“There are many ways a state can improve its own individual marketplace. Some are effective at lowering premiums and increasing enrollment and others merely are full of sound and fury and contain no real money flows…We need to separate signal from noise and make trade-offs explicit when we look at what states are doing to their individual health insurance markets.”

– David Anderson “Performative instead of performing marketplace protection”

Rate review in the Affordable Care Act (ACA) markets was built on traditional measures. A large focus of the initial federal guidance was greater scrutiny on proposed increases of 10% or more. The holistic consumer impact in a market with convoluted premium subsidy dynamics was not an expressed concern, as “reasonable cost assumptions and solid evidence” was directed toward the average changes in gross premium rates.

Rating Factors versus Rates

It’s unlikely that the authors explaining the tenets of rate review had any technical understanding of premium subsidies mechanics, had considered how various populations would be impacted, or were aware higher premiums would result in higher subsidies and consumers paying less, so it is a bit ironic that they referenced consumers having access to both “easy-to-understand information” and “greater value for their premium dollar”. Eight years later, states and consumer advocates still struggle to explain to people why their premiums continue to increase while we are publicly celebrating three consecutive years of slight premium reductions.

In the midst of premium confusion and already convoluted dynamics, Metalball games scramble premiums across state markets, harming consumers and confusing regulatory reviewers without adequate allotted time to sift through the intricate differences in every rate filing. If rates are actuarially certified, all issuers remain in a state market, and the overall average gross premium increase that appears in the local newspaper is reasonable, then everyone is happy? Does it matter if issuer incentives and unbalanced competition drove down premium subsidies and caused consumers to pay more? Perhaps it does not if it is not commonly understood. Once it is understood, does a focused review on material rating factors replace or supplement a view of traditional commonly understood measures that are not as meaningful as they once were?

Metalball and Value

The pricing relationship between metal level plans is mathematically wonky, but it is this relationship that is of preeminent importance when determining consumer value. It is also clearly the most abused. This is evident from a specific review of individual issuer Induced Demand factors in rate filings and a nationwide scan of market premium relationships.

A state that allows issuers to play their own version of Metalball and scramble premiums allows consumers to be shortchanged from the level of premium subsidies that they would receive in a compliant environment. In almost every state that allows Metalball, the game has been played to develop more competitive on-exchange silver premiums, resulting in lower premium subsidies and often offsetting higher premiums at other metal levels to balance the silver aggression.

The state’s role in Metalball is that of an umpire. Unlike Moneyball, Metalball is not a game that should be played; the ACA prescriptively disallows it. It is a direct violation of the principal tenet which requires pricing for health benefit plans to vary by the benefits provided, not by the expected population to enroll or the metal level profitability dynamics. Issuers and consumers ultimately lose in Metalball; federal taxpayers are the only winners, as they save money from artificially reduced premium subsidies.

There is a proper ACA mechanism for issuer protection. The ACA risk adjustment methodology is designed to equalize enrollment differences and negate the need for Moneyball games. As CMS states, “the purpose of the risk transfers is to offset variations in plan actuarial risk due to risk selection, beyond the premiums plans are able to collect.” Part of the Metalball strategy originates from inequities, real and perceived, in the ACA risk adjustment methodology. Issuers are concerned that such inequities could disproportionally impact them, and premiums are imbalanced to guard against such risks. While the concerns may be justifiable, the ACA does not allow discriminatory pricing to act as a hedge against these concerns. Apprehensions should be properly addressed through regulatory comments, not by rearranging pricing factors to counterbalance perceived inequities to the detriment of low-income consumers.

If issuers in a marketplace have variant tolerances for unenforced compliance, premium subsidies are compressed, and the market landscape of comparable benefits and premiums is illogical and confusing. In the worst cases, it results in a silver pricing “race to the bottom” and overpricing in other metal levels with subsidies gutted by Metalball games.

I have had this direct discussion with many issuers. Most are agreeable to eliminating Metalball but unwilling to fully comply without a state directive. A minority are like baseball scouts who still haven’t accepted the ACA’s single risk pool basis, and view pricing via profitable segmentation as an actuarial tradition rather than adopt conformity to appropriate alignment based on benefit value. They may be initially resistant to change, but they will all benefit from a fair game where the rules are strictly and not arbitrarily enforced; unenforced rules result in arbitrary enforcement, as issuers’ voluntary compliance standards differ.

Silver premiums determine what the subsidy is. Bronze and gold premiums, in relation to silver premiums for subsidized consumers, determine what consumers pay. An artificial silver premium compression obviously harms consumers. By compressing silver premiums, Metalball results in smaller enrollment and a greater uninsured rate, primarily by not providing value to the healthiest, prospective consumers.

