On June 13th, 2019, the Departments of Health and Human Services, Labor, and Treasury issued a final rule[1] that completed the three goals of Trump’s 2017 Presidential Executive Order: Promoting Healthcare Choice and Competition Across the United States[2]. The first two goals, focused on the expansion of Short-Term Limited Duration and Association Health Plans, intended to provide coverage relief for unsubsidized individuals and some small employers priced out of the high cost individual and small group markets. The final goal expanded the ability of employers to fund Health Reimbursement Arrangements (HRAs) which can now be used to purchase individual market coverage on a pre-tax basis regardless of employer size. However, the question remains, do HRAs create value opportunities for employers and will employers actually consider them?

What is an HRA?

A great explanation of the new rule and background on HRAs can be found on the Health Affairs Blog, Following the ACA: https://www.healthaffairs.org/do/10.1377/hblog20190614.388950/full/. In brief, an HRA is an account-based group health plan, similar to HSAs, that is owned by the employer and can be used to pay for medical expenses. Only the employer can contribute to the account and the amount put into the account is tax deductible to the employer. HRA funds can be rolled over at the end of each year but employees do not own the account and as such cannot take the account funds with them if they change employers. Prior to 2016, HRAs had to be coupled with a qualified group health plan which meant employers could not simply offer an HRA as a stand-alone health benefit. In 2016, the 21stCentury Cures Act allowed an exception for small employers with fewer than 50 full time employees to fund HRAs that could be used to purchase individual market insurance as a stand-alone health benefit.

What’s New?

The new final HRA rule is set to go in effect for plan year 2020 and there are a few major changes to the current rules in place. I highlight some of them below:

- All employers of any size can now offer an HRA as a stand-alone health benefit. For larger employers (50+), if the difference between the amount contributed in the HRA and the lowest cost on-exchange Silver premiums (in other words the employee contribution to premium) are deemed affordable (no more than 9.78% of the employee’s household income) than the HRA is sufficient to satisfy the employer mandate.

- Employees can receive subsidies only if the HRA amount is deemed unaffordable and they reject the HRA account all together. Previously, the subsidy was reduced by the HRA funds but now the full federal subsidy is given, potentially resulting in more money back to the employer for these low-income employees.

- If employees purchase off-exchange coverage, then the employee portion of the premium contribution can be tax free as well[3].

- Contribution limits were eliminated. In 2019, small employers could contribute up to $5,150 annually ($429.17/month) for self-only coverage and $10,450 annually ($870.83/month) for family coverage.

Where’s the Value?

The Trump administration believes that this new rule will usher in 11.4 million new enrollees in the individual market by 2029 with 6.9 million coming from those currently covered in the group market. In a market that has less than 16 million enrollees[4], the administration is predicting that overall enrollment will nearly double. However, when it comes to Obamacare, predictions are as trustworthy as Buffalo Bills quarterbacks. Just ask the CBO about their close to 25 million individual market enrollees by 2018[5] prediction. While it’s difficult to predict magnitude, I can predict that this rule will increase enrollment overall as some employers will find it advantageous to fund HRAs going forward. As with all things in the ACA, the value equation is different for different types of employers.

Small Employers Currently Offering No Coverage

Approximately 25-30 million employees work at firms employing less than 50 full time workers[6] and are not subject to the employer mandate. Of those firms, only about 34% of them offer health coverage in 2018 down from about 48% in 2010[7]. The administration believes that this new HRA rule will have the greatest effect on these roughly 15-20 million employees who don’t receive benefits from their employer.

Where is the value: Something is better than nothing! If you are a small employer and currently offer no benefits, your employees will either have to purchase individual market coverage on a post-tax basis or receive coverage through their spouse’s employer. Two huge benefits can be offered to employees through an HRA:

- Employees can receive some money to purchase insurance. This could be $1,000 a year, could be $5,000+. Anything is better than $0 and if the employee doesn’t purchase individual coverage, the HRA is forfeited and costs the employer nothing.

- Any amount given in the HRA will qualify employees to purchase individual market plans on a pre-tax basis if the employer allows salary reductions through a cafeteria plan[8]. The new rule extended the tax benefits to the employee contributions toward premiums as opposed to just the employer contribution to the HRA. This tax benefit only applies if the plan is purchased off-exchange. This is a great benefit, especially for those employees currently footing the entire cost of individual market premiums on a post-tax basis.

