“Everybody’s got to be covered. This is an un-Republican thing for me to say because a lot of times they say, ‘No, no, the lower 25 percent that can’t afford private’…I am going to take care of everybody. I don’t care if it costs me votes or not. Everybody’s going to be taken care of much better than they’re taken care of now.”

– Republican Presidential candidate Donald Trump, 2015 on ‘60 Minutes’

Four years ago today, the New York Times acknowledged “Obamacare Marketplaces Are in Trouble” and asked, “What Can Be Done?”. It was not a surprising headline at the time as we were all aware of marketplace peril, but four years later, most of us have forgotten the dire situation in the three-year-old marketplaces created by the Affordable Care Act (aka Obamacare). From 2016 to 2018, Obamacare markets shifted from their worst to best year in remarkably quiet fashion. How did this happen? In the New York Times parlance, what did we do? If your Obamacare understanding is primarily from traditional news sources or even non-profit, seemingly transparent health policy organizations, you probably have no idea. You may have wisely ignored a few stories about insurers suddenly learning how the new markets worked; you probably are not aware of the dramatic ongoing changes that I refer to as the Affordable Care Act makeover.

For the last three years, the political news cycle has been focused on low probability events that might occur, while neglecting the real dynamic changes within Obamacare markets. We will examine the expressed 2016 concerns, their unreported resolutions, and where Obamacare markets are today. After reading this, you will not only understand why Obamacare markets are stronger than ever but that they will continue getting stronger if undisturbed. This understanding should frame the health policy discussion for the 2020 election and override the Congressional charade in the Supreme Court and the unending consideration of phantom legislation.

For continuity with the 2016 article, we will use the New York Times four section headings and lead with a quotation from each section.

Choice is Disappearing

“Competition, at least in theory, helps keep premiums low and service high. That’s the whole point of having a market for health insurance.” Competition in Obamacare markets actually increases what most consumers pay; it’s beyond the scope of this article but useful to understand.

The concern in 2016 was not so much a lack of competition, but rather a concern about no competition. While a “public option” today is a philosophical signal and not a solution to address a specific need, President Obama’s call for a public option was specifically designed to target counties without any participating insurers. This was a real concern until 2018.

The “choice” problem was the financial environment. As the New York Times notes, many insurers were bleeding financially and some had “gone belly-up”. After a three-year market exodus, insurers began returning in 2019 after record industry profitability in 2018.

Prices are Rising

“Everyone is anticipating a much bigger price increase for Obamacare plans next year than in the past.” Prices did rise in 2017. They rose again in 2018, primarily in silver plans to offset the defunding of cost-sharing reductions (CSR) payments, which did not adversely impact consumers. Premiums declined for the first time in 2019. They dropped again in 2020. What happened?

By their nature, insurance prices reflect expected claim costs for the population presumed to enroll. Insurers did not fully grasp the positive environmental change in 2018. Rather impressive in retrospect, the Congressional Budget Office notified Congress that insurers would not immediately understand the new dynamics, highlighting “by 2020, though, insurers would have observed the operation of markets in many areas under the policy”.

2019 prices were developed in the middle of 2018 using 2017 experience, but insurers were able to see the good news emerging in 2018. 2020 was the first year fully-based on the new market environment, so another decrease was good news but not all that surprising; I had predicted a very small increase in March 2019. Anecdotally, we are hearing of roughly overall flat changes in 2021, which suggests increasing market attraction to young healthy people, a demographic Obamacare markets struggled to attract in its early years. Of course, the COVID-19 impact is going to be baked into any discussions going forward so segmenting Affordable Care Act makeover implications after 2020 enrollment will be a more difficult task.

