I’m a math guy. I always have been. While I did well in most subjects in school, I excelled at math. In high school, I completed an advanced calculus course in my junior year. I had to commute to the local university during my senior year because I had exhausted all the high school courses and could not fathom going to school without math class. A high school friend still remembers one half of my SAT course; the math part of course. I’m 50, and he still introduces me by announcing my SAT math score. I have to remind him that the total score is all that matters, and my SAT verbal score was lower than his batting average; I don’t know if that’s true, but he did play a few years of professional baseball, so it seems rational.

I tell you all of this to tell you that the Affordable Care Act (ACA) has changed me. It has turned me into a writer; you know, words and stuff. I still do the math, but I spend as much time writing. How did I get here and what does this have to do with the ACA? I majored in math in college and went to business school for a Master’s degree in actuarial science. It was a natural transition for a young man who was weary of learning theory and ready to apply his knowledge practically. I spent twelve years working in the health insurance industry crunching numbers before becoming a consultant.

As a consultant, I had to write more and had to write for nontechnical readers. It challenged me but I enjoyed it. I gradually grew better and became more passionate about writing after the ACA became law. This was primarily due to reading misconceptions about the ACA from people who did not understand the math. From the beginning, the public has been misinformed by politically-based narratives of how the ACA actually works. While the ACA has been a large part of my professional life, I am also socially conscious and personally passionate that our health insurance market of last resort is equitable and sustainable. I have been blessed with opportunities that I would not have imagined ten years ago, and I am very thankful that I have been able to contribute to this discussion.

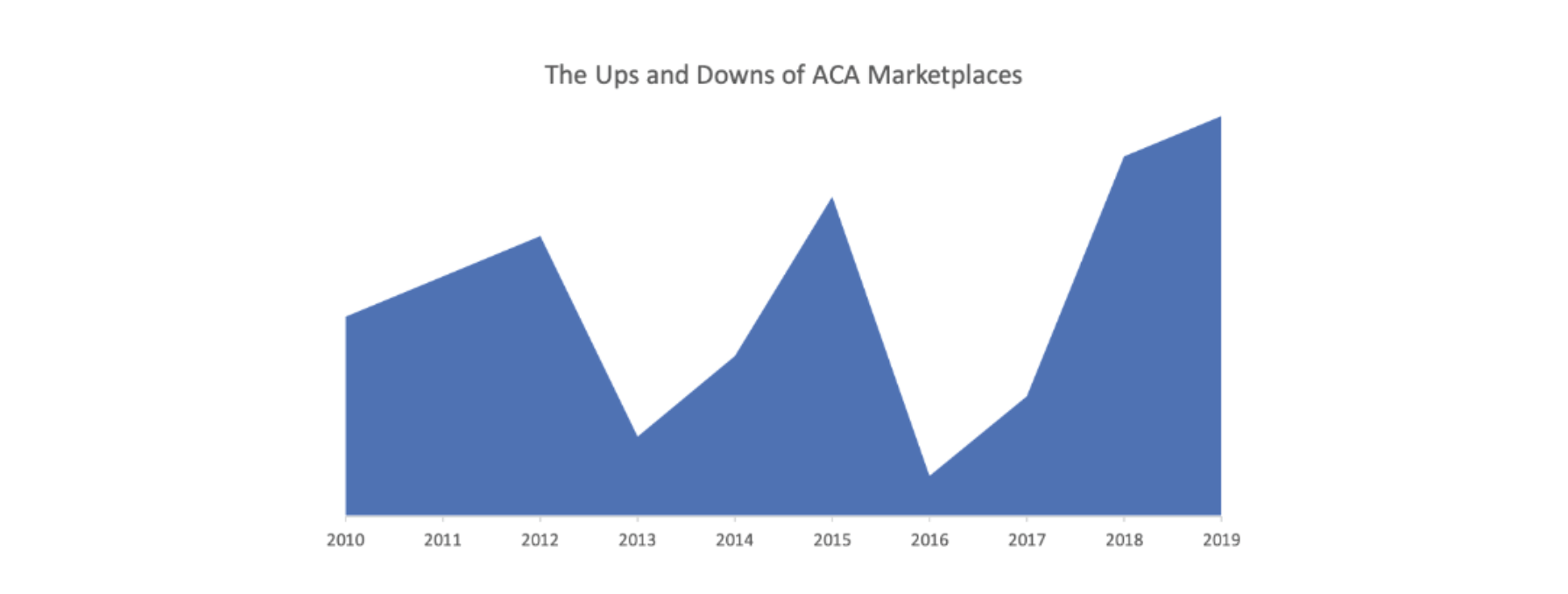

March marked the ACA’s 10th anniversary. The 2010 legislation has dominated the health care discussion over the past decade. Unlike any experiment attempted before, it sought to comingle a government program with a traditional private market and negate its actuarial design challenges with promotional efforts. Through a series of bumps and bruises, the ACA has weathered storms and has received boosts from legal rulings and new regulatory guidance.

As I reflected on the last decade when almost all health policy landscape was shaped by the ACA, I have thought about people and events that have played a key role in the ACA story and deserve recognition. Many of these people have become new friends, with technology partially to thank, as we have a common interest in the law’s unique details and a shared desire to optimize ACA markets and benefit ACA consumers. As the mathematical dynamics of the law are convoluted, some contributors who have not engaged in deep study have got some things wrong along the way. Accordingly, everything in this article is not complementary. My intention is not to insult (or conversely to overly promote) anyone, but to encourage better approaches to think about the law’s unique mathematical dynamics. My goal is education and loosening strongholds on “blue pill” beliefs that prevent progress; I want readers to grasp where current ACA challenges lie, and better understand some of the ACA concepts.

Through this effort, I have constructed a list of 30 individuals and entities that have been instrumental in the ACA’s direction. I will let them speak for themselves, but I suspect the ACA has changed many of them too. If you want to learn more about the ACA, listen to these voices. I personally have a stronger grasp of ACA dynamics from following my own advice. It goes without saying that there are more than 30, and our country is also indebted to the many contributors who are not included on this prestigious list.

30 Voices

The Academic – From his perch at Duke University, David Anderson crunches numbers and identifies the disparate consumer impact due to the mechanical nuances of the ACA’s subsidy formula. He was the first to identify that gold-level coverage was free in twelve Oklahoma counties, which inspired the “gold rush” movement. Progress continues and all states will eventually strike gold. With transparent, color-coded maps, Mr. Anderson will let us know how the story unfolds.

