Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.

Provider reimbursement models are evolving as the healthcare system attempts to combat rapidly rising healthcare costs. A major development has been the push towards value-based care (VBC). Value-based payment arrangements can take on many forms, but the general emphasis is a shift away from fee-for-service (FFS) reimbursement, where providers are financially incentivized to increase the number of services, in lieu of linking reimbursement to both financial and quality targets. Thus, providers are financially rewarded if they can deliver positive health outcomes while efficiently utilizing healthcare services. Examples of VBC include capitation, bundle payments, gain/loss sharing, and other arrangements.

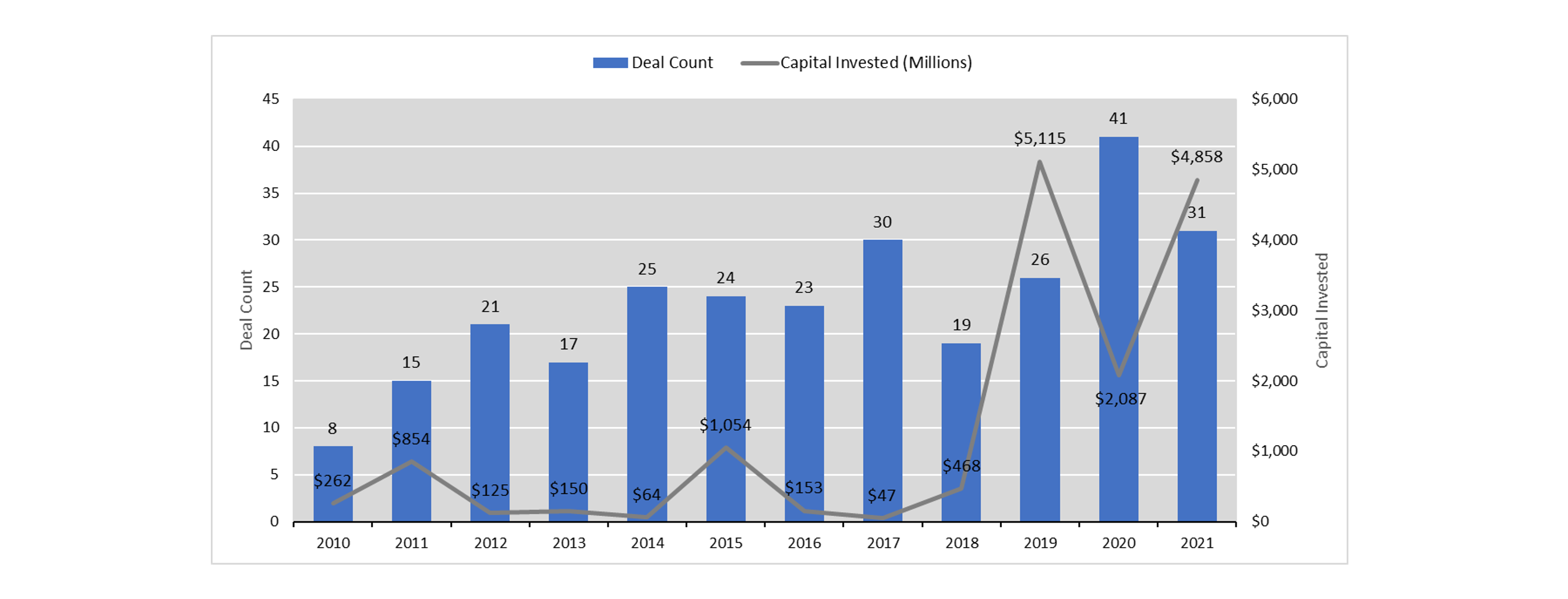

Coinciding with the rise of VBC is the acceleration of merger and acquisition (M&A) activity within primary care. The influx of capital from institutional investors and private equity means this trend is not likely to slow down anytime soon. The chart below demonstrates the increase in deal count and capital invested over the last ten years[1]. Particularly noteworthy is the sharp increase in capital invested in 2019.

Primary Care M&A Activity

In a 2018 study by Mergermarket and West Monroe Partners, respondents identified value-based reimbursement as the top regulatory issue affecting M&A strategy[2]. There are many reasons why VBC provides an impetus for consolidation and investment. Insurers and CMS are pressuring providers into VBC arrangements to align incentives, lower overall healthcare costs, and increase competitive positioning. Some insurers might even threaten lower reimbursement levels or network exclusion unless VBC is adopted.