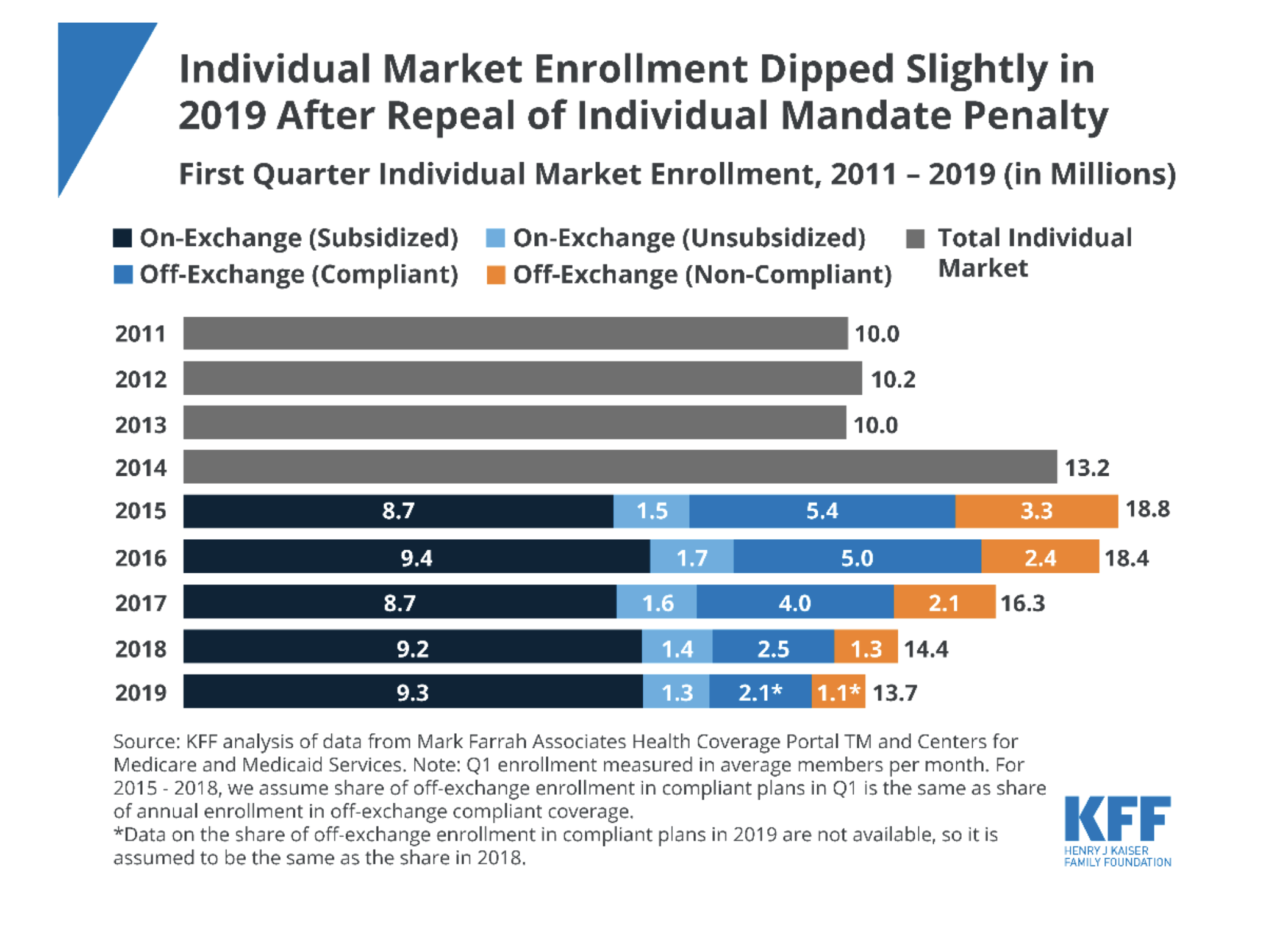

The New York Times accurately defined high premiums in an Obamacare context. “People who do not receive federal tax credits to help pay for their coverage are particularly hard hit by having to pay higher premiums and could be unable to afford the cost. They are a small minority of people currently in the Obamacare marketplaces, but more than a third of all people buying their own insurance, according to recent estimates.” It is worth noting that many commentators including me have expected unsubsidized enrollment (people who do not receive federal tax credits) to perpetually shrink and Obamacare marketplaces to eventually have immaterial unsubsidized enrollment. I have noted, perhaps somewhat theoretically, that the best way to attract unsubsidized enrollees is to make the subsidized market more attractive, and over the long-term a healthier market would reduce premiums and eventually attract unsubsidized enrollees. A recent government report indicates an increase in on-exchange unsubsidized enrollment in 2020. Off-exchange enrollment is not yet known, but an increase in the on-exchange segment is a surprisingly positive development.