The Administrator – While his predecessor spearheaded the initial enrollment rollout and his successor managed the changing market dynamics, Andy Slavitt managed the program during its operational improvement and its worst year when the implications of its inherent financial mechanics became apparent. An industry executive prior to government service, Mr. Slavitt maintains a large following and is perhaps best known for his health care advocacy following his government service. Mr. Slavitt is better when he leads with his intellect rather than his bitter politics; the politically divisive ACA needs more of the former during the election season.

Ironically, his revealing 2017 pronouncement that providing young Americans access to reasonably priced health insurance was “not a national concern” would be a better message today, as some imagine that access to insurance is the COVID-19 public health solution and an emergency Special Enrollment Period would magically attract 29 million uninsured people who decided the same insurance options were not attractive just a few months ago.

The Advocate – Unlike many in his profession, Stan Dorn is not reactive and takes time to digest things that initially strike him as politically objectionable. His relentless pursuit of improving affordable coverage for low-income enrollees is aided by his willingness to dig into the math, and his natural writing style delivers his message with logical transparency rather than strong-armed advocacy.

The Animal – No animal personifies convoluted ACA markets as well as the invasive Lionfish. A natural part of its ecosystem, its placement in a different setting wreaks havoc on a new environment. The dynamics of the ACA are not universally understood, which has allowed Lionfish to live unabated in ACA waters. While rare, a Lionfish catch along the Atlantic coastal waters of Rhode Island in October 2017 captured attention as two plans proposed by Neighborhood Health Plan were approved by the state insurance commissioner but not by the state exchange. “The exchange was concerned that the additional low-cost plans would have reduced the subsidies available to all exchange enrollees, making coverage less affordable if people chose plans other than the new low-cost options.” Blueprints of future legislation suggest the Lionfish danger is still not fully appreciated at high levels of government.

The Architect – While David Cutler has been laying low after his reassurance[1] that young adults would enroll in ACA markets despite the mathematical dynamics and Ezekiel Emanuel has been selling luxury chocolate while planning his death in 2032, Johnathan Gruber, who played a central role in the development of the pre-ACA Massachusetts exchange model, was the ACA’s primary design architect. Insurers learned early on that referencing the “Gruber model” before data was available was well-received by state regulators unclear about verifiable methods. Publicly, Mr. Gruber is better known for his lectures referencing that the ACA was only passed due to “the stupidity of the American voter” and because “lack of transparency is a huge political advantage”.

The Attorney – While Nicolas Bagley is the most recognized expert on ACA-related legal matters and very quick to weigh in with legal news and commentary, his inherent distrust of the current administration has led to a few alarmist overreactions. Among other things, he continuously questioned the administration’s legal strategy in defending, and ultimately preserving the Obama administration’s risk adjustment methodology, while Tim Jost called such reactions “way over the top” and I “urged a more tempered response”. On the other side of the risk adjustment litigation, Barak Bassman has led the charge against risk adjustment inequities. While the Trump administration prevailed in the appeals court on New Year’s eve 2019, Mr. Bassman’s litigants shined a light on the systemic inequities in the most important mechanism of the ACA, one that I argued in 2016 the government had the duty to get right. Major modifications to the risk adjustment program began in 2017, and continue to be made today.

The Blogger – Hailing from a state that has retaliated against President Trump’s policies without making substantive improvements, liberal blogger Andrew Sprung delivers a wonkish, fact-filled collection of useful short pieces. Left-leaning states such as his own could benefit from understanding his perspective rather than reflexively reversing President Trump’s actions. A recent study determined that it was not the conventional wisdom of fidelity to ACA dogma (e.g. Medicaid expansion, the individual mandate, limiting alternative plans), but rather the gold rush exuberance which struck a chord with Mr. Sprung, that served as the best predictor of market success.

The Broker – With honorable acknowledgment to Brian Boss, Jenny Hogue, Pat Paule, and Henry Stern, one broker has steadfastly kept the country informed on ACA developments. While serving the marketplace as a knowledgeable purveyor of insurance products, Louise Norris somehow finds time to keep up with the latest rules and dynamics in all 50 states and publishes her insights at www.healthinsurance.org. She is vocally opposed to recent regulatory flexibility, and is an ACA purist in the sense she rigidly promotes the ACA’s community rating principles and regards non-ACA compliant plans as not qualifying as “real coverage”.

The City – Charlottesville, Virginia received recognition for having the highest premium rates in the country in 2018 and became a symbol of ACA’s costs being out of control. It initiated the formation of the consumer group Charlottesville for Reasonable Health Insurance (CHRI), who has pestered a local health plan and the Virginia Bureau of Insurance for the high premiums in 2018 and follow up activity that it finds objectionable. During 2019 open enrollment, CHRI warned of a national player re-entering the market as a Lionfish.

The Commissioner – While most insurance departments have understandably played defense by doing what was necessary to keep insurers in their state, few have sought to deeply understand the unique dynamics of ACA individual markets. An exception is Iowa Commissioner Doug Ommen, whose publications demonstrate not only his concerns for his fellow citizens but his technical comprehension. While symbolic of the impact of outlier claims and insurers leaving small markets, Iowa’s individual market has improved, attracted insurers to return to its exchange, and claimed the top spot in a recent study of market performance.

The Conference Promoter – Running conferences focused on health policy while maintaining a non-partisan flavor would appear to be a natural challenge, especially in an ACA environment. DJ Wilson has freely stepped into that space and hosts a series of well-known events that attract business and government leaders in eight states. As a frequent writer on his website and in other publications, Mr. Wilson is not afraid to recognize policy implications that strike him as incongruent with collective intent.

The Congresswoman – Perhaps unfairly best known for her pronouncement “we have to pass the bill so you can find out what is in it”, Nancy Pelosi deserves more credit (or blame if you are so inclined) than anyone for diverting the ACA from Obama’s vision and for doing what was necessary to get the law passed. While Obamacare will always be associated with the president who charismatically championed change, the legislative development and the vote-gathering were the result of Pelosi’s efforts.

The Consumer – While the media and his political enemies encourage President Trump to drop the Texas v. Azar case (customarily not something defendants can do) and he plays along with the fantasy narrative that he has real influence, the real consumer plaintiffs are readily unacknowledged. The Attorneys General of 20 (now down to 18) states, and US citizens and Texas residents Neill Hurley and John Nantz, have mounted a case alleging harm from the ACA. While many of us focus on the politics of the ACA, there are millions of people who have been helped and millions of people who have been personally harmed by the implications of the law. While there are tradeoffs with every piece of legislation, those harmed have little recourse if the law is constitutional. While Congress will surely strike the individual mandate from the law and clean up the constitutional questions before the Supreme Court rules, Mr. Hurley and Mr. Nantz are the public representatives of those who have been harmed during this interim period.

