Today we are nearing the fourth quarter of 2021 and the world has been augmented in major ways since the pandemic began nearly 18 months ago. Not long-ago masks were hardly seen outside of the hospital, then they became an everyday item, and have since become one of the most contested points in our culture. Some medical claims cost estimates at the beginning of the pandemic thought the total cost of care could double when in the end most insurers experienced a better year than they ever have. The one constant in this pandemic is that nothing is constant, and we will need to wait and learn more as we go. Many things in healthcare have progressed a lot over the pandemic (e.g., telemedicine), while other things have stayed constant through the confusion.

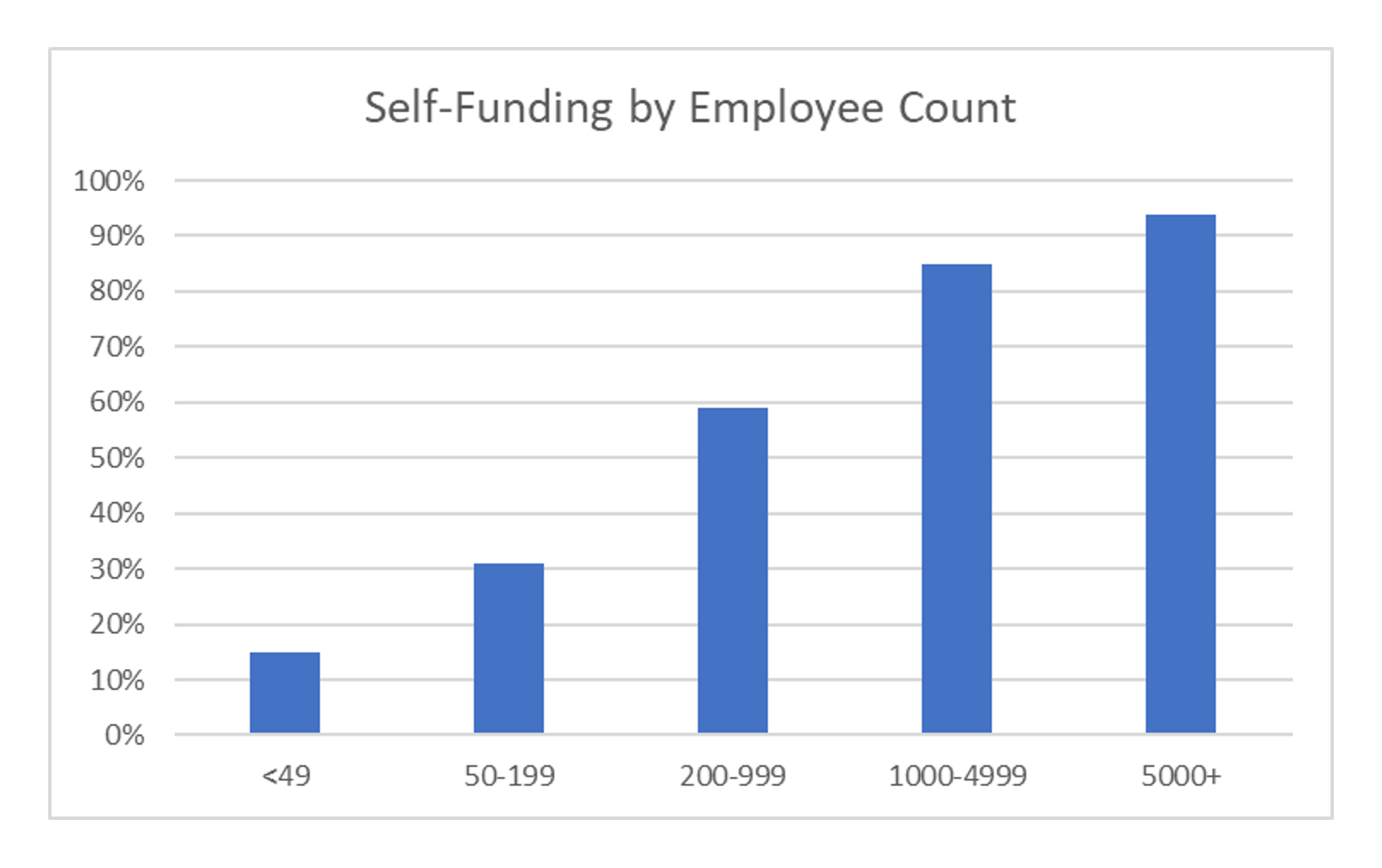

One of the significant changes we have observed since the pandemic began is in the portion of companies that are choosing to self-fund their benefits. According to the Kaiser Family Foundation 2020 Employer Health Benefit Survey, 67% of covered workers are in a self-funded plan[1]. That means that nearly 2 out of 3 covered workers are covered by a plan that is not directly insured by an insurance company, but rather work for a company that is taking on the risk of their own health benefits. For much of the past, larger companies have self-funded their health benefit plans, but more recently we are seeing an increased number of the smaller companies being open to taking on these insurance risks as well. The graphic below shows the percentage of employers that are self-funding benefits based on the number of employees. It is not surprising to see, but the larger employers still continue to self-fund at a much higher rate but we are starting to see more and more smaller employers moving that direction. When aggregating the graphs below it is seen that 84% of the larger firms (200+ EEs) are self-insured, while about 23% of the smaller firms are. When you average those two populations you can see the 67% that was shown above.