The Market is Too Small

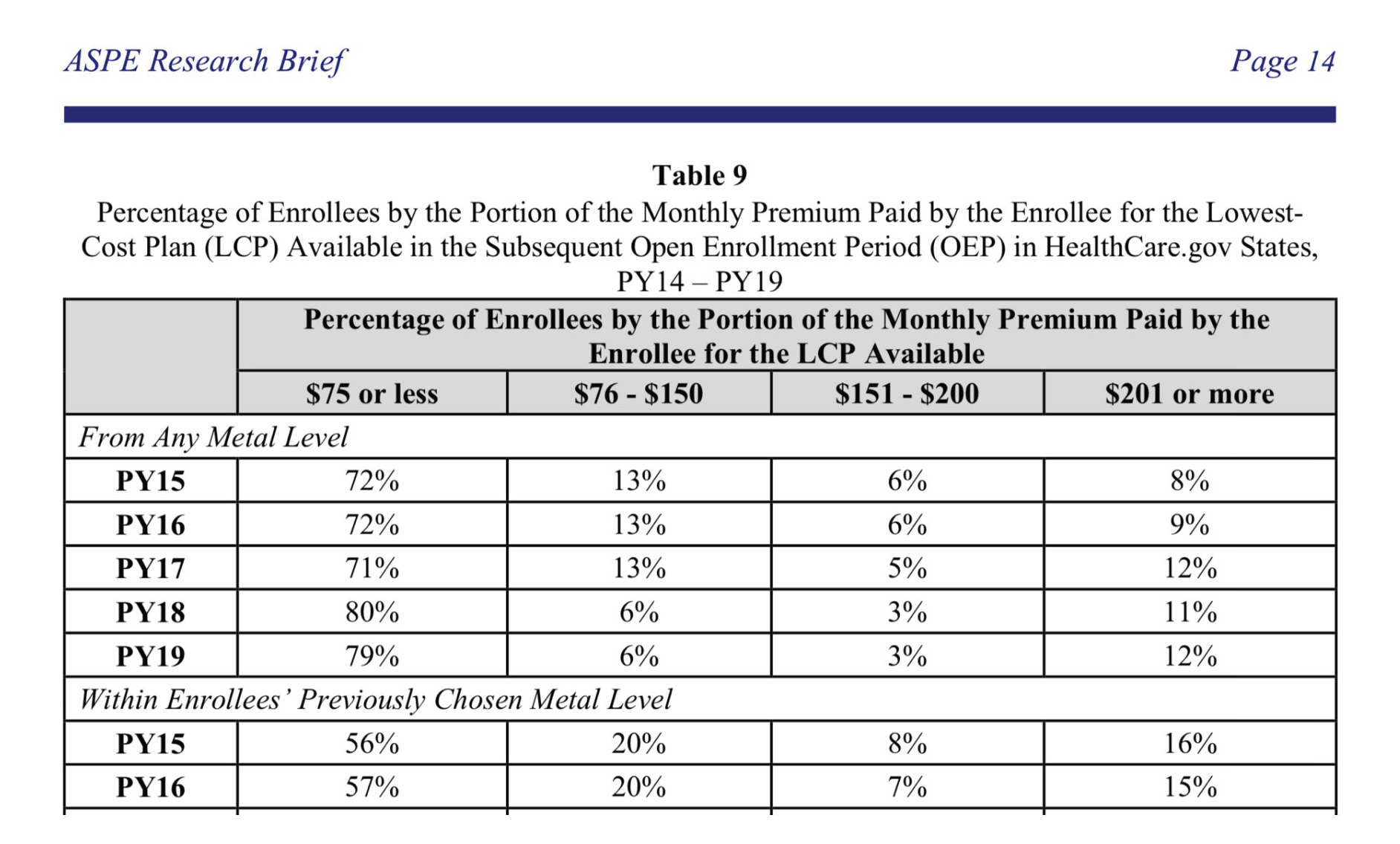

“There are currently about half as many people in the exchanges as the Congressional Budget Office expected.” Some possible solutions mentioned were: “Change the incentives, so more people who are currently uninsured buy health insurance. Hillary Clinton has talked about giving out more generous subsidies, so insurance costs less and more people can afford to buy it. Many Republican politicians suggest another way to lower prices: eliminating current requirements that insurance cover a wide array of services.” Ironically, Donald Trump defeated Hillary Clinton and gave out more generous subsidies aligning with his “not an un-Republican thing” commentary, as simply lowering costs does not help most enrollees due to the Obamacare subsidy mechanics. Measurably, the percentage of enrollees eligible for coverage of less than $75 increased from 71% to 80% in 2018.

As a whole, the marketplaces have not grown due to Trump’s action, but subsidized enrollment increased in 2018, reversing from a sharp decline. Subsidized enrollment increased again in 2019, despite the removal of the shared responsibility payment and expansion of non-Obamacare compliant options.

In June 2019, President Trump issued a final rule expanding the use of Individual Coverage Health Reimbursement Arrangements (ICHRAs), allowing employers to fund premiums and out-of-pocket costs, bringing more stability to individual markets. If insurance is not “affordable” for employees, they can opt-out of the ICHRA and be eligible for premium subsidies.

The Rules are Complicated

“If the insurers think the marketplace is unfair, or that there’s no way they can ever make money there, they are unlikely to participate. Because the health law relies on private companies to participate, conditions have to be favorable enough to keep them involved.” The New York Times also noted that “The Obama administration has already made a few changes, including making it a little harder for people to sign up for insurance in the middle of the year.” At the time, I had written that such regulations “ignore the real problems and are limited to enforcing special enrollment rules and continuing existing outreach efforts”.