The Detective – A mild-mannered investment advisor in Philadelphia, Rich Weinstein did not set out to become part of the ACA story. Like many Americans, the “if you like your plan, you can keep your plan” scenario did not work out well for him. In the process of researching plan options and seeking to learn more about the ACA after his insurance was canceled, Mr. Weinstein struck digital gold. His discoveries of architect Jonathan Gruber’s public speeches damaged President Obama’s credibility on the transparency and impact of the ACA. Mr. Gruber spoke of how the law would have never passed had the administration been honest, and he said retrospectively that ACA proponents owed a debt of gratitude to ‘lack of transparency’ and ‘voter stupidity’. Without the sleuthing from Mr. Weinstein, Mr. Gruber’s explosive comments may still be buried today in the dark caverns of the internet.

The Economist – As a Healthcare Economist and Exchange Coordinator at Blue Cross Blue Shield of Louisiana, Michael Bertaut produces an educational series at articles, podcasts and videos that he calls “Straight Talk”. Designed primarily to educate consumers in Louisiana of their plan options, his genial presentations are of value to Americans across the country wanting to better understand insurance mechanics and the ACA environment.

The Enrollment Guru – You know this one already, don’t you? From an unpretentious beginning, Charles Gaba noted a vacuum in the reporting of ACA enrollment statistics while curiously trying to understand initial market performance results. In his spare time, he began assembling data and his website www.acasignups.net became a well-known repository of compiled results from various sources. Mr. Gaba has since parlayed his ACA-fame into Democratic fundraising efforts and a health policy blog. He believes in government advocacy to achieve universal coverage, which he balances with a realistic perspective of the current political climate and pragmatic recognition of the need to play defense while retooling the offense.

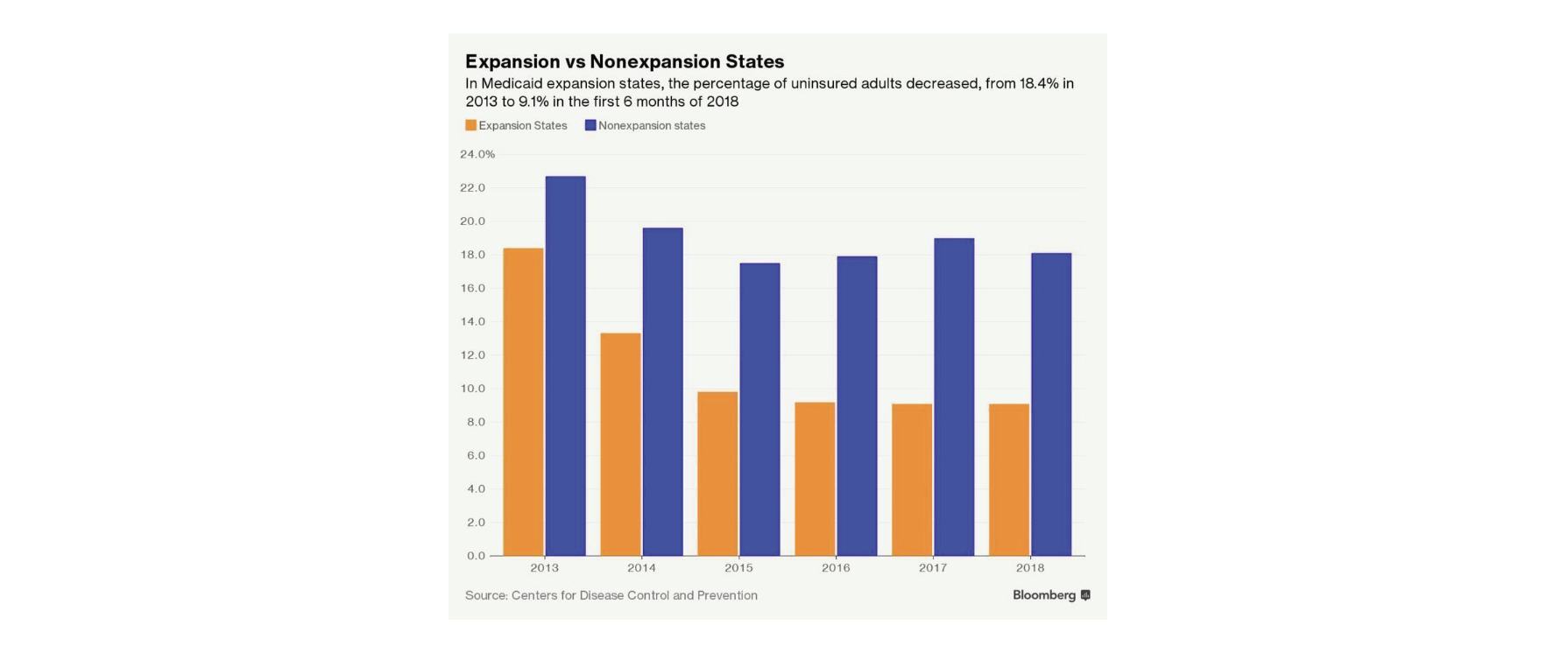

The Fake News – To be fair and balanced, I should note that two of the best and two of the worst articles I have read about the ACA are from Politico. Starting with the good, Paul Demko’s 2016 piece on ACA was an excellent assessment of the market’s challenges. The inexplicable prediction that 2018 would be “Obamacare’s worst open enrollment season ever” may have won their Lie of the Year award if Politico could self-nominate. As we know, 2018 marked the beginning of the ACA market makeover and it was the first year that enhanced premium subsidies, as a result of President Trump’s Cost-Sharing Reduction (CSR) action, were in effect. It reversed the 2017 subsidized enrollment decline by increasing the percentage of enrollees with access to ACA coverage of $75 or less by 9% in a single year. It also led to a reverse of the post-ACA climb in the uninsured rate in non-expansion states.

With a retrospective look at 2018, Politico, among others, changed course and acknowledged “Obamacare is stronger than ever”. More important than the singular recognition, Politico’s perspective seemed to change. Unlike the original perspective that largely ascribed President Trump’s inclinations to his policy implications, Politico’s six words established guidance which all media should adopt: “separate the politics from the policy”.

Unfortunately, the “secret success” in 2020 correlated gross premiums and net premiums in the wrong direction. While “nearly 8 million uninsured Americans are eligible for exchange subsidies” and “the number one reason eligible people report not taking up exchange plans is cost”, it is incorrect to suggest “the key to robust exchange enrollment is low premiums.” The ACA is an elusive paradox and the reverse is true. The same article also pretends that a shorter enrollment period harms markets and was an idea concocted by President Trump rather than the insurance industry and President Obama. It fails the “Separating Politics from Policy” standard.

