BILLY BEANE

Exploit the fact that unspectacular runs are just as valuable as 450-foot bombs.

PETER BRAND

Unspectacular runs are more valuable.

BILLY BEANE

Why?

BEANE AND BRAND SIMULTANEOUSLY

Because they cost less.

– Moneyball, 2011

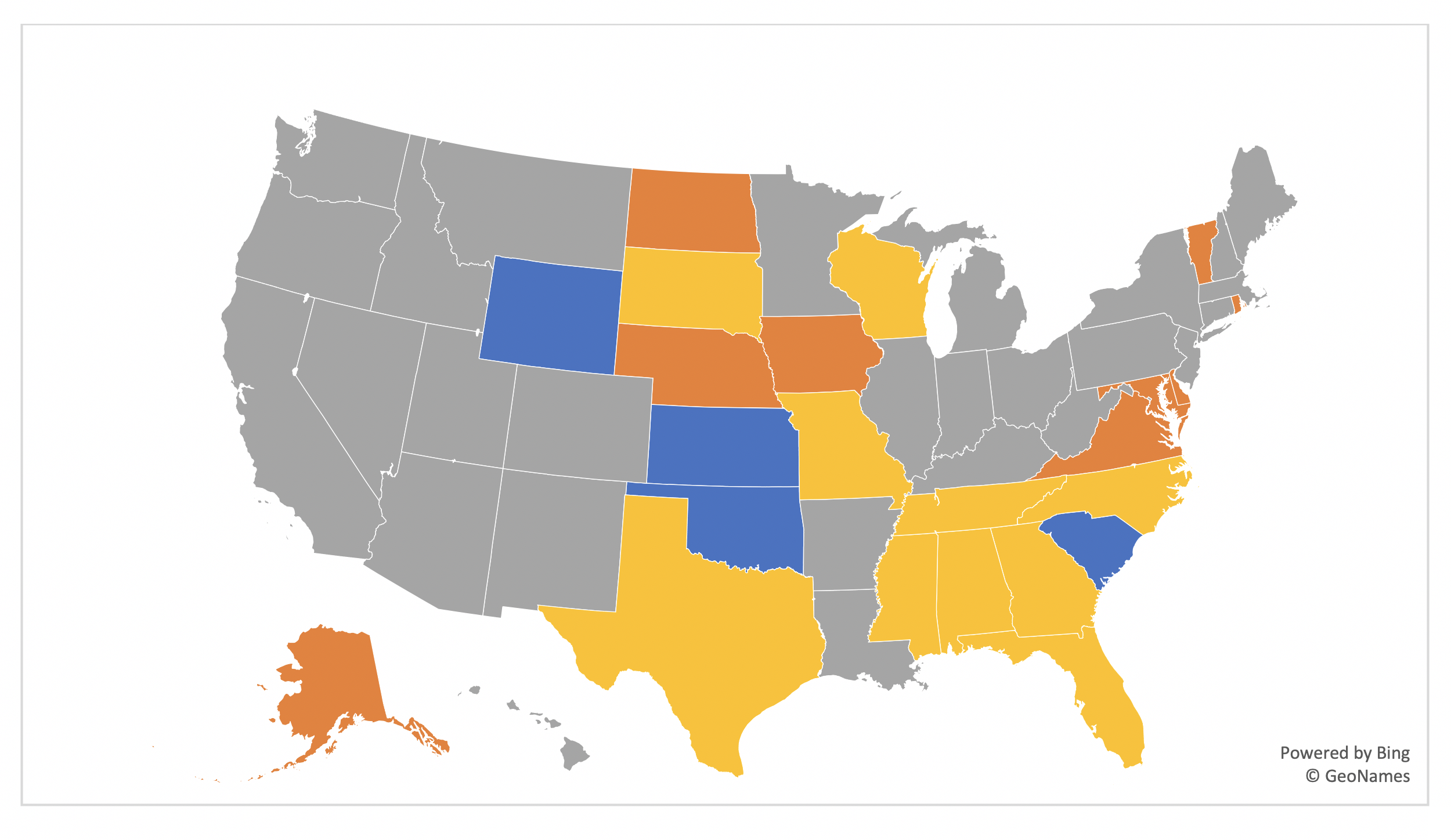

You have seen the maps. They are pretty and color-coded. They show which states have expanded Medicaid, which operate their own exchange in the Affordable Care Act (ACA) markets, and which have applied for a Section 1332 waiver. Each of these decisions has been applauded (not universally) and each effectuation provides states with opportunities to enhance markets. They also cost states money.

