“Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones.”

– Secretary of Defense Donald Rumsfeld, 2002

A few days before ‘shelter in place’ became a common part of our lexicon, I returned home from the office one afternoon and told my wife I had a nice chat with the New York Times. She was a little surprised. It wasn’t because I infrequently speak to the media; it was because the nuanced (but fascinating) financial dynamics of policy implications that I usually speak to the media about seemed less pressing during a dangerous pandemic. When I told her that the discussion was related to the Coronavirus (aka COVID-19), the subject matter registered as plausible but the noted conversation with me struck her as even more perplexing. “Do you know anything about the Coronavirus?” she asked. It was a fair question given that we have learned about the novel virus together through daily news updates, and a major media organization wouldn’t be calling her to get an expert take.

Thankfully, the questions I was asked were not clinical in nature. They were twofold and related to the impact on the health insurance industry. First, should consumers expect premiums to rise? More importantly, were risk-assuming insurers prepared for this and would they be able to pay associated claims? I liked the questions for three reasons: I knew how to answer them, they were at the heart of what insurance is all about, and I had good news to share at a time when good news was needed.

While not every insurer may have been fully prepared and certainly no insurer planned for this pandemic (and the reactive government response) with any degree of timing or specificity, the insurance industry as a whole and the financial system, in general, were ready. Even though we couldn’t predict what was to come, preparations had been made to address unknown events that generate significant financial consequences. This article explores the historical account of those preparations which benefit insurers, insurance consumers, and the greater societal good. While such risks are not readily considered by the general public, the risk management-focused insurance industry has prepared for ‘unknown unknowns’ to be ready for a time such as this.

The Business of Insurance

Insurance is a risky business; that is its fundamental nature. The usual discussion of health insurance today is centered around social policy and distracts us from pure insurance principles, but all insurance exists because of a mutually beneficial exchange[1] between one party that wants to reduce its risk and another party willing to assume that risk for appropriate financial consideration. The party reducing its risk requires some guarantee that the risk-assuming party has the financial capacity to fulfill such a requirement.

Accordingly, rules containing complex mathematical formulas have been established to provide such assurance. Generally, these rules determine the minimum amount of capital (or surplus) that a risk-assuming entity must retain to satisfy its obligation in good times and bad times. While individual risks are not predictable, the business of insurance involves preparing for and managing unknown risks.

Adequate Capitalization

Surplus requirements determine the amount of financial capital that a licensed insurer is required to hold. It is impractical for an insurance company to obtain and maintain a level of surplus that would result in absolute immunity of financial danger. At the same time, insurance companies should have surplus levels that minimize the possibility of ever falling below minimum levels of necessary capitalization.

Various standards have been developed as required minimum surplus levels. An early, simplistic method was a fixed dollar surplus requirement. As this standard does not appropriately adjust to an insurance company’s size, it was replaced in many jurisdictions by a ratio of surplus to annual revenue. A consideration of “surplus as a percentage of revenue” is commonly known as SAPOR and offers a transparent calculation with surplus requirements varying by insurer size. Unfortunately, the SAPOR statistic is also overly simplistic and does not consider an individual insurer’s risk profile.

Insurance company insolvencies in the late 1980s and early 1990s led the National Association of Insurance Commissioners (NAIC) to establish a working group to consider a more rigorous calculation reflecting the inherent risk of an insurer’s business to determine a minimum capital level; specifically, the working group believed companies with greater risks should be expected to hold higher amounts of capital. The group studied companies that had failed or exhibited weak financial conditions to better understand indicators of potential financial trouble.

The resulting Risk-based Capital (RBC) construct is more refined than earlier, simpler assessments of capital adequacy. RBC measures consider not only an insurer’s size but also its growth rate and various risk exposures. As RBC results are widely used and reported, the process leads to RBC being a conveniently used internally tracking measure as well.