While the ACA is convoluted and most of the “news” is imprecise, regurgitated groupthink, Politico’s politically-based prediction that the ACA’s best year would be its worst takes home the prize.

The Insurer – As the subsidy structure favors low-income individuals, insurers with a Medicaid-focused platform can bridge coverage between Medicaid and the individual market. Some insurers have had unique success while many traditional commercial insurers have struggled. Centene, a minor individual market player before the ACA market implementation, is now the dominant player and known for its Ambetter brand in ACA markets and adoption of state slogans to name its various Medicaid plans.

The Judge – Rosemary Collyer paved the way for President Trump’s 2018 liferaft and Texas judge Reed O’Connor has become a nemesis of ACA advocates, but the original John Roberts will always be the face of the ACA’s legal story. The creative reasoning of the Bush-appointed Chief Justice of the United States Supreme Court led to 5-4 ruling which allowed the ACA to legally survive. His encore performance in 2015, with more controversy ignited by Mr. Gruber, allowed premium subsidies to flow in states that did not establish their own exchanges.

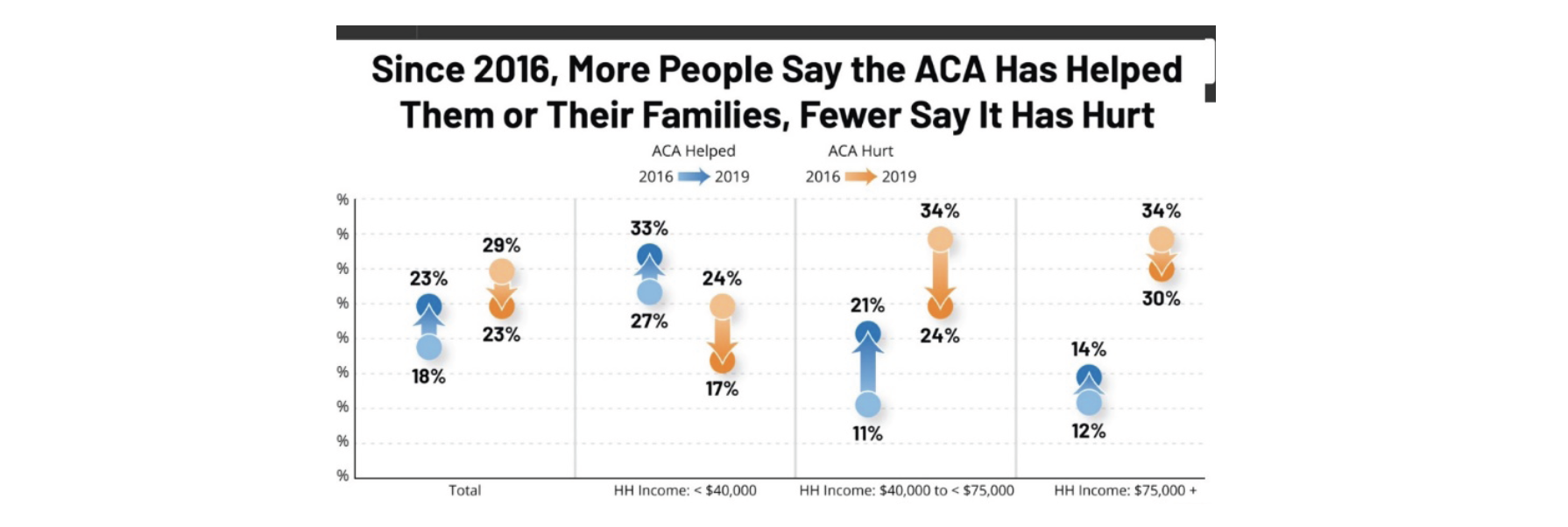

The Market Measurer – The Kaiser Family Foundation (KFF) has been a valuable source of information since the ACA was passed. Before premium rates were developed, KFF developed an online calculator that was useful in beginning to understand ACA dynamics. Larry Levitt, Cynthia Cox, and others stay on top of enrollment, premium rates and relationships, market performance, new regulations, and consumer sentiment. Continuous polling has tracked the ACA’s popularity, as enhanced premium subsidies and more consumer flexibility have resulted in more people being helped and fewer hurt by the law. My minor quibble with KFF commentary is the recurring sentiment that responsive market improvements related to the ACA’s makeover are the result of inherent “resilience” in the law which is purportedly “overcoming headwinds” of Trump-induced uncertainty.

The Movie – As you know if you are reading sequentially, ACA mechanics are counterintuitive. We are conditioned to think rationally about insurance markets, or at least to believe that they behave like each other. If costs go down, that benefits consumers, right? Everything is different in the individual market due to the premium subsidy mechanics. The primary driver of market success, which President Trump would undoubtedly describe as “like nothing anybody has ever seen before”, is the spread between the premiums of plans that people buy and the premium of the subsidy-determining benchmark plan in the marketplace. Higher premiums are almost always beneficial to low-income enrollees.