Where are the problems: The biggest landmine for small employers is making sure they don’t make current employees worse off by disqualifying them for federal subsidies. Employees qualify for subsidies if they make less than 400% of the Federal Poverty Level (FPL), $49,960 for individuals, $103,000 for a family of four AND they do not receive “affordable” coverage from their employer. In terms of the HRA, affordability is measured by taking the difference between the lowest cost Silver on-exchange premium and the monthly contribution to the HRA. If the remaining amount is less than 9.78% of the employee’s monthly pay, then the HRA coverage is deemed “affordable” and the employee does not qualify for federal subsidies. Let’s do an example just to make it clear.

Travis Best (employee): $30,000 annual salary ($2,500 a month)

Affordability = $2,500 x .0978 = $245.

Lowest Cost Silver On-Exchange = $400

HRA Affordable Threshold = $400 – $245 = $155 ($1,860 annually)

The HRA Affordable Threshold is the maximum amount the employer can contribute without disqualifying the employee for federal subsidies. The employer cannot give Travis Best more than $155 a month, otherwise Travis would no longer qualify for federal subsidies. An employer will have to do this analysis for every low-income employee and target a contribution amount that does not trigger the loss of individual market subsidies or balance that decision against offering better benefits for higher income employees. The employer can give different amounts to different classes of employees such as part-time vs full time, hourly vs salary as well as vary the contribution by age and family composition. These flexibilities may allow for targeted contributions to maximize benefits. Each benefit year an evaluation of salaries and available individual market premiums will need to be completed.

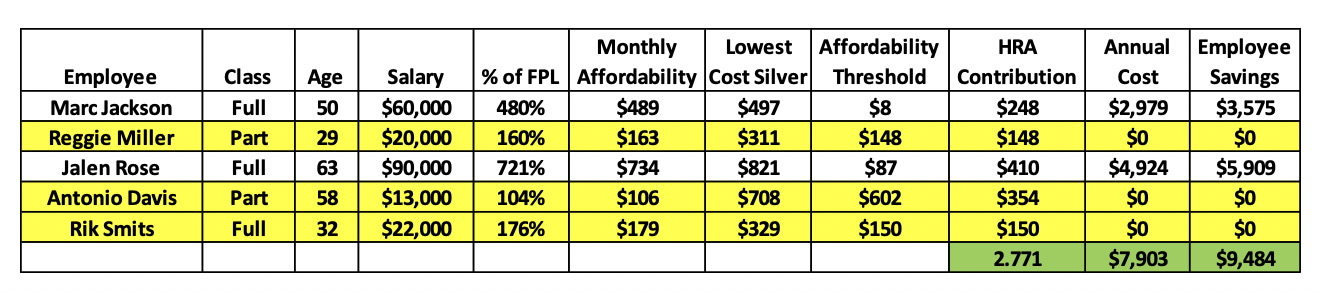

Contribution Example: The following is a five-employee firm that is seeking to cover 50% of the lowest cost silver premium and allow the low-income employees to qualify for subsidies. The yellow highlighted rows are the low-income employees. The affordability threshold for these employees is the amount that the HRA contribution must be below for the employee to receive federal subsidies. In addition, the HRA contribution difference between the highest and lowest ages cannot be more than 3 for a particular class of employee.

Offering to pay 50% of the lowest cost silver plan for every employee would have disqualified Reggie Miller and Rik Smits from receiving federal subsidies. However, the employer can vary the contribution by age which means they can set the contribution to an amount that no longer disqualifies these employees from receiving subsidies. By running the analysis and targeting the ideal HRA contribution, this employer is able to preserve the federal subsidies for his low-income employees and save his higher-income employees $9,484[9] at a $7,903 cost to the firm. All of the employees now have access to health coverage at a more reasonable price.

Small Employers Currently Offering Coverage

Approximately 10-15 million employees work at firms employing less than 50 full time workers and are receiving health coverage through the small group market. The small group market, like the individual market is a community rated market. That means that the health risk of a particular small employer is not considered when developing the premium rates just as the health status of the individual is not considered in the individual market. Instead, health risk is combined statewide through the single risk pool requirement for insurance companies and then even further through the risk adjustment transfer that essentially forces health insurance companies to rate premiums based on the market wide statewide average risk.

All of that is to say the individual market is a direct competitor to the small group market as both markets offer age rated premiums that do not vary by health status. If a Blues plan is 10% cheaper for a 40-year-old in the small group market, than a small employer has little incentive to favor the individual market over the small group market. The HRA does add some incentive via increased choice and roll over amounts, however, price should be the biggest driver.

