Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

In many of our recent client situations we encounter a surprising lack of awareness and concern about the importance of care management and how it might directly impact the project we are working on. Whether a concern about product price competitiveness, establishing value based reimbursement systems, eliminating provider operating losses, or selecting providers for ACO programs, it seems that care management has become a forgotten resource. Care management is the core of our consulting services as actuaries and clinicians. Almost every project’s success hinges on the ability of the client to perform or delegate effective care management. Yet care management is the most likely resource not invited to the discussion table. This article will demonstrate why care management must be integrally involved in most activities.

The Three-Legged Stool

We often introduce the discussion with the following graphic. A successful or “happy” outcome is dependent upon three core competencies: reimbursement and provider incentive, appropriate plan design and care management.

Missing any one of these three resources results in an underperforming product, a more expensive and unaffordable product, and/or significant financial losses.

Some recent value based reimbursement projects demonstrate this clearly. Most likely resulting from an outdated silo-like organizational structure, multiple clients have failed to involve the care management staff in the process to develop the company’s new approach to control costs, motivate providers for efficiency and beat their competitors. Without all stakeholders appropriately represented the proposed product is likely doomed. Plan design and an innovative reimbursement and incentive system will not be enough to be successful without effective care management and the integration of these resources into the program.

Why is Care Management So Important?

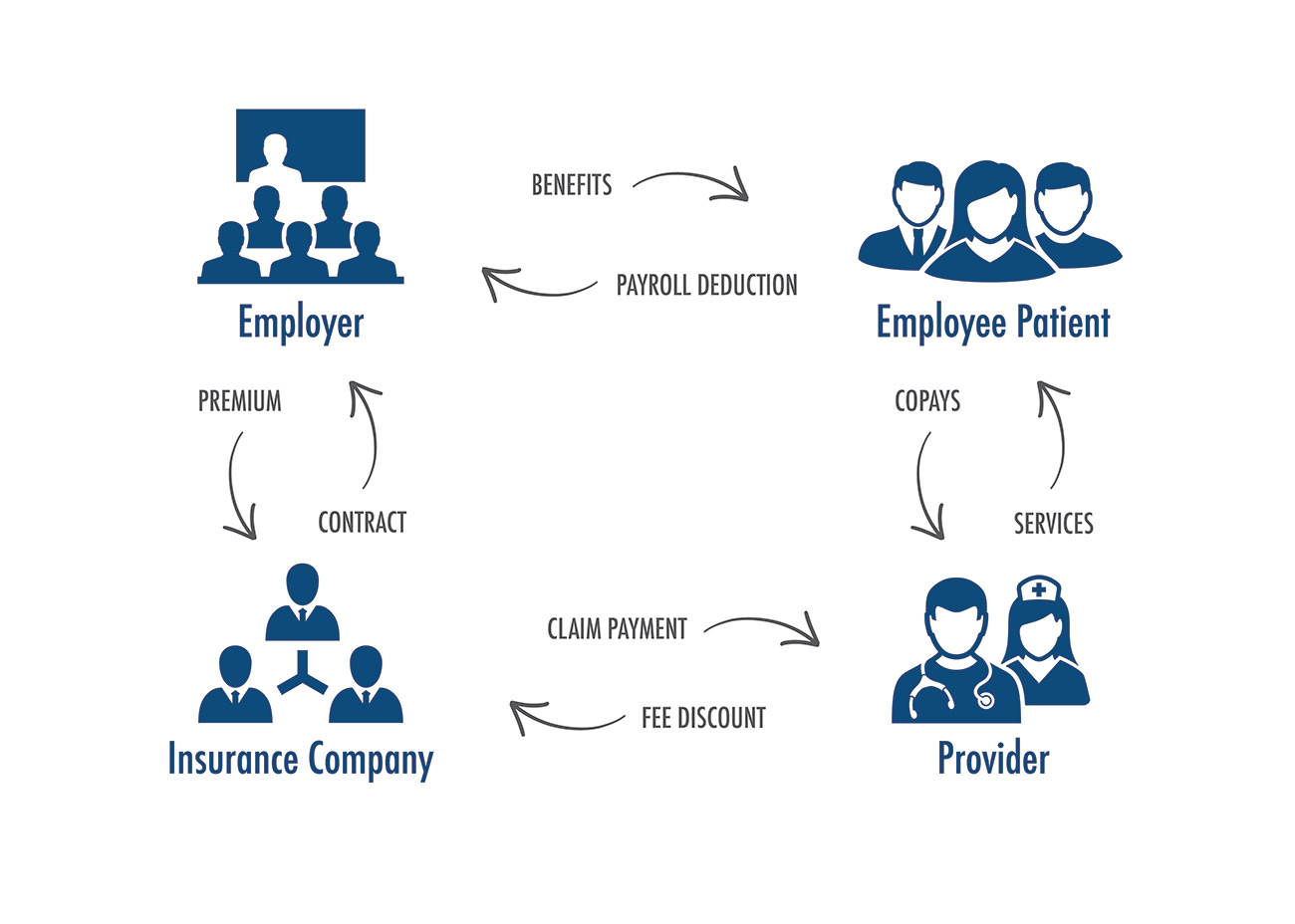

Let us consider a fully insured health insurance plan. Much of today’s health care system operates under the following business model.