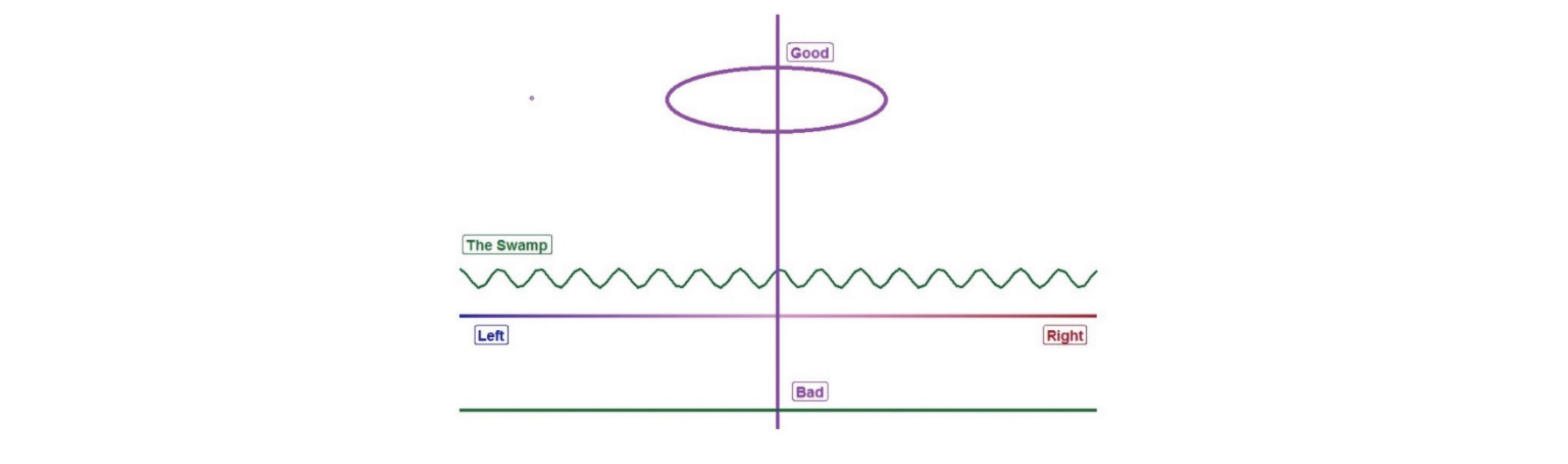

In the science fiction film The Matrix, the pivotal moment occurs when the central character has to choose between irrevocable binary options. He can elect to swallow a blue pill and continue to live in comfortable obliviousness to the harsh truth of the world around him. Alternatively, he can swallow a red pill and clearly see the cruel and unpleasant truth. With the ACA, our default selection is the blue pill, which causes us to miss so much about how the ACA works. We need to swallow the red pill. It requires uncomfortably unlearning things that we know which are in fact not true, but it is something we all need to do if we are serious about understanding and improving ACA markets.

The Objective Journalist – Mother Jones is not where you would expect to find objective ACA commentary in the Fake News era and you usually don’t. However, Kevin Drum has asked the right questions and sought to understand ACA results. Recognizing the market implications, he encouraged President Trump to terminate CSR benefits while the supposedly more neutral CNN was warning of doom and gloom. While other commentators were quick to blame (some still do) President Trump when the expected enrollment reduction occurred in 2017, Mr. Drum was refreshingly honest regarding the timeline and said “It’s tempting to conclude that the culprit for this is Donald Trump’s efforts to sabotage Obamacare, but the declines began in 2016, when Obama was still in office, and have continued pretty steadily since then…The 2017 year began in October 2016 and ended in early 2017. That’s all Obama.”

The President – The ACA is colloquially named “Obamacare”, but the ACA is alive today because of the executive actions of Donald Trump. While President Barack Obama provided charismatic leadership, he signed a bill that Congress negotiated. President Trump’s actions have largely been single-handed efforts without any help from Congress. If the volume of media is any indication, my assertion will likely receive some objection not because commentators dispute that President Trump has acted alone in ACA matters, but because they believe his actions have not been helpful. This is understandable not only because of the convoluted mathematics and the common media groupthink narrative, but because it is a narrative that the president himself has personally proclaimed. His policy record, however, is entirely distinguishable from his rhetoric.

President Obama held on to ACA control as long as possible, even accelerating the promulgation of the 2018 annual regulation to have it reflect his views. After the law’s passage, there is little to celebrate due to President Obama’s efforts. A few cases were won at the Supreme Court, with one major assist from the Chief Justice. The operational rollout was disastrous, followed by a 2015 recovery, and then a near-fatal storm in his final year of office. Enrollment was less than half of its original projected size, the population was skewed (older and sicker), insurer losses were substantial, and there was no cohesive plan to address the challenges.

The troubled market catalyzed proposals from Republicans in Congress that also included federal subsidies to support the individual market (direct federal funding for this market began with the ACA), but in the form of age-based tax credits rather than income-based subsidies and ACA-like mechanics.

CO-OP plans fell like dominoes, major companies exited markets, and there was fear of some counties potentially having no insurers in place. ACA blowback was not election year partisanship. Democratic Minnesota Governor Mark Dayton stated that “the reality is the Affordable Care Act is no longer affordable” and tapped into state funds to dilute the damage. At a campaign event in October 2016, former President Bill Clinton referred to the ACA framework as a “crazy system” and said the subsidy structure (limited to certain income levels) in an inflated premium environment was “the craziest thing in the world”. His description of premium cliffs was visibly clear with a simple graph-plotting of premium rates by income level.

The best opportunity to correct ACA market limitations was through Section 1332 waivers which President Obama had unnecessarily constrained, and he released guidance too late for states to do anything meaningful in 2017. A feigned effort to stop the bleeding was a reactive limitation to render non-ACA short-term coverage options less attractive. President Obama left office with ACA markets in bad shape. His regulations were not bold, and overly restrictive limitations on Section 1332 waivers and limitations on inefficient off-market options signaled fear and defensiveness. Obama’s presidency ended with ”ACA markets in rough shape, insurer exits and high premium increases, consumer frustration, and anticipation that the remaining days of the ACA experiment were numbered.”

