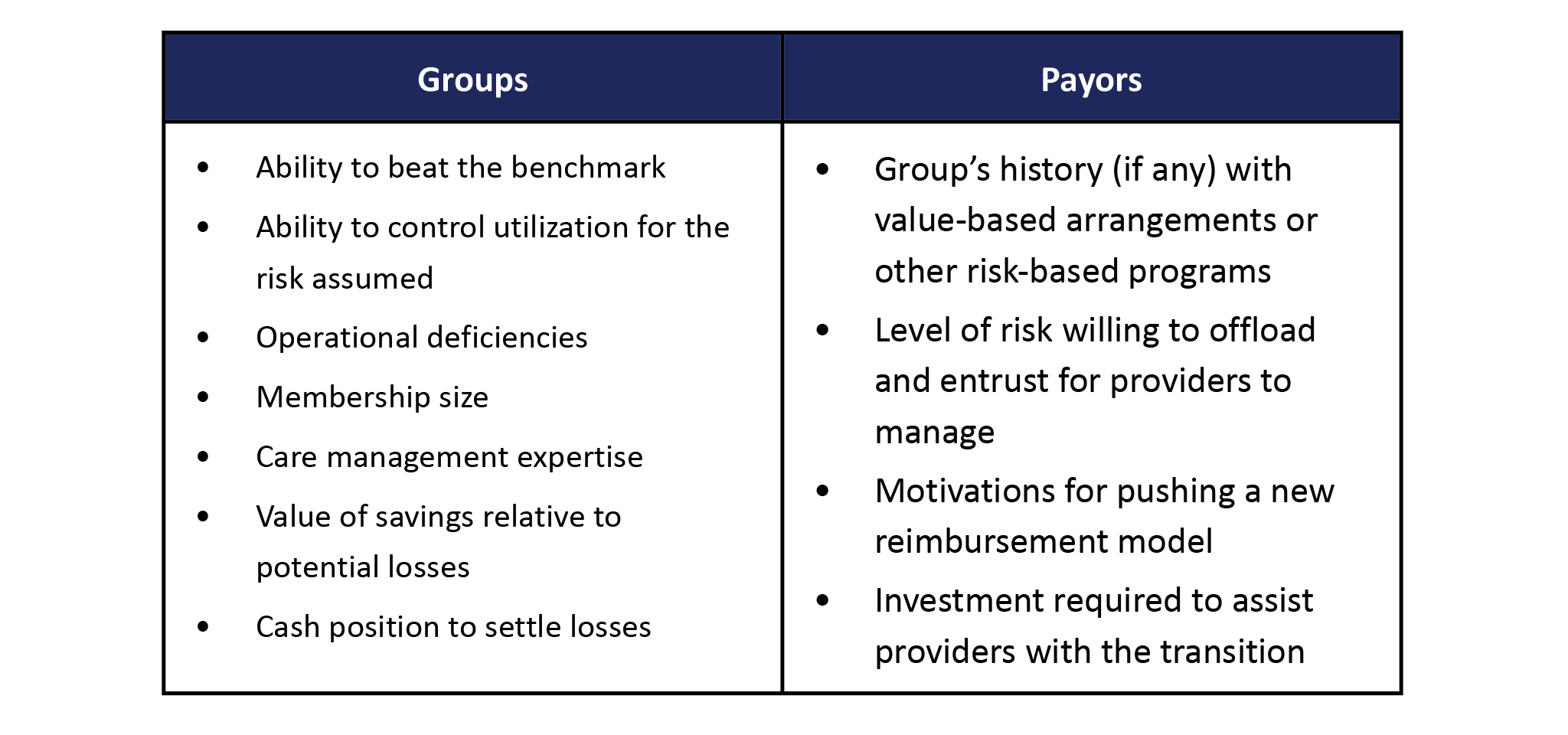

Any group or payor entering a sharing arrangement must first assess the degree of risk they want to share (i.e., the percentage of savings/loss to be shared). Table 1 lists a mere handful of considerations for payors and groups when negotiating the sharing percentage. Alternative arrangements include upside-only or asymmetric savings and loss percentages, which payors might offer to entice groups hesitant to leave the security of fee-for-service.

Table 1: Some Considerations When Setting Shared Savings/Loss Percentage

Alignment Methodology

Payors and groups must agree on a methodology for determining the set of members whose medical costs will be evaluated against the benchmark. Groups will be responsible for managing the cost of care for these members, usually referred to as “attributed” or “aligned” members. Members who elect a PCP with the group are easily attributed, but subsequent alignment methods vary by contract. Typically, the health plan builds a hierarchy to prioritize how members are attributed or aligned to the group. For members who have not selected or are not directly assigned to a PCP, the attribution or alignment will follow a simple algorithm to determine the assignment. Below is one hierarchical approach used to assign members[1]:

- PCP selection or assignment

- The plurality of primary care claims

- Most recent preventive care visit

- Most frequent problem-focused visit

- Most frequent prescription drug prescriber

- Most frequent referring PCP

Benchmark Setting

A group’s gain/loss is calculated by measuring its performance against a benchmark, which is developed by starting with a base amount. Typically expressed as PMPM, this cost of care (CoC) figure is modified into a realistic target reflecting the group’s attributed population. The base PMPM usually reflects the group’s prior year performance but can also incorporate adjustments for geographic or peer averages. Outlier claims are normally excluded from the base PMPM since these are covered by stop-loss and might not reflect the group’s actual capabilities.

