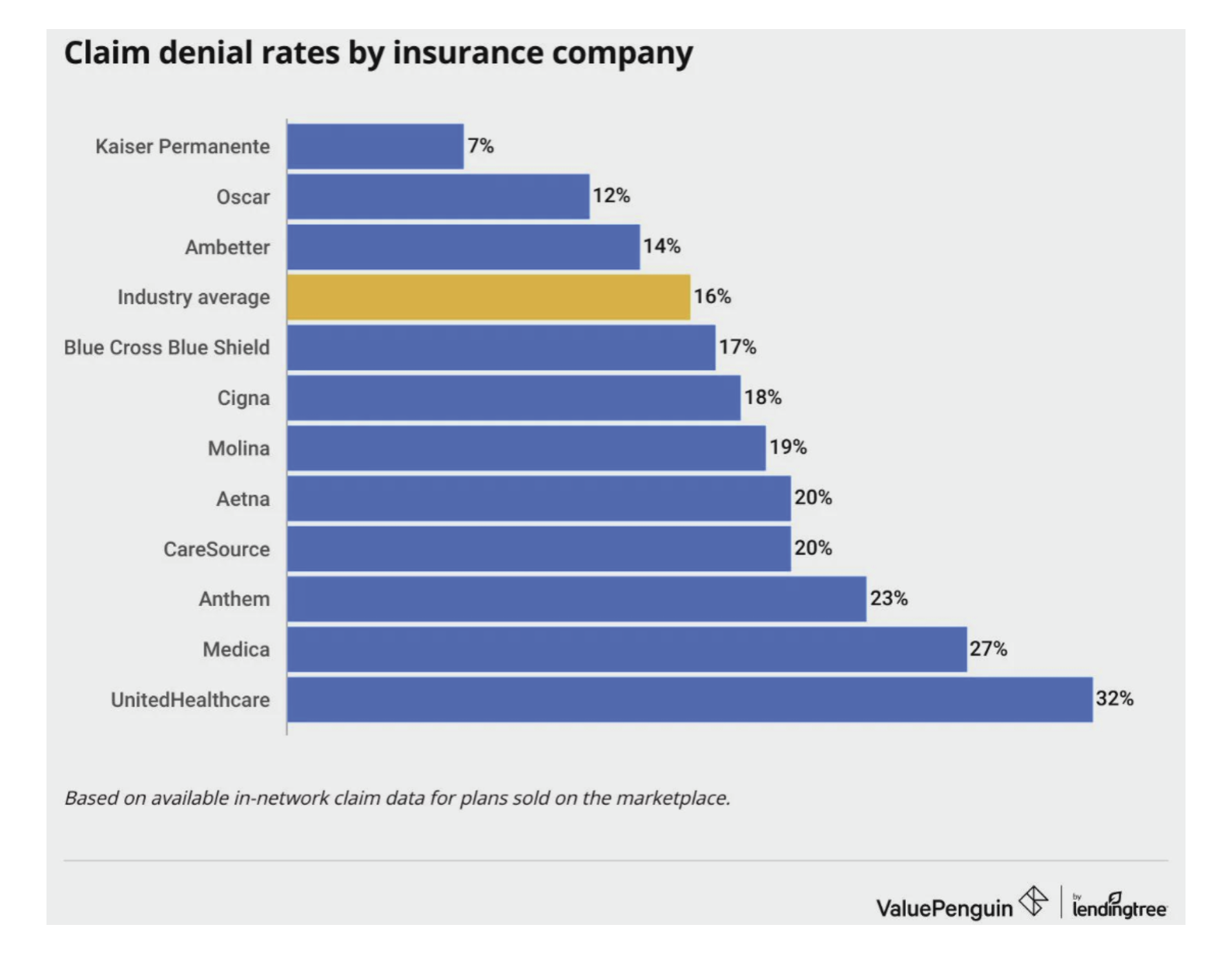

Following the recent shooting death of UnitedHealthcare’s (UHC) CEO, claim denial rates have recently become a highly scrutinized statistic in the news and on social media. I came across the chart below that indicates UHC’s denial rate is twice the industry average. This high denial rate has been hotly debated as a potential reason that prompted the shooting incident.

There are several reasons why claims may be denied, and without more detailed information available, I am not going to speculate what is driving UHC’s high denial rate. Instead, this article focuses on an outlier at the opposite end of the chart from UHC. Kaiser Permanente has, by far, the lowest denial rates of any of the listed insurers. Kaiser’s 7% denial rate is less than half the industry average and less than a quarter of UHC’s denial rate.

