Each year around this time, we can gain tremendous insight from reading articles preceding the annual open enrollment period (11/1-12/15 in most states) in marketplaces of the Affordable Care Act (ACA), colloquially known as Obamacare. The insight this year could be the most valuable yet, learning to separate the underlying and oversized ACA politics from actual policy.

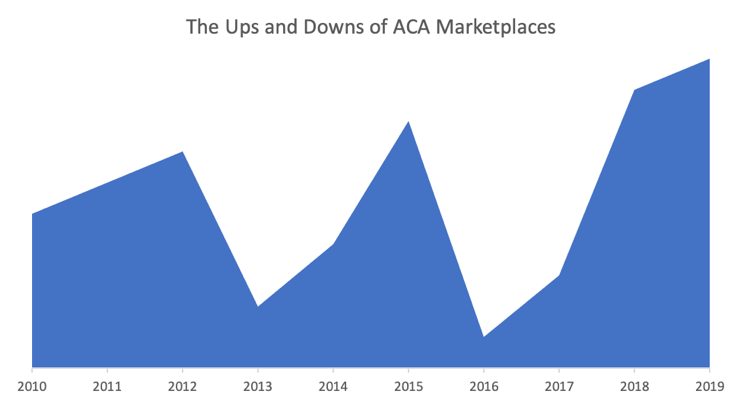

A recent Politico headline led with “Obamacare is stronger than ever”. I agree. In conjunction with its ninth birthday in March, I analyzed and ranked the performance of the ACA for each year of this decade. 2018 and 2019 were by far its best years, and it was foreseeable that 2020 could be even better. Importantly, the positive headline is diametrically opposed to the opening of a Politico article two years and two days earlier “Obamacare is about to have its worst open-enrollment season ever”. This is important because there have not been policy changes between 2018 and 2020 that can appreciably explain a “worst ever” to “strongest ever” level of market improvement.

Politico’s 2020 rationale is “it’s clear the ACA is maturing”, but to obtain that clarity, you have to first “separate the politics from the policy”. I take strong exception to the suggestion that markets have completely turned around in two years due to simple maturation (rather than responding to policy change) and the uncanny notion expressed by Politico and others that insurers have suddenly become smarter about how insurance regulation works, the same way I objected to “large investment firms who lose billions of dollars in one year and regain it in the next have suddenly become smarter investors.” However, the mere mention of ‘separating politics from policy’ is encouraging and raises cautious optimism in those of us who have no hesitation in casting aside the rigid requirement that policy implications must align with ascribed political motivations. We have been waiting for years for the rest of you to join us, and Politico cracked that door open this morning.

Why is Politico’s view of 2020 open enrollment different than 2018? The 2018 assessment was simply wrong and grounded in politics. It was a view largely cemented on a lack of political support overriding the fundamental financial dynamics in markets, and peppered with claims like “Trump won’t be going on TV comedy shows to urge people to sign up”. Politico’s 2020 view is appropriately based on 2018 policy implications, not necessarily from a technical understanding of market dynamics but from observation of the discernible policy impact in 2018 and 2019 that was rationally predicted from a policy-based viewpoint. One policy-based view impressively and accurately predicted stakeholders’ behavior as a result of delayed timing in understanding policy implications.

Why is this important? Unwillingness to separate politics from policy prohibits understanding of a wide range of potential outcomes and limits retrospective explanation of policy implications. It creates confusion and results in the dissemination of misinformation. I discussed the incoming “good news” related to policy changes before the 2018 open enrollment period but my claim was not the headline; the rosy implications should have been the primary message, but instead were a positive offset in a “Confusion abounds” story in a major market newspaper. Each year, ACA results are almost always surprising to those who hold politically-based viewpoints, and politically-based narratives are developed to backfill the rationale. This is both amusing or frustrating to those who hold policy-based viewpoints and aim to improve markets by communicating a transparent understanding of technical dynamics.

