“The ACA isn’t perfect, but the choices we made when designing the law flowed from a commitment to provide the best possible care to the most people.”

– Joe Biden

A recent summary of “Where Joe Biden Stands on 10 Important Issues” notes his defense of the Affordable Care Act (ACA) in a Washington Post editorial. It was the “most people” reference in the quotation above that drew my attention. Are the claims of “best possible care” and “most people” true? Would an understanding of the law’s design lead one to conclude those were the ACA (aka Obamacare) designers’ primary commitments? A “commitment to provide the best possible care” is hard to assess but it is suspect. Despite the name, the ACA has had little impact on the delivery of health care; the law primarily provided income-based financial incentives for insurance coverage and left operational aspects alone. I will let others discuss the ACA’s quality initiatives and commitments toward value-based “best care” if they are so inclined, but I would like to explore the “choices we made” to provide “care to the most people”.

The policy dynamic of increasing insurance coverage[1] is straightforward. To encourage someone to procure insurance, we simply make the price of insurance more attractive relative to the expected benefits such insurance provides. We maximize coverage when we do this for the most people. The ACA did not significantly alter health insurance benefits; its real impact was premium changes unrelated to benefit changes. The ACA inflated average premiums with a compressed unisex age slope and community rating requirements, the latter more publicly known now as the fashionable but shadowy “protection for pre-existing conditions”.

High premiums were necessary to accommodate the costs of the sickest of Americans being allowed to enroll in ACA marketplaces at the same costs as healthy Americans. To offset the high premiums, third-party subsidies from the federal government reduced the net premiums that some consumers were required to pay. Along with rating rules, subsidy allocation and resulting net premiums influence enrollment which influences risk pool morbidity and gross premiums, which circularly influences net premiums and enrollment results. An understanding of these mechanics, aided by knowledge of retrospective results, allows us to determine if the ACA’s design ‘flowed from a commitment to care for the most people’.

ACA Enrollment Results and Structural Design

Based on Congressional Budget Office (CBO) estimates after the 2012 Supreme Court decision, ACA enrollment is less than half of its expected size. This accounts for assumptions of some states not expanding Medicaid. With an understanding of the premium dynamics, the results are not hard to comprehend.

The ACA, by its design, targets sick people, not more people. Despite spending $54 billion per year on new private market premium subsidies, we have fewer people enrolled in private insurance than we did in 2009 before the ACA legislation was passed. The subsidies did not really expand coverage, but rather allowed individual markets to absorb the unhealthy population and attract new enrollees whose premiums were based on their income rather than the health care costs of the risk pool, at the same time repelling others who previously had health coverage. The poor allocation inherent in the subsidy formula, resulting in older adults paying less that young adults at the same income level, also contributed to enrollment inefficiency.

But isn’t ACA enrollment primarily driven by income-based premium subsidies rather than the exaggerated number of sick enrollees now able to receive community-rated coverage? Yes, and net premiums are determined by income rather than risk pool morbidity, but premium subsidies must cover the remainder of the cost. With a limited funding allotment, the community rating and premium subsidy structure is expensive and limits market attractiveness and the per person subsidy amounts that can be allocated, quite different than designing a law to “care for the most people”. Effectively, we are not spending $54 billion each year to insure the most people; we are spending $54 billion each year to accomplish other goals while maintaining a similar number of insured people.

