What if I told you that two sentences in a rate filing guidance could potentially add $5 billion of federal subsidies to the individual market and bring substantial premium relief to low-income consumers across the nation if implemented by every state? And that doing so would not be a “gimmick” designed to increase federal spending but rather correcting anti-consumer pricing distortions by properly enforcing current ACA rating rules and assuming rational consumer behavior? If interested, keep reading! These two sentences have been implemented in the state of Pennsylvania and can be implemented elsewhere. This article was written specifically for regulators and will walk through the two sentences, discuss the potential impact, and systematically explain the ACA compliant and consumer-oriented rationale for state regulators to implement what I call the “Silver Bulletin” in their states.

The Silver Bulletin: A Rate Guidance Solution to one of ACA’s biggest problems

Let’s take a look at the two sentences which can be found in the link below[1]. An excerpt from page 1 is replicated here with the two sentences bolded:

- “The Department requests that all issuers of the Individual market file uniform adjustments as follows in their rate submission: a. Individual Adjustment of 1.01 – all individual plans. b. CSR Defunding Adjustment of 1.20 – all individual silver exchange plans. c. User Exchange Fee of 3%. d. Reinsurance Morbidity Adjustment of 0.999 (i.e., -0.1%).

- The Market Adjusted Index Rate for small group filings now reflects a January 1 rate to mimic the URR template.

- Induced demand factors should be based on the HHS induced demand factors utilized in the risk transfer formula and should be calculated using the following formula: (Plan AV)^2 – (Plan AV) + 1.24. The “Plan AV” should be the product of the “Pricing AV” (column K of Tab III) and “Non-Funding of CSR Adjustment” (column P of Tab III).”

Sentence 1: “The Department requests that all issuers of the Individual market file uniform adjustments

as follows in their rate submission:

b. CSR Defunding Adjustment of 1.20 – all individual silver exchange plans”

Sentence 1 Commentary: Pennsylvania has mandated the “Silver-load” amount, which is the factor used by carriers to increase Silver premiums to account for the defunding of CSR reimbursements by the federal government in 2018[2]. There are two main reasons a state should consider adding sentence 1 to their rate guidance:

- Create parity amongst carriers: In most states, this load is based on the % of CSR enrollees a carrier has on their silver on-exchange plans which create advantages and disadvantages between carriers depending on their enrollment mix. By making the load uniform, carriers can price their metal level factors on equal footing. Additionally, carriers in many states currently derive this factor in different ways with different assumptions, further creating disparities in the market. The ACA is designed to have carriers compete on quality and price, not metal level pricing and CSR enrollment. Creating parity regarding the Silver-load brings a market closer in line with the intended design of ACA rating rules.

- Assure adequate Silver-loading to enhance premium subsidies: The premium subsidies in the ACA market are based on the second-lowest-cost silver plan. By regulating the Silver-load, Pennsylvania is now in control of the dollar amount of federal subsidies that enter their state. On average, CSR 87/94 enrollees represent 40-50% of on-exchange enrollment[3]. Carriers compete to gain this enrollment which creates competitive pressures to compress Silver premiums through adjusting the Silver-load. Compressing Silver on-exchange premiums helps virtually no consumer while hurting most subsidized consumers by decreasing their subsidies. Taking control of this factor can allow a state to fairly and appropriately maximize premium subsidies to help all consumers.

Revising Sentence 1: I would suggest changing sentence 1 to say the following:

“The Department requests that all issuers of the Individual market file uniform adjustments

as follows in their rate submission:

b. CSR Defunding Adjustment of 1.44 – all individual silver exchange plans”

The ACA has strict definitions of pricing factors that are designed to benefit the consumer. Silver-loading was not anticipated within ACA rating rules, which has resulted in a variety of approaches by states. Most states allow a load to be applied to Silver-on-exchange premiums only but how that load is developed also varies by state. Some states like Pennsylvania have defined the load, other states have defined the approach by requesting carriers project what the CSR payments would have been and other states leave it up to the carriers with some carriers using a weighted average of the actuarial value to develop the load and others choosing different methods.

I believe the variety of approaches is a function of the unexpected nature of the defunding of the CSRs. However, there is a strong case to be made that CMS has issued guidance that should result in more uniformity surrounding the development of the CSR load. There are two main CMS documents that relate to each other and can be interpreted to be consistent with the 1.44 load I have suggested.