Public Requirements: RBC Uses and Limitations

Health insurance companies require surplus for many reasons, including support for company reserves, protection from adverse events, and funding of future capital investments and growth. Insurance regulators are generally not privileged to have a full qualitative sense of the various risk exposures of the many companies that they monitor; RBC models provide an early warning systemand a measure of capital adequacy determined quantitatively by insurer risk levels. RBC should not be considered a stand-alone tool for determining the financial solvency of an insurance company; it is a formulaic calculation that provides an indicator of potential trouble.

A major RBC weakness is that it lacks a qualitative assessment of ongoing risk and provides only a retrospective viewpoint of enrollment, premiums, and other measures; it does not capture changing dynamics in regulatory rules or population health. In terms of the Coronavirus, RBC models could not project its timing or specific impacts but do incorporate factors based on historical results which include prior pandemic occurrences.

RBC calculations do not offer an opinion regarding an ideal or an excessive surplus level. Despite this, regulatory considerations around maximum RBC ratio surplus levels have been a discussion topic since the measure was adopted. Some states, notably Pennsylvania, have developed RBC ranges for certain nonprofit health insurers and have recognized a size distinction that suggests higher RBC ratios and target ranges are appropriate for smaller health insurers.

Private Requirements: A Signal of Financial Strength

The Blue Cross Blue Shield Association (BCBSA) owns and manages the BLUE trademarks; while used internationally in 170 countries, the trademarks are primarily associated domestically with licensure granted to independent companies offering health insurance and employee health benefits in exclusive geographic territories. The association of thirty-six independent and locally operated Blue Cross Blue Shield companies provides health insurance to over 100 million people in the United States.

Each licensee has formal requirements that it must meet to maintain good standing within the Association. This includes semi-annual submission of RBC reports. The Association uses these reports to assess and monitor the financial condition of its member companies. Each licensee must maintain RBC ratios greater than 200% of an ‘Authorized Control Level’ to retain licensure of the BLUE trademarks. The 200% ratio is intentionally set at the highest of four threshold levels in the NAIC Risk-Based Capital Model Act. While the BCBSA regards a 200% HRBC ratio as an unacceptable level, it also begins formally monitoring BCBSA licensed companies whose RBC ratio falls below 375% as an early warning mechanism and facilitation of a process to establish corrective measures. Maintenance of a higher minimum level of capital helps BCBSA licensed companies communicate a higher level of brand integrity and financial strength to stakeholders.

Minimal vs. Optimal

Surplus adequacy is usually characterized in two realms. Minimum capital is defined in the regulatory realm and is largely formulaic in nature. RBC provides a measure for a minimum regulatory capital standard, but that measure is not the full amount of capital/surplus that an insurer needs to hold to meet its objectives and maintain an appropriate level[2] of risk exposure.

Optimal surplus reflects corporate-specific objectives and is generally expressed as a preferred RBC range to maximize corporate security, financial efficiency, and furtherance of corporate goals. As each insurance company is unique, the determination of an optimal surplus range is specific to the unique circumstances of each organization. Axene Health Partners, LLC (AHP) has developed proprietary modeling designed to help organizations determine their optimal surplus range; a sample report highlighting our modeling capability is included here.

Optimal surplus is of mutual interest to all stakeholders. In ordinary circumstances, the required surplus generally increases with growth in enrollment and health care expenditures. As costs rise and companies’ revenues are generally growing, a continuous contribution to surplus is usually required to maintain a constant RBC ratio. Unusual events such as the Coronavirus pandemic can cause surplus to diminish; premium rates may rise in the future to rebuild surplus levels, but insurers must be mindful of remaining competitive in the marketplace and regulatory rate review which could limit attempts to rapidly reestablish surplus levels through higher premiums.

Factors That Impact Optimal Surplus

Insurance companies are vulnerable to risks that not only take time to recognize but also require time to respond and implement corrections. From a consumer perspective, “insurers set their prices for a whole year so you don’t have to worry about any immediate jumps in costs”. An insurer’s analytical capabilities, its business distribution, and the regulatory environment will influence its response timeline. As sustained periods of adverse conditions can cause significant losses, insurance companies need surplus levels to withstand difficult times, protect consumers and ultimately prevent corporate insolvency.