States can still do all the things that attract headlines. They can expand Medicaid, add state subsidies, innovate with Section 1332 waivers. These things cost money, and value judgments come into play. Understanding and umpiring the Metalball game doesn’t really cost anything. It simply involves a commitment to improving markets by enforcing ACA rules, and it benefits insurers, consumers, medical providers, and the state’s economy.

Fortunately, everything lines up nicely to make the solution easy and agreeable: The most meaningful measure is the one that should be reviewed. It is the most frequently abused measure and it is now receiving legal scrutiny. It is identifiable and correctable. Correction benefits all stakeholders, and appropriate action requires immaterial investment from states.

State Action

Through the rate review process, states can take appropriate action that translates to real consumer value. Some states have taken proactive steps in 2021 steps in 2021 through legislation and regulation, and others are considering stricter 2022 guidance to ensure ACA compliance. Here are some suggestions to eliminate Metalball-induced premium differences.

- Presume rationale consumer behavior – Mandate that issuers price Silver plans assuming 100% CSR 87/94% enrollment – This would eliminate inequities and prevent issuers from artificially manufacturing lower silver premiums by presuming some consumers choose (or exaggerating assumption) an overpriced silver plan (for 70/73% value) rather than an appropriately priced benefit plan at another metal level. Of course, this is self-fulfilling as expected migration out of silver plans has lagged due to aggressive silver pricing. As silver plans have historically attracted many consumers with aggressive pricing, the ease of auto-reenrollment has caused many consumers to not examine the implications of the confusing dynamics and passively make poor value decisions. In the process of appropriately aligning metal level pricing, states may also want to refocus consumer education efforts on the value dynamics of different metals.

- Mandate that issuers follow ACA guidance regarding benefit relativities rather than utilizing metal level specific claims data – This would eliminate metal level “experience rating”, sometimes applied to only a portion of claims in silver benefits; this usually results in a compression of silver premiums.

- Mandate that issuers utilize the CMS-developed induced demand factors unless there is objective, conclusive proof that such factors would be inappropriate. – In my experience and review of public rate filings, application of inappropriate Induced Demand factors is the greatest and most harmful abuse in the market today. Induced Demand should directionally align with Actuarial Value; if Silver plans have a higher Actuarial Value than gold, silver plans should also have a higher Induced Demand factor than gold. Remarkably, I have seen silver plans with lower Induced Demand factors than bronze; these factors were derived by using disparate data sources and a private risk adjustment model. By any actuarial standard from an issuer or regulator’s perspective, such an outcome is unreasonable. The Induced Demand factors should also be consistent with small group markets; this is an easy compliance check for both issuers and regulators.

- Discontinue automatic re-enrollment into silver plans for enrollees with incomes above 200% of the FPL – Many non-CSR 87/94 enrollees have remained in silver plans despite the poor value. Automatic re-enrollment plays a role in enrollees remaining in their silver plans which can be alleviated if issuers auto re-enroll members into appropriate benefit plans.

- Metalball Review – Focus rate review on areas that are most often noncompliant and impact consumer value. A review of premium rates and a more detailed review of rate filings can explain how Metalball is being played. Here are some questions that all states, particularly those hesitant to adopt first four recommendations should ask: Do premiums align with benefits? Are metal level factors developed from a common data source? Do Induced Demand factors mirror the factors provided by CMS? If not, why do they vary? Do issuers discuss Induced Demand factor methodology? Does risk adjustment influence benefit factor development? Are individual and small group factors identical? Do issuers project non-CSR enrollees to inexplicably remain in silver plans? Is that due to silver plans being aggressively priced? Do issuers assume irrational consumer behavior? Do issuers in market have different metal level slopes? Are metal levels slopes developed in a way that compresses silver premiums and reduces enrollee subsidies?