The first document is a CMS memo[4] addressing “Silver-loading” and describing the pricing factor that should be used to adjust the premiums. The following is the relevant quote (bolded emphasis is mine):

“A plan-level variation for the actuarial value and cost-sharing design of a plan is permitted under 45 CFR §156.80(d)(2)(i). A health insurance issuer that offers a QHP may vary premium rates for the QHP based on the impact of the loss of anticipated federal funding for CSR payments. The exercise of this flexibility to vary premium rates has resulted in some consumers not eligible for premium tax credit or CSRs being enrolled in a QHP for which the issuer applied a load to account for a cessation of federal funding for CSR payments. Those consumers absorb the full impact of the load, despite not being eligible for these forms of subsidy.”

While this guidance does not directly define the approach of Silver-loading, it does define what rating factor should be used. This factor is called the “AV and cost-sharing design of a plan” and CMS has defined guidance surrounding the development of this factor. The “Silver-loading” impact to this factor is typically a singular load applied across all silver on-exchange plans that reflects the impact of the loss of anticipated federal funding for CSR payments as directed by the CMS memo above. Some states have interpreted this to mean that the load itself should reflect actual expected claims which would include the actual health status and utilization patterns of Silver-level enrollees. Given the unexpected nature of the defunding, it’s an understandable interpretation from a state. However, if utilizing this pricing factor to implement Silver-loading, it is arguably required, that the Silver-loading factor development remain consistent with the rating rules surrounding the “AV and cost-sharing design of a plan” factor. The following is the rate guidance from CMS for this rating factor[5]:

“The AV and cost-sharing design of the plan may take into account the benefit differences and utilization differences due to differences in cost-sharing. The utilization difference may reflect the impact higher cost-sharing has on utilization, but cannot reflect differences due to health status. If the cost-sharing impact on utilization is reflected, describe in detail how the difference was estimated and how the methodology ensures that differences due to health status are not included in the adjustment”

The AV and cost-sharing design of the plan, which is inclusive of the Silver-load factor, may take into account the benefit differences and utilization differences in cost-sharing. It explicitly excludes this rating factor from reflecting the health status of the enrollment and doesn’t mention other factors like the utilization patterns due to income. This means that the Silver-loading factor can reflect the actuarial value and induced demand difference between a Platinum and a Silver plan or the difference between the CSR benefits and the base Silver benefits. It also can be interpreted that the Silver-loading factor cannot reflect actual expected claims or the health status of silver enrollees. Using CMS risk adjustment factors as a benchmark, there is a case to be made that it is reasonable to define the Silver-loading factor to roughly equal (.9 x 1.15) / (.7 x 1.03) or 1.44. Currently, the Silver-loading factor in most states reflects the percent of CSR enrollees in Silver on-exchange plans. The 1.44 would have to be justified assuming 100% enrollment in CSR 87/94 plans for silver on-exchange plans. The following provides a rationale for making this assumption:

- It is a consumer-centric assumption: If you do not qualify for CSR 87/94 plans and select a Silver plan, you are paying more premiums for fewer benefits. The consumer in this case overpays and subsidizes the CSR 87/94 enrollment and contributes to compressing the benchmark and reducing subsidies. On average, 20%-25% of silver on-exchange enrollment are for non-CSR 87/94 plan designs[6]. These consumers are receiving poor value and are likely selecting these plans because Silver premiums remain lower than Gold premiums due to lower Silver-loading and overpriced Gold plans[7]. Maximizing the Silver-load would help move Silver premiums higher than Gold premiums creating a consumer-oriented incentive for non-CSR 87/94 consumers to optimize their subsidies and choose a non-Silver plan.

- It is based on a rational consumer assumption: The 100% CSR 87/94 enrollment assumption is justifiable with the rational consumer assumption. If Gold is priced below Silver, all rational non-CSR 87/94 consumers should move from Silver to either Gold or Bronze because Gold would have greater benefits and lower premiums. The assumption is not unreasonable. On the flip side, not assuming 100% CSR 87/94 enrollment is based on consumer behavior that negatively impacts the consumer and contributes to a cycle of a continual negative outcome to the consumer.

- Provides the market funds to reduce premiums: By appropriately maximizing silver premiums for 40%-50% of the exchange enrollment, carriers will have more ability to offer competitive rates for non-Silver plans. Subsidies will have been maximized but also, premiums can be lowered to create even greater savings for both subsidized and unsubsidized consumers which should attract healthier enrollment creating further downward momentum for premiums.