Each corporation is inherently different and capital needs are determined by each insurer’s unique circumstances, business requirements, and management objectives. Corporate structure and access to outside capital play a role in determining an optimal surplus range.

Assessment of Optimal Surplus Range

Insurers periodically assess their optimal surplus range. This is a prudent exercise for obvious and less intuitive reasons:

Public Interest – A question on the mind of insurance consumers is of the form “Should I worry about my health insurer being able to pay for the costs?”. Periodic assessment of an optimal surplus range and continuous maintenance of surplus level serve the public well. In ordinary circumstances, surplus requirements generally increase with growth in enrollment and health care expenditures.

Risk Assessment – Without a formal assessment, many insurance organizations do not have a strong sense of what their optimal surplus range is, nor do they understand the likelihood and magnitude of a significant loss over a multiple-year period. A thorough assessment can project potential losses over multiple time horizons.

Risk Tolerance Discernment – An optimal surplus range is dependent on the risk tolerance of corporate management. It may sound surprising, but companies that have not deliberately thought about it do not know what their risk tolerance is and likely have disparate views among management teams. Defining risk tolerance in terms of probabilities of being in a financially challenged position provides clarity of a company’s view toward risk tolerance.

Tangential Learnings – A proper determination of an optimal surplus range investigates corporate processes and assesses strengths and weaknesses. The comprehensive process may reveal opportunities to enhance certain functions that are tangentially related to the project scope.

Understanding of Risk Components – An external review of risk components often reveals items that are not on the shortlist of its management teams’ concerns.

The ACA/Coronavirus Storm

The Affordable Care Act (ACA), signed into law in 2010, brought new risk challenges to health insurance companies. In addition to new market rules and a changing population, the ACA “single risk pool” concentrates pricing exercises into an annual decision well in advance of when premiums become effective. This concentration diminishes opportunities to offset losses through other products with various rate filings throughout the year. In the early years of the ACA, regulatory changes were unpredictable and often occurred mid-year, which did not allow insurers to reflect changes in prices.

The unique nature of the ACA arrangement and the construction design creates new challenges related to surplus requirements. The economic impact of the Coronavirus, likely resulting in greater unemployment and larger individual market enrollment[3], and the new expectation of insurers to provide extra-contractual benefits, provide additional challenges. State dynamics will differ as the 12 of the 13 state based-exchanges are offering an emergency Special Enrollment Period (SEP) while the federal exchange will not reopen.