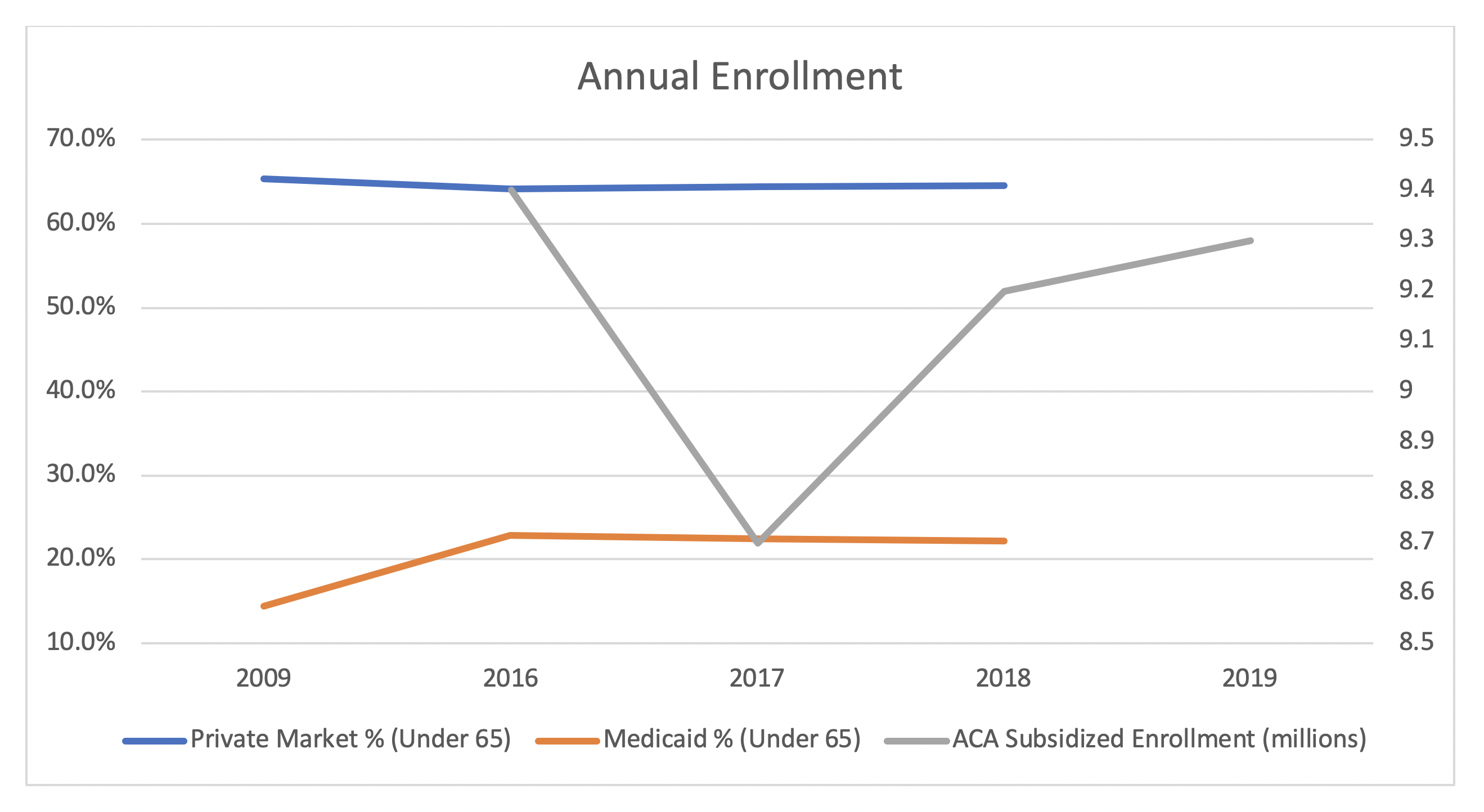

Confusion always arises when we discuss unattractive ACA markets and flat enrollment because we all know “the ACA expanded coverage”. The reduction in uninsured Americans of 20 million people, or 8% of the under 65 population, is due to the expansion of Medicaid as displayed in the chart below. Recalling the price/value consideration for increasing coverage, we made Medicaid “insurance” free for millions of people and “insurance procurement” an easy choice for Medicaid eligible enrollees. Despite significant new funding in the private marketplace for people without Medicaid eligibility, we did not effectively make insurance a better value for “the most people”, and coverage has accordingly declined since 2009. If the ACA was designed to provide coverage for the most people and we changed some rating rules, added significant federal funding, and fell backwards toward our “covering the most people” goal, we would collectively agree that the ACA failed and we would all be calling for its repeal; of course, that was never the intention of the ACA.