Sentence 2: “Induced demand factors should be based on the HHS induced demand factors utilized in the risk transfer formula and should be calculated using the following formula: (Plan AV)^2 – (Plan AV) + 1.24. The “Plan AV” should be the product of the “Pricing AV” (column K of Tab III) and “Non-Funding of CSR Adjustment” (column P of Tab III).”

Sentence 2 Commentary: Pennsylvania has mandated the induced demand factor which is the factor largely responsible for very high Gold premiums and moderately high Bronze premiums in markets across the nation. In Pennsylvania for the plan year 2021, this rule change resulted in the average lowest-cost Bronze premium decreasing by 9% and average lowest-cost Gold premium decreasing by 12% while the average benchmark remained relatively flat[8]. There are two additional reasons a state should consider adding sentence 2 to their rate guidance:

- Create parity amongst carriers: Similar to the Silver-loading factor, the induced demand factors vary widely between carriers even when plan designs are similar or exactly the same. The ACA was designed to force insurance companies to compete on price and quality and not to compete on targeting specific populations. It did so by standardizing benefits and establishing rating rules to eliminate rating games designed to attract certain populations. This should result in carriers having similar metal level slopes when benefits are similar. By standardizing the induced demand factor, Pennsylvania has created further parity between carriers to accomplish this aim of the ACA.

- Assure that Gold is cheaper than Silver: If you make between 200%-400% of the FPL, you qualify for subsidies but do not qualify for Platinum level CSR benefits. Therefore, you are incentivized to select Bronze or Gold plans. Gold plans are more expensive than Silver plans in most states in part because carriers attempt to compete for Silver enrollment by reducing their Silver load factor[9]. By setting the Silver load and induced demand factors, appropriately priced Gold plans should drop below Silver premiums which helps consumers in the 200%-400% range have access to lower cost-sharing plans for lower costs. Currently, low-income consumers are forced to select Bronze plans or overpriced Gold plans. This would provide market incentives to provide meaningful protections for low-income ACA consumers.

Fixing Sentence 2: Sentence two is fine as it is. It is consumer-centric and appropriately implements ACA rating rules. One note to make is that the induced demand factor also falls under the “AV and cost-sharing design of a plan” and is subject to the same requirements.

The Overall Impact:

The two sentences provide a pro-active solution to a pervasive problem across the country. Pennsylvania should be applauded for attempting to assist its low-income consumers. Focused rate review[10] will still need to accompany the “Silver Bulletin” to assure the implementation is adhered to and additional rating factors are appropriate. I will highlight two major impacts, the first being a return to my initial $5 billion claim by looking at some high-level numbers (sentence 1) and the second is increased parity among carrier metal level slopes that subsequently result in better consumer costs (sentence 2).

Sentence 1 Impact:

Consider that Pennsylvania has set their Silver-loading factor to 1.20 but could have set it to 1.44. This means that if they implemented the rational consumer-centric assumption, silver premiums would immediately rise by 20% (1.44/1.2-1). Available[11] premium subsidies would also rise by 20%. Unfortunately, little is published in terms of Silver-loading and so we can only assume the impact based on some published information, recognizing that the actual impact will be different.