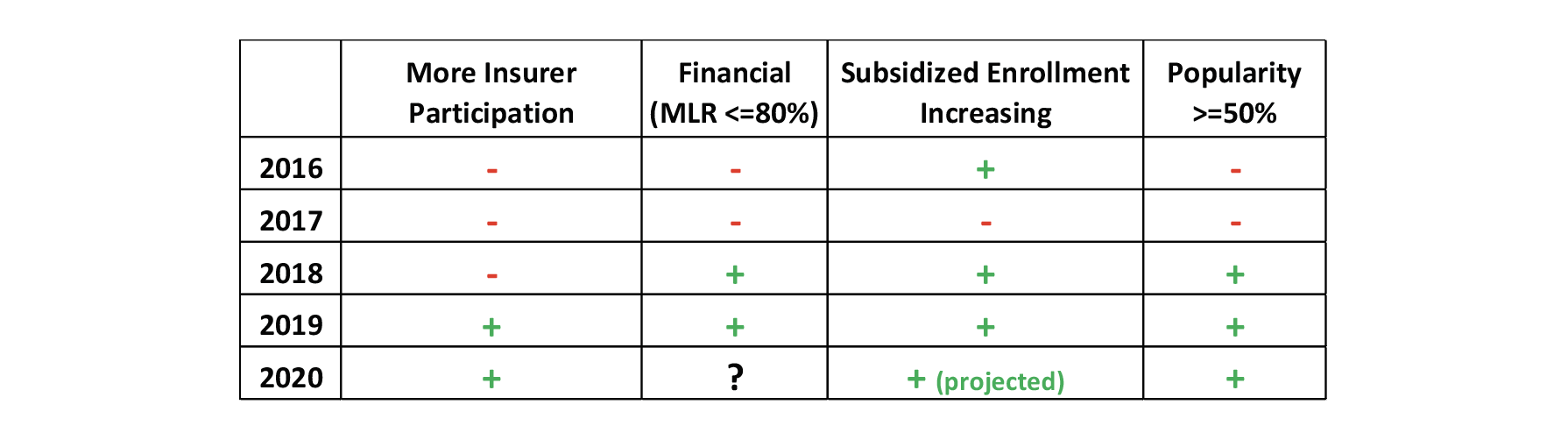

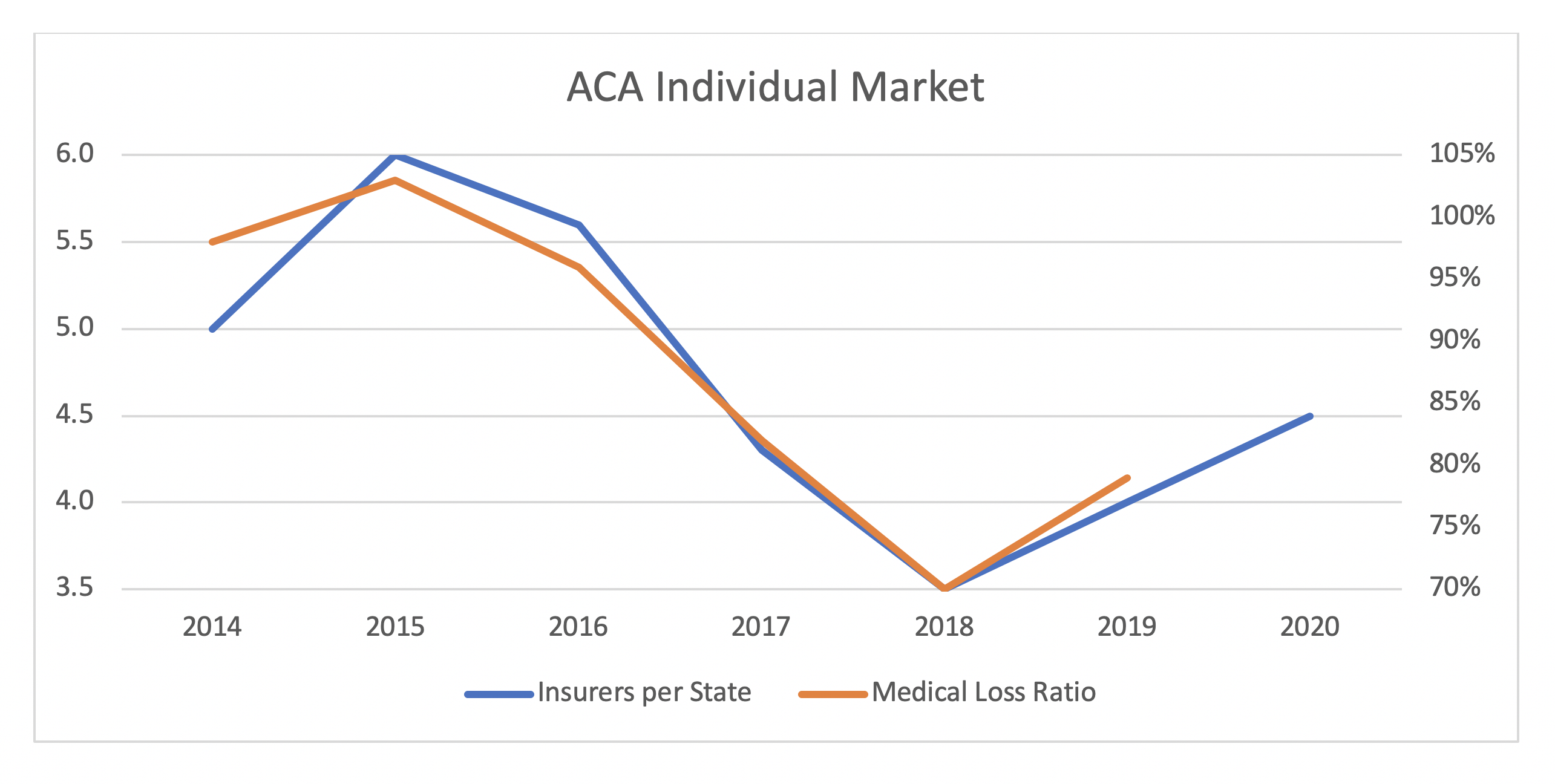

Three years into the Trump presidency, ACA financial results have dramatically improved, insurers have returned to markets, the law’s least popular provision has been stricken, sharply increasing premium rates have suddenly flattened, and consumer popularity is at a record high with polling responses indicating ‘more people have been helped and fewer have been harmed’ by the law since 2016.

While some reject ‘separating politics from policy’ and are quick to suggest that market revitalization is all a tragic accident, this seems implausible given that policy implications are modeled before the policy is adopted. I beat the Congressional Budget Office (CBO) to the punch by identifying that CSR defunding would result in silver premiums exceeding gold premiums, lower-income consumers benefitting, and drowning ACA markets receiving a life raft from an unexpected source. My study likely never crossed the president’s desk, but the CBO report that specifically “estimated the effects of terminating those payments for cost-sharing reductions” certainly did.

It is plausible to evoke that the president deserves little credit because he simply followed his Department of Justice’s legal recommendation after a court order, although that is something his predecessor stubbornly did not do. It is undeniable that President Trump’s decision to defund CSR payments boosted premium subsidies for lower-income enrollees and is the best thing that has happened to ACA markets. Additionally, his promotion of new flexibility has increased the law’s popularity. His championing of Individual Coverage Health Reimbursement Accounts (ICHRAs) promotes stability in a market that is characterized by frequent churn. ACA markets should continue to improve as the makeover construction may last throughout the decade, but improvement may be cyclical.

While markets are stronger than they have ever been, some states still face significant challenges. The current challenges are not the result of President Trump’s actions, but rather a reflection of local markets not responding appropriately to his actions. Consumers without generous CSR benefits have remained in silver plans (supposedly due to market confusion) which are necessarily priced higher to accommodate the higher CSR benefits; the high distribution of non-CSR enrollees lowers the actuarial value, which in turn lowers silver premiums and premium subsidies. Insurers continue to aggressively compete at the silver level rather than gold and bronze, further compressing premium subsidies. Insurance regulation has largely focused on overall rate changes, which is what is first reported in local newspapers, rather than properly enforcing ACA rules regarding benefit relativities. As premiums for 75% of enrollees are primarily income-based, this has a larger consumer impact than gross premiums. Employers have been slow to adopt President Trump’s market-benefitting Individual ICHRAs, which allows pre-tax contributions and allows some employees to opt-out and receive exchange subsidies.

If markets are left alone at the federal level and the consistent message directed to stakeholders is “appropriately respond to the ACA makeover“, we may see swifter market improvement. If the next few years are anything like the last, there will be some continued enhancements in markets and little recognition of it, and simultaneously we will hear more blabber about President Trump’s supposed sabotage. Either way, there will be more public resistance to ‘separating politics from policy’, ‘swallowing the ACA red pill’, and seeking to understand how ACA markets function; the politically-based narrative cannot trump actual ACA results forever, at least that is what I keep telling myself.