The ACA’s designers essentially required community rating, developed a goofy and convoluted premium subsidy formula, and without much strategy, allocated funds that were limited by moderate Democrats needing to be assured “the bill is deficit neutral” to vote for it; and then they relied on heavy promotional efforts, and hoped everything would work itself out. There was no strategic effort in the design to maximize coverage, and ACA marketplaces were accordingly in deep trouble in 2016.

Covering more people was a policy option consideration in 2010, but it would have compromised the ACA’s core nondiscriminatory principle of community rating; while ACA supporters frequently boast about the embedded “consumer protections” associated with this vision, the rules promoting such an ideal have never been strictly enforced. While states (passing laws) and the president (announcing executive orders) are now considering strengthening community rating enforcement, some commentators should acknowledge that the ACA as written fails the “strict standards” that they require of other policy proposals to be deemed as including such protections; perhaps they lack attentiveness to their own definitions. A more substantive approach would be an assessment of policy considerations based on effectiveness and an understanding of implications, not mandated allegiance to a nebulous catchphrase.

ACA Alternatives and Providing Care to More People

No private market reforms are identical to each other, but all recent proposals have had three common general elements: the private market platform is left alone, premium rates are restricted in some fashion and required to be actuarially unfair[2], and premium subsidies (or tax credits) are provided to incent coverage procurement in an actuarial unfair environment.

In the summer of 2016, I analyzed the efficacy of Tom Price’s proposed Empowering Patients First Act (EPFA) relative to the ACA and another Republican alternative plan authored by Congressman Fred Upton. I favorably concluded that the balanced tax credit allocation in the EPFA “produces the lowest median, the lowest standard deviation, the lowest maximum and the highest minimum. Based on this illustration, it appears that the Price tax credits provide a more ‘efficient use of funds,’ better ‘aligned incentives,’ and greater ‘equity among participants’ in line with actuarial requirements of sustainable financing programs.”

After President Trump was elected, the design of the EPFA attracted more attention. Christine Eibner, an economist with RAND Corporation, noted that the EPFA’s loosening of age band regulations “increases the overall number of people with coverage, but older people end up falling out of the market as premiums rise”. Sarah Kliff at Vox[3] effectively disputed Mr. Biden’s claim of the ACA’s broad coverage design, lamenting the prospect of EPFA passage: “This worries some Obamacare supporters, who say the goal of insurance reform isn’t just expanding coverage — it’s expanding coverage for people who really need health care.”

The American Health Care Act (AHCA), which passed the House of Representatives in 2017, was much like the EPFA. It provided age-based tax credits and did not require eligible enrollees to estimate their income to determine their premiums. While missed by major media outlets, President Trump’s nuanced responses to the AHCA’s passing were intriguing, and if properly dissected, shed light on his never-asked[4] about health policy goals.

To frame an understanding of the president’s responses, it is important to realize that designing a law with a commitment to cover the most people requires two primary considerations. The first is funding level, which may be externally limited. The second is structural design; sometimes policymakers are required to work within funding constraints, and policy ideals are strategically expressed within financial boundaries. To understand policy goals, funding allotment and structural design strategies need to be separately considered.

After passage of the AHCA, President Trump reacted positively to its structural design but negatively to its funding level. He first called the legislation “very, very incredibly well-crafted” after its May 2017 passage, but a month later said it was “mean” and needed more generous tax credits, and he urged the Senate to design legislation that was “more kind, more generous”. President Trump’s support for a more efficient and strategic model with enhanced funding aligns with a “coverage for more people” ideal. His objection to the AHCA based on its lack of generosity rather than its structural efficacy further aligns with “coverage for more people” advocacy.

The president’s broad enrollment goals did not translate to legislative action in the slim majority Republican Senate, who illogically (rationally compromised by reconciliation limitations) responded with the Better Care Reconciliation Act, an ACA-style structural model with reduced funding which was dubbed ‘Obamacare-lite’. It was literally the opposite of President Trump’s desire for a more efficient model intended to cover more people with greater funding, and it exposed the lack of a Republican path toward a clean replacement of the ACA.