The employer provides benefits to the employee and their dependents. There is usually a payroll deduction by the employee to help pay for the benefits. The employer pays the premium to the insurance company and in exchange the insurance company provides a contract to the employer. The insurance company pays claims to the providers and sometimes is able to negotiate a discount with providers. The provider provides services to the patient and collects appropriate copays for services rendered.

Under this model the provider acts independently with their provider/patient relationship. The patient is sheltered from much of the cost of care. The provider recommends services and the patient usually complies. The provider gets paid most of the time and the carrier and the employer are only tangentially involved in the business model and the care decision process. It lacks traditional supply/demand economics. The patient is free to choose expensive care, whether or not it is clinically appropriate, since they are responsible for only a small part of the cost. The only contractual relationship is between the insurance company and the employer.

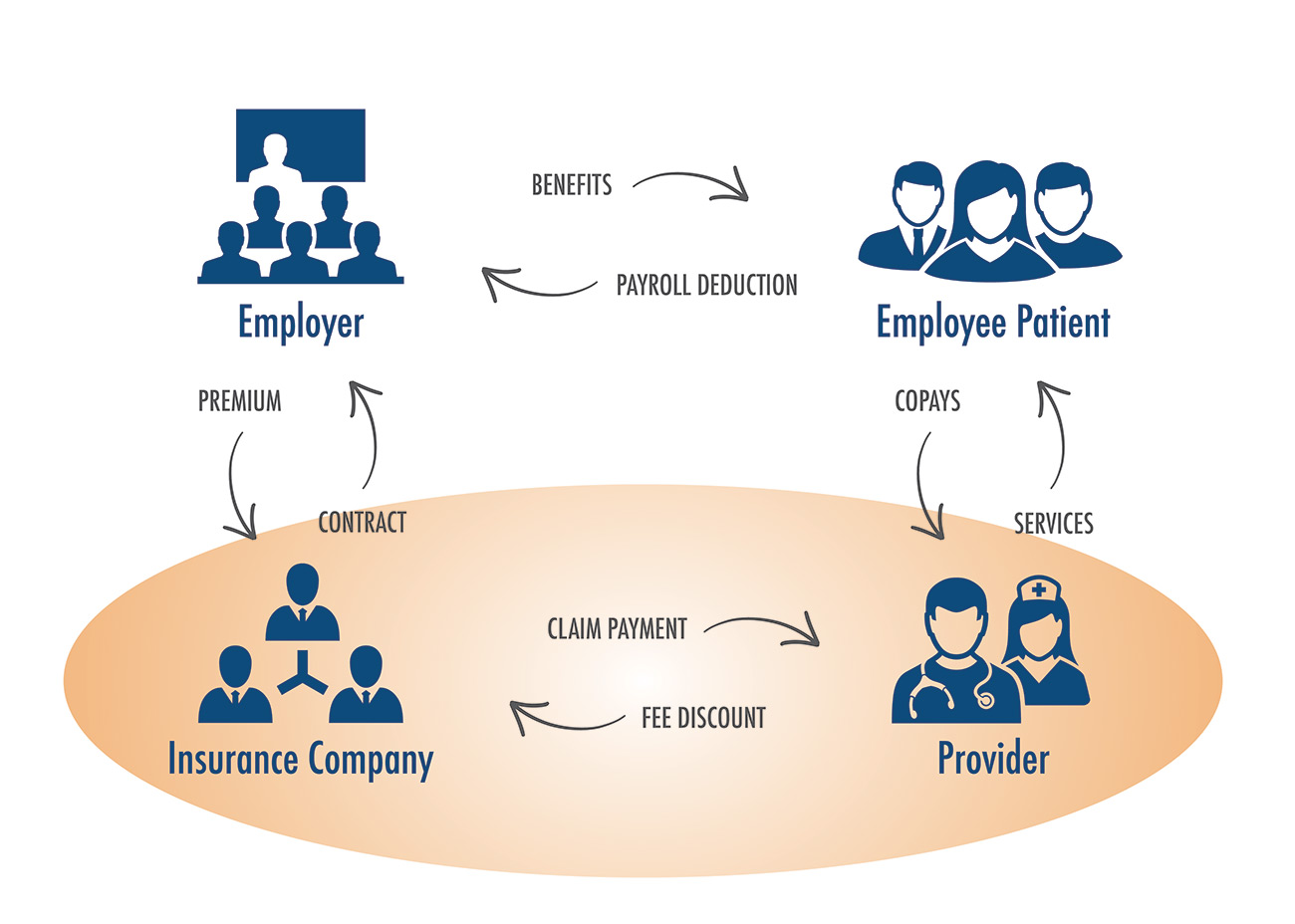

A more appropriate structure is shown below. This involves the linking of the provider and the insurance company in some fashion to be sure incentives are aligned with the primary business entity offering the health benefits and the provider providing those health care services.