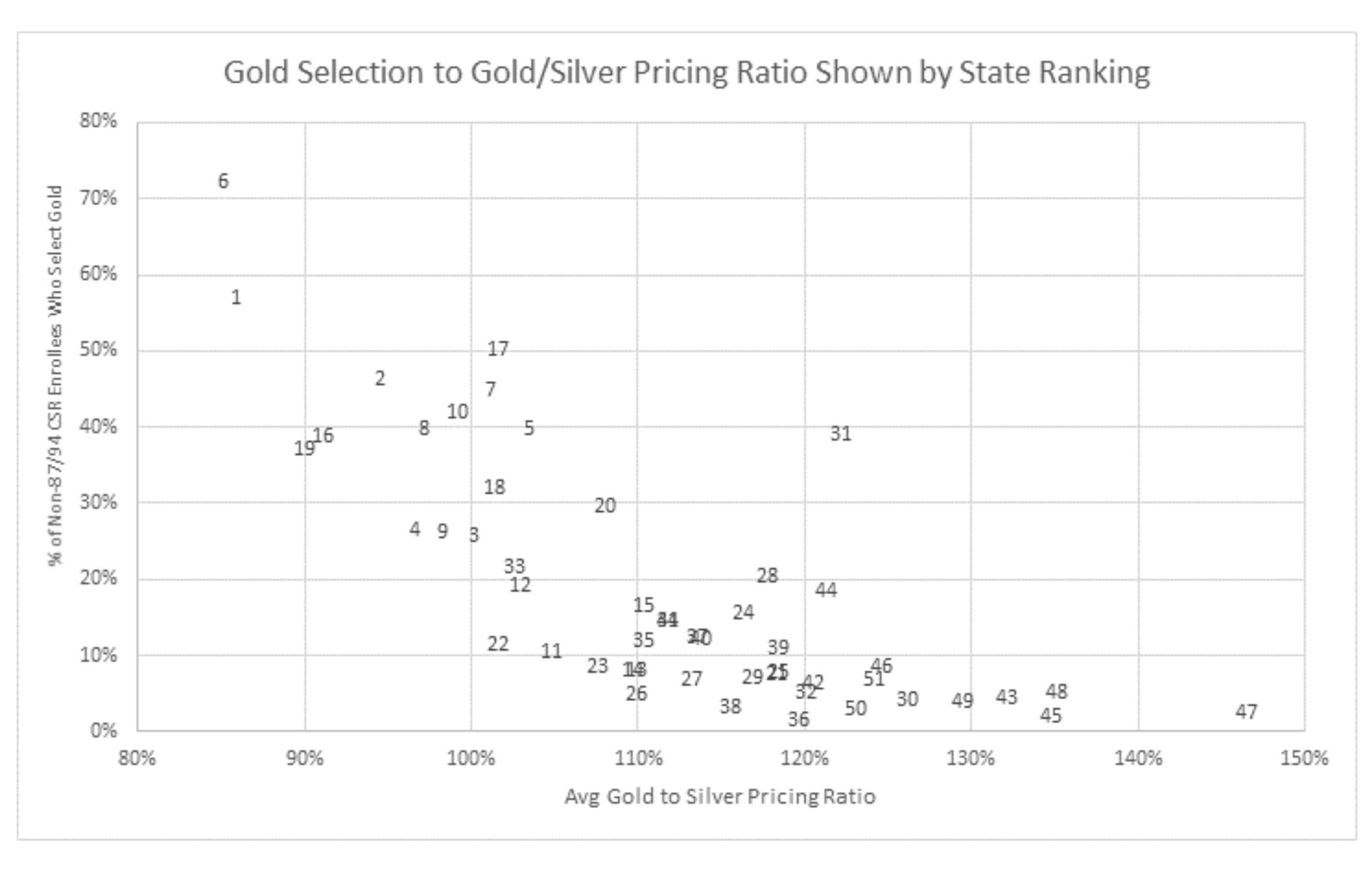

The benefits of state action can be directly quantified. State rankings measure consumer value through an assessment of gold/silver relationships, lionfish penetration in markets, and premiums for subsidized and unsubsidized enrollees.

There is a strong correlation between overall ranking and gold/silver relationships and between overall ranking and gold level enrollment. Of the various measures, the gold/silver relationship is the easiest for states to directly influence. 10 states are “on base” in 2020 with gold premiums less than silver, and 8 of the 10 are in the top 10 overall rankings.

To provide clarifying budgetary context to these dynamics, a recent actuarial/economic assessment in a small state already in relatively good position concluded that proper metal alignment would result in an increase of $40 million in federal premium subsidies, increased economic activity of $70 million, an additional $6 million in state and local taxes and 1,000 new jobs, all with immaterial costs to the state.

Conclusion

Appropriate metal alignment will optimize ACA individual markets. The results will be appreciated while the action driving the results may be overlooked. States don’t need to hit home runs to end (or win, depending on how your view of semantics) the Metalball game. They do need to review rates in a manner that ensures compliance, eliminates abuses, improves markets and protects consumers. State regulators that do that are of tremendous worth to their state, as their decisions both protectconsumers who have been harmed and optimize their markets. I can’t promise that decisions that have a real impact on ensuring compliance and protecting consumers will attract commensurate attention, but I can promise they will provide immeasurable value.

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.