How do we measure value and determine whether such actions are worthwhile? It is a formulaic consideration, and it involves subjectivity regarding what worth we place on measurable items. States exploring a reinsurance wavier may compare the expected premium savings for consumers relative to the required state contribution. They should also consider the premium subsidy implications and the resulting impact on low-income enrollees.

States exploring a Medicaid expansion may consider the budget implications, the projected impact on the uninsured rate, and the residual individual market impact on premiums and subsidy dynamics. State-based exchanges can control local operations, determine enrollment periods and keep lionfish out of their markets, but there are new responsibilities and administrative costs involved.

A comprehensive review of state markets reveals that highly publicized, state actions generally improve markets; Return on Investment (ROI) “value” was not calculated in this review as state costs were not readily available. However, the highlight revelation is that simply having actuarially appropriate pricing relationships between subsidy-generating silver plans and other plans, tremendously improves consumer value in markets, much more so than the notable and publicized costly options.

Value can be constructed as an objective measure, but there are sometimes subjective tradeoffs. In my work across the country, I have found the correlation of unsubsidized and subsidized premiums to be about -20%. This means that reducing premiums for higher-income people increases premiums for lower-income people, but it is a partial offset. Reduced gross premiums alone can result in higher rates for low-income enrollees, and facilitate disenrollment for price-sensitive consumers and render the risk pool more difficult to predict.

These tradeoff decisions are no longer theoretical as ACA dynamics once relegated to actuarial newsletters become understood once actual consumers are impacted. Colorado’s insurance commissioner Michael Conway understands and accepts the ACA dilemma with a reinsurance waiver, “We’re going to always fight to lower (gross) premiums (for the unsubsidized population) and we just have to figure out a way to deal with the downstream impacts on the subsidized population.”

A complete assessment of value should involve state costs and a holistic impact on ACA enrollees, both subsidized and unsubsidized. A long-term view recognizes that reduced subsidized premiums can easily lead to lower unsubsidized premiums through attracting a healthier enrollment base, and not the other way around.

A recent RAND study reveals surprising news; the “compressed” 3:1 age slope is too steep. It is not steep enough for a general population, but it is too steep for the enrolled ACA population. The rationale for the enrollment dynamics is that subsidized premiums are related to income rather than expected costs. Younger people and older people are charged the same premium for a benchmark plan; older people paradoxically pay less for plans priced below the benchmark. Consequently, there is broad enrollment for older individuals, while younger enrollees are limited to predominantly an unhealthy mix.

This dynamic is explainable and can be offset. Premium subsidies are artificially deflated by Metalball, increasing net premiums and rendering the market less attractive to primarily young healthy enrollees. Appropriate pricing relationships would increase premium subsidies, lower net premiums, and catalyze a healthier, more balanced risk pool. It seems too simple but it’s true; enforcing ACA rules appropriately aligns metal level pricing, reduces net premiums, attracts a healthier enrollment mix, and ultimately reduces gross premiums in the marketplace This dramatically improves markets at virtually no cost. As of 2020, a minority of states are at “equilibrium” pricing relationships.

Rate review focused on relevant measures is mutually beneficial, ensures compliance, and benefits all consumers. Alternatively, negotiating an issuer’s rate change from 12% to 9% through a change in trend assumptions may look good in the newspaper, but it accomplishes none of these goals. Winning a debate over speculative assumptions is aesthetic and temporal; requiring fidelity to ACA rules is important, meaningful and long-lasting; and it provides immeasurable and real value in ACA markets.

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.