The enhanced premium subsidies and favorable environmental conditions in 2018 catalyzed participation in 2019 and future years. Insurers and states complained that the implications, while positive, were confusing. In fact, I provided what I thought was a clear explanation of market dynamics in a media interview; it was embedded in a story titled “Confusion abounds…”.

Was more confusion added to the complicated rules? It is noted in State of California vs. Donald J. Trump that “the states express concern that the termination of CSR payments will cause confusion among people who shop on the exchanges. In particular, the states argue, the fear of increased premiums may scare consumers from the exchanges.” The judge disagreed and stated that consumers’ experience wouldn’t change but that their premium would likely be lower; “If you benefit from tax credits and you go shopping for insurance on the Covered California website, you may never even realize that premiums went up. You are only informed of what you have to pay for insurance. And as already discussed, if you’re eligible for tax credits, it’s highly likely you’ll pay the same or less.”

The judge concluded his ruling with a poignant observation and pointed to the source of the confusion. “If the states are so concerned that people will be scared away from the exchanges by the thought of higher premiums, perhaps they should stop yelling about higher premiums. With open enrollment just days away, perhaps the states should focus instead on communicating the message that they have devised a response to the CSR payment termination that will prevent harm to the large majority of people while in fact allowing millions of lower-income people to get a better deal on health insurance in 2018.” The rules are indeed complicated, which makes it more important that stakeholders do not add to the confusion.