Trending the base PMPM from the historical to performance period is one of the most critical and complex adjustments to the base PMPM. The final target is more sensitive to minute trend changes than any other assumption, so it is critical that the input is fair and agreed upon by both parties. Insurers devote entire actuarial teams to developing trend assumptions so it will be difficult for groups to validate trend calculations internally. However, emphasizing data and methodological transparency will offer reassurance and prevent potential disputes.

Since the base PMPM amount reflects the historical population, it’s necessary to account for changes in the risk. A fair benchmark is calibrated higher when average health status deteriorates, and vice versa. Numerous standardized risk adjusters can be used to derive risk scores. Additional risk factor changes might include the network or plan mix.

Many other adjustments can be contractually required, not all of which can be described here. Ultimately, it is critical to not become so engulfed in the quantitative details that the primary goal is forgotten. Fair targets reward high-performing groups for lowering the cost of care relative to a reasonably achievable goal, which accounts for the group’s attributed population and operating environment.

Performance Measurement

Despite the myriad of ways to derive a final savings/loss amount, all ultimately measure the group’s actual healthcare costs against the benchmark. This may be presented by comparing PMPM figures or the group’s actual trend against the benchmark trend (not to be confused with the projected actual trend which doesn’t account for other benchmark adjustments). Many arrangements institute a minimum savings/loss rate (MSR) to account for random fluctuations in medical costs. No payments are made by either party if the savings/loss does not exceed the MSR. This rate should be calculated as a function of attributed membership size since greater fluctuation is expected in smaller groups. Likewise, a maximum sharing amount may be included to cap the gains or losses. Finally, the sharing percentage is applied to the full amount if the savings/loss exceeds the MSR.

Summary reports should be generated throughout the year and include conversion from current performance to projected end-of-year performance. Healthcare costs may be adjusted for seasonality since claims tend to be higher or lower depending on the time of year. Member months will also be projected to end-of-year totals to calculate a projected total payment for the year.

Quality Metrics

Nearly all shared savings arrangements will incorporate a quality component intended to encourage preventive care and member engagement. The methodology varies greatly among payors and typically involves a plethora of metrics. Scores are generally derived by comparing the group’s performance against a regional or national standard. It may also account for data sharing between the group and payor. A convoluted formula yields the group’s final quality score, which influences the final payment to/from the payor. This occurs in two common manners: by directly raising/lowering the sharing percentage or impacting a separately calculated quality bonus. Groups should not underestimate the importance of quality metrics. They are a controllable opportunity to increase returns and an effective way to mitigate losses.

Year-over-Year Changes

Shared savings arrangements usually span multiple years where the target is reset annually. When evaluating a contract, groups might mistakenly believe the terms and targets are favorable based on the initial year. However, after benchmark resetting and other year-over-year changes, targets can easily become unachievable in later years. For example, a group can be punished for good performance if the benchmark-setting process is heavily dependent on last year’s actual costs (including trend and risk adjustments). Additional target modifications are necessary, or the group will eventually encounter losses as it is measured against its best-managed costs. Long-term modeling is critical to understanding multi-year, multi-variable dynamics that are not readily apparent.

Data & Methodological Transparency

For providers, engaging in a new reimbursement arrangement can be daunting when payors have an abundance of data and actuarial expertise on their side. Transparency of data and assumption development is paramount to maintaining the trust and ensuring contractual fairness. However, this can be problematic in some cases such as the trend assumption. Trend figures are usually developed using proprietary or competitor data which will limit transparency. Enlisting independent consultants to review the information can help overcome this confidentiality obstacle. Furthermore, groups are encouraged to build robust internal data processing and reporting capabilities so their claims figures can be reconciled with the payor’s figures. Sometimes, payors will provide upfront investment to aid the transition to a sharing arrangement but that will depend heavily on the group’s negotiating leverage.

Conclusion

Every sharing arrangement is unique and will require individualized expertise to understand whether the terms are favorable to either party. Healthcare is experiencing a dramatic shift towards value-based care and insurers are increasingly shifting risk to providers. Regardless of whether a group is currently engaged in shared savings, becoming educated in the common contract structure and potential pitfalls will prove valuable in future discussions with payors.

Endnotes

[1]If there is a “tie” for providers at one level, the next criterion applies.

About the Author