Discussions of repealing the ACA continued through September 2017, ending with discussion of the Graham-Cassidy amendment. The legislation proposed state flexibility to strategically promote broader coverage. Joseph Antos and James Capretta noted in a Health Affairs blog, “States would have wide latitude to use their federal funds in ways that might be more effective in promoting health insurance enrollment.” Larry Levitt of the Kaiser Family Foundation thought otherwise, opining that purported funding efficiencies would reduce coverage and outweigh any benefits of improved structural design; “The ballgame here is the money. If states have a lot less money to play with than under the current system, it’s inevitable that fewer people will be covered.”

Senator Jim Inhofe was optimistic of coverage opportunities and expressed the benefits of federalism, “I think the efficiencies that come with transferring the funding to the states can very well make up the difference between what the federal thing would be…I mean it’s more efficient when it’s done from the states, and so they can do it with less money.” President Trump indicated he would sign the legislation if it passed, but it never reached his desk.

Short of necessary support, Republicans never voted on Graham-Cassidy. As the promise of ACA legislative repeal died, President Trump continued his active streak of regulatory implementation, which “favorably shifted the rules for the market’s two significant eligible population groups”, led by more generous funding within the confines of the ACA’s design structure.

The ACA Makeover and Improving Results

After a three-year ramp up with risk stabilizing mechanisms and benefits from early promotional activities, ACA observers naturally expected declining enrollment beginning in 2017, driven primarily by a sharp reduction in unsubsidized enrollees. The two unanticipated bright spots in ACA enrollment history are the increase in subsidized enrollment in 2018 and 2019, and the increase in on-exchange unsubsidized enrollment in 2020. The first is rationally intuitive, and even though I had theorized rationale for the second due to makeover-induced market improvement, I did not see it coming so soon.