Given that the statistics are accurate, the question is how Kaiser achieves such a low denial rate. In my opinion, it is most likely due to Kaiser’s business model as an HMO. Kaiser is both the payer and provider of healthcare services on behalf of its members. This is not true for most other health insurers. Other insurers, such as UHC, are the payers but not the providers of healthcare services. Instead, they form networks by contracting with unaffiliated providers. When these providers submit claims or pre-authorizations, the insurers will often disagree that services are medically necessary and deny the services (i.e., overruling the provider’s medical opinion). This is very frustrating to both the provider and especially the patient. A Kaiser patient does not have to deal with this type of situation very often since the provider and payer are affiliated entities and have a tight-knit relationship.

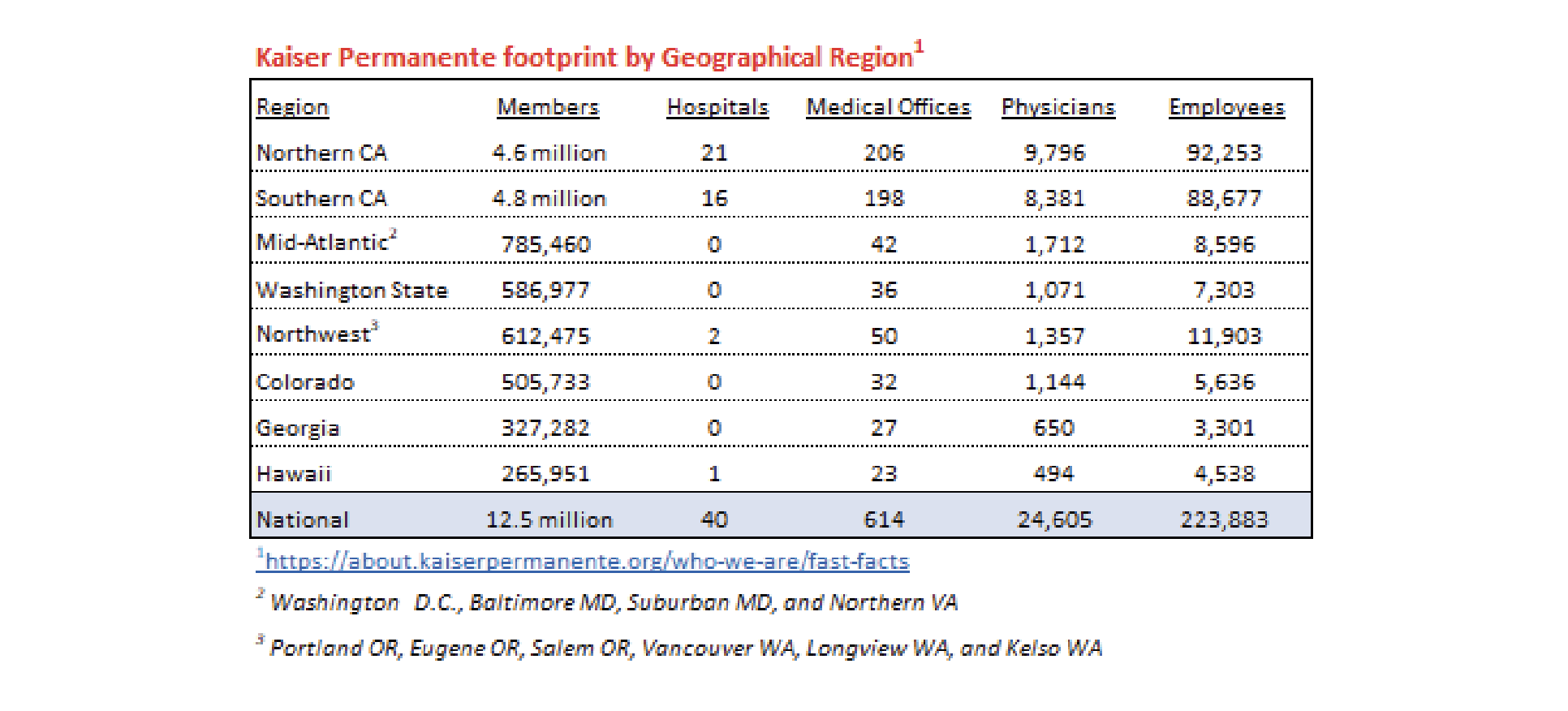

If high denial rates are a critical issue that is preventing and delaying healthcare services, then Kaiser’s care delivery model may be a potential solution. It’s unfortunate, however, that Kaiser has a very small footprint outside of California (see chart below). Kaiser has 9.4 million members in California (nearly 25% of the population) but only 3.1 million across all other states (about 1% of the population) and only three hospitals outside of California.

Although Kaiser has made some progress expanding into Pennsylvania and North Carolina in recent years through their affiliate Risant Health acquiring Geisinger and Cone Health, extending their footprint outside of California is a relatively slow process. I’m not hopeful that much policy change will happen in the wake of the UHC CEO shooting death, but if anything, I am hoping that the Kaiser care delivery model will get its much-deserved recognition and that leads to universal support to fast-track Kaiser/Risant to expand their footprint nationwide and give consumers the option to experience their delivery model.

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.