Where is the value: In select states and select regions within a state, individual market premiums might actually be cheaper than small group market premiums. There are a couple of considerations here. First, some low-cost health plans that are unique to the individual market offer premiums 10-20% cheaper than commercial health plans in return for more restrictive physician and hospital access. These plans are often referred to as Medicaid-focused plans[10]and are Medicaid managed care plans that have expanded into the individual market. The biggest players are Centene and Molina. Additionally, some individual risk pools are similar to the small group risk pools or better and may have certain carriers offering more favorable rates in the individual market. Two benefits can be offered to employees through an HRA:

- Premium savings where individual market premiums are favorable to the small group market could save employers money for those employers currently purchasing insurance in the small group market.

- On top of premium savings or when premiums are similar between the markets, employees could benefit from increased choice. Employees may choose to purchase lower coverage in exchange for saving money. This can be done by choosing Bronze plans or Medicaid-focused plans.

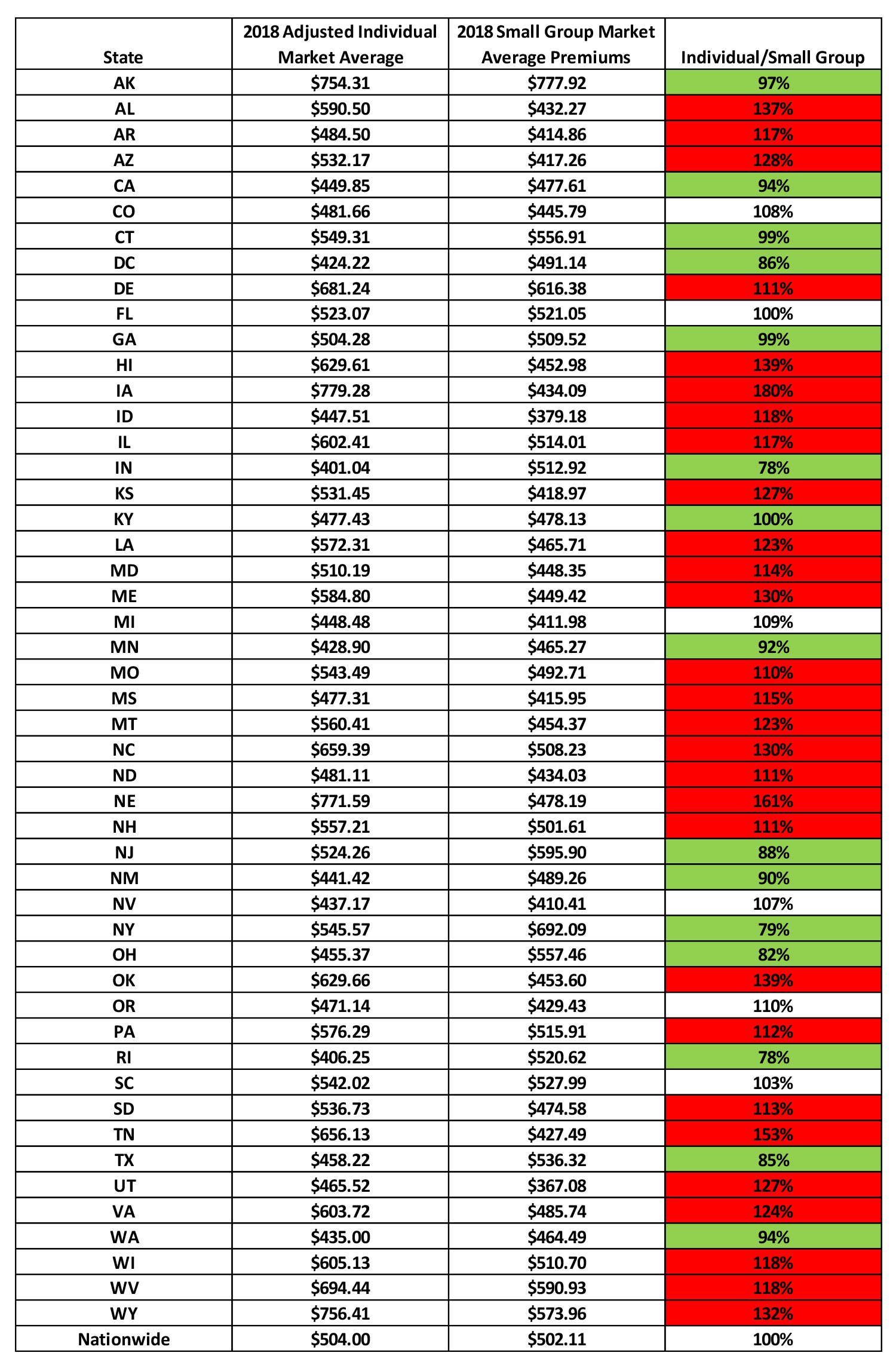

To get a sense of where value may exist, we performed a high-level analysis of the Appendix A to 2018 Benefit Year Risk Adjustment Summary Report – HHS Risk Adjustment Program State-Specific Data produced by CMS[11]. Adjusting the individual statewide average premiums for the average Small Group rating factors (Age, AV and Induced Demand), we compared the individual market adjusted average premiums to the small group average premiums[12]. The following table shows the results with the green highlighted states representing states with lower individual market premiums, white colored states where individual and small group market premiums are similar and red colored states where individual market premiums are more than 10% higher than small group premiums.