The nature of this linkage is simple. It is the ability to integrate care management into the insurance company/provider relationship. We are using the term care management broadly. This includes all innovations which are designed to impact the way care is delivered, minimize potentially avoidable care, select the right provider to provide care at the right time to the right person, etc. Disease management, complex case management, pre-certification, discharge planning, utilization review, and discharge planning are all part of this process. When the provider is working collaboratively with the carrier, with aligned incentives, everyone wins.

The author has referenced the above two diagrams as the “current unstructured health system” and the “desired structured health system”. In late 1970s Paul Elwood called the second chart “managed care”. This was the genesis of managed health care and has morphed into today’s population health management and value based reimbursement.

Care Management EffectivenessTM

The author developed the concept of Care Management Effectiveness or CME. Once a delivery system is assessed, its CME score or CME IndexTM describes how effective the system’s care management process as implemented is. The CME Index ranges from 0% to 100%. A 0% score suggests an ineffective system or a system without any care management. A 100% score describes a system without any potentially avoidable care. Since medicine is not a perfect process and clinical judgement is required a 100% score is not expected. Our broad experience over the past 30 years suggests it is rare to exceed 90% or 95%. Retrospectively with 20/20 hindsight potentially avoidable care can be identified, however prospectively clinical uncertainty requires the provider to anticipate situations that might not exist leading to some avoidable care.

There are two major ways to develop a CME Index, one clinical and one analytical or actuarial. We regularly use both in our consulting practice. The clinical process involves the review of actual patient charts usually based upon a stratified random sample. This can be an inpatient hospital review or an ambulatory physician review. Both are useful tools and lead to believable results in clinical language that the physicians can understand and learn from. The most frequent reaction is “why didn’t I think about that?” The use of a chart review provides concrete information that can be used as a teaching tool for physicians and physician leadership.

The analytical/actuarial approach compares actual results to ideal benchmarks developed from real health care systems. In the case of an inpatient analysis, the actual length of stay by DRG is compared to the ideal length of stay.1 The difference in these values identifies potentially avoidable days. This combined with an appropriate cost or charge per day provides adequate information to project potential savings. We most often complete this analysis on inpatient care and have found that over the years that about 2/3rds of what can be saved in the system is inpatient based. We have also found that in almost all of these projects the clinical results were consistent with these results and matched the opportunity to improve.

So Why is Care Management Forgotten?

For the most part we have found that most organizations fail to recognize the effectiveness of their care management process. They assume that since they do it, what they do must work and there is little to do to improve their performance. This couldn’t be further from the truth as our CME Index assessments have shown. Since care management resources are often separated from other operational departments, they aren’t often included in the product design or the reimbursement/incentive discussions. After all the care management staff just do what they do and aren’t part of the decision-making process. The important department, perhaps the most important part of the organization is treated like “Rodney Dangerfield” without respect. The stool metaphor results in a tilted stool which fails to accomplish its goals.

What is the Appropriate Approach?

CME assessment is critical. It is important to complete a Gap Analysis to compare actual performance with the hoped-for ideal targets. In the case of a commercial under-age 65 group population the ideal target is about 135 – 150 bed-days/1,0002. If the actual results are greater than 250 this suggests significant potentially avoidable care. At an average net charge per day of $6,000 this translates to a potential PMPM reduction of more than $57. Adding an estimate of outpatient and Rx savings this would translate to a potential savings of about $86 PMPM based upon the “rule of thumb” we use (i.e., inpatient savings typically reflect 2/3rds of the potential savings). Armed with this information the health plan can more strategically plan their new product design with an improvement in prior costs, magnitude of incentives, and determine what processes will have to be implemented to achieve these results. Without the CME assessment they are essentially operating in the dark.

In the case of value based reimbursement where providers are incentivized to reduce the cost of care and minimize potentially avoidable care, the CME assessment is critical to project what savings could potentially emerge. In a health system environment where a hospital is experiencing unfavorable results, a CME assessment will help project potential cost reductions through improved care management. In the situation of an uncompetitive health plan product a CME assessment will help project how much improvement in competitiveness (i.e., reduced rates) is possible through improved care management. It can also be used to help hospitals and health systems earn margins under their capitation and risk-bearing contracts.

Summary

As our country’s health care costs continue to escalate with any apparent limit, it is critical that stakeholders do all they can to implement improved care management processes that help keep health care affordable. It is time to give care management the recognition it is due.

1 The ideal length of stay is the expected length of stay for a typical patient reflecting expected complications of the patient. The actual value is calculated based upon a weighted average of uncomplicated patients (the best possible patient) and patients with complications.

2 The target is based upon a 40 – 45 admits/1,000 and an average length of stay of about 3.2 days.

About the Author

David Axene, FSA, FCA, CERA, MAAA, is the President and Founding Partner of Axene Health Partners, LLC and is based in AHP’s Murrieta, CA office.