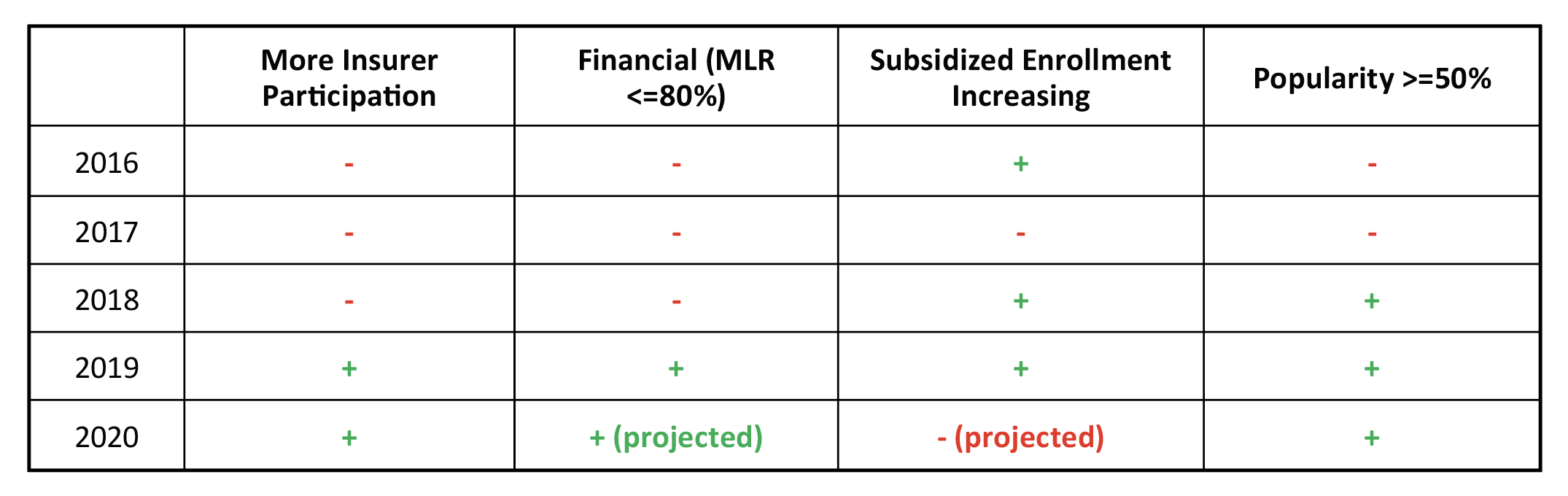

Subsidized enrollment, shown in the chart above, increased significantly in 2018 after a sharp decline in 2017. Subsidized enrollment increased again in 2019, despite the concurrent elimination of the shared responsibility penalty. The impetus for this enrollment shift was the ACA’s life raft, the litigation-induced defunding of cost-sharing reduction (CSR) payments which bolstered premium subsidies. Along with additional flexibility to promote alternative coverage to populations not well-served by the ACA, President Trump’s regulations have ignited a makeover of the ACA with more attractive consumer offerings, increased popularity and tolerability, insurers returning to ACA markets, and three years (2019-2021) of flat premiums. The chart below illustrates the market improvement, notably including a slight Metaball-induced regression in makeover progress in 2020.

The 2020 increase in ACA unsubsidized enrollment is surprising. A flattening of gross premiums in 2019 and 2020 is linked to insurers overestimating the risk pool morbidity after the makeover began in 2018. This potentially has attracted unsubsidized enrollees back to ACA markets, while most observers would expect the makeover to increase subsidized ACA enrollment and increase enrollment in non-ACA options among prospective enrollees ineligible for subsidies.

The ACA makeover has not been broadly reported in general media, and state responses have varied both in terms of timing and scale of response. In some states, competitive Metalball games are stronger than compliance enforcement, leading to the 2020 makeover regression, resulting in “higher than appropriate premiums for low-income enrollees in ACA markets to the tune of billions of dollars a year”. Market improvement will accelerate as community rating regulations are more broadly enforced and effective premium dissection during CSR litigation uncovers premium misalignment courtesy of Metalball games.

Policy Goals and Conclusion

Despite its inefficient design, some Americans believe that the ACA structure is the right policy approach and we should aim to cover the sickest people by enforcing strict rating rules within a traditional insurance framework; this necessarily inflates individual market premiums, contrary to separate risk pools funded by taxes or assessments across a broader population. It is Americans’ prerogative to champion an ACA-like framework, but we should not pretend that policy which saddles the excessive costs of the sickest Americans on the relatively tiny individual market has anything to do with a “commitment to care for the most people”.

The ACA, by its design, inflated premiums and compressed enrollment by allocating limited funds to attract certain populations, not by committing to insure the largest potential population. At the same time, its designers sought to “protect the risk pool” (rather than insure more people) by prohibiting actuarially fair insurance alternatives. Mr. Biden’s erroneous characterization of the ACA design as promoting broad coverage is not unusual. While he was Vice President when the legislation was passed, he has said little to demonstrate that he grasps the mechanics of the law and he appears unaware of the changed market dynamics that have occurred since he left public office.

Mr. Biden naturally understands that removing income limits on premium subsidy eligibility (a principle espoused in the EPFA) will attract broader coverage and require more funding and higher taxes, but each element of his three-pronged approach to “build on the ACA” could effectively damage ACA markets; (1) ‘calibrating subsidies on gold level coverage’ reduces the enhanced subsidies in a growing number of states, (2) ‘enabling Medicare eligibility at age 60 poaches well-served ACA enrollees, ‘harms risk pool size/morbidity and increases premiums, and (3) offering a public option strikes at the ACA’s core constituency rather than addressing a specific population need. While President Obama envisioned “adding a public option to the exchange marketplace in counties lacking competition”, Mr. Biden expresses an unformulated concern, “If your insurance company isn’t doing right by you, you should have another, better choice.”

