The Patient Protection and Affordable Care Act (ACA) is known for its non-intuitive paradoxical mechanics in the individual market. The defunding of cost-sharing subsidies increases government spending, lowers net premiums and enhances ACA market enrollment. Premium rate increases are good news and result in lower net premiums for some individuals. Free coverage is available, but inexplicably more so for older enrollees in higher cost areas. New competition in markets only makes current coverage more expensive, as does implementation of cost-saving initiatives.

The specific dynamics of the ACA subsidies were first discussed in the May 2014 edition of Health Watch, a Society of Actuaries publication. The examination of ‘Implication of Individual Subsidies in the Affordable Care Act’ revealed some new philosophical challenges for Rate Review regulators. It was noted that state insurance departments historically balanced the competing goals of consumer protection and solvency. Naturally, lower premiums served the interest of consumer protection and higher premiums protected insurer solvency. This purity of this offsetting balance was changed with ACA dynamics in 2014 and further compounded in 2018 as each led to more consumers benefitting from higher premium levels.

“With the federal government subsidies affecting net premiums, states should understand the new complexities of the subsidy mechanics and the impact of the rate review process across the population. Ironically, some of the states that were first in line to announce that they would accept federal funds for Medicaid expansion have also reduced the federal liability for exchange subsidies through the rate review process, which likely increased the net cost for some low income exchange enrollees in the process…The rate review process benefits higher income individuals but actually increases net rates on low income individuals. This anomaly might alarm regulators who view the rate review process primarily as a consumer protection function with a focus on representing low income residents.”

The Rise of ACA Rate Review

Prior to the ACA, external review of premium rates proved to be a worthwhile endeavor. The robustness of review levels varied widely by state, due to different regulatory rules, expertise of staff, and funding commitments. A major selling point of the ACA was increased regulatory opportunity to prevent “insurance company abuses”. When the ACA was passed, Rate Review was considered a crucial component. States received federal grants to beef up their Rate Review processes; this provided “states much needed resources to build on their historical primary role of reviewing proposed health insurance premium increases and to hold insurance companies accountable for unjustified premium increases.”1

In the ACA’s 3rd best year, the Society of Actuaries Health Section published The ACA@5: An Actuarial Retrospective. As I described in 2016, it “provided a comprehensive look back at the work of actuaries related to the implementation of the ACA. At the time, there was a general sense of cautious optimism regarding the ACA. The early implementation struggles had been resolved; market participation was active for buyers and sellers; and several legal battles that reached the U.S. Supreme Court had been weathered”.

A fascinating article from the compendium was ‘A Regulatory Perspective on Rate Review Before and After the Affordable Care Act’. It detailed the changes in the regulatory environment after the ACA implementation. Notably, it was mentioned that while “the responsibility of the state regulatory actuary has increased, the actuary’s sphere of control is smaller than ever before”. Overall, it hinted at a more complicated review process and stricter rate regulation than the pre-ACA world. Undoubtedly, most insurers would agree with that assessment in the ACA’s early years.