Most employees would not even know or understand that their benefits are being self-insured, but it is amazing to think that such a large majority of employees receive their benefits through such an arrangement. There appears to be momentum in the market to move towards self-funding and it can be seen in the Kaiser Survey when comparing the 67% in 2020 to 61% in 2019.

When contemplating self-funding many things need to be considered and some of them are new due to the effects of COVID. This is not a comprehensive list of everything to consider, but a list of things of the most common ones we have recently been hearing or seeing.

- Don’t overact to good claim experience during the pandemic to move towards self-funding.

We feel that this is a trap that many people have fallen into. I recently heard of a group that wanted to switch from fully insured to self-insured because they performed so much better than expected when looking at their loss ratios. Loss ratios may have looked good in 2020 and or early 2021, but keep in mind that the Pandemic created an unparalleled disruption to the healthcare system and we do not fully know what the future runout could look like.

- Review options for Stop-loss insurance closely.

A major key to a self-funded group being successful in a self-funded arrangement is properly setting the stop-loss attachment point and parameters. There are many different flavors of stop-loss coverage such as the: term, incurred/paid basis, exclusions and attachment point. Of all these, I feel the last one is the most important as it has the strongest correlation to the price of coverage. Doing proper simulations and testing of the group claims helps create the highest chance of positive outcomes. The goal of properly chosen stop-loss coverage is not to make money on the coverage, it is to lower risk and hopefully be paying for coverage more to diversify the risk rather than game the outcome. Stop-loss coverage is most often analyzed on a net basis, where recoveries offset premiums. It is often good to aim for coverage where premiums paid, and reimbursements collected are very close to each other. Stoploss is a risk mitigation strategy and should be looked at over longer periods of time. During COVID there could be a trap where stoploss/claims experience has been good and that could lead to higher rate increases in the future when normal patterns return.

A major key to a self-funded group being successful in a self-funded arrangement is properly setting the stop-loss attachment point and parameters.

- Understand the company Risk Tolerance before making a major change.

Self-funding can sound very interesting, but the risk involved needs to be fully understood. There is a level of risk associated with self-funding as stop-loss insurance alone does not insulate from all negative outcomes. In many cases, there may be baby steps that could be taken on your way to becoming self-funded, one of those may be the idea of “level funding” funding where the TPA creates a program that is very similar to self-funding, without assuming as much risk. These are programs that often include stop-loss coverage at a very low attachment point simulating an insurance product. COVID has exposed many companies’ risk tolerance as companies reacted many different ways to the pandemic. If you are a company and you are considering self-funding, look at how you reacted to COVID and see where you find yourself on the spectrum of risk. If you are open to taking on risk and it does not paralyze you, consider it. If you would rather remove as much risk as possible, then stay fully insured.

- Can vaccination status be considered in rates for members?

Vaccines are a hot button in the United States and around the world. More and more companies are starting to incentivize their employees to get the COVID vaccine. Recently Delta Airlines came out with a rule stating that employees that do not get vaccinated will have to pay an additional $200 per month towards health coverage[2]. When creating a self-funded program COVID costs need to be considered. We have completed many different projections of COVID costs for our clients, some being on the cost of COVID claims, others related to the “pent up demand” that might exist from services that have been skipped due to COVID. Another consideration related to COVID that some are exploring is the increased exposure to claims related to those that are not being vaccinated. This week an article was published by the AMA saying that unvaccinated people with the delta variant are twice as likely to be hospitalized compared to alpha variant[3]. It seems clear that the potential costs of an unvaccinated person can be higher than a vaccinated person, but does that justify higher rates? That is a land mine that I am not willing to step on right here, but to me, this comes down to a question of Carrots or Sticks. Through my work I have seen the best results when people are incentivized instead of punished. When an employee is given a carrot (incentive) to get them to react it appears to be much more effective than a stick (punishment). I would rather see companies offer discounts to vaccinated employees in the form of a health and wellness benefit, rather than punishing people for not having been vaccinated.

In conclusion, I believe that self-funding is a good option for many companies, especially bigger companies with a larger risk appetite. A majority of employees are covered by a self-insured program, but that does not mean that it is a good fit for all. COVID claims experience should not be a reason to become self-funded, but COVID has opened up the conversation for many to explore things that they had not previously looked into. Every decision related to insurance needs to be taken seriously as the goal of health insurance is not profitability, but rather the health of the members. If the reason to become self-funded is strictly cost savings, I would not do it. If the reason for changing is being able to offer better benefits to your members, I believe it should be explored.

[1] https://www.kff.org/report-section/ehbs-2020-section-10-plan-funding/

[3] https://www.thelancet.com/journals/laninf/article/PIIS1473-3099(21)00475-8/fulltext

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.