15 states have individual adjusted average premiums lower than the small group market average premiums. Small employers currently offering coverage in these states could benefit from performing an in-depth analysis of potential savings for switching to an HRA benefit for employees.

Where are the problems: Administrative difficulties may exist for switching over to an HRA. The employer will need to create a system that verifies employee purchase of individual coverage along with other cumbersome administrative tasks like analyzing employee salaries, reviewing individual market premiums and deciding what contribution to make.

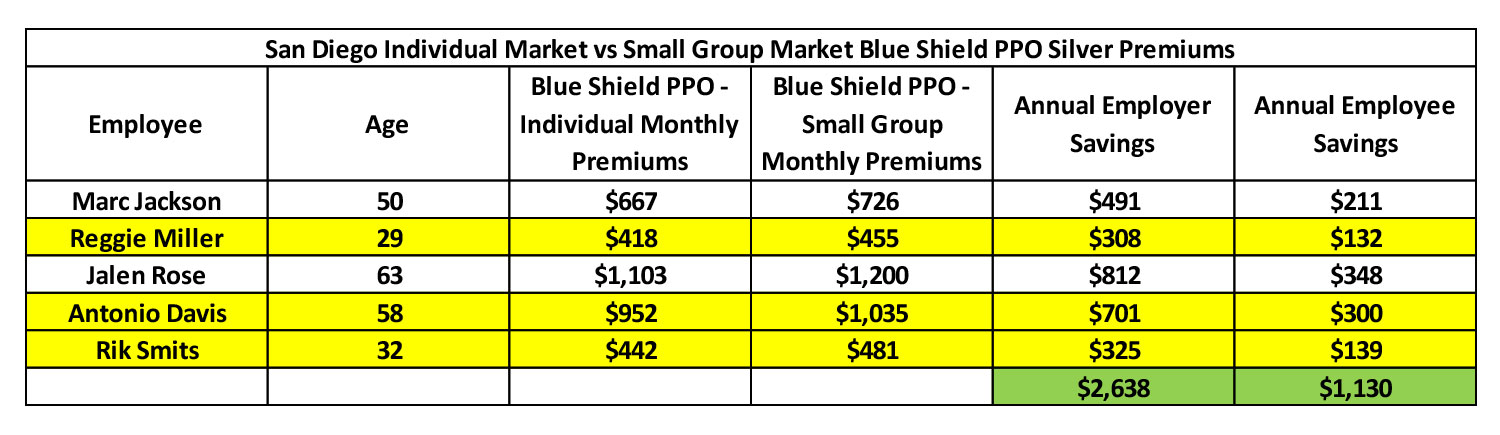

Premium Comparison Example: The following example shows a premium comparison using actual premiums for the average 2019 Blue Shield PPO premiums available in the individual and small group markets in San Diego, CA. The employer in this case covers 70% of the premium.

In this example, if the small employer in San Diego is currently offering a Blue Shield PPO plan to their employees, the employer could save the employees $1,130 and save $2,638 by switching over to an HRA benefit. That’s assuming the employees choose the same plan.

Large Employers Currently Offering Coverage

Most employees in the United States work for a large employer and receive coverage through their employer. While the new HRA rule opens the possibility for large employers to cover their employees through HRAs it is unlikely that they will. For one, the premium costs in the individual market will on average be up to 20% higher than the large group due to higher morbidity in the individual market. Only large firms that have much higher health risk and who are experience rated will be able to find savings in the individual market.