The Fall of ACA Rate Review

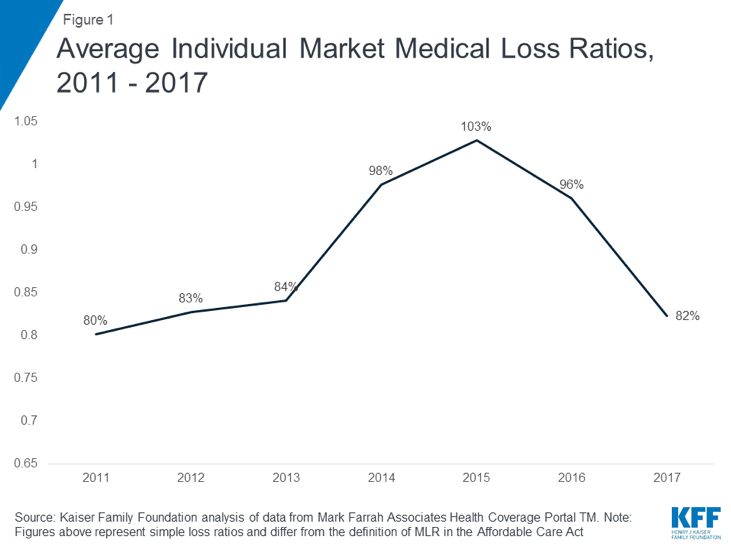

In recent years, Rate Review has become less fashionable. There are several apparent reasons for this. First, more states recognize that premium rate levels serve mixed constituencies. Advocates (the mathematically-inclined ones at least) for low-income individuals realize that gross premium levels are not correlated with net premiums and have shifted their focus to mechanical items such as increasing subsidies through formulas or preserving “Silver Loading”. Second, as ACA market competition has dwindled, states have lost their traditional leverage. Rather than seeking moral victories through reduced rates, some states celebrate the mere fact of maintaining insurers in their markets. Third, the usual outcome (not always) of Rate Review is a reduction in premium levels. When medical loss ratios are averaging close to 100% in ACA markets as they did 2014-2016, almost everyone agrees that the problem is not ‘premiums excessive in relation to benefits’.

Improved ACA Markets

In 2017, President Trump received a recommendation from the Department of Justice (DOJ) to stop funding CSR payments. The implications of this have boosted premium subsidies to low income individuals and led to improved markets. The good news began in 2018 as “enrollment significantly exceeded expectations, insurer profitability skyrocketed to record levels, and premiums decreased for the first time in 2019. The beneficial market changes reignited insurer interest, and the number of state-levels insurers increased 17% in 2019 after a 28% reduction in 2017 and a 21% reduction in 2018.”

While not every state has seen more insurers return to ACA markets, all states have opportunities to benefit from the federal changes. A constructive Rate Review process can play a large role in enhancing state markets.

Mutually Beneficial Rate Review

Federal regulatory activity was heavy in the first two years of the Trump administration. While there are mixed sentiments regarding the intentions and implication of policy changes, ACA markets have improved in recent years. While ACA markets are smaller than expected and some challenges remain, the recent regulations facilitate new flexibility for states to improve their markets. When we hear ‘opportunities for states to improve their markets’, we undoubtedly think of Section 1332 waiver opportunities. While the 2018 guidance has been criticized for sending political signals, the substance in fact allows states to resolve many of the structural inefficiencies within the ACA framework.

The less obvious solution is through mutually beneficial Rate Review. Mutually beneficial Rate Review? What is that? By “mutually beneficial”, we are referring to stricter compliance with ACA rules that ultimately benefits both insurers and consumers. In a nationwide analysis, a colleague and I observed large disparities in metal level slopes across the country. In many instances, premium subsidies are compressed, resulting in higher premiums for low-income individuals. This suggests that some states have a stronger review process related to the appropriateness of Actuarial Value and Induced Demand factors. It is also conceivable that insurers in some states filed rates with appropriate rating slopes, rather than a rate review process being responsible for such alignment. We did not investigate the rationale for each of the state variances, but we noted that many states have relationships that are not properly aligned, resulting in lower premium subsidies, higher net premiums, and a more challenging environment for insurers, consumers, and state regulators. Mutually beneficial Rate Review is an obvious solution.

Conclusion

Rate Review was a high-profile item in the early days of the ACA. As insurer financial results worsened and competition was thin in many markets, aggressive Rate Review practices logically fell out of favor. Regulatory changes in 2018 have re-energized markets and attracted more insurers in 2019. A nationwide scan of premium rates reveals variances outside the bounds of effective Rate Review. Fortunately, greater Rate Review enforcement would result in mutually beneficial outcomes for both insurers and consumers. States should return to a stronger Rate Review process, and one that is focused on appropriate actuarial factors rather than overall rate levels. If states would renew their commitment to Rate Review as the new dynamics are mutually beneficial, that would be great.

Axene Health Partners, LLC has developed a Market Optimization Model (MOMTM) to measure rate review and premium efficiency in state markets. Please contact Greg Fann at greg.fann@axenehp.com for details.

1 https://www.cms.gov/CCIIO/Programs-and-Initiatives/Health-Insurance-Market-Reforms/Review-of-Insurance-Rates.html

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.