There are many unknowns in the future of health care funding and costs given the current crisis faced by our country. With unemployment rising at an unprecedented rate and overall economic output shrinking in the near term, many individuals and families in the United States will be experiencing a change in how they fund their health care and where they purchase insurance coverage. For many who relied upon employer-based coverage, the shifting economic landscape may result in a loss of coverage and a new reliance upon Medicaid or subsidized individual market coverage. In the midst of many unknowns, the individual market dynamics for low income subsidized consumers remains a stable reality. Improving the individual market also remains a straightforward opportunity for states who can provide increased consumer value by simply focusing on their rate review process. Nearly 30 million people have lost their jobs due to the coronavirus pandemic, many of them will enroll in the individual market. States have more incentive than ever to maximize value for these consumers.

To the layperson, the pricing dynamics of the individual market can seem complicated and surprisingly non-intuitive. The provided links will help the reader understand the details. In this article, I lay out this opportunity for states in a straightforward manner while assuming the reader has a baseline grasp of some of the more not so straightforward ACA pricing dynamics. The following is a summary of the opportunity for states:

- Since the defunding of cost-sharing reduction subsidies, Silver plans offer richer benefits than Gold plans on average. As a result, Gold premiums should be priced lower than Silver premiums in the individual market if ACA rating rules were strictly enforced. https://axenehp.com/fields-of-gold/

- Adjusting premiums this way would result in decreased net premiums (after subsidies) for consumers and a flood of low-income consumers purchasing low deductible Gold plans, initiating what we have called “The Gold Rush”. https://axenehp.com/hard-pill-to-swallow/

- When Gold premiums remain higher than Silver premiums, this can lead to undesirable outcomes such as standard consumers keeping their over-priced Silver plans or low-income consumers being pushed into the less desirable high deductible Bronze plans. https://axenehp.com/aca-math-and-2020/

- Only 9 states have initiated “The Gold Rush”, but the potential is open to all states. https://axenehp.com/gold-rush-lionfish-optimizing-unique-dynamics-aca-markets/

The following graph shows 2020 on-exchange selective Gold enrollment (Y-Axis) in relation to Gold-to- Silver-premium ratios (X-Axis) for each state[1]. By selective enrollment, I mean consumers who have a real choice of value between metal levels. Consumers who receive the CSR 87 and 94 platinum level benefits have significant incentives to select Silver plans (since they get greater than Silver benefits without paying more) and are not included in the selective enrollment calculation[2].