The other issue in the individual market is that currently health insurance companies compete on Bronze and Silver but not so much on Gold and Platinum premiums[13]. Large employers typically offer Gold or Platinum level coverage so if there were to be savings to be had, the employer would not find them in the rich benefit plans but rather in the lower benefit plans. Employees may not find a move to high deductibles to be desirable.

Where is the value:

- High risk experience rated large groups may find cheaper community rated plans in the individual market.

- Large Employers who desire to control annual expenses can move to a community-rated environment and tailor fit contribution amounts to keep expenses stable.

Where are the problems: The same administrative and employee involvement issues exist as mentioned for the small employers currently offering coverage.

What Will Happen?

As the saying goes in Texas, don’t get me lyin’! But that’s no fun. My prediction is that many small employers will find this to be an advantageous option for funding health care benefits but the administration’s prediction is far too ambitious. The administration predicted 4.5 million new enrollees will come from those not receiving coverage through their employer. Small employer coverage dropped from 48% to 34% from 2010 to 2018. Rules may be more favorable now and I predict that the 34% will rise above the 48% to 55% if accounting for HRAs. That could result in 3 million new enrollees in the individual market[14]. For employers who currently provide coverage I do not see a great amount of benefit or incentive to migrate employees to the individual market. The administration predicted 6.9 million enrollees to come from the group market. The states where individual market premiums are favorable comprise about 5 million small group enrollees. At most, I would predict 20% migration resulting in 1 million new enrollees. Overall my prediction is lower than the administration at 4 million new enrollees over ten years vs 11.9 million.

Final thoughts

The biggest benefit is for those small employers currently not offering any benefits to their employees. They have little to lose and a lot to gain from simply providing some level of assistance to their employees. HRAs allow for the control of expenses and provide favorable tax treatment for individual market premiums. Value exists for HRAs in 2020 and beyond and it is incumbent upon employers to seek out that value. Half of the battle is marketing and employer benefit consultants or brokers will need to be able to understand the new rule and clearly articulate the value proposition for employers seeking to add benefits or control costs.

As far as its impact on our American health care system goes, this new rule is a drop in the bucket. It will, however, likely have a greater impact than the Short Term Limited Duration and Association Health Plans which as Avik Roy put it, were like “rain drops on a rhinoceros”[15]. Perhaps this is more like raindrops on Gorillas[16] that boosts enrollment by 20-25% but still impacts a small portion of the overall health care industry. Going forward, the biggest drawback to HRAs is that they are not portable and are not employee owned. Expanding this type of purchasing power to HSAs and untangling some of the HSA requirements like being tied to an HDHP would be a huge victory for the American consumer[17]. The expanded HRA rule is a welcomed step in that direction.

[3]FAQs on New Health Coverage Options for Employers and Employees, Q1 – https://www.irs.gov/pub/irs-utl/health_reimbursement_arrangements_faqs.pdf

[4]https://www.markfarrah.com/mfa-briefs/a-brief-analysis-of-the-individual-health-insurance-market/

[5]Figure 5: https://www.cbo.gov/system/files/115th-congress-2017-2018/reports/53094-acaprojections.pdf

[6]https://www.sba.gov/sites/default/files/advocacy/2018-Small-Business-Profiles-US.pdf

[7]https://www.dol.gov/sites/dolgov/files/OPA/factsheets/wh-hra-factsheet.pdf

[8]https://www.investopedia.com/terms/c/cafeteriaplan.asp

[9]Assumed 20% savings due to tax benefits.

[10]https://www.healthaffairs.org/do/10.1377/hblog20180823.490433/full/

[11]https://www.cms.gov/CCIIO/Programs-and-Initiatives/Premium-Stabilization-Programs/index.html

[12]The Risk Adjustment Report does not adjust the Actuarial Value and Induced Demand factors for the CSR-enhanced benefits. In order to compare the premiums we used actual AV and Induced Demand factors for the proportion of CSR 87/94 enrollees in each market. The proportion was estimated using the CMS 2019 Marketplace Open Enrollment Period Public Use Files (https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/2019_Open_Enrollment.html).

[13]https://axenehp.com/fields-of-gold/

[14]Assuming half of the non-covered small group employees currently don’t have individual insurance.

[15]https://www.youtube.com/watch?v=CHbWYm3IiLg

[16] https://www.bing.com/videos/search?q=gorillas+scared+of+rain&view=detail&mid=10542A524E2E6464934110542A524E2E64649341&FORM=VIRE

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.