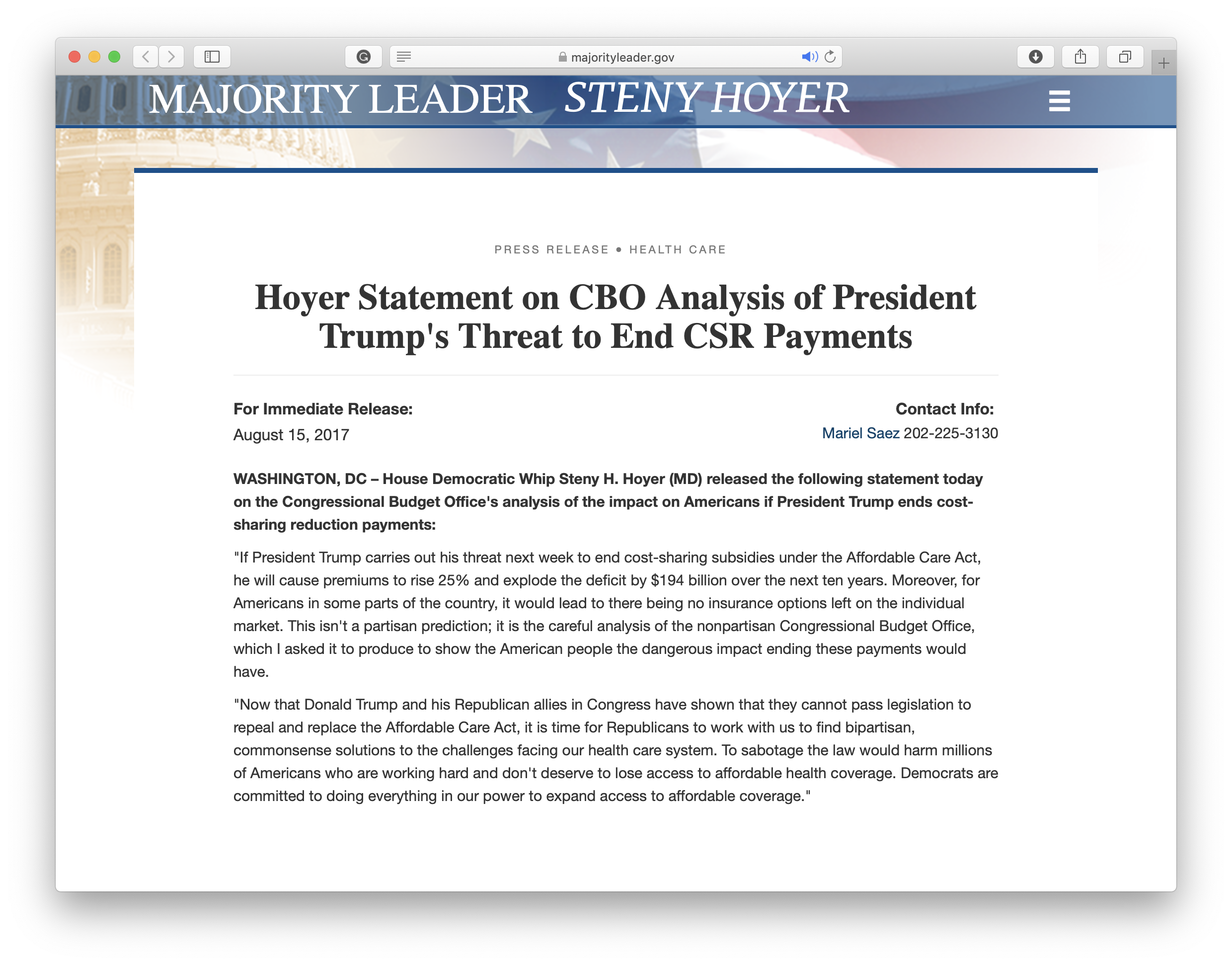

The intrinsic problems (community rating, family glitch, subsidy cliffs, paradoxical dynamics, inefficient use of federal dollars to incent the purchase of health insurance) inherent in the ACA model still plague ACA markets; they haven’t been diluted at all by market maturation. President Trump is unable to change the basic ACA structure without Congressional legislation, although states can now address some of these items through Section 1332 waivers. President Trump’s policy actions have primarily impacted ACA markets in three ways: (1) In 2018, his adherence to a court ruling and a Department of Justice recommendation added federal funds to ACA markets which increased premium subsidies for eligible consumers. (2) In 2018, he revised Section 1332 guidance to be more flexible for states. (3) In 2019, he added flexibility to obtain off-coverage alternatives, benefiting those without attractive options in ACA markets and increasing the popularity of the ACA.

“Adding federal funds to inefficient markets reduces consumers’ net premiums and improves markets.”