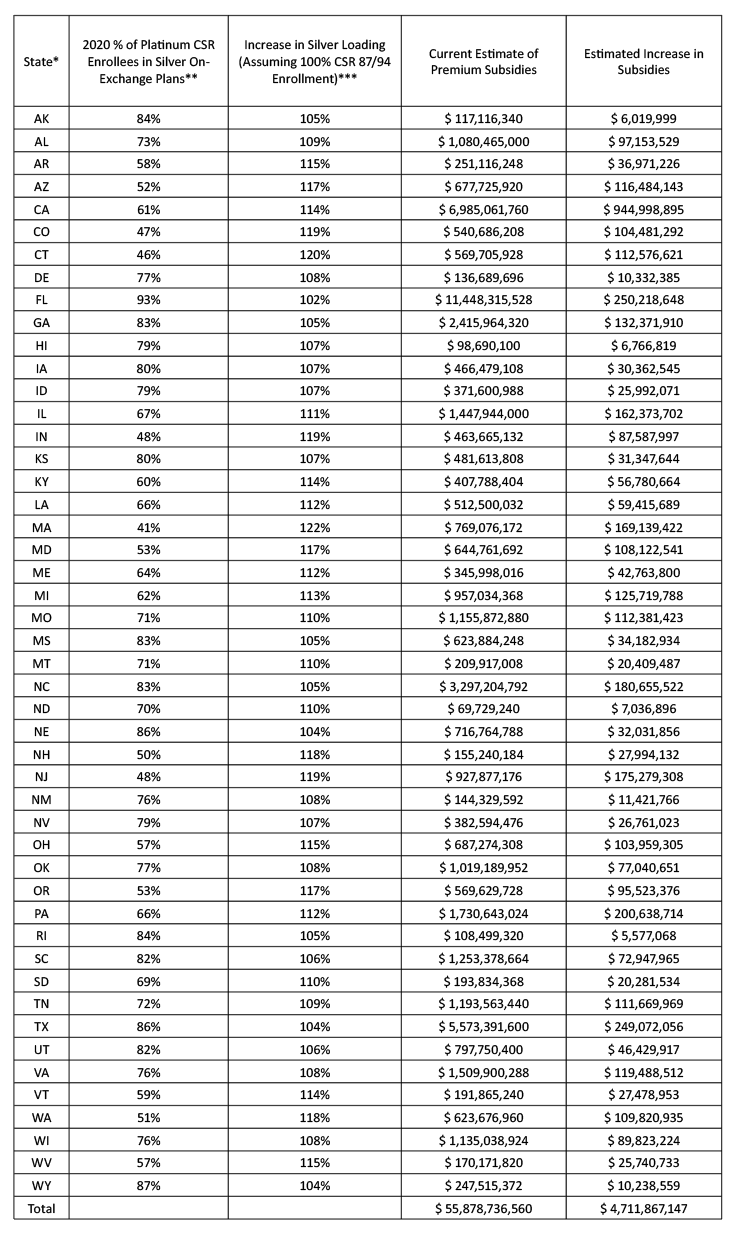

To get a sense of the potential impact, I reviewed the 2020 total amount of subsidies available in each state and the current % of CSR 87/94 enrollment in silver on-exchange plans[12]. A simple way of measuring the impact of the rational consumer-centric assumption was to assume that the Silver-load in each state is directly correlated to the % of CSR 87/94 enrollment in on-exchange Silver plans. Further, I assumed the Silver-load reflects both the increased actuarial value and induced demand based on the CMS rate guidance. These two assumptions are likely conservative, and I would expect actual Silver-loading factors to be currently lower in most states and thus the actual impact to be even greater (see that Pennsylvania produces a smaller impact in my table below than the 20% stated above). The following table represents the impact of moving the current % of CSR 87/94 enrollment to 100% for the assumed Silver-load. The increase in subsidies represents the increase in “available” subsidies and not the “realized” subsidies as some consumers have $0 premiums and do not utilize their entire subsidy amount available to them. The results show that there is likely significant untapped potential for states to improve their markets and help low-income consumers by utilizing the rational consumer-centric assumption.

*Excludes DC and the basic health plan states (NY and MN).

**SBE data used the FPL categories of 100%-150% of FPL and 150%-200% of FPL. When CSR or FPL enrollment was unavailable, nationwide averages were used.

*** Equal to 1.44 / (1.44 x Column 2 + (1-Column 2))

Sentence 2 Impact:

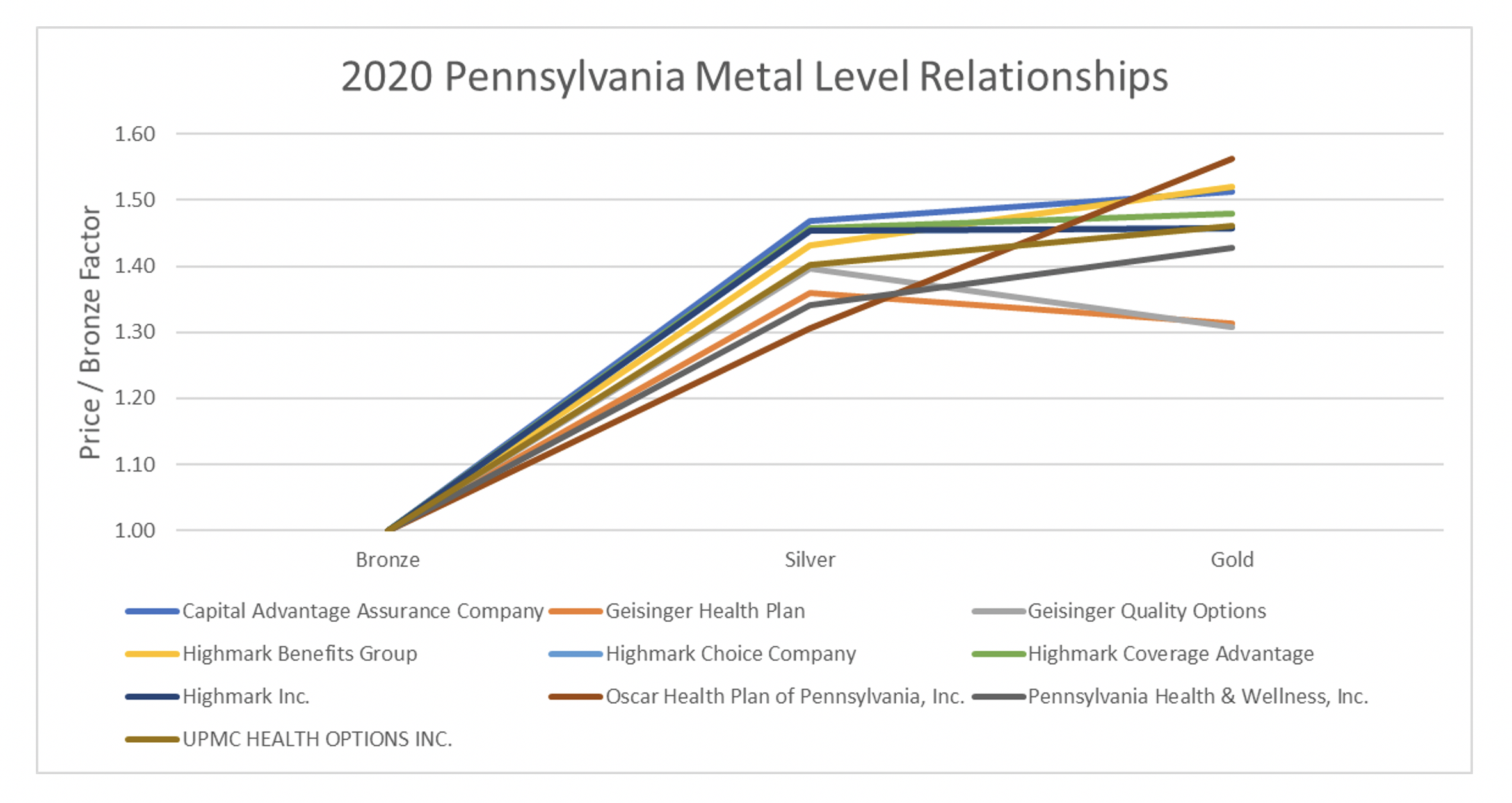

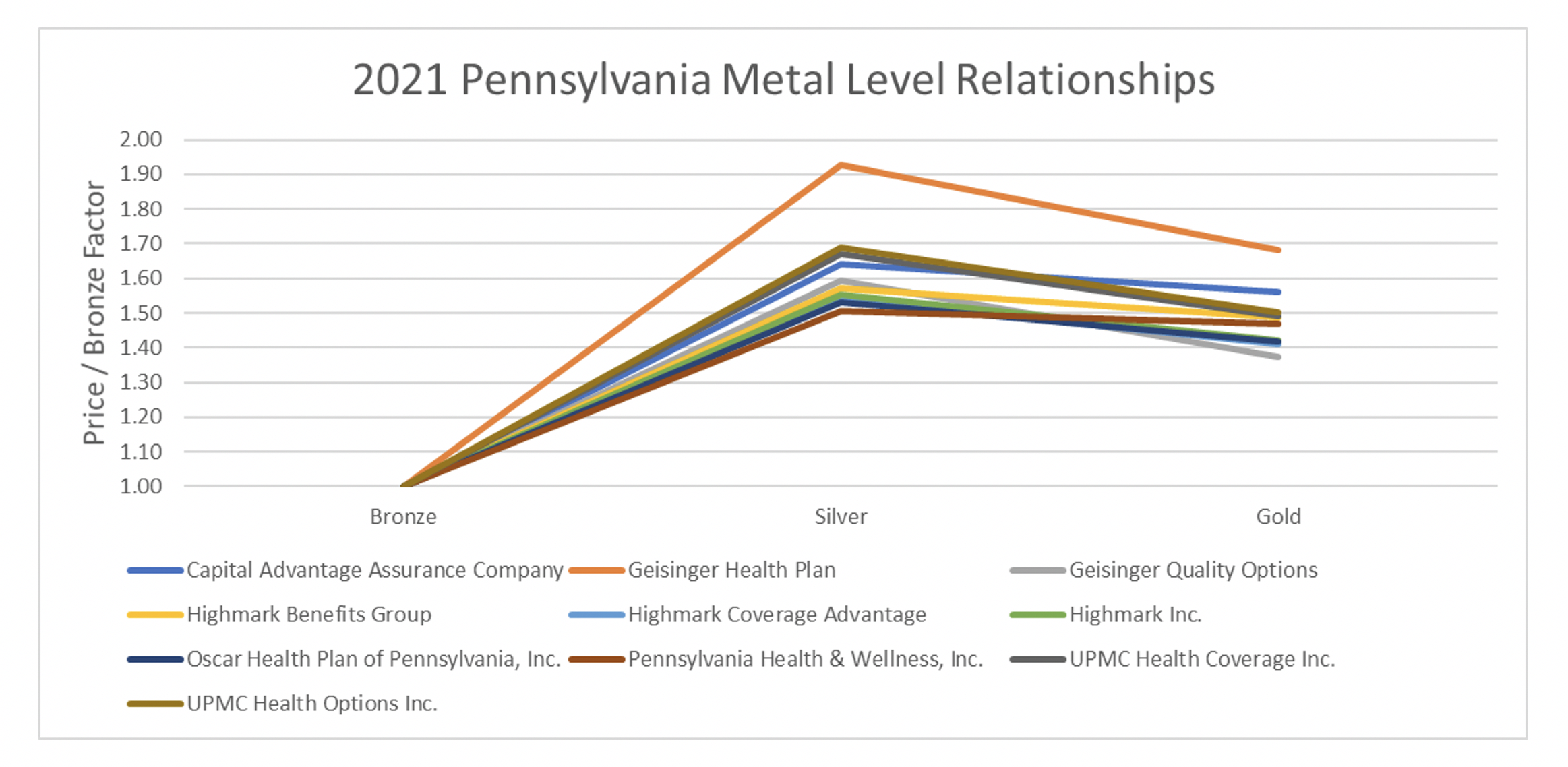

Sentence two creates parity amongst carriers and improvements to consumer costs. To measure the impact in Pennsylvania, I mapped out the metal level slopes for the plan year 2020 by carrier and compared them to the 2021 metal level slopes[13]. I then looked at changes in net premiums for a 40-year-old consumer making 300% of the FPL. Below are graphs of the 2020 average rating factors of Silver and Gold premiums in relation to the average Bronze rating factors in both states split by carrier. Bronze was set to 1.00[14]. In 2020, some carriers had Gold premiums below Silver premiums and others did not. In 2021, virtually all carriers had a similar shape and had Gold premiums below Silver premiums.