The Profession – Perhaps I am biased because I am an Actuary, or perhaps I became an actuary because of such bias, but the casting aside of actuarial principles in the initial legislative design handicapped the ACA from the beginning. Generous third-party subsidization can overcome such deficiencies, as Medicare Advantage does for example, but the ACA limited premium subsidies to subpopulations who were not the people directly harmed by ACA rules. The disparate impact helped millions and harmed millions, and its advocates relied primarily on promotional efforts (with a president well-suited for such an endeavor) to overcome financial fundamentals. This approach can potentially sustain markets in the short-term, but we empirically knew by 2016 that such a platform was not sustainable long-term.

Less than five months after the ACA was passed, the Wall Street Journal endorsed a 2012 presidential candidate; it was actuary Richard Foster. The endorsement was due to a government official being “honest enough to expose the plan’s true costs” without reward as the politically-advantageous lack of transparency government environment meant “real costs are disguised and hard for taxpayers to figure out.” Mr. Foster also provides storylines for rock stars, so he is always a good actuary to highlight.

Rather than being asked to inform policy development, actuaries were asked to implement it. As problems became clear, Senator Lamar Alexander, chair of the Senate Committee on Health, Labor and Pensions (HELP), remarked several times that actuaries were needed to help clean things up. In arguing for market solutions, advocate Stan Dorn has referenced the “fundamental actuarial principle that insurance premiums should accurately reflect the coverage they finance” and the need to rely on “actuarial wisdom”. Expect more actuarial involvement upfront the next time we restructure national health insurance markets.

On a positive note, more people now recognize the need to consult actuaries before making technical adjustments to ACA rules. As I noted in the closing article of a Society of Actuaries Health Section Strategic Initiative, “the multi-variate implications at play are mathematically intricate and are often beyond the understanding of legislators and their office and committee resources. The interconnectivity among each of the underlying issues is undoubtedly complex, but the consequences can be quantified; understanding these dynamics ‘before’ rather than ‘after’ policy implementation is a worthy and necessary goal. The actuarial profession can provide useful objective analysis on the potential outcomes for policymakers to consider before making critical decisions that are difficult to unwind down the road.”

The Prophet – The Congressional Budget Office has been the brunt of jokes with its overestimation of the individual mandate impact and its 2012 projection that individual market enrollment would be about twice the size that it is. Its 2017 projection on the CSR defunding impact was a thing of beauty, not only in its understanding of the policy implications and the accuracy of the projections, but the bold and accurate prediction that other stakeholders would misunderstand the policy and initial reaction would be misguided and short-lived. Insurers continued exiting markets in 2018, but began their return in 2019, perhaps a year earlier than the CBO expected. A 26% improvement of medical loss ratios in two years can have that effect.

The Senator – As we watched the Senate deliberate ACA repeal in 2017, one senator seemed out of place. The mostly elder group of adults had their one-liners ready and did not demonstrate a detailed curiosity in mechanical details. In questioning witnesses, Dr. Bill Cassidy appeared genuinely interested in listening and followed up with questions to enhance understanding and search for solutions rather than make political points. He became the face of Republican efforts in search of a better model, although the repeal zeal in the House never materialized in the slim majority Senate. An affable physician, Dr. Cassidy appeared attracted to vertical-line market solutions rather than horizontal-line political signals or compromises.

The Silliness – I suppose a lot of behavior around the ACA is silly, and most of it is around reflexive suggestions of “sabotage” without any effort to understand policy implications. Some have described the Republican’s interest in repealing the law as akin to dogs on opposite sides of a fence wanting to fight and then becoming friendly when the gate is opened. However, there is really no debate for the winner here. Perhaps envious of his neighbor Rich Weinstein’s sleuthing, Pennsylvania Senator Bob Casey celebrated gaining access to a “Secret Sabotage Document”. I encourage you to take a look at this; there is nothing secretive about it and there is nothing relating to “sabotage” in any respect. Most of you who start reading will not finish the short one-pager; it is that mundane and boring. That didn’t stop Senator Casey from promoting his prized possession of a “Secret Roadmap to Sabotage the ACA”. He continued this pretense into 2018, but apparently lost interest at some point.

The Social Media Network – While Facebook is primarily social and LinkedIn is business-focused, the nuts and bolts of ACA dynamics flow freely on Twitter. It has become a source of better and faster information than traditional news sources. You will find many of the people on this list there with their latest insights on the ACA. At the time of this writing, Parler is gaining traction amidst bias accusations of Twitter.

The Sport – ACA market dynamics are so dramatically different than other markets and a view above the surface will leave you with a misguided perspective. It is a different world, and Scuba Diving allows you to enter it and forget about the way that other markets work. You will never see a lionfish from the surface and it’s easier to stay grounded when you are underwater and away from the noise.

The State – The only state in the country that has lower benchmark premiums in 2020 than in 2016 is the frontier state of Alaska. The ability of states to make ACA markets work consists of two paths, which can be strategically combined to strengthen markets, though no states have yet attempted to coordinate this effort. The first is simply the enforcement of ACA rules. The second is through innovative Section 1332 waivers. Initial promulgation of regulatory rules limited innovation opportunities, and Alaska was the first state to adopt a Section 1332 “reinsurance waiver”. It dramatically lowered premium costs, and most of the other states that have proceeded with Section 1332 have followed Alaska’s lead.

Final Thoughts

Others in my profession may have had different views, but I had initial reservations about the ACA. It lacked actuarial integrity and flirted with the danger of “ignoring the impact of differences in risk characteristics” warned about in Actuarial Standard of Practice No. 12. It disassociated voluntary premiums with health care costs in favor of income-based contributions with enrollees having to painstakingly estimate their incomes to determine their premiums and hence speculate the relative value of coverage offered; a weak and ineffectual mandate was supposed to help in those deliberations.

I thought a charismatic president could keep such markets afloat for a short time period, but the mathematical dynamics lacked long-term financial stability; I was also frustrated with the obtuseness of ACA champions pretending the law was a benefit for young adults. I still remember giving a 2012 presentation in a health insurance company office and discussing my disappointment with the impact on young adults while showing age-based premium changes on a presentation slide. An older gentleman piped up, “Don’t worry about him. He voted for Obama”, suggesting the young adult hypothesized on a slide deck received the inflated premiums that he voted for. In aggregate, he was right. Young adults were preferential to President Obama, while the ACA was not preferential to them.