It is baffling that no one on Mr. Biden’s campaign team has considered the ramifications of these haphazard and arguably reckless policy proposals. Perhaps the public sentiment and media complicity is so far in the camp of “Biden is for the ACA and more coverage, and Trump is against it” that the contrary factual details do not shape electoral views, but I can point to numerous examples where ACA markets are not optimized and enrollment results have suffered because stakeholders have erroneously misunderstood policy implications due to ascribed political motivations. Lack of transparency may be a huge political advantage, but for those of us striving toward optimization of individual health insurance markets, we recognize how important clear transparency is in achieving broader coverage.

Despite all the noise about efforts to “take away health care” and the election-induced Congressional charade at the Supreme Court, President Trump’s signals have suggested not only advocacy for a broader coverage model and principled opposition to the inefficient ACA design, but a willingness to enhance funding and work within the law’s constraints to improve coverage levels. Americans deserve to hear more from the president in this regard, and we should strongly pressure the media to remember its responsibility is to “inform the public”.

Lagged state compliance is partially due to a lack of public discussion of the ongoing makeover but it was not altogether unpredicted. We may have to wait patiently for further market improvement and ACA makeover completion; in 2018, the CBO said the makeover may be concluded “by the end of the coming decade”, defining makeover equilibrium as gold plans being priced lower than silver plans. ACA markets will steadily improve and continuously attract a broader coverage of enrollees each year, and President Trump’s promotion of consumer flexibility should promote further insurance coverage outside of ACA walls.

While overarching legislation is off the table, President Trump has used executive action to attract a beneficial and more stable population through employer-sponsored Individual Coverage Health Reimbursements Account (ICHRAs) and allow structural ACA innovative opportunities. In fact, one of the initial limiting factors to covering the “most people” was President Obama’s Section 1332 regulatory guidance which arbitrarily applied guardrail tests to “vulnerable populations” in addition to the total population; President Trump removed this extra requirement in 2018, but few states have yet sought to leverage Section 1332 opportunities.

The ACA was not designed to provide coverage for the most people. The rating rules and financial assistance provisions were specifically designed to target a limited population of older, sicker, low-income individuals. Regulatory changes implemented in recent years have facilitated opportunities for broader coverage, in both ACA-compliant and alternative markets. State responses to these changes have varied due to local market dynamics, the technical understanding and attentiveness of state regulators, and various political reactions.

Appropriate market-improving responses to the new regulations require better understanding and stronger compliance with the ACA’s community rating requirements. Acknowledgment of non-compliance and efforts to enforce stricter adherence are ramping up at the federal and state level. Community rating, by its nature, usually restricts coverage expansion, as it has done with the ACA. In the case of Metalball, stricter community rating compliance, aligned with the ACA’s nondiscriminatory ideal of premiums reflecting benefit generosity rather than population characteristics, paradoxically and mechanically facilitates lower net premiums when paired with the ACA’s subsidy dynamics. The results of complying with the ACA’s nondiscrimination rules after President Trump’s regulatory modifications to the ACA are lower premiums and higher subsidies. Adherence to ACA rules in reshaped ACA markets promotes something the ACA was never designed to do; provide care to the most people.

Endnotes

[1] Logically, Mr. Biden was referring to ACA insurance coverage in his reference to “care to the most people”.

[2] ACA regulations refer to “actuarially fair” coverage as insurance that “is priced so that the premium paid by an individual reflects the risks associated with insuring the particular individual or individuals covered by that policy”. https://www.federalregister.gov/documents/full_text/xml/2018/02/21/2018-03208.xml

[3] Ms. Kliff is now a health reporter for The New York Times.

[4] “Unfortunately and inexplicably, when the president begins to talk about that which he does control, the discussion is shifted back to areas of apparent comfort; away from where all the action is, away from where we might learn substantive facts and concepts, away from answers that may catalyze ACA market improvements. It is why I listen so intently hoping for a sparse nugget; it is strange to say this, but the media seems to go out of their way to not allow the president to talk directly about what he is doing with regard to health policy.”

About the Author

Any views or opinions presented in this article are solely those of the author and do not necessarily represent those of the company. AHP accepts no liability for the content of this article, or for the consequences of any actions taken on the basis of the information provided unless that information is subsequently confirmed in writing.