The first of the three has had the largest and clearest impact. Adding federal funds to inefficient markets reduces consumers’ net premiums and improves markets; this is simply not debatable, although some politically-based protagonists have tried. Did President Trump fully understand the implications of his consequential policy? We don’t know for sure. (It still amazes me that health reporters have never directly asked him this question.) Was it a wise use of taxpayer funds? We all have different, subjective opinions that lead to our conclusions. Does adding federal funding incent more healthy consumers to obtain coverage and benefit inefficient markets? Of course. Do ascribed intent and philosophical viewpoints alter the policy impact of consumer reaction to financial changes? Of course not.

The cultural stubbornness to dogmatically align policy implications with underlying politics is responsible for the harmful market misunderstanding. Political leaders are not blameless. President Trump’s campaign-trail claims that “Obamacare is finished” add confusion to markets, as do Democrats’ claims of “relentless sabotage” and recent prioritization of ‘deflecting any market-improvement credit away from the president’ over ‘honest assessments of policy impact’. The recent posturing that market improvements are due to “ACA resilience” rather than a market response to policy change is objectively absurd. Resilience implies not being impacted by changes in policy. It doesn’t imply sudden “worst ever” to “best ever” transformation in the face of purported policy headwinds.

I don’t like it, but maybe we shouldn’t realistically expect political leaders to avoid communicating politically-based views. The media has historically been as guilty as our political leaders. Maybe we should start there. Politico’s signaling of a change to separate politics from policy is refreshing, but I remain cautious.

The media culture of reporting politically-sensitive news from a political perspective won’t change overnight. I have thought about this as I have spent a lot of time digesting technical information related to 2020 open enrollment. It appears that the market changes (new insurers, aggressive benchmark premiums) will create more challenges than many observers expect. Lower benchmark premiums and participation from more insurers are a response to strong market performance, but the responsive reactions do not translate to good news for most ACA consumers. We should anticipate a more difficult open enrollment period due to financial dynamics, likely accompanied by bewildering, politically-based stories in January about something else being responsible for enrollment outcomes. We should summarily reject such narratives. Sadly, I have a larger concern about the rationale for enrollment results being misrepresented than I do about the actual results themselves. I hope I’m wrong, as politically-based explanations of rational consumer response to financial changes will further damage ACA markets.

At a core level, health insurance is very expensive; consumer decisions related to health insurance selection are all about the coverage they receive and the prices they pay, not whether presidents sit between green plants and share laughs with young comedians. Clever, promotional efforts can generate some short-term success, but that is not what sustains markets. I have no philosophical objections to promotion and outreach efforts; some consumers receive helpful suggestions from third-parties while others receive bad advice. Ultimately, after all the noise is filtered out, increased net premiums lead to lower enrollment. Most of us are now aware of the lower (but misunderstood) benchmark premiums but not the associated “higher net premiums”, but we will be soon. ACA dynamics are complicated and convoluted, and ACA markets will work better when our focus remains on understanding and communicating the financial dynamics rather than the political overtones.

Avoiding politics completely is not achievable in ACA matters. It’s a sensitive market, and passion about various ways of funding health care services runs deep. A year after ACA markets were implemented, two regulatory actuaries expressed some concern about the encroaching element of politics in their work; the article was spiced with a Wizard of Oz theme. The authors indicated that premium rates that were justifiable through an objective analytical exercise may now not be “politically palatable”. Interestingly, recent analyses suggest that the political winds have reversed and catalyzed a looser regulatory environment in the interest of maintaining insurer presence in local markets. Ironically, stricter adherence to ACA guidance today would improve markets and benefit both insurers and consumers. In the current scenario, the political implications of loose regulation serve to benefits taxpayers and withhold funding from the challenged marketplaces. That’s not an understandable outcome from commonly reported politically-based views, and consequently many states have missed the real opportunities to optimize their markets.

Perhaps there’s even a good ‘separating politics from policy’ lesson on how to approach ACA comprehension buried in the aforementioned 1939 Best Picture nominee (for the record, “The Wizard of Oz” lost to “Gone with the Wind”). ACA dynamics are extremely convoluted; a proper understanding requires a technical understanding and a singular focus on policy implications; we can see more clearly if our attention remains locked on the impact of those implications and we disregard the identity of the man behind the curtain.

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.