The ACA was clumsily designed; while it provided new federal funding and brought some semblance of equity with the tax-preference in group markets, it established a structural design that nobody would build with a clean slate. It was constructed by people who, as far I know, would never personally participate in the intricate market that they created. My concerns with the ACA were structural, and shared by colleagues in my profession, some more publicly (including me) than others.

In 2014, I concluded that individuals ineligible for premium subsidies would be better off remaining on pre-ACA plans or being uninsured. This led to my first invitation to write in The Actuary, which added transparent visualizations to some of my insights. In 2016, I explained how Congress might struggle with legislatively managing insurance dynamics. I also illustrated that a model designed by House Budget Chair Tom Price provided “more efficient use of funds, better-aligned incentives, and greater equity among participants in line with actuarial requirements of sustainable financing programs.” After the 2016 elections, I fully expected a legislative change to a more efficient structural model.

My perspective on the ACA changed in 2017; not because it performed any different than I expected, but because I realized I overestimated lawmakers’ comprehension of ACA challenges and their seriousness to develop a better model. My loyalty was always to a well-functioning marketplace, not to a political party, a specific law, or an alternative to such law. Realism set in June. It was clear that the House of Representatives was aligned with the Republican policy principles of 2016. We all remember the May 2017 rose garden party celebration of the American Health Care Act (ACHA); some of us may even remember the brand of beer that was served. Few of us remember the more significant event a month later. At a “private” Republican lunch, President Trump labeled the repeal bill “mean”, said the Senate needed to be “more kind, more generous”, and added that it could use more “heart” in the form of additional money for consumer tax credits. I was surprised to see brakes applied to the momentum of a repeal effort with legislative substance.

I naturally interpreted the President’s sentiments that day to be more about funding concerns, not the AHCA model structure. The Senate’s response was the Better Care Reconciliation Act, a watered-down ACA model that confused me on multiple levels. While I thought that President Trump liked the new model and wanted more funding, the Senate reverted to the old model with less funding.

ACA repeal died that day. I know there was further Senate discussion, but it looked like a prepaid wedding reception that a couple decided to have anyway after calling off the marriage. It was a party that would have gone late into the night, but John McCain shut the lights off early. That is now the iconic moment that we will remember, but the truth is that the ACA repeal died at a Republican lunch in June, not during a Senate vote in July.

I did not grow to like the ACA any better that summer, and I did not think it was functioning well (#8 of #10 on the countdown), but I came to the realization it was not going to be repealed. My passion to preserve a sustainable individual health market was met with the reality that there was not the necessary interest to move away from the ACA model. I was mostly indifferent to all of the labelings, whether it was called the ACA, Obamacare, or Trumpcare; a “repeal” versus a “fix” was a frequent debate, but a breakpoint between the two was really never clearly defined. The bottom line in my mind is that we were stuck with the ACA structural model, and our efforts should have been focused on making it work, albeit it with the aforementioned actuarial challenges still present. Without legislative correction, there was one thing on the horizon that summer that could boost ACA markets and it happened two months after I wrote about it.

Some people are nice about shortcomings and say things like “the ACA didn’t do enough”, but we need to be more direct and acknowledge the ACA harmed people. Yes, it undeniably helped millions of people, but its disparate impacts also stripped fairly-priced insurance from millions and did not provide reasonable ACA options.

If you are a conservative, you should acknowledge that the individual market was unnecessarily tax-disadvantaged until the ACA. If you are a liberal, you should acknowledge that marketplaces were in serious trouble until President Trump’s action boosted premium subsidies and ignited the ACA makeover. We should all acknowledge that, despite our ideals, it is very unlikely that the ACA will be replaced anytime soon. We should work together to understand its mechanics and make it work best for insurance consumers. That means that state actions should be based on a concrete understanding of policy implications rather than political retaliation. If states need help with this, they should call me. I will directly tell them the status of their markets and what actions would be helpful. Too many have stalled, believing that a federal overhaul is imminent. “It is not”, I have said for three years and will continue to say.

Christopher Holt, a conservative at the American Action Forum, agrees that the ACA is a fixed reality. He notes, “To move forward on health care policy, conservatives must accept that we are not going to remake the system in one fell swoop, and embrace an incremental approach to moving the health care system in a better direction. We aren’t going to repeal Obamacare, but we can change it.”

Like Mr. Holt, my acceptance of the ACA is not based on its policy ideals. Either political party could construct better policy in five words[2], but there is no logical reason to believe they will. The ACA model is not great, but our stumbling block is no longer the model; it is our understanding of the model. We can make a bad model work with more money; it is an inefficient solution, but we can make it work. That gets us to the truth that nobody, and I mean both Democrats and Republicans, wants to admit. The ACA was not working until President Trump threw more money at it. His follow up actions over the last three years have made the ACA stronger and more popular. Those are the not pre-mix instructions for a repeal recipe, and we need to stop the nonsensical talk that this is what the president is “trying” to do. The law is not going to be repealed by Republicans, and we are only delaying market improvements by pretending that it is.

The ACA can work, but we need a little more humility. ACA markets have strengthened without a coercive mandate, and ACA popularity has grown in the last three years for two primary reasons. For the people whom the ACA works for, enhanced subsidies have made it work better. For the people whom the ACA does not work for, we have given them other options. In KFF’s words, more people are helped and fewer are hurt.

Others have been less than kind, suggesting the enhanced subsidies and consumer flexibility are “sabotage” and “promotion of junk plans”. This volatile language, arising largely from people who do not understand policy implications, needs to stop; a genuine “sabotage” concern coupled with market understanding would be an objection to Metalball, yet this interest is never expressed. Likewise, states need to mind their own shop. It is not their business to tell other states how to run their ACA markets. When we recognize how the ACA works, separate the politics from the policy, and acknowledge that the ACA was not designed to work for everyone, we will be able to optimize markets. I have done that; will you join me? Let’s do it together for the people in the health insurance market of last resorts, regardless of whether they have been helped or hurt by the ACA.

Those are my impressions of the ACA. I would love to hear your impressions. Perhaps you can step up and write “Impressions of the ACA: 20 Years”. If you decide to write it, I will be available for interviews and proofreading. As I will then be in the age group that benefitted most from the law, maybe I will have left my comfortable group insurance cabana and jumped into the ACA pool that millions of Americans were involuntarily forced in. Unlike the architects who put the ACA together, I would like to think personal rather than professional participation in the market of last resort would not change my objectively intended perspective. That is the first question you should ask me.

Endnotes

[1] America’s Health Insurance Plans (AHIP) and the Blue Cross Blue Shield Association have been lobbying for “structuring the subsidies to be more generous for younger adults to encourage more enrollment”.

[2] ACA money without ACA rules.

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.