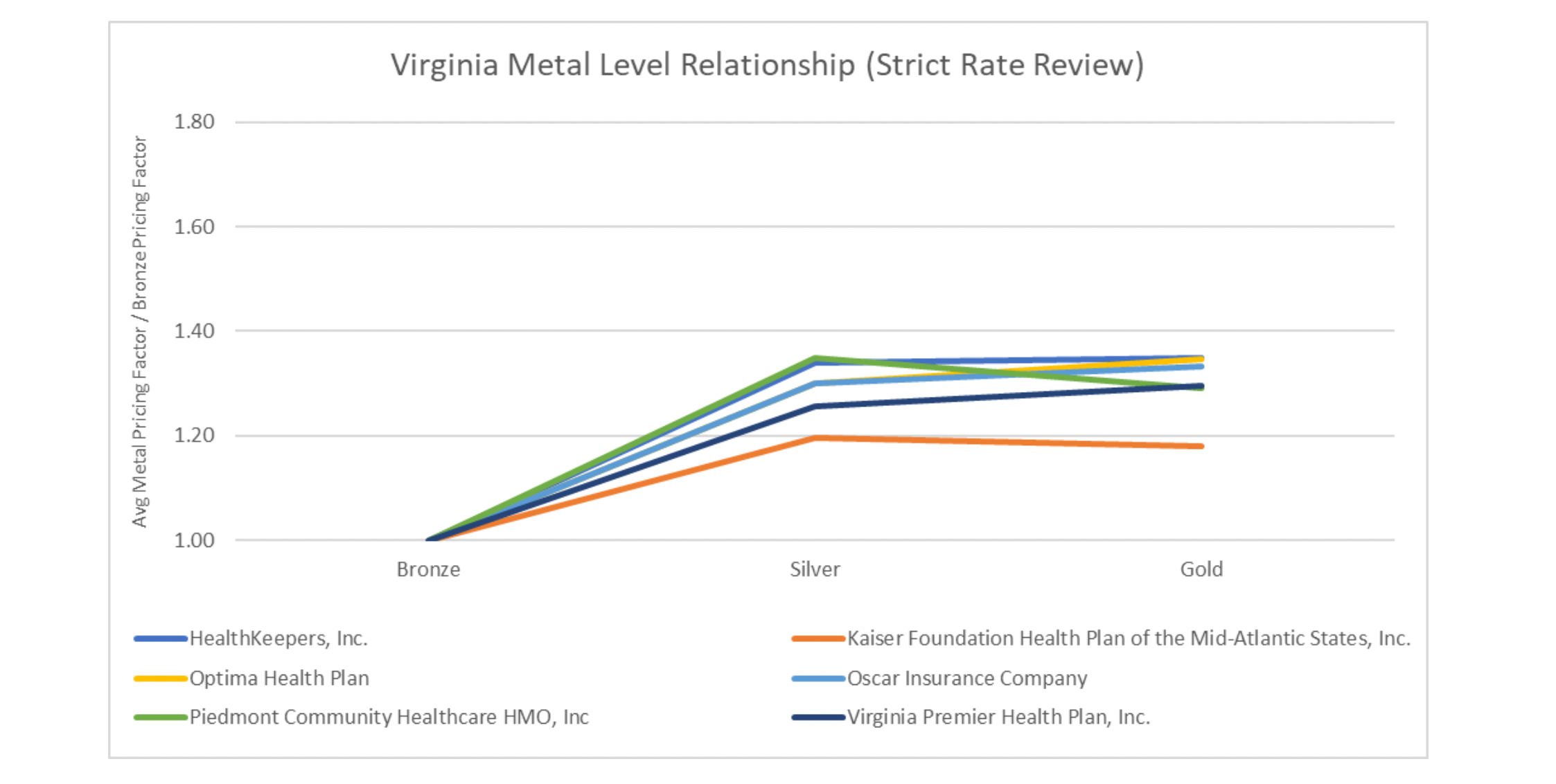

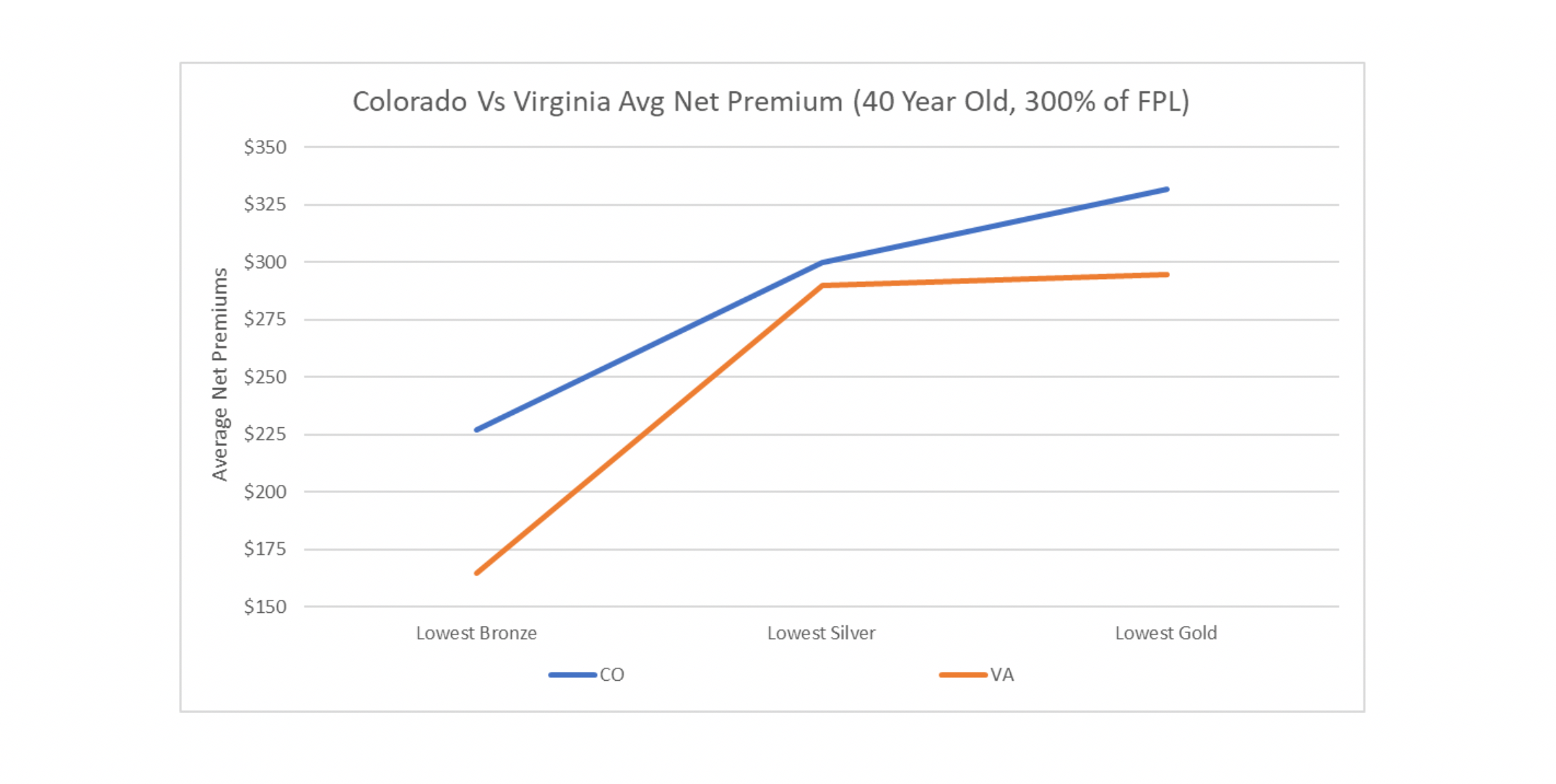

The pattern is simple. The lower your Gold-to-Silver-premium ratio is, the more Gold enrollment you get. The great point here is without any complicated laws or 1332 waivers, any state who finds themselves on the right (or wrong) side of this graph could easily change their situation for the better. How easy? Let’s look at two states. One state, Colorado, is in the process of implementing a major resource-consuming effort to reduce costs by creating a public option, which may increase costs for subsidized enrollees by reducing subsidies and decrease costs for the unsubsidized by reducing hospital reimbursements. There is a plan to offset the lower subsidies by applying for a 1332 waiver but will be subject to approval. This effort is a multiyear endeavor that could result in Colorado hospitals funding the loss in federal subsidies. The other state, Virginia, standardized one rating factor that has caused high Gold rates, induced utilization, and has created parity between carriers and reduced net consumer costs. Below are graphs of the 2020 average rating factors of Silver and Gold premiums in relation to the average Bronze rating factors in both states split by carrier. Bronze was set to 1.00.

The ACA was designed to force insurance companies to compete on price and quality and not to compete on targeting specific populations. It did so by standardizing benefits and establishing rating rules to eliminate rating games designed to attract certain populations. This should result in carriers having similar metal level slopes, something that looks like the Virginia graph. The Colorado graph likely represents carriers trying to be more competitive at particular metal levels to attract what they deem as a more profitable population, which is why you see more crossing lines. Colorado does not have parity between carriers, something that runs directly against the intended purpose of ACA rating rules. Contrast Colorado with Virginia who has controlled one rating factor. Virginia did this by requiring the induced utilization factors to be equivalent to the CMS induced utilization factors used in risk adjustment which resulted in carriers having similar metal level slopes. Uniformity between the carriers is brought about by strict rate review which is at the end of the day implementing one rule. The end result is lower net premiums across the board for subsidized consumers. For a 40-year-old making 300% of the FPL, the average lowest Bronze net premiums are $62 lower a month and $38 for Gold[3].