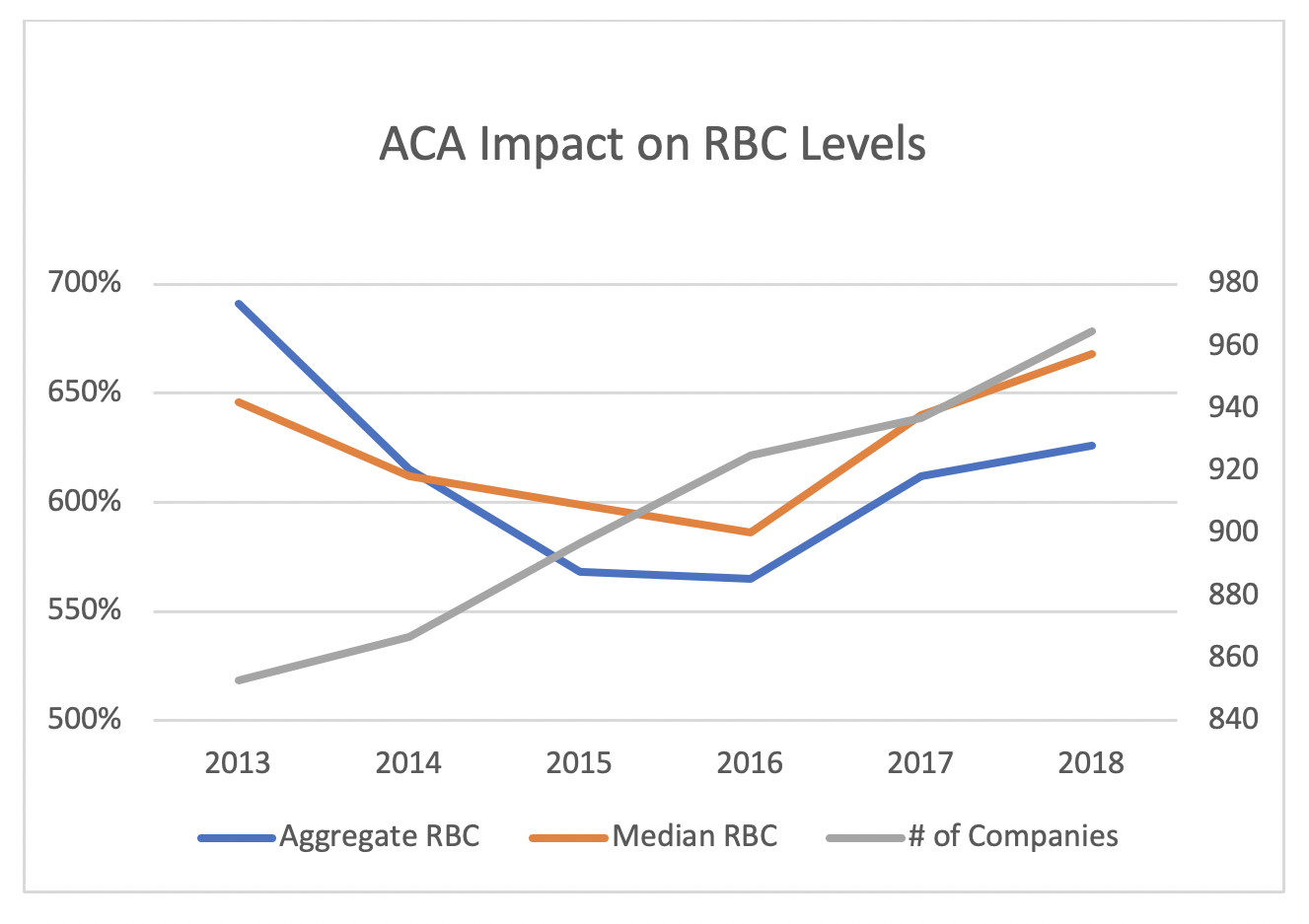

Inherent ACA challenges remain. Rebates subject to the minimum loss ratio requirement act as a one-sided risk corridor; smaller insurers and others subject to larger fluctuations have a greater risk. Risk adjustment continues to be a challenge to predict, particularly for insurers with small market share. A review of aggregate RBC levels reveals a significant drop in RBC surplus since ACA implementation in 2014.

ACA market conditions have improved each year since 2016, and insurers are gradually rebuilding their surplus. Financial improvement began in 2017, but enhanced premium subsidies in 2018 were attractive to both insurers and consumers. A healthier market has attracted more insurers. This naturally reduces premium subsidies, leading cyclically to a less attractive market. The unique dynamics of ACA markets generally require a higher surplus range from insurers with a large concentration of ACA business. The table below illustrates improved financial results, and recent growth in enrollment, popularity and the number of insurers participating in the marketplace.