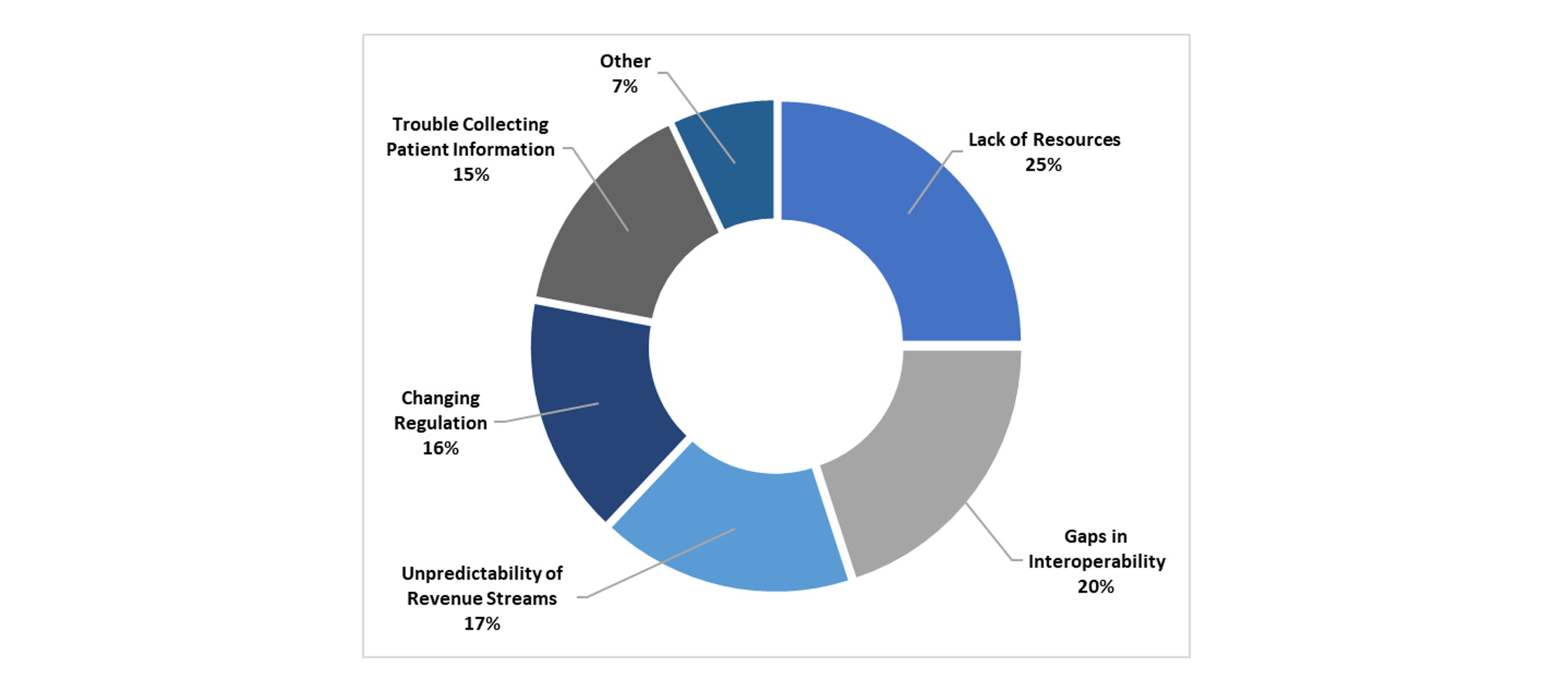

Healthcare Leaders’ Largest Barriers to VBC

A survey of healthcare leaders revealed their largest barriers to entering VBC arrangements posed by payers[3]. Providers can overcome many of the barriers to VBC, particularly lack of resources and unpredictability of revenue streams, by consolidating with other groups and benefiting from economies of scale. As such, increased M&A activity is a natural byproduct in the evolution of reimbursement models as providers consolidate to survive and accommodate payers.

Not all VBC-driven M&A activity is coerced by insurers. If healthcare can be managed appropriately, a value-based payment arrangement can be very lucrative. It has been demonstrated that a utilization profile emphasizing care management can save upwards of $50 PMPM relative to less-managed care[4]. Assuming a panel size of 1,000 Medicare patients per physician, this equates to more than $600,000 per physician annually. Capturing a portion of these savings can yield a substantial ROI, creating an attractive opportunity for private equity and institutional investors. Furthermore, the COVID pandemic enlightened many investors and providers whose FFS revenue was crushed while those in value-based arrangements thrived. However, despite the newfound attraction to VBC, there are several key considerations when identifying targets that will succeed in VBC arrangements:

- Data Collection – unless providers are collecting, processing, and reporting their own service data, they will be completely reliant on reporting from the insurer. It is vital to establish internal data collection to validate shared savings figures as well as take proactive measures to address areas of improvement. One valuable way to utilize claims data is to create actuarial cost models, which summarize healthcare costs by category of service, unit cost, and utilization. This report allows for easy identification of services that are over or under-utilized and may be contributing to higher-than-desired costs.

- Contract Features – value-based care contracts can take a variety of forms, but one of the more complicating factors is the disassociation from FFS reimbursement. Therefore, it is very important to actuarially determine appropriate compensation for services included and realistic savings targets. Additionally, there is usually a quality component with defined, measurable metrics. Most contracts span multiple years with savings targets that become more aggressive over time. Without expert input, providers can easily be fooled into an arrangement that appears favorable in the short term but yields significant losses in the long term.

- Care Management Capability – to succeed in VBC, providers must demonstrate an ability to lower overall healthcare costs, or at least lower relative to FFS. This could entail a totally different way of practicing healthcare than some doctors were taught at their medical school. A critical role is the Medical Director, responsible for coordinating the goals and policies to contribute to VBC success.

- Reserving – a key practice for stabilizing revenue streams is to establish adequate reserves. However, over-reserving could diminish investment returns. Analyzing claims patterns and trends is a complicated process that insurers typically rely on actuaries to understand. Providers will need to develop or utilize actuarial expertise to manage unpredictable revenue streams.

- Regulation – providers can become subject to additional regulations depending on how much risk they assume and the state in which they operate. This may require additional investment to ensure compliance on an ongoing basis.

Healthcare economics is fundamentally different than most other goods and services. Unique dynamics arise within the patient-provider-payer triumvirate, which becomes increasingly complicated with a shift from fee-for-service to value-based payment arrangements. Although value-based arrangements have proven lucrative investment opportunities with some providers, investors should exercise caution before being swept away in the hype. When VBC is a factor in any M&A effort, additional due diligence is necessary to ensure that providers are engaged in advantageous risk-sharing contracts, identifying care management opportunities, and complying with regulations.

Endnotes

[2] https://www.acuris.com/reshaping-healthcare-ma-how-competition-and-technology-are-changing-game

[4] https://axenehp.com/geographic-utilization-disparities-financial-impacts/

About the Author