Unfortunately, rate review is only sexy to a handful of people, and I’m not publicly going to admit I’m one of them, but they do exist. In comparison to the public option, individual mandate and 1332 waivers (aka the Brad Pitt, George Clooney and Leonardo DiCaprio of individual market improvements), rate review remains the less glamorous and forgotten bulldog that may be the most effective market improvement tool (the Joe Pesci if you will). So, while Ralph Northam may be a household name for unfortunate reasons, he will not get special interviews like Jared Polis[4] for the true market improving actions taking place in Virginia, nor will the actuaries in either Virginia or Maryland where similar results are occurring. And therein lies the little secret of the ACA.

States that tend to be pro-ACA, vocalize their support for the law and receive publicity for implementing large scale progressive ACA improvement plans all the while lagging in subsidized consumer value to states like Virginia, Maryland, Wyoming, Iowa, Nebraska, Alaska, Oklahoma and North Dakota. The disparity in value exists because most states are not enforcing the straightforward rating rules of the ACA, even amongst states that champion the law. By doing this, they leave federal dollars on the table and in some cases have replaced those dollars with either state funding or savings taken from their doctors and hospitals.

On the other hand, states that tend to be anti-ACA don’t want to optimize federal subsidies or don’t really want you to know that their states have increased federal spending because that, of course, runs afoul of the narrative. The president, who created the current windfall of subsidies, tens of billions of dollars added to the individual market, at times seems contradictory as he balances the dual position of publicly opposing the ACA and at the same time acting as its savior[5].

Large scale efforts to improve the ACA may make headlines and opposition to making improvements may help in political messaging but both sides of this coin have largely ignored the glaring reality that their state residents pay more money than they should because simple rules are not followed. In terms of rate review and market improvements, perhaps there is a road less traveled that could unite both political spectrums by putting politics aside[6]. Whether you agree with the ACA or not, it is the law of the land, and I for one believe that as long as it is in place, we should maximize the value for American citizens by appropriately implementing the rules, be it a red state or blue state. Whether or not we should get rid of or replace the ACA is a separate debate, as is the positive or negative impact of implementing some of these large-scale efforts.