Conclusion

So, what did we do? It is helpful to summarize by the branch of government. The legislative branch zeroed out the shared responsibility payment in the 2017 Tax Cuts and Jobs Act. This increased Obamacare popularity and paved the way for eligible enrollees without attractive Obamacare coverage to explore alternative options without penalty.

While it garners a lot of media attention, the judicial branch has had little impact. The Trump administration won an appeal defending Obama’s risk adjustment methodology and the Federal District issued a rulingthat will involve significant actuarial dissection in the future. The ongoing Texas v. California saga is a case about legislative inaction. If Congress strikes the individual mandate from the law, the Supreme Court will have to determine whether it can be severed.

Virtually all of the impactful Obamacare activity has occurred within the executive branch, but it attracts little attention. This is potentially because it’s more difficult to understand and perhaps does not align with political presuppositions. Perpetual discussions of overhauling legislation with a split Congress and the administration’s legal briefs on a case that Congress can easily remedy are not appropriate media coverage of Obamacare. I am not shy to acknowledge that most of our collective misunderstanding about Obamacare is the result of the media failing to cover Obamacare.

While the Trump administration has been very active, its policies can generally be classified by two implications. A few years ago, I coined the phrase “more love, less hate” to point to the Trump administration’s actions which have reduced net premiums for and provided more consumer flexibility. The Kaiser Family Foundation gathered similar sentiments in a recent survey, noting more respondents reported being helped by the law and fewer reported being hurt. Adding a little commentary, President Trump’s policies have made Obamacare markets work better for people for whom Obamacare was designed to work and provided alternative options for those who never had reasonable Obamacare solutions.

Looking forward, Obamacare markets should continue to grow stronger. There are many untapped opportunities through Section 1332 waivers and the promise of ICHRAs.

Looking forward, Obamacare markets should continue to grow stronger. There are many untapped opportunities through Section 1332 waivers and the promise of ICHRAs. While enhanced premium subsidies have strengthened markets as a whole, insurers in some states have been slow to respond. Obamacare requires nondiscriminatory Community Rating, which we casually refer to as “pre-existing condition protections”. While regulatory enforcement has been loose, it is beginning to strengthen this year.

In 2015, President Trump said, “I’m going to take care of everybody”. The first president to be impeached for non-criminal “abuse of power” is not able to do that on his own. He has not had much help from Congress. His executive action has drawn mixed responses; some states have embraced the makeover and their residents are “taken care of much better”; other states have simply reacted with political retaliation. Four years after the New York Times article “What Can be Done?”, the efficiency in which we improve Obamacare markets relies on our understanding of what we have already done to improve them, not our eagerness to modify the law.

What did we do? We saved Obamacare marketplaces, but we did it through executive action, not a legislative rescue. We made rules more flexible and the law more tolerable. We listened to and did not defy the courts, and we strengthened the law where it works for many people. At the same time, we led with humility and recognized that Obamacare was not designed to work for everyone.

When asked his first question about Obamacare at a recent town hall, the President prefaced his response with “I think it’s probably the thing that I’m most disappointed that I haven’t been able to say what a good job we’ve done. I haven’t been able to sell what a great job we’ve done.” Of course, the question was not about revitalized markets or anything that we have done over the past three years. It was about what Congress might or might not do. I am a strong advocate of understanding what we have done and the resulting dynamics before making significant changes. In 2016, the New York Times was willing to ask, “What Can be Done?” and take a shot at some answers. In 2020, are they willing to ask, “What Did We Do?”, with dramatically improved markets and benefit of hindsight. It is a story that must be told by someone who has a far larger reach than me. Who is going to tell it?

Greg Fann is a consulting actuary at Axene Health Partners, LLC in Temecula, CA. He strategically advises clients and policymakers on issues related to the Affordable Care Act and is a frequent author and speaker. He is an active volunteer and leads the Individual/Small Group Subgroup of the Society of Actuaries Health Section. The opinions expressed herein are his alone and not reflective of his employer or any actuarial organization.

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.