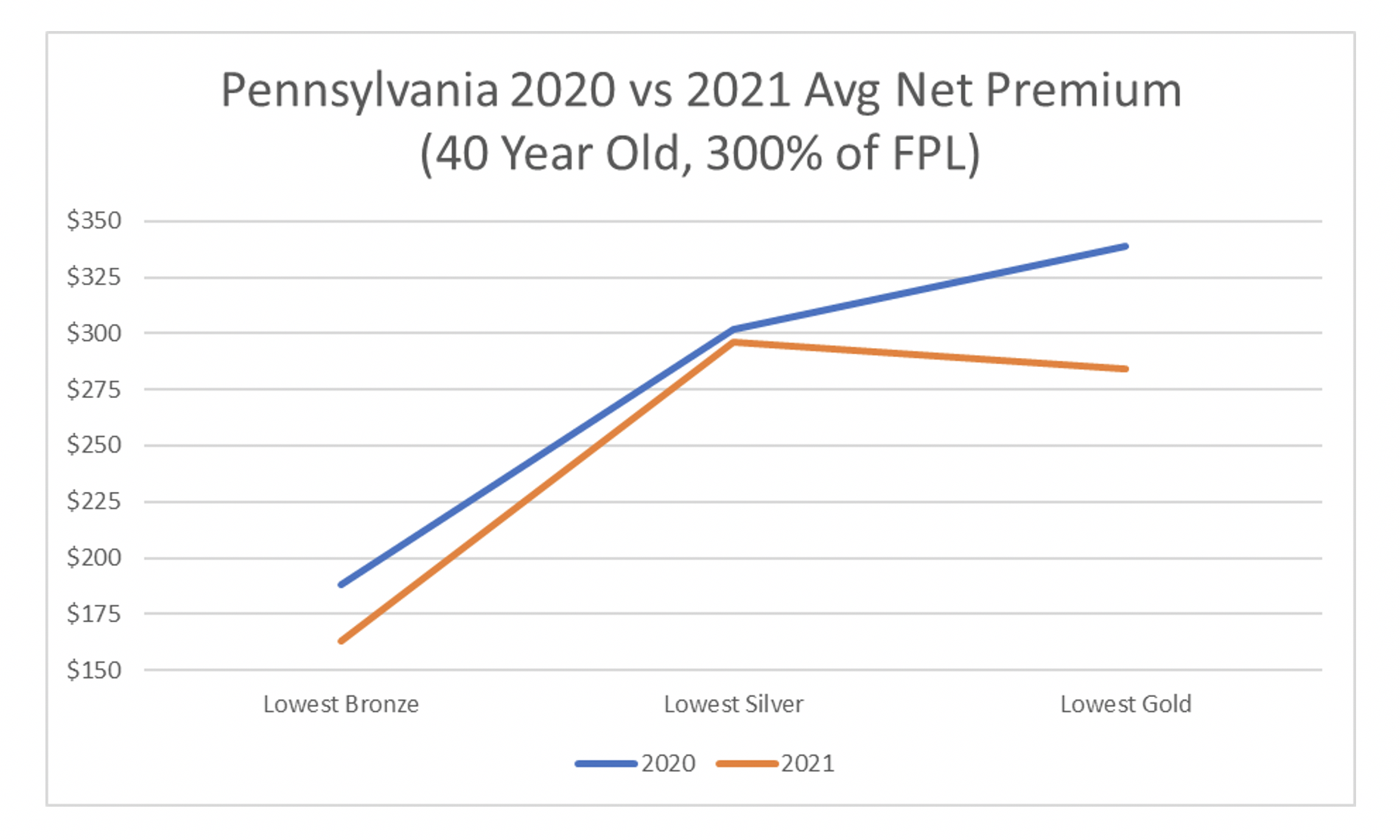

The end result is lower net premiums across the board for subsidized consumers. For a 40-year-old making 300% of the FPL, the average lowest Bronze net premiums are $25 lower a month and $55 for Gold[15].

Endnotes

[2] https://axenehp.com/cost-sharing-reduction-paradox-defunding-help-aca-markets-not-make-implode/

[3] Based on 2020 OEP State, Metal Level and Enrollment Status Public Use File “CSR_Cnsmr_87” and “CSR_Cnsmr_94” enrollment. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/2020-Marketplace-Open-Enrollment-Period-Public-Use-Files

[6] See footnote 2. All enrollment estimates use the public use file linked in footnote number 2.

[7] https://axenehp.com/joe-pesci-option/

[9] https://axenehp.com/fields-of-gold/

[10] https://axenehp.com/focused-aca-rate-review/

[11] “Available” as opposed to “Realized” as some consumers have $0 premiums and do not utilize their entire subsidy amount available to them.

[12] Based on 2020 open enrollment numbers. See footnote number 2. Total subsidies equal to “APTC_Consmr” x “APTC Cnsmr Avg APTC” x 12.

[13] Excluded QCC Insurance Company who had extreme outlier slopes that seemed inconsistent with the rate guidance and may be due to URRT data errors or another anomaly. More inside knowledge in Pennsylvania would need to be understood to explain their metal level slope.

[14] From Worksheet 2, field name ADJ_FACT_AV_CS. 2021 URRT PUF. Values used the lowest metal level AV value normalized to 60% for Bronze, 70% for Silver and 80% for Gold: https://www.cms.gov/CCIIO/Resources/Data-Resources/marketplace-puf

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.