| More Insurer Participation | Financial (MLR <=80%) |

Subsidized Enrollment Increasing | Popularity >=50% | |

| 2016 | – | – | + | – |

| 2017 | – | – | – | – |

| 2018 | – | + | + | + |

| 2019 | + | + | + | + |

| 2020 | + | ? | ? | + |

The ACA also influenced the products that its enrollees purchase. The rating rules result in incentives that lead to leaner value (aka Bronze-level) plans to be more financially advantageous. In many cases, it is significantly cheaper to pay low premiums and high cost-sharing rather than a higher premium. With the COVID-19 outbreak, many stakeholders are concerned that the significant cost-sharing may result in many individuals not seeking appropriate treatment. At the time of this writing, insurers are voluntarily (and involuntarily being pressured) waiving cost-sharing and co-pay benefits in excess of the basis for which premiums were developed. Commercial group markets are subject to waiving cost-sharing as well, but the risk is greater in ACA markets where cost-sharing is generally higher and the population is older. At the time of this writing, it remains unclear whether the federal government will provide financial support for the extra effort required. The Coronavirus pandemic has added a new risk dynamic. Insurers are subject to known regulatory requirements, and they seek to understand them and develop risk-based premiums accordingly; new requirements and public finance decisions being made in real-time is a new development.

The prospect of insuring a previously uninsured population with restrictive market rules has obviously created unprecedented challenges. Furthermore, the estimation required for assets and liabilities associated with ACA risk adjustment has concerned insurers and regulators alike. The risk adjustment mechanic required insurers to develop pricing factors based on overall market enrollment rather than their own enrollment. This is naturally more challenging for small insurers than large organizations that insure the majority of enrollees in state markets. Rapid insolvency of many new health organizations has renewed the focus on insurers being adequately capitalized. As a result of the Coronavirus epidemic, ACA market dynamics will react to a new employment environment and a change in employed-based coverage. Insurers will need to adapt to understand the shifting risk dynamics inherent in this change.

Conclusion

Health insurance companies require adequate capitalization to maintain operations, achieve their goals in competitive marketplaces and safeguard against insolvency risk. Adequate capitalization is primary to every company’s viability and operations. It is what ensures that promises and commitments to its members can be kept. Fortunately, “most insurers have plenty of capital, and state regulators also keep an eye on them to make sure the companies can pay their medical claims”.

There is a strong public interest in optimizing capital levels. Consumers should appreciate insurers’ efforts to build surplus in good times, and their ability to pay claims and remain viable in bad times. As each company is unique in a multitude of ways, it is worthwhile that they periodically assess its optimal surplus range. With the implementation of the ACA, the need for such an assessment became more acute. Periodic reassessment (every five to ten years) of an optimal surplus range is a healthy exercise for insurance organizations in normal times. In a post-Coronavirus world with expected growth in ACA individual markets, an updated assessment is likely to reveal significant changes in risk exposure. Some companies are now performing a formal assessment for the first time, some at the behest of regulatory agencies and others for internal management purposes.

AHP has performed multiple RBC and Own Risk and Solvency (ORSA) assessments for organizations of various sizes and for-profit status. Each corporation is inherently different, and AHP recognizes that capital needs are determined by each insurer’s unique circumstances, business requirements, and management objectives.

Optimal surplus range development and maintenance of appropriate financial strength provides comfort to regulators and consumers, and it enables insurers to weather unexpected challenges. As a whole, the insurance system is properly designed to manage ‘unknown unknowns’, and maintenance of surplus levels within an optimal range provides assurance that risk-assuming entities are well-prepared to meet their obligations to their customers.

Greg Fann has assisted health plans with establishing optimal surplus ranges related to RBC thresholds and analyzed required capital levels to satisfy Own Risk Solvency Act (ORSA) requirements. Please contact Greg at greg.fann@axenehp.com to discuss logistical opportunities to determine an optimal surplus range.

Endnotes

[1] In the event of a government mandate, procuring overpriced insurance is mutually beneficial in the sense that allows the purchaser to avoid a tax penalty for not having insurance.

[2] It should be noted that the RBC formulas were developed utilizing the experience of poorly performing companies to identify weak insurers and alert both insurers and regulators of potential trouble, not as a metric to rank the financial adequacy of well-capitalized insurers.

[3] A loss of other insurance coverage qualifies for mid-year enrollment in the ACA individual market. An emergency Special Enrollment Period applies to previously uninsured individuals.

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.