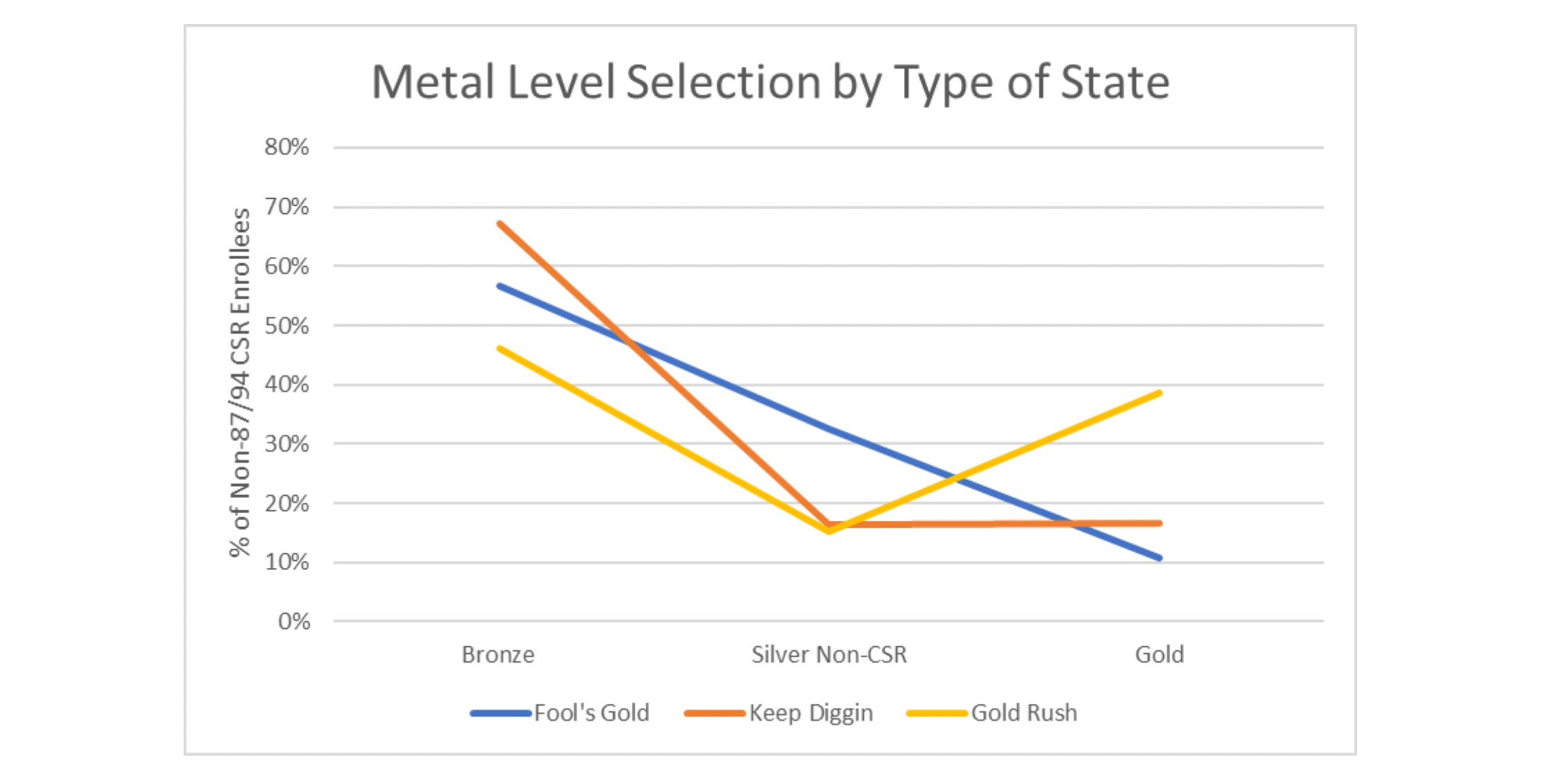

To conclude, good value for consumers means they have good options at affordable prices. The differences in enrollment outcomes between states are clear and discernible. Too much selective enrollment in Silver Non-CSR (87/94) plans likely means Bronze and Gold plans are not as relatively attractive as they should be, resulting in the straight downward enrollment pattern most often seen in “Fool’s Gold” states (Gold premiums 10% or higher than Silver premiums). Too much selective enrollment in Bronze plans likely means Gold plans are unaffordable, resulting in an L-shaped enrollment pattern most often seen in “Keep Diggin” states (Gold premiums within 10% of Silver premiums). Equal selective enrollment between Bronze and Gold plans means consumers are making value choices between lower premiums and richer benefits resulting in the V-Shape enrollment pattern most often seen in “Gold Rush” states (Gold premiums less than Silver premiums). The final takeaway is that consumers value choice and are willing to pay more for richer benefits if they are priced appropriately. Plan year 2021 can still make this materialize, making individual markets more stable for future enrollees who may need a little stability in their lives during this tumultuous time.

Endnotes

[1] From Worksheet 2, field name ADJ_FACT_AV_CS. 2020 URRT PUF: https://www.cms.gov/CCIIO/Resources/Data-Resources/marketplace-puf

[2] To eliminate CSR 87/94 enrollment, CSR_Cnsmr_87 and CSR_Cnsmr_94 fields were used when available and FPL_100_150 and FPL_150_200 for Silver enrollees when not available. “2020 OEP State, Metal Level, and Enrollment Status Public Use File” used. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/2020-Marketplace-Open-Enrollment-